How to Build an Investor Data Room - The Only Guide You'll Need as a Founder. | VC & Startup Jobs.

Jeff Bezos' Heuristic for Hiring & Capturing long term value.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How to Build an Investor Data Room - The Only Guide You'll Need as a Founder.

Quick Dive:

How Great Tech Companies Capture Long-Term Value.

Jeff Bezos' Heuristic for Hiring

Major News: Peter Thiel raises $3 billion fund, US and UK refuse to sign AI safety declaration, ChatGPT’s energy use lower than expected & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

How to get Investors to say Yes - Lessons from a Founder who raised $1B

A simple 5-step framework to determine your startup's valuation.

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

50 most viral hook patterns extracted from 46,606 TikTok.

Ready-to-go financial modelling template to build your startup financial model that every investor wants to see.

Paul Graham's framework to get startup ideas.

Meco is the best free web app used to read newsletters in distraction-free systematic ways.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

Tips on making investor update a valuable asset

5 things to know when building successful paywalls.

Must-have resources to stay updated on AI tools, trusted by MIT students and tech professionals from OpenAI and NVIDIA.

INVESTMENT OPPORTUNITY FOR YOU

🧐 A Fresh $62B Market Play—Why Investors Are Backing Lettuce Grow

Spotted something interesting this week that got me digging deeper. Lettuce Grow is changing how we get fresh produce—starting with home hydroponics and now making its way to grocery aisles.

Why I’m paying attention:

The founding team is stacked—Jacob Pechenik (MIT grad with a major NYSE exit), Greg Campbell (built 4 successful ventures), and Zooey Deschanel (who sold HelloGiggles to Time Inc.).

The numbers? They’re crushing it:

$10M+ revenue, ranked #11 on Inc. 5000 in California

11x LTV/CAC ratio (fellow investors, you know how rare that is)

And here’s the big news: They just landed a major retail deal with Costco, bringing their fresh, hydroponic produce into one of the most trusted retailers in the U.S. It’s a huge validation of their market potential and signals that demand for better, fresher food is only growing.

With Collaborative Fund and top VCs already in, they’re now raising $7.9M on WeFunder to fuel expansion.

Deep dive into the deck + invest (min $250) →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How to Build an Investor Data Room - The Only Guide You'll Need as a Founder

As a first-time founder, you might find yourself in this situation - excited about a positive response from a potential investor, but suddenly faced with an unfamiliar term: 'data room.'

A data room is essentially a secure, organized collection of documents that provides detailed information about your company. It's a tool for due diligence, allowing potential investors to examine your business's financials, operations, and potential in depth.

But before diving into how to build an investor data room, let me share an important insight: Don't send all your data to investors too early in the process.

Just because investors request data room access doesn't necessarily mean you're making progress. Many founders make the mistake of sending all their information at once (even before the first investor call) and end up getting ghosted by VCs. The best way to avoid this is to create a two-stage data room approach:

A pre-term sheet data room

A post-term sheet data room

This structured approach helps protect your sensitive information while maintaining investor engagement throughout the fundraising process.

Stage 1: Pre-Term Sheet

At this point, investors typically have limited information about the company, relying mainly on the pitch deck, website, and publicly available data. They request access to a preliminary data room to perform a quick spot check and gather material for internal discussions with their partners.

This Stage 1 data room helps investors validate their initial interest and prepare for more in-depth conversations about the potential investment.

Here’s a list of the 5 sections and types of content you’ll want to include in your stage 1 data room:

Business Summary / Company Overview

Purpose: provide an overview of the problem you are solving, your solution, and competitors - make it easy for the investor to create a deal memo

Docs to include:

1-page business overview

Links to your company website and social platforms

A PDF copy of your current pitch deck

Traction / Product Market Fit

Purpose: provide data that proves you’re solving a real problem - better yet with a solution to a problem that a lot of people have and are willing to pay meaningful dollars for

Docs to include:

Market sizing - bottom-up or top-down TAM backed by relevant up-to-date data from reputable sources

Customer / User data - how many customers or users do you currently have, how engaged are they

Competitive positioning / Unique Selling Proposition (USP)

Customer acquisition data - CAC, CAC payback

Financials

Purpose: provide a financial overview of your business from the day you started to the present day with forward-facing projections. If you don’t have a financial model built, I highly recommend you check out Sturppy. Sturppy’s is used by 4,000+ startups and allows founders to build an investor-ready financial model without being an expert on finance or financial modelling.

