Startup fundraising frameworks: what the best founders use. | VC & Startup Jobs.

Venture Is Unbundling, A Sample VC Memo & VCs Pass For Reasons You Won’t Expect.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Startup fundraising frameworks: what the best founders use.

Quick Dive:

Why some great startups get passed over (and what fund math has to do with it).

How Venture Is Unbundling: A New Era for GPs and LPs.

How Investors Will Grade Your Startup: A Sample VC Memo.

Major News: Andreessen Horowitz is raising a $20 billion AI-focused fund, Mira Murati’s new AI venture adds the co-creator of GPT as advisor, Ilya’s AI startup picks Google Cloud to power its AI research & OpenAI countersues Elon Musk over fake takeover and bad-faith attacks.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

a16z dominance in AI startup deals.

Beyond ARR: how Monte Carlo reinvented their business with daily revenue

PitchBook Benchmarks offer a window on the latest data for closed-end fund returns across strategies and vintage years.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Lessons from Investing $2BN and Returning $8BN in Cash

All-In-One Guide to Venture Capital interview questions (And how to answer them).

LPs focus on performance as PE AUM growth slows.

Every marketing channel sucks right now.

AI Index 2025: State of AI in 10 Charts.

Startup legal document pack – essential legal docs for founders.

A new framework for AI agent pricing: analyzing patterns from 60+ AI agent companies

Naval Ravikant: "Inspiration is perishable — act while the spark is fresh."

How to get Investors to say Yes - Lessons from a Founder who raised $1B.

SaaS Startup Financial Model: All-in-One Excel Template.

Ask HN: Do you still use search engines?

Top mistakes first-time fund managers make.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

The 50 most viral hook patterns extracted from 46,606 TikTok videos.

300+ Australian angel investors & venture capital firms contact database (Email + LinkedIn Link).

Raising money but struggling to connect with the right investors? We help startups reach 85,000+ investors and connect with members of our investor Slack community. Fill out this form to get started. It’s FREE!

FROM OUR PARTNER - RXPERIUS HEALTH

🚀 Rethink Healthcare Data. In Real Time.

Unfiltered patient insights from across the US—delivered daily.

rXperius Health is helping healthcare companies make better evidence-based decisions.

We provide healthcare organizations with the opportunity to realize new insights directly from patients across the USA.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Startup fundraising frameworks: what the best founders use.

One of the most common patterns in the best founders? They’re not just focused on tactics — they’re obsessed with frameworks.

While tactics come and go, frameworks act like mental maps. They help founders see challenges clearly, make smarter decisions, and stay grounded in first principles as they build.

The startup world runs on shared knowledge — wins, failures, and everything in between. That’s why we’re sharing a curated collection of some of the most useful frameworks we’ve come across, especially around fundraising.

1. Y Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M.

Most first-time founders overcomplicate their pitch decks or miss the mark on storytelling. A great seed deck should focus on clarity, simplicity, and a strong narrative investors can remember. This YC-backed framework walks you through each essential slide — from problem and solution to traction, market, and the ask | See Framework

2. How to Talk About Valuation When Investors Ask

Founders often feel pressure to name a valuation early—but doing so can backfire.

Instead, use price signaling: share past round data and invite VCs to share what they’re seeing in the market. Focus on being fair, realistic, and flexible—VCs are gauging not just your price, but how you negotiate. Know that VCs care about your last round, capital raised, investor participation, and whether you fit their ownership targets.

Fundraising is a two-way street—ask thoughtful questions to gather signal while keeping the process collaborative. | See framework

3. The Ladder of Proof: How Investors Evaluate Startups

VCs often rely on a mental framework that helps them assess risk and traction — we call it the Ladder of Proof. Each step you climb gives investors more confidence that your startup is fundable and has breakout potential. From idea to product, from early users to revenue — every rung matters. Founders need to know exactly where they are on this ladder, and what signals will move them up. Clarity, proof, and momentum — that’s what earns investor conviction. | See framework

4. Most founders think fundraising is all about the pitch - CRM

But in reality, 80% of a successful raise comes down to organization. An investor CRM helps you stay on top of who you’ve talked to, what stage they’re at, and when to follow up—so no opportunity slips through the cracks. You don’t need fancy software. A clean Google Sheet works perfectly. We’ve put together a free CRM template + extra fundraising resources to get you started | See CRM framework.

5. How Iman Abuzeid Raised from Top-Tier VCs

Iman, CEO of Incredible Health, breaks down what really goes into a strong fundraise—beyond just the pitch.She shares actionable lessons on identifying the right investors, running a smooth process, and building momentum. This includes her personal frameworks like the Fundraising Decision Tree and Pitch Deck Structure.

If you’re raising or planning to, this is one founder breakdown you don’t want to miss. | See framework

6. How to Build an Investor Data Room (Without Overthinking It)

A data room isn’t just a folder—it’s a critical part of fundraising, but timing matters.

Use a two-stage approach: share only key info before a term sheet, and detailed docs after. Start with essentials like your pitch deck, team info, traction, and a cap table summary.Google Drive is more than enough—don’t waste money on fancy tools this early. | See framework

7. How to Prove to Investors That Now Is the Right Time

Founders often explain what they’re building, but forget to answer why now—a key question for investors. Your job is to show how tech shifts, market timing, or regulation make your startup possible today (and urgent). It’s not about being first—it’s about arriving when the conditions are right and the window is open. Nail your “why now” narrative, and you instantly add momentum, credibility, and FOMO to your pitch. | See framework

8. How VCs Decide to Take First Meetings (and What Founders Often Miss)

Before investors invest, they decide whether you're even worth a meeting—and that decision happens fast. Strong intros, a crisp one-liner, traction, timing, and clear fundraising goals all increase your odds. Once you're in the room, it's not just what you pitch—it’s how you show up, speak, move, and ask questions. Pitching is performance + preparation—refine it constantly, and think like a VC when you walk in the door. | See Framework.

9. How to Handle the Most Annoying Fundraising Questions from VCs

Raising money means facing a mix of curiosity, skepticism, and vague maybes from investors. From “What if Google builds it?” to “Come back when you have a lead,” most VCs are testing how you think. This guide breaks down common VC pushbacks and how to respond with clarity, confidence, and strategy. If you're fundraising (or about to), read this before your next investor call. | See framework

We’ve also built multiple guides and frameworks that can be helpful to you in your startup journey:

Excel Template: Early Stage Startup Financial Model For Fundraising.

Startup Legal Document Pack

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

VC TACTICS EVERYONE SHOULD KNOW…

🚀 Due Diligence 2.0: Strategies for the AI Era

When AI startups reach billion-dollar valuations in months and market conditions can shift overnight, traditional due diligence approaches are pushed to their limits. VCs are challenged to validate complex technologies, assess business model sustainability, and pick out the highest-quality deals amid the hype.

Join this webinar to see how Vanessa Larco, former Partner at New Enterprise Associates, has evolved her due diligence process and the investments she’s considering to support the next generation of innovative companies.

📃 QUICK DIVES

1. Why some great startups get passed over (and what fund math has to do with it).

Many founders think timelines are just a VC’s internal problem.

But the truth? It affects your chances of getting funded more than you might think.

When you're building something ambitious—especially something that takes time to get right—it's easy to assume that if the idea is good enough, someone will back it. But venture capital has a ticking clock. And if your startup doesn’t fit that timeline, even the most excited VC might still pass.

Hustle Fund recently shared some sharp insights on this, and it really resonated.

So I’ve pulled together a few notes and takeaways that I think every founder should see.

An angel investor is investing their own money. They’re flexible, patient, and often driven by gut instinct or personal passion. If your startup takes 12 years to exit? Cool. They’ll wait.

VCs, on the other hand, are managing other people’s money. They’ve raised capital from LPs—like endowments, funds of funds, or family offices—and made promises about how and when they’ll return it.

Most VC funds run on a 10-year cycle. That’s their horizon for deploying capital, helping companies grow, and eventually returning money to their investors. It’s not just a guideline—it’s built into the very structure of the fund.

Why it matters: Even if a VC loves your startup, if your timeline doesn’t align with theirs, they might not be able to invest.

The VC fund lifecycle: a 10-year sprint

Here’s how a typical venture fund plays out:

Years 1–3 → Deploy capital (writing new checks)

Years 4–7 → Support portfolio companies, double down on winners

Years 8–10 → Exit investments and return capital to LPs

Now, let’s say a VC meets you in year 5 of their fund. Even if they invest immediately, your company would need to exit by year 10 (or close enough to it) for them to return capital.

And here’s the kicker: Big outcomes take time. The kinds of returns VCs need—think 50x or 100x—don’t usually happen within 4-5 years. A 5x exit might sound great to you, but to a fund managing dozens of portfolio companies and trying to return 3x overall, it’s barely a blip.

VCs are under pressure to find startups that can go massive—and do it within a tight window.

Why good exits still might not be “good enough”

Let’s walk through a scenario:

You raise from a VC in year 5 of their fund. You exit in year 9 with a 10x return. That sounds like a win, right?

Maybe. But here’s what might actually happen:

That return is solid—but not transformational for the fund.

The VC can’t reinvest that cash into a new company (the fund’s done deploying).

They’re trying to close their next fund, so their energy is elsewhere.

In the end, your success doesn't move the needle much for them. Which means they’re less likely to place the bet in the first place—especially if your startup is still early-stage and unproven.

For many VCs, a “great” 10x in year 9 just doesn’t fit the fund math.

Startups that often get passed on (even if they’re brilliant)

So what kinds of startups might get a polite “no” purely because of timing?

Long-horizon tech – Think deep science, biotech, or frontier tech that might take 15–20 years to mature.

Meta-investment models – Startups that invest in other startups (VCs don’t want to wait for two cycles of returns).

Solid-but-not-massive return profiles – Businesses with clear paths to a 5x or 10x, but unlikely to break out to 100x.

None of this says your company isn’t good. It just might not be a fit for venture, especially given the timeline pressure.

VCs don’t always say “no” because they don’t believe. Sometimes, it’s because the math just won’t work.

What founders should actually do

If you’ve been hearing “no” from VCs and can’t quite figure out why, zoom out and ask yourself:

Does my business fit into a 10-year window?

Can this company realistically return 50x+ within that time?

Is my product so early or complex that it needs a longer arc to deliver?

If the answers suggest you're on a longer or more unpredictable timeline, you might be better off raising from angels, family offices, or long-horizon investors who aren’t bound to the same fund cycle.

It’s not just about who you're pitching—it's about when you're pitching, and how your story fits their model.

There’s a myth in startups that the best ideas always get funded. But it’s not just about the idea. It’s about timing, fit, fund mechanics, and return profiles.

VCs are building portfolios that match a specific promise to their LPs. If your company doesn’t help fulfill that promise on their timeline—it might not be a match, no matter how good it is.

And that’s okay. Because not every great company needs VC. Some of the best founders find better matches outside the traditional fund world.

So if a VC passes, don’t just ask “Was the pitch good?” Ask: Was this the right investor for my timeline?

2. How Venture Is Unbundling: A New Era for GPs and LPs.

Venture is changing. Not in the subtle “new cycle” kind of way. More like a tectonic shift beneath the surface.

What used to be bundled under the roof of traditional VC firms is now fragmenting into a new model—driven by media, personal brands, software, and a completely different set of founder + LP expectations.

This piece I read dove into that shift. Below are my notes and thoughts—along with what I believe are the real insights behind all the noise.

The venture firm is unbundling

https://twitter.com/sam_sends/status/1483255401562968066

It’s no longer just about five partners in a room, picking from a proprietary Rolodex and calling it “value add.” That bundled, legacy model is getting picked apart—one vertical at a time. Now, some GPs are winning by building niche communities. Others are scaling distribution through podcasts and Substacks. Some are embedding themselves deep into founder networks, and others are building tools that give them leverage at scale.

Emerging managers aren’t just “smaller funds.” They’re different animals altogether. And the best of them are productizing their advantage—whether it’s sourcing, king-making, or storytelling.

So, the traditional VC model is breaking apart. Emerging managers win by specializing and productizing a distinct edge.

Stripped down, a GP’s job comes down to 8 things:

Source

Pick

Win access

Value right

Construct a smart portfolio

King-make

Raise the next fund

Return capital

Very few are great at all 8—and that’s okay. You can build a top-decile fund by doing just 2 or 3 of these exceptionally well. Some GPs are phenomenal pickers (like USV). Others win deals by having distribution and founder goodwill (like a16z). Some win by moving fast (Tiger Global). Know your lane.

“Because the internet…”

The internet didn’t just change how founders build—it changed how VCs build, too.

Knowledge isn’t a moat anymore. Every template, strategy, and best practice is online. There’s a wikiHow for starting a hedge fund. Tools like Carta, AngelList, and Odin let anyone set up a fund in days. YC made legal documents free. And for GPs willing to dig, there’s a goldmine of public knowledge—valuation guides, sourcing playbooks, capital stack breakdowns, you name it.

Distribution is a product now

Today’s standout GPs aren’t just good investors—they’re great at telling stories, building audiences, and moving fast.

Media-first funds are real now. 20VC, The Generalist, Packy, NFX, Redpoint’s TikTok, a16z’s Future—these aren’t content side projects. They’re core to the fund’s sourcing and brand strategy.

And it compounds. The more you write, the more founders read. The more you share, the more LPs listen. The more visible you are, the more top founders want you on their cap table.

LPs and founders don’t want the same things

Here’s where nuance matters. LPs and founders are buying two different versions of you.

LPs want to know: Will you return capital? Can you raise your next fund? Are you built to last?

Founders want to know: Will you help me raise my next round? Can you open doors? Do you make my startup look legitimate?

That gap explains why some GPs feel like celebrities to founders but are still raising $10M microfunds—and why others are loved by LPs but barely get into hot deals.

In bull markets vs bear markets, different GPs win

In a bull market, capital is cheap, and the best GPs are the ones who win access to the best deals. These are the collaborative, good-karma folks. They spread small checks across the hottest companies, get markups, and ride the momentum.

In a bear market, that flips. Capital is expensive. Deals slow down. Now, pickers win. The wartime generals. The ones who have conviction, discipline, and can see around corners.

Private > Public — and the shift isn’t slowing

VC went from $60B invested in 2012 to $643B in 2021. That’s not random—it’s structural.

LPs are hungry for higher returns

Private markets are less volatile, more founder-friendly

Start-ups need less capital and stay private longer

Public markets are overregulated and overcrowded

Plus, the tooling and access infrastructure is 10x better than it was a decade ago. It’s never been easier to build a fund—or harder to make it stand out.

GPs need product-market fit too

Founders aren’t the only ones who need a tight pitch.

If you’re an emerging manager, you need to be just as crisp:

What’s your edge? Why now? Who is this for? How do you win?

Whether it’s through media, software, community, brand, niche sourcing, or portfolio support—your differentiation needs to be obvious.

The venture model is being rebuilt in public, in real-time. What’s replacing it isn’t just newer—it’s weirder, more personal, more fragmented, and way more founder-aligned.

And honestly? That’s exciting.

If you are building your VC fund deck, I would highly recommend checking out our previous write-up on the same topic - Here’s the link.

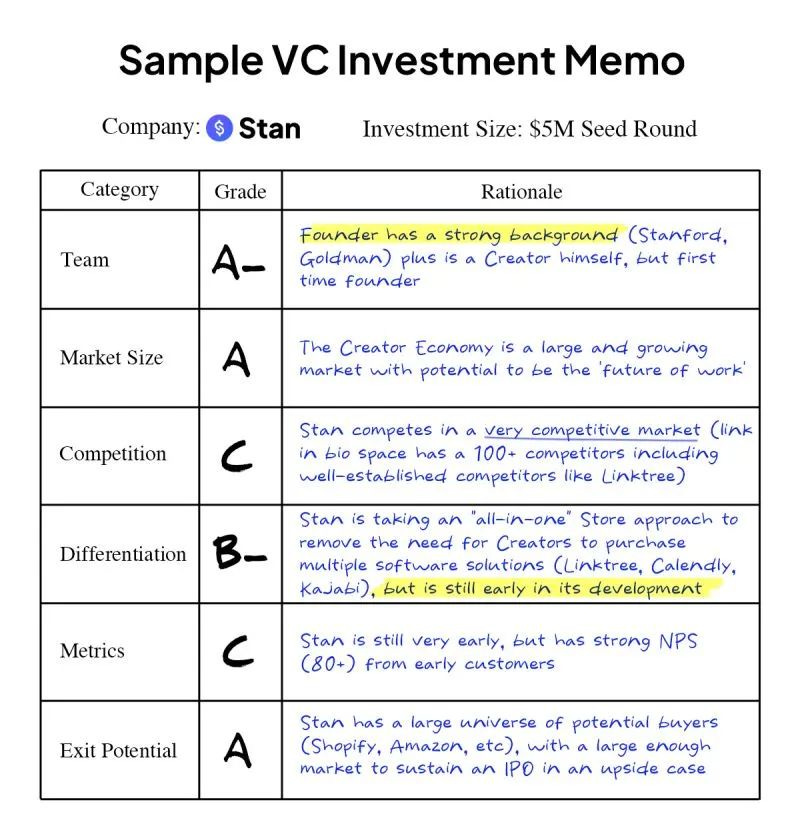

3. How Investors Will Grade Your Startup: A Sample VC Memo.

Many founders wonder: How do VCs decide which startups to fund? John Hu, who’s worked at top VC firms like Goldman Sachs and Norwest Venture Partners, shared the exact framework investors use to evaluate startups. He even applied it to his own startup—here’s how each column was rated:

Team: What is the quality of your team? How strong is your “Founder-Market’Fit? Why is your team the best team to solve this problem?

Market Size: How large is this market? Does it have BN$+ potential

Competition: How competitive is this market?

Differentiation: How will you beat the competition? What’s your competitive angle?

Metrics: How strong are your metrics? How strong of a growth indication do they give?

Exit Potential: How many potential buyers are there of your company?

These are great points that founders can consider to grading their startup, but there is a simpler way to grade a startup as 'A' or 'C,' as shared by Herwig Springer -

𝗧𝗲𝗮𝗺

A for taking market feedback over theory.

C for having outside commitments at play.𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲

A for evidence to support target market cap.

C for overestimating the accessible market.𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻

A for having a key competitive advantage.

C for failing to acknowledge key competitors.𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗶𝗼𝗻

A for building strong moats like proprietary technology.

C for differentiation based on easily replicable factors.𝗠𝗲𝘁𝗿𝗶𝗰𝘀

A for balancing growth and profitability metrics.

C for focusing on vanity metrics like sign-ups.𝗘𝘅𝗶𝘁 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹

A for considering options like M&A.

C for hyperfocusing on one path.

Try it for your startup. Make sure it will be A for each column.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New VC Launch

Andreessen Horowitz is reportedly raising a $20 billion AI-focused growth fund, its largest ever, to back U.S. startups amid global investor demand. (Read)

Lerer Hippeau, a New York-based seed-stage venture capital firm, closed its ninth fund with $200M, bringing its total assets under management to $1.4B. (Read)

DIG Ventures, a Europe-based operator-led VC founded by MuleSoft’s Ross Mason and Melissa Klinger, announced a $100M institutional fund to back pre-seed and seed startups. (Read)

Major Tech Updates

Former OpenAI CTO Mira Murati’s new AI venture, Thinking Machines Lab, has quietly added two influential advisers: Bob McGrew, OpenAI’s ex-chief research officer, and Alec Radford, co-creator of GPT and DALL-E. (Read)

Amazon unveiled Nova Sonic, a generative AI voice model that processes and generates speech with natural conversational flow, boasting performance comparable to OpenAI and Google’s best voice models. (Read)

Ilya Sutskever’s new AI startup, Safe Superintelligence (SSI), is partnering with Google Cloud to use its TPU chips for developing safe superintelligent AI systems. (Read)

Google has introduced Gemini 2.5 Flash, a lightweight AI model optimized for speed, efficiency, and cost, set to launch soon on Vertex AI. (Read)

OpenAI has filed a countersuit against Elon Musk, accusing him of launching a “fake takeover bid” and spreading bad-faith attacks to disrupt the company’s transition into a for-profit entity. (Read)

New Startup Deals

Ottometric, a Boston, MA-based emerging technology company which specializes in the validation of Advanced Driver Assistance Systems (ADAS), raised $10M in Series A Funding. (Read)

Springtail, a San Francisco, CA-based provider of a cloud-native distributed database that separates storage from computation, raised $2.5M in Pre-Seed funding. (Read)

Diamo, a NYC-based provider of a revenue platform for independent hotels, raised $4M in Seed funding. (Read)

Rondah AI, a NYC-based provider of an AI platform purpose-built for dental service organizations (DSOs), raised $1.8M in Pre-Seed funding. (Read)

Glimpse, a NYC-based provider of an AI-powered end-to-end deduction management service for CPG brands, raised $10M in Series A funding. (Read)

Osstec, a London, UK-based joint replacement implants startup using 3D printing technology, raised £2.5M in funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Manager - Amgen Venture | USA - Apply Here

Investor Relations Manager - Griffin Venture Partner | USA - Apply Here

Investment Manager - Redalpine | UK - Apply Here

Investment Associate - Shell Venture | India - Apply Here

Principa - Identity Venture | Germany - Apply Here

Investment Manager - Sagana | Africa - Apply Here

Werkstudent - Venture Capital - Growth Partner | Germany - Apply Here

Principal - Artha Group | India - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Deal Sourcing Manager - Tracxn | India - Apply Here

Finance Associate - Thomvest | USA - Apply Here

Associate / Senior Associate - Physis Capital | India - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

Investment Analyst - M13 | USA - Apply Here

Investment Manager - Sagana | Africa - Apply Here

Werkstudent - Venture Capital - Growth Partner | Germany - Apply Here

Principal - Artha Group | India - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator