9 Annoying Questions From VC & How To Turn Them Around. | VC Jobs

Framework to determine startup valuation & New platform to get startup deals.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: 9 Annoying Questions From VC & How To Turn Them Around.

Emerging tools you should explore.

Quick Dive:

Venture Radar: Where Founders Meet Their Perfect Investors.

Sequoia Capital Framework: Understanding Startup Runway.

A Simple Framework To Determine Your Startup Valuation.

Major News: Apple offers rare iPhone discounts in China, Peter Thiel-backed fund raised $300 M, Microsoft to invest $80 billion in AI data centers & Tesla’s sales fell year-over-year for the first time.

In-depth reports: CBInsights' 7 charts; solo GPs' rise: why GPs build personal brands; investor databases: guide to 20 VC lists; SaaS retention: ChartMogul on customer trends.

20+ VC & Startups Jobs Opportunities.

THE MOST EMERGING STARTUP YOU CAN'T-MISS

The VA Agency That's Disrupting the Industry - A Team Overseas

Ever had one of those moments when you're explaining the same task to your VA for the fifth time and think 'There has to be a better way!'? (Trust me, I've been there! )

Meet A Team Overseas - they're flipping the virtual assistance game on its head. While those fancy agencies charge $3K/month but pay EAs only $700, these folks said 'enough!' They're snagging top EAs, paying them $1,400 (finally, fair pay!), and charging clients just $2.5K.

But here's what made me jump out of my chair - these aren't just task-takers. My friend Sarah's EA caught a major sales funnel issue and fixed it before Sarah even noticed. No more endless training, just pure magic!

→ Ready for an EA who gets it? Book a call here with A Team Overseas.

Partnership With Us: Want to get your brand in front of 85,000+ readers like founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

How Much Funding Should a Startup Raise? - Marc Andreessen’s Framework. (Read)

The Slide Every Investor Wants to See... (Read)

8 unique paths founders take to reach Product-Market Fit. (Read)

Fundraising Simplified: What to Show Investors at Each Stage.. (Read)

Big changes in AI to watch for over the next 12 months (Read)

Mistakes this second-time founder isn’t making (Read)

A bad habit of early-stage startups (Read)

The real application AI will have with social apps (Read)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources (Read)

The best handbook on how to scale with cold email (Read)

The harsh realities of being a founder (Read)

The truth about great business partners (Read)

TODAY’S DEEP DIVE

9 Annoying Questions From VC & How To Turn Them Around.

If you are fundraising or looking to fundraise for your startup, you will see annoying questions from VC :). Not only this, you will find some other things like - I don’t think this can be a venture scale business, We’d be interested when we see a bit more traction, Come back when you have a lead etc… and most founders don’t know how to think on this questions and proceed with it.

So in this post, I will try to answer how you can think about these questions:

What if Google Builds It?

You will find a lot of VCs asking this question where Google substitutes with Amazon or Facebook or any other big company.

It’s a valid question - this shows your startup edge and how will you win. Here are a couple of answers that may help:

Too big to care: These giants are so huge, your "little" idea might not even catch their eye. They're busy chasing bigger fish.

Slow movers: Big companies are like big ships - they turn slowly. You're a speedboat. You can zip around, change direction fast, and give customers exactly what they want before the big guys even start their engines.

Proof you're onto something: If a big company notices your idea, it means you've found a real problem to solve. That's exciting!

People will pay for better: Even if Google makes a free version, many folks will happily pay for a product that actually answers the phone when there's a problem. Just look at companies like Mixpanel or Superhuman - they're doing great against free Google stuff.

Show off your speed: Can you build things faster than the big company? Can you make your customers super happy? Focus on that. It's your secret weapon.

Remember, being small and quick can be your superpower. Use it to outmanoeuvre the giants!

I don’t think this can be a venture-scale business

Previously I shared my thought process on how investors think about this particular question, let me know to share more info here

Not every business needs venture capital (VC) money. It's like rocket fuel - great if you want to go to the moon but overkill for a quick trip to the store. VCs are looking for companies that can grow incredibly fast and become huge. They want to turn their money into a fortune, and fast. We're talking about businesses that can make $100 million a year in just five years. That's a wild ride, and it's not for everyone.

But here's the funny thing: it's really hard to predict which ideas will explode like that. VCs often think they know, but they're wrong all the time. They might ignore a business selling stuff online, thinking it can't grow big enough. But what if it's the next big thing, like Stitch Fix?

So, if you're thinking about chasing VC money, ask yourself: Do I really want to build a massive company? Can I handle hiring tons of people and working like crazy? If that sounds exciting, great! Think about how you'll grow your business super fast. How will you double or triple your sales each year?

But if that sounds like too much, don't worry. There are other ways to get money for your business. You could talk to individual investors, try crowdfunding, or look into loans based on your revenue. These options are becoming more popular and might be a better fit for your dreams.

The most important thing is to be honest with yourself about what kind of business you want to build. There's no shame in staying small or growing slowly if that's what makes you happy. Just make sure you're chasing the right kind of money for your goals.

We’d be interested when we see a bit more traction

When a VC tells you they want to see "more traction," it's like they're saying, "I'm not sure about your business, but maybe if you grow more, I'll change my mind." The problem is, most VCs can't really tell you exactly how much growth would convince them. If you suddenly made $100 million, sure, they'd all jump on board. But what if you grow to $100,000 a month in a year? Well... it depends. VCs like to keep their options open, so they'll always want to "check in later" unless you're clearly terrible or a scammer.

It's frustrating, right? But here's how to handle it: Don't waste time trying to convince these fence-sitters. Put them in your "not interested" pile. Keep sending them updates, sure, but focus on finding investors who believe in you right now. You're better off meeting tons of investors and quickly figuring out who's actually excited about your idea.

Remember, it's like dating. You don't want to spend months trying to convince someone to like you. You want to find someone who's into you from the start. So get out there, talk to lots of investors, and find the ones who get that spark in their eyes when you explain your business. Those are the folks you want on your team.

Don't get hung up on the maybes. Keep moving, keep pitching, and the right investors will show up. It's a numbers game, so play it smart and don't let the "show me more traction" crowd slow you down.

Come back when you have a lead

When a VC says, "I'm in once you have a lead," they're basically saying, "I don't want to take the risk, but I don't want to miss out either." It's like they're waiting for someone else to give your idea a thumbs up before they jump in.

But here's the thing - "lead" can mean different things to different VCs. Some want to see most of your money raised. Others just want to know the deal terms. And some are looking for a big investor to take charge and join your board.

So, what do you do? First, get clear on what they mean by "lead." Don't be shy - ask them straight up.

If they just want to see most of the money raised, you've got options. You could bring together a bunch of smaller investors without a traditional lead. It's called a party round, and it's pretty common these days.

If they're just after the terms, you can set those yourself. Create your own deal on a simple agreement like a SAFE or convertible note.

But if they want a big-shot lead investor who'll take a board seat and run the show, that's a whole different ballgame.

The key is to not get hung up on these "maybe" investors. Keep moving, keep hustling. Build your round in whatever way works for you. Remember, there's more than one way to skin a cat - or in this case, raise some cash.

Don't let the "we need a lead" crowd slow you down. If your idea's good and you keep pushing, you'll find the right investors who believe in you from the start. That's who you want on your team anyway.

Why hasn’t this been done before?

This might sound like a silly question, and some could say a lazy VC just doesn’t want to do their homework. But really, it’s a smart way to see how you think about trends and changes in your market.

If you believe that markets are efficient, then your opportunity shouldn’t exist. Why? Because if it were that obvious, everyone would have already jumped on it.

So, what’s your special insight? What do you know that others don’t? Is it your deep knowledge of the industry? Is the opportunity sitting at the intersection of two areas that most people don’t understand? Or is it a trend you’ve noticed in a specific group of people that others haven’t picked up on?

Every startup needs to have a solid answer to this. Even investment funds face this question—why is no one else doing what you’re doing? It might be annoying to hear, but it’s a valid question.

So, if a VC asks you this, don’t get defensive. Use it as an opportunity to explain what makes your idea unique and why you’re the right person to take advantage of it. If you can’t answer this question, it might be time to rethink your approach.

Contact us if you like but we prefer warm introductions.

It’s kind of funny that VCs often want warm introductions, yet many VC analysts still reach out cold to startups asking to chat.

My advice? Always aim for a warm referral to a VC if you can. Having a mutual connection really helps in building rapport. However, many newer VCs, especially microVCs, are open to cold emails. Also for most VC firms, about 20% of deals come from completely cold outreach, and see no difference in performance between those and the ones that come through warm introductions.

Looking ahead, I predict that in the coming year, the VC landscape will increasingly accept good cold emails. Sure, most cold emails are poorly written and will be ignored, but if you craft a strong one, you might just catch their attention.

What’s the moat? (for a seed stage)

This can be really frustrating for a seed-stage company since, let’s face it, there’s usually no real moat in place yet.

When you think about it simply, the only true way to create a moat is to make your customers love your product so much that they never want to leave and keep coming back. There are many ways to achieve this. For example, you might offer a better user experience, leverage more data to improve your solution's accuracy or create strong network effects that enhance your product. The path to building this loyalty will vary depending on your idea.

VCs are particularly interested in understanding how you plan to achieve this on a larger scale. This is especially important for companies with commodity products, like those in finance. Competing on price or better deals isn’t sustainable. Instead, VCs want to know how you’ll create a smarter, more appealing product. How will you design your business model to encourage customer retention? They’re more focused on how you envision this five years down the line than on your current situation.

How can this be a billion-dollar company?

The reason VCs are so fixated on billion-dollar companies is simple - the economics of running a VC fund are brutal. Most of the startups in their portfolio will fail completely. So any 1 or 2 winners they have need to make up for all those failures, plus a whole lot more, in order to generate the returns their investors expect.

This means VCs are looking for at least a 100x return on a successful investment. If they invest at a $10 million post-money valuation, say at the seed stage, 100x on that is around $1 billion, before accounting for dilution.

So it all comes back to the question you have to ask yourself - do you really want to be raising money from VCs? Is this the type of business you want to build? One that needs to be a unicorn to justify their investment?

There are other paths, like bootstrapping or targeting a smaller but profitable market. Those may not make you a billionaire, but they can still lead to a great business. It's a very personal decision based on your goals and aspirations as a founder.

The key is to be really honest with yourself about what you want, and what you're willing to do to get there. Don't just chase the VC money because it's available. Make sure it aligns with your vision. Because once you take it, you're locked into their timeline and expectations.

“Yes but what *traction* do you have?” & “Your valuation is so HIGH now!”

It's like the classic Goldilocks story - sometimes you're too early, sometimes too late, and it's rare to be just right.

At first, VCs might say you don't have enough traction. Then, once you gain some momentum or bring in another investor, suddenly you're too late - the valuation is too high for them to get in.

As frustrating as this is, it really comes down to luck, timing, and fit. As pre-seed investors, we face this too. We invest super early, before traction even exists. So we rely heavily on gut instinct about the opportunity. If we're not fully convinced, we'll pass. And if a founder later proves us wrong with traction, we still can't invest because the valuation is out of reach.

It's a bummer, but VCs who miss out feel the pain too. Look at the Uber IPO - tons of VCs lost out on huge gains because they didn't believe in the idea early on.

Gut instinct is huge in this business. To be honest, you only need to be right 20-30% of the time to be considered a great VC. It's like baseball - you strike out most at-bats. Imagine if surgeons only succeeded that rarely - they'd be fired and patients would be dead!

The only exception is multi-stage investors. If they miss your seed round, you can always circle back for a Series A or B. But for early-stage VCs, it's a constant dance of being too early or too late.

That’s it.

EMERGING TOOLS

Tools You Should Try

Meco: The best free app for newsletter reading in a clean, organized interface on iOS and the web.

Venture Crew’s Pitch Deck Tool: Build your pitch deck with help of investors & designers.

tl;dr sec: The best way to keep up with cybersecurity research for free.

QUICK DIVES

1. Venture Radar: Where Founders Meet Their Perfect Investors.

We're excited to share something new we've built for you.

After countless conversations with founders struggling to reach the right investors and investors drowning in unsorted pitch decks, we've created Venture Radar — your biweekly dose of promising startup opportunities.

Here's the deal:

Every two weeks, we feature 4-10 carefully selected startups raising capital

Founders get exposure to our verified investor network

Investors receive curated, detailed startup profiles

Simple "reply to connect" system for instant introductions

100% free platform (no fees, no hidden costs)

For Founders: Just fill out the form to get featured. If selected, we'll showcase your startup to our investor network.

For Investors: Get handpicked startup opportunities delivered straight to your inbox. No noise, just quality deals.

Ready to join? Subscribe to Venture Radar here.

2. Sequoia Capital Framework: Understanding Startup Runway.

Many founders make mistakes when calculating their runway period. Sequoia Capital has shared a simple framework that can help founders think beyond the basic runway calculation equation. It covers -

Calculating your current runway?

Determining how much runway you actually need? and

How to extend your runway if you need more time?

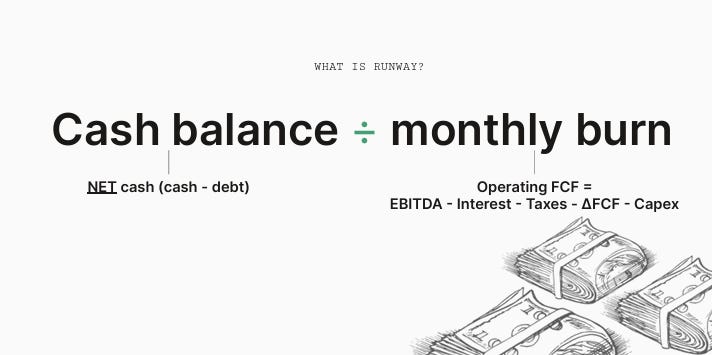

Calculating Runway:

Runway is calculated as your cash balance divided by your monthly burn rate. However, it's important to use your net cash balance, which is your cash on hand minus any debt you've drawn. Debt is borrowed money that you owe creditors, so it should not be counted as part of your runway calculation.

The monthly burn rate is different from net income - it accounts for cash inflows and outflows, including inventory purchases, capital expenditures, and upfront revenue collection.

Determining Needed Runway:

Runway needs to be evaluated in the context of meeting valuation milestones for your next fundraising round. Your runway should allow enough time to hit the fundamental metrics (ARR, gross profit, etc.) required to raise at your desired valuation, whether an up round, flat round, or reaching cash flow positive.

Many founders are 3-4 years away from their last valuation milestone but have less cash runway than that.

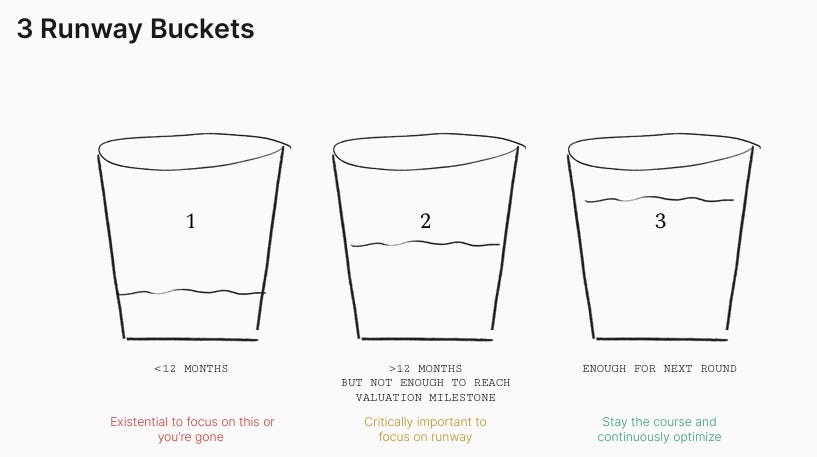

Generally, companies are into three buckets:

<12 months runway (existential focus on extending)

12+ months runway but not enough for a flat round

Enough for a flat round, up round, or cash flow positive

Most founders think they are in Bucket 3 but are likely in Bucket 2, needing to manage their runway carefully.

Extending Runway:

To extend the runway, deeply analyze your P&L to identify the biggest areas of cash burn. Prioritize high-impact changes even if they are difficult to execute. Set a realistic goal for how long it will take to hit the milestones for your next round, then target having 12 months more than that timeframe.

Making the difficult decisions to significantly reduce burn (e.g. layoffs, exiting markets, raising prices) will be painful but put the company in a stronger long-term position.

Key Takeaways:

You likely need more runway than you think

Your next round valuation will be based on real metrics and financials, not just the story

Most companies in Bucket 2 need to proactively extend the runway

Executing on reducing burn will position you for long-term success

3. A Simple Framework To Determine Your Startup Valuation.

Many founders ask me, "How do I know what my startup's valuation should be?" So here's a simple framework that you can use to determine your startup's valuation:

Identify your key milestones

Remember, raising capital from VCs relies on hitting milestones that expand your startup's growth potential. At later stages, this is driven by metrics like ARR, active users, retention, and growth rate. But at pre-seed, seed, and Series A, milestones are more narrative-driven.

The first step in planning a fundraiser is understanding what milestones you'll need to hit before your next round. That will shape the growth strategy you pitch to investors now.

What's Your Expected Burn

Next, conservatively map out the cash you'll need to burn to hit your milestones. Always assume you'll need 1.5x more than you think, in case things go wrong.

This forces you to think through a full, honest growth strategy. Work backwards from the milestones:

What needs to happen for them to be true?

How long will that take in optimistic, realistic, and pessimistic scenarios?

How much will you need to spend?

Can you move faster or reduce risk by spending more?

Map this out month-by-month against your expected revenue. VCs don't expect profitability, but this shows your total burn and monthly burn rate before your next raise.

Your Round Size?

To determine your fundraising size, use this formula:

Fundraise size = expected total burn + (expected burn rate * 12) - current cash

VCs typically want 12 months of runway, so multiply your expected burn rate by 12 and add that to your total burn between raises.

(Your current cash is what's in the bank now.)

Example: Let's say your startup has a burn $50K per month over the next 10 months before you'll hit your milestones for the next round and you have $100K in the bank right now:

$500K + ($50K * 12) - $100K = $1,000,000 round size

Calculate Your Valuation

Consider how much of the company you're willing to sell in this round. Generally, startups sell 10-20% per round.

Do an honest risk assessment - more unknowns mean you'll need to be on the higher end. If you don't urgently need to raise, you can negotiate lower.

In our example, let's assume you want to sell 15% for $1 million. That sets our valuation around $6.7 million, or $7 million to keep it simple.

Double Check the Markets Right Now

Now look at recent deals in your industry and consider market factors using Pitchbook. Talk to VCs not pitching to get context on whether valuations are "high" or "low" right now.

If valuations are "high" you can be aggressive with your story. If "low", you'll need to rely more on traction and metrics and may need to accept selling more equity than preferred.

In our example, let's assume the markets are "low", so you might have to choose between a $6M valuation or raising less capital than desired. That’s it.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

PayPal Sued Over Racial Bias in $530M VC Fund Diversity Program. (Read)

Accel has raise $650 million Indian focused fund. (Read)

Meta removes AI profiles after backlash. (Read)

Generative AI investments hit a record $56B in 2024, up 192% from 2023. (Read)

Microsoft to invest $80 billion in AI data centers in 2025. (Read)

Tesla’s sales fell year-over-year for the first time. (Read)

Peter Thiel-backed venture debt firm Tacora raises $268.7M for new fund. (Read)

Apple to pay $95 million to settle Siri privacy lawsuit. (Read)

xAI’s next-gen AI model didn’t arrive on time, adding to a trend. (Read)

Apple offers rare iPhone discounts in China amid rising competition. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

REPORT THAT YOU SHOULD LOOK

In-Depth Insights

7 top charts to ring in 2025: CBInsights shared 7 charts that can help you understand what’s next for tech in 2025.

Why Venture GPs Keep Going Solo General Partners launching solo ventures and the motivations behind these shifts. “Everything falls on him or her. Their name is their brand, not the name on the door.”

All-in-one Startup Investors database (20 different investor databases) A curated 20 different investors database. For each database it includes - VC Fund Name, Partner Name, Portfolio Startups, Fund Stage, Sector Focus, LinkedIn & Twitter Link.

SaaS Retention: The New Normal ChartMogul's report on SaaS retention trends, focusing on customer behavior, revenue patterns, and strategies for sustainable growth.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get Access to our all-in-one VC interview preparation guide — We offer a 30% discount for a limited time. Don’t miss this. (Access Here)

Content Creator Intern (Marketing) - Antler | Singapore - Apply Here

Operations Executive - SucSEED Ventures | India - Apply Here

Chief Venture Officer - Cool Climate Collective | USA - Apply Here

Investor Relations Analyst - B Capital Group | USA - Apply Here

Visiting Analyst (Venture Capital) - YZR Capital | Germany - Apply Here

Growth Associate - B Capital Group | USA - Apply Here

Summer Intern - Connecticut Innovation | USA - Apply Here

General Partner - Maroon Invest Global | USA - Apply Here

Investment Analyst - Rubicon Founders | USA - Apply Here

Investment Analysts - Zeta Capital | India - Apply Here

Investor Support Specialist - Microventure | USA - Apply Here

Investors - Griffin Gaming Partner | USA - Apply Here

Portfolio Success Manager - Array Venture | USA - Apply Here

Operations and Events Manager - TO Ventures | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Your valuation framework is straightforward. How would you recommend founders adjust this approach in industries with volatile market conditions (e.g., AI or climate tech)?