Docs to include:

P&L / Income Statement, Balance Sheet, Cashflow Statement, Financial Projections 1-3 years in the future

Team & Roles

Purpose: provide an overview of your team, their experience, and the roles they play in your business

Docs to include:

Brief profiles on each team member, their role, their prior work experience, their time with the company, and links to their social channels (LinkedIn)

Cap Table

Purpose: provide an overview of who owns equity in the business today.

Docs to include:

Cap table summary

After receiving and negotiating a term sheet, you enter Stage 2 of the data room process.

Stage 2: Post-Term Sheet

This stage is crucial for streamlining due diligence before any final agreements are signed. It's wise to create a separate, more detailed data room for this phase, rather than just expanding your Stage 1 room. This approach gives you better control and flexibility, especially when dealing with multiple investors at different stages.

Here’s a list of additional sections and content you’ll want to include:

Entity Formation Documents

Purpose: These documents are mostly needed by the legal team and are the set of documents used to certify your business’s good standings. These docs are going to fluctuate based on where your business is incorporated and the type of business entity you’ve chosen. If you’re a startup in the US, 9/10 if you’re raising venture, you’re going to be established as a Delaware C-Corp

Docs to include:

Shareholder certificate documents

Local/state/federal business licenses/letters of good standing

Articles of incorporation

Bylaws, Tax ID number, Operating agreement between founders, Shareholder meeting minutes/board minutes, Annual meeting notes/minutes

Customer & Partner Contracts

Purpose: Material agreements will vary from company to company based on the nature of the business but the general gist is to include anything that could significantly impact the business

Docs to include:

Standard terms of service or use between your business and customers

Any agreements or understandings between your company and others with obligations exceeding $25K

Property leases (real estate and personal)

Licenses of any company IP to 3rd parties

Proof of Intellectual Property

Purpose: If your company has IP and that was part of the pitch, you’re going to have to show proof of that IP. This includes patents, trademarks, copyrights, design

Docs to include:

Evidence that you have the right to the IP that you’re developing

Patent information (proof of filing/issuing)

Trademark registrations

Copyrights

Full cap table documents

Purpose: If you’ve followed this guide, you’ve already shared a summary of your cap table. At stage 2 you’ll likely need to divulge additional details such as:

Docs to include:

Details of previous fundraising rounds or liquidity events

Shareholder certificates

Vesting schedules

ESOP details

Tax Filings

Purpose: Proof that your company is in good standing with the IRS

Docs to include: Tax History, Previous filings, Previous audit statements and any third-party financial evaluations

Information on Any Outstanding Litigation

Purpose: This one is key…failure to divulge pending or outstanding litigation can and will likely result in a very bad outcome for you and your business. Be honest here, have a hard conversation with the investor at this stage in the process.

Just remember - unless you’ve received a term sheet and you’re asked to share (and you will be asked if you’ve received a term sheet and decide to move forward) don’t share (Stage 2 data room data) it until it’s requested.

Also, many founders ask about what solution to use to create and store all this data. Let me address that:

If you're a founder on a budget, Google Drive works perfectly fine as your data room. There's no need to spend money on fancy solutions. Some of you might worry about privacy, security, analytics, and tracking - but honestly, at your early stage, these aren't critical concerns.

Google Drive is secure enough, costs nothing, and most importantly - investors are already familiar with it. Save your money for things that actually move your business forward. That’s it.

Also, I highly recommend checking out this article titled - “Why you should never have a data room — the most counter-intuitive fund-raising advice you’ll ever get” by Mark Suster.

A MESSAGE FOR FOUNDERS

📢 RNO1 Has a Message for You: Your Digital Presence Should Drive Results

Your website or app isn’t just a digital asset—it’s the foundation of your brand’s success. At RNO1, we don’t just design; we create Radical Digital Experiences that captivate users, drive conversions, and fuel business growth.

Whether you need a bold new website, an intuitive app, a high-impact SaaS platform, or a data-driven marketing strategy, we help brands break through the noise and dominate their industries.

What We Deliver:

✔️ Branding & Identity – Your brand should do more than stand out—it should make a statement.

✔️ Web & App Development – Future-proof platforms built for speed, scalability, and success.

✔️ UX/UI & Product Design – Seamless, high-converting digital experiences users love.

✔️ Go-To-Market Strategy – Position your brand to win with a strategic roadmap.

✔️ Performance Marketing – SEO, PPC, email & social strategies that turn traffic into revenue.

We’ve helped Airbnb and Dentsu scale their digital presence and powered startups that secured $100M+ in funding and hit $1B valuations.

Let’s build something extraordinary. Reach out today →

📃 QUICK DIVES

1. How Great Tech Companies Capture Long-Term Value.

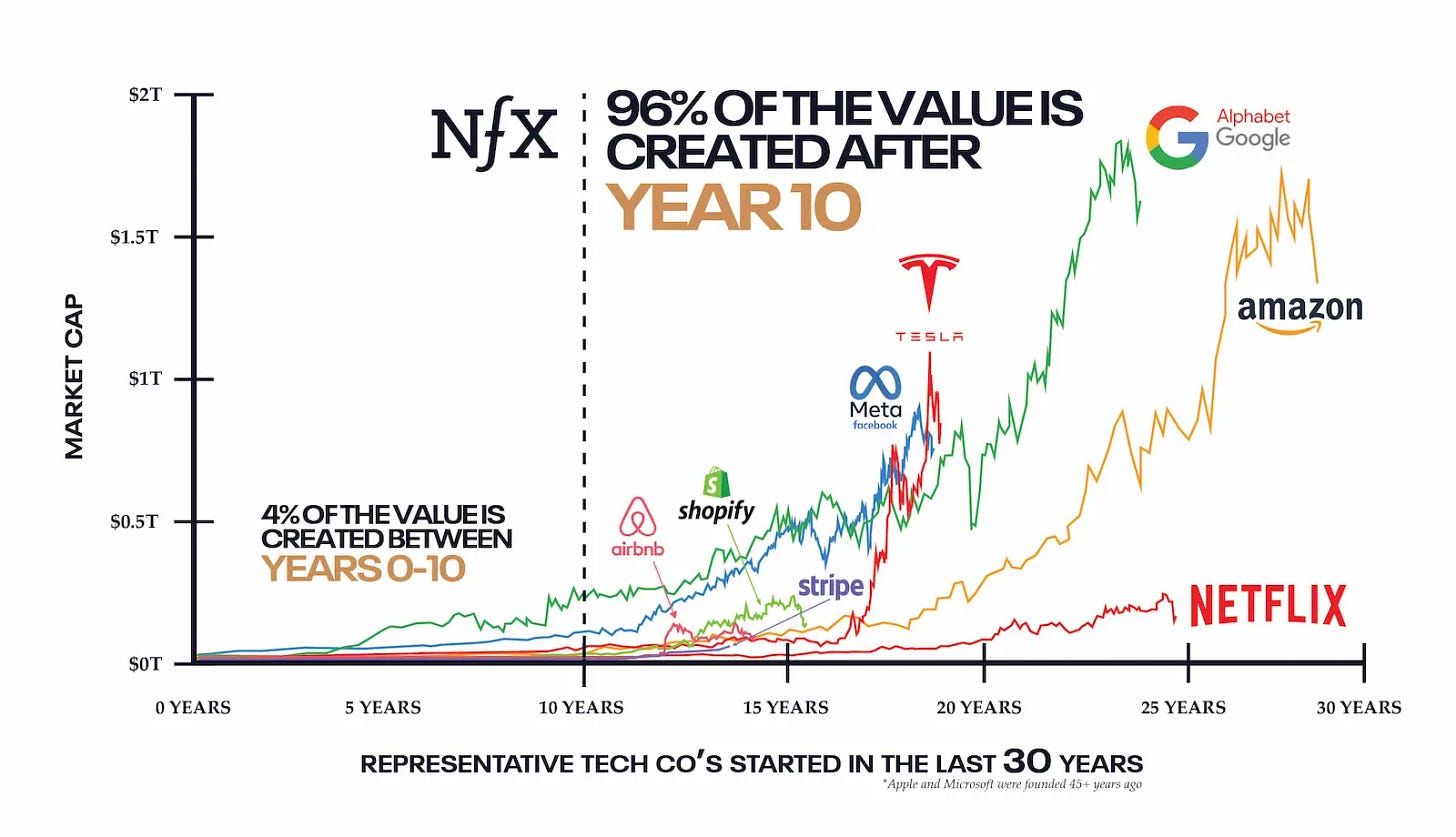

There is an article titled 'The Durability Formula' by NFX. I feel many founders overlook building companies that last. I'm sharing some key points and my thoughts on this.

Remember most of the real value in tech companies isn't created in those exciting early days but in the long run. The catch? You can only capture the value in the long term if you design for durability from day one.

What’s the Secret of Lasting Companies?

Think of durability like a recipe with five key ingredients:

Network Effects (making your product more valuable as more people use it)

Economies of Scale (getting stronger as you get bigger)

Brand Power (building emotional connections)

Embedding (becoming essential to your customers' operations)

Intellectual Property (protecting your innovations)

Let's break these down and explore the questions you should be asking yourself.

Network Effects: Making Your Product Sticky

Remember this golden rule: a "multiplayer game" beats a "single-player game" every time. Think about it - isn't Facebook more valuable because all your friends are there? Here are some key things to consider:

Does your product get better when more people join?

Have you solved the chicken-and-egg problem of getting those first users?

Where's your "white-hot centre" - that core group of super-active users?

Watch out for potential pitfalls too. Can users easily switch between your platform and competitors (like drivers do with Uber and Lyft)? Are users trying to bypass your platform for direct deals (like happens with freelance marketplaces)?

Economies of Scale: The Beauty of Getting Bigger

This is where math becomes your friend. As you grow:

Can you negotiate better deals with suppliers?

Do your costs per unit go down?

Can you outspend competitors on marketing because your economics work better?

Think Amazon - they can offer lower prices while still making money, which makes it really hard for others to compete.

Brand: The Emotional Moat

Here's where human psychology comes into play. Apple users don't just buy phones - they buy into an identity. Ask yourself:

Do people feel like they're part of something special using your product?

Would users feel like they're "downgrading" if they switched to a competitor?

Does your brand carry social proof that makes decisions easier for customers?

Embedding: Making Yourself Indispensable

This is particularly powerful for B2B companies. Once Workday or Salesforce is integrated into a company's operations, good luck trying to rip it out. Consider:

How painful would it be for customers to switch away from you?

Are you becoming their "system of record"?

How many of your products are they using?

Intellectual Property: Your Technical Moat

While software patents might not be super effective (things move too fast), this becomes crucial in bio and tech. If you're in these spaces, you need to think about:

Your patent strategy

Clean ownership of your IP

Any university or government grant obligations

Building for the Long Haul

Here's what it all comes down to the real value in tech companies comes from compound growth over many years. But you can only capture that value if you build durability into your company's DNA from the start.

Think of it like building a house - you need to lay a solid foundation before you can add all the fancy stuff. The most successful founders I know spend serious time thinking about these durability factors early on. They know that as their companies grow, these factors make them increasingly difficult to compete with.

Remember: You're not just building for today or next year - you're building something that should get stronger over time. Start with durability in mind, and you'll be setting yourself up to capture the kind of compound value growth that creates truly exceptional companies.

2. Jeff Bezos' Heuristic for Hiring

Jeff Bezos says he hires people only if they pass 3 separate bars:

Can the person do exceptional things?

Does he admire them?

Will the person raise the effectiveness of the team?

You can get answers to all three of these questions in a single, 30-minute interview if you ask the right questions.

I would highly recommend reading - Smart Management by Jochen Reb to learn more about it.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Founders Fund, the Peter Thiel-founded VC firm, is nearing a $3B close for its third growth fund by March.

Apple is reportedly partnering with Alibaba to bring its Apple Intelligence platform to China after rejecting potential deals with DeepSeek and ByteDance due to compatibility concerns.

The U.S. and U.K. declined to sign the AI Action Summit declaration in Paris, which was endorsed by 61 countries, including China, India, Japan, and Canada, citing concerns over ideological bias and regulatory overreach.

A new study from Epoch AI estimates that a typical ChatGPT query consumes 0.3 watt-hours, far less than the widely cited 3 watt-hours per query, reducing concerns over AI’s immediate energy impact.

The U.S. Army is set to transfer control of the troubled Integrated Visual Augmentation System (IVAS) project from Microsoft to Anduril, pending final DoD approval, marking a major shift in the $22 billion program.

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

Associate - Notion Capital | UK - Apply Here

Venture Capital Summer Associate - Stepstone Group | USA - Apply Here

Business Development Analyst - Korea Investment Partner | USA - Apply Here

Venture Capital Associate - Life Science SCI Venture | UK - Apply Here

Operations Associate - Techstar | USA - Apply Here

Associate - Investor Relations and Sales - True Beacon | India - Apply Here

Investment Associate - Sorenson Capital | USA - Apply Here

Investment Analyst - TDK Venture | UK - Apply Here

Investment Associate - Softbank Vision Fund | USA - Apply Here

Investment Analyst - Softbank Vision Fund | USA - Apply Here

Ecosystem Associate - TDK Venture | UK - Apply Here

Associate - Omerse Venture | USA - Apply Here

Associate - NFX | USA - Apply Here

Principal - NFX | USA - Apply Here

Analyst - Elev8 Venture Partner | India - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator