Y-Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M. | VC & Startup Jobs.

A Hot Take on Using Memos, The Hidden Patterns of Great Startup Ideas & North Star Metrics.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Y-Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M.

Quick Dive:

Framework: The Hidden Patterns of Great Startup Ideas.

A Hot Take on Using Memos Instead of Pitch Decks From Founder Raised $42 Million.

North Star Metrics: How to Identify Bad & Good Metrics?

Major News: Tencent unveils a Deepseek competitor, General Atlantic may acquire TikTok’s US, Claude’s new web search likely powered by Brave Search & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Jack Dorsey’s advice to founders raising venture capital.

Financial modelling template to build your startup financial model that every investor wants to see.

VC RETURNS REVEALED: See IRR Performance for 50+ Venture Funds in 2024.

Reframing “Freemium” by charging the marketing department by a smart bear.

All-In-One guide to pitch deck storytelling - free template & curated resources.

On the Lifecycle of Industries.

Finding the right sales metrics.

Write your monthly investor update (email template download).

Anand Sanwal on how to find startup ideas.

Verified 2700+ US angel investors & VC firm’s contact database (email + LinkedIn link).

Tim Denning on learnings from an 8-figure entrepreneur.

Brian Feroldi shares great advice on selling.

Global expansion in Generative AI: a year of growth, newcomers, and attacks.

Startup legal document pack – essential legal docs for founders.

Must follow AI resources to get the latest AI trends, tools, and tips in under 3 minutes - The AI pulse.

🤝 INVESTMENT OPPORTUNITY WORTH EXPLORING

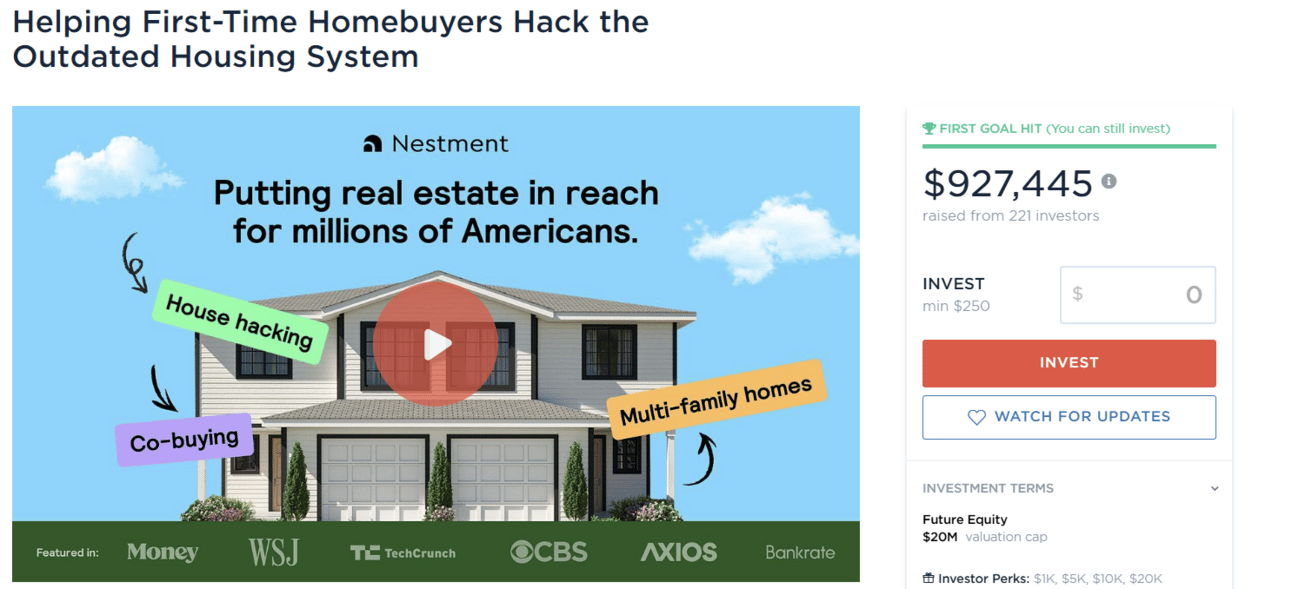

Making Homeownership Accessible—Why Investors Are Backing Nestment…

First-time homebuyers are being priced out, but Nestment is making ownership possible. By streamlining creative financing and house hacking, they help first-time buyers unlock new paths to homeownership and enter the market sooner.

Why It Matters:

✅ $100M in home transactions in the first year, growing 30% month-over-month

✅ 78% of customers are first-time homebuyers, 65% are from communities of colour

✅ Profitable 6 months ahead of schedule, earning $11K per home at 80% margin

Why I’m Watching:

Featured in WSJ, CBS, Bankrate, and backed by top VC investors

Bringing co-buying mainstream—helping Gen Z & Millennials unlock homeownership

Huge market potential as 60M+ renters could afford homes with creative solutions

Nestment is tackling one of the biggest financial challenges of our time. Now, they’re raising to scale and expand.

Want to invest in the future of homeownership? Learn more & invest →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ an audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Y Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M.

Building a pitch deck for your seed round is a crucial step in your startup journey. It’s not just about putting slides together—it’s about crafting a story that resonates with investors and gets them genuinely excited about your vision.

While there are plenty of guides online about building pitch decks, most of them fall short of offering clear, actionable advice. That’s why I’ve taken the time to dive deep into Y Combinator’s resources, watch hours of their videos, and analyze detailed articles to create this comprehensive and practical guide for you.

Why a Great Pitch Deck Matters

Your pitch deck should achieve two things:

clearly convey the most critical points about your startup and

make it easy for investors to understand and remember your story.

For seed-stage startups, this often means focusing on simplicity and narrative clarity. Remember, at this stage, most startups don’t have extensive data or years of history to share—and that’s perfectly fine. Your goal is to make your story as compelling and concise as possible.

Structuring Your Seed Round Pitch Deck

Creating a pitch deck doesn’t have to be overly complicated. It’s all about telling a clear, concise, and compelling story that investors can follow easily. Here’s how you can structure your deck:

Title Slide

Start strong with a title slide that sets the tone for your pitch. It should include:

The name of your company.

A one-line description of what you do.

Keep it simple and professional. This is your first impression, so make it count.

The Problem

This is where you lay out the real-world issue your startup is solving. A well-defined problem statement is crucial for connecting with your audience.

Focus on the impact of the problem on real people or businesses.

Use a statistic, example, or story to make it relatable.

Avoid overloading this slide with too much text or technical jargon. The problem should be clear and easy to understand.

The Solution

Next, explain how your product or service solves the problem you’ve just described. This is your chance to show why your approach is unique and valuable.

Keep your explanation brief and to the point.

Highlight the concrete benefits of your solution.

If needed, use visuals or diagrams, but avoid cluttering the slide.

Traction

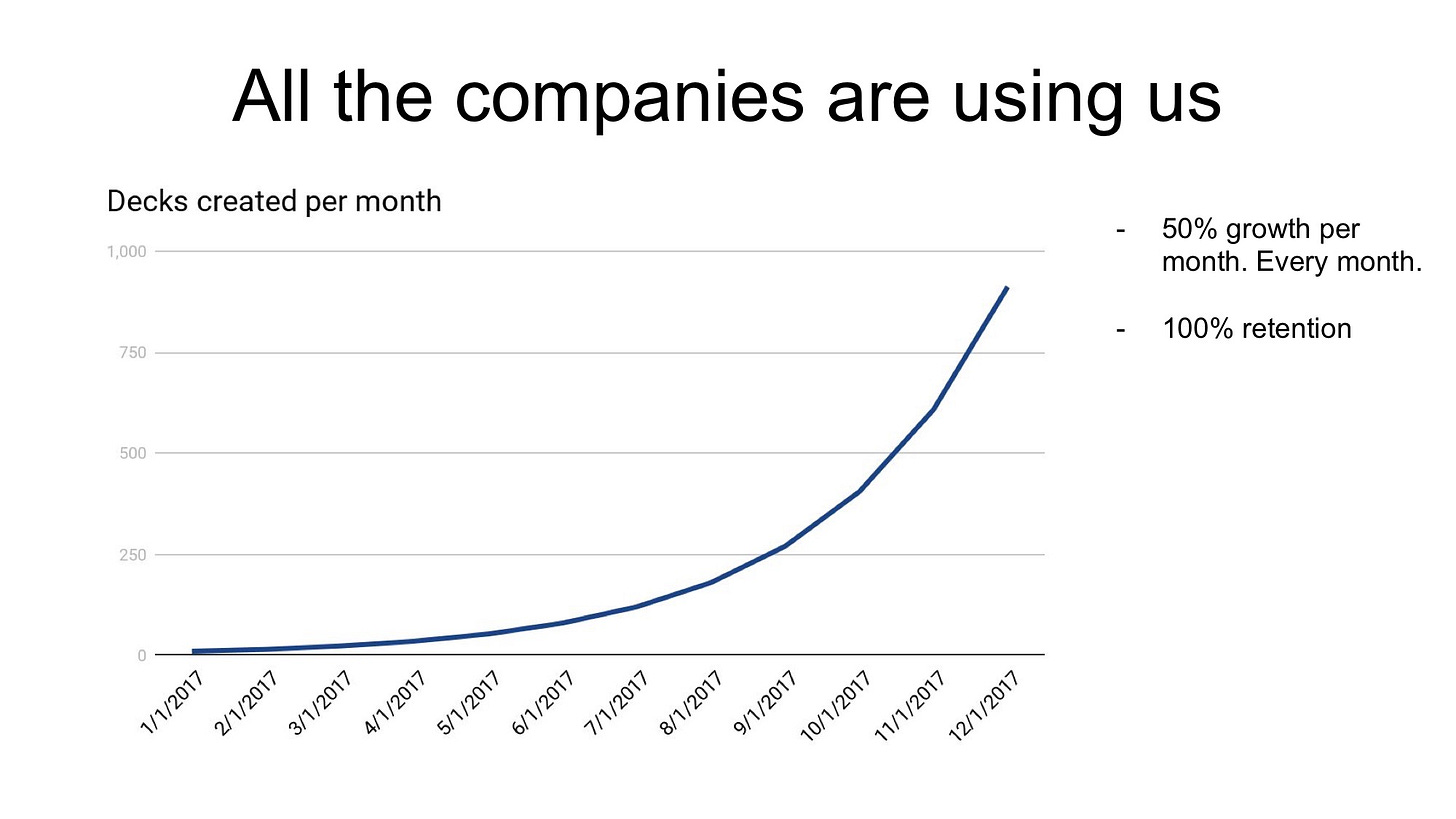

Investors love to see traction—it’s proof that your startup is making progress. Even if your numbers are early, show them off in a way that’s easy to understand.

Use a chart or graph to showcase key metrics like revenue or user growth.

Add context to explain why these metrics are important.

Keep it honest and straightforward. Smooth growth curves are rare, and that’s okay.

Your Unique Advantage

What makes your startup special? Use this slide to highlight what sets you apart from competitors.

Focus on your unique insights, technology, or approach.

Keep it concise and avoid unnecessary technical details.

Business Model

Your business model is all about showing how you make money. While it doesn’t have to be perfect, it should be clear enough for investors to understand.

Explain your revenue streams and pricing strategy.

If you have any early results, include them here.

Break complex models into simpler components if needed.

Market Opportunity

Investors need to see the potential for scale. Use this slide to showcase the size of your market and the opportunity you’re addressing.

Provide a high-level overview of your Total Addressable Market (TAM).

Use a clean, visual representation to convey scale.

A compelling market opportunity slide gives investors confidence in your startup’s long-term potential.

Team

Your team is one of the most critical factors for early-stage investors. Use this slide to show why your team is uniquely qualified to solve the problem.

Highlight the key strengths and relevant experiences of the founders.

Keep the focus on the people leading the company rather than advisors or extended team members.

The Ask

Wrap up your pitch with a clear “ask.” Be specific about what you need and what investors can expect in return.

State the amount you’re raising.

Explain how the funds will be used (e.g., product development, hiring, marketing).

Outline where you expect to be within a year and how this funding helps you get there.

Remember — even the best content can fall flat if your slides aren’t designed effectively. You might be wondering how startups that raised millions of dollars build and design their pitch decks.

That’s why we’ve curated 40+ real slides from startups that secured funding from Y Combinator and leading VCs. Here are a few examples:

Maikbou – Raised $3.3M (Seed round)

Pathrise – Raised $3M (Seed round)

Lago – Raised $22M (Seed round)

Apriora – Raised $2.8M (Seed round)

Careerist – Raised $8M (Series A)

Vori – Raised $45M (Series A)

Rippling – Raised $145M (Series B)

Thunkable – Raised $30M (Series B)

Pelago – Raised $58M (Series C)

And many more. Link below -

You can find pitch decks here.

We’ve also built multiple guides and frameworks that can be helpful to early-stage founders:

Excel Template: Early Stage Startup Financial Model For Fundraising.

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

Startup Legal Document Pack

Investor CRM Template – The Ultimate Fundraising Tracker

5000+ Verified Investor contact database from USA, India, Africa, and Australia.

📃 QUICK DIVES

1. Framework: The Hidden Patterns of Great Startup Ideas.

Too often, we glamorize the moment of inspiration — the mythical spark that launches a billion-dollar startup. But behind the scenes, most successful founders don’t stumble into great ideas. They hunt for them with intention, pattern recognition, and repeatable frameworks.

If you’re a founder in the “what should I build next?” phase, this is the time that matters most. Direction, at this stage, is everything. A slightly better idea today can compound into an exponentially better outcome tomorrow.

Below are five powerful mental models to stress-test and refine your startup idea before you build shared by NFX fund:

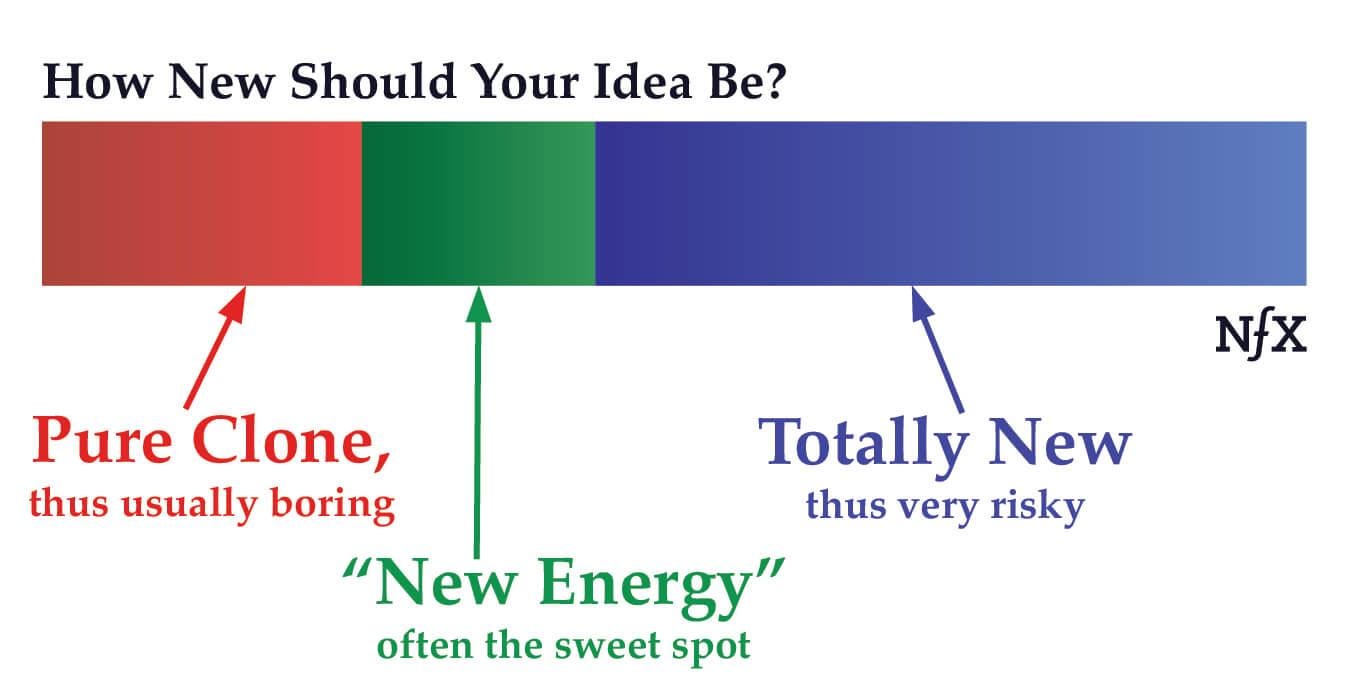

Framework 1: Innovate Just Enough

Going all-in on something radically new might sound visionary — but novelty is a double-edged sword. Too little, and you're indistinguishable. Too much, and you're unrelatable.

Borrow a tactic from the gaming industry: when launching a new game, change just one of three elements:

Platform (e.g., PC, mobile, VR)

Core mechanic (e.g., first-person shooter, match-3, simulation)

Theme (e.g., pirates, vampires, outer space)

This principle applies beyond games. A startup idea with one meaningful twist on a familiar pattern often resonates more deeply and grows faster than something unrecognizably novel.

Tweak one major lever. Don’t reinvent all three.

Framework 2: Ride the Tech Wave

Startups that align with recent technological shifts have an unfair advantage. It’s not just about solving a problem — it’s about timing.

Ask yourself: what’s newly possible because of tech advancements in the last 3–36 months?

Examples:

Smartphones → Uber: Real-time geolocation and payment made ride-hailing obvious.

APIs → Wealthfront: What used to require a private banker can now be done with software.

Broadband → YouTube: Suddenly, streaming video to the masses was viable.

Look for new behaviors unlocked by recent tech, not just underserved needs.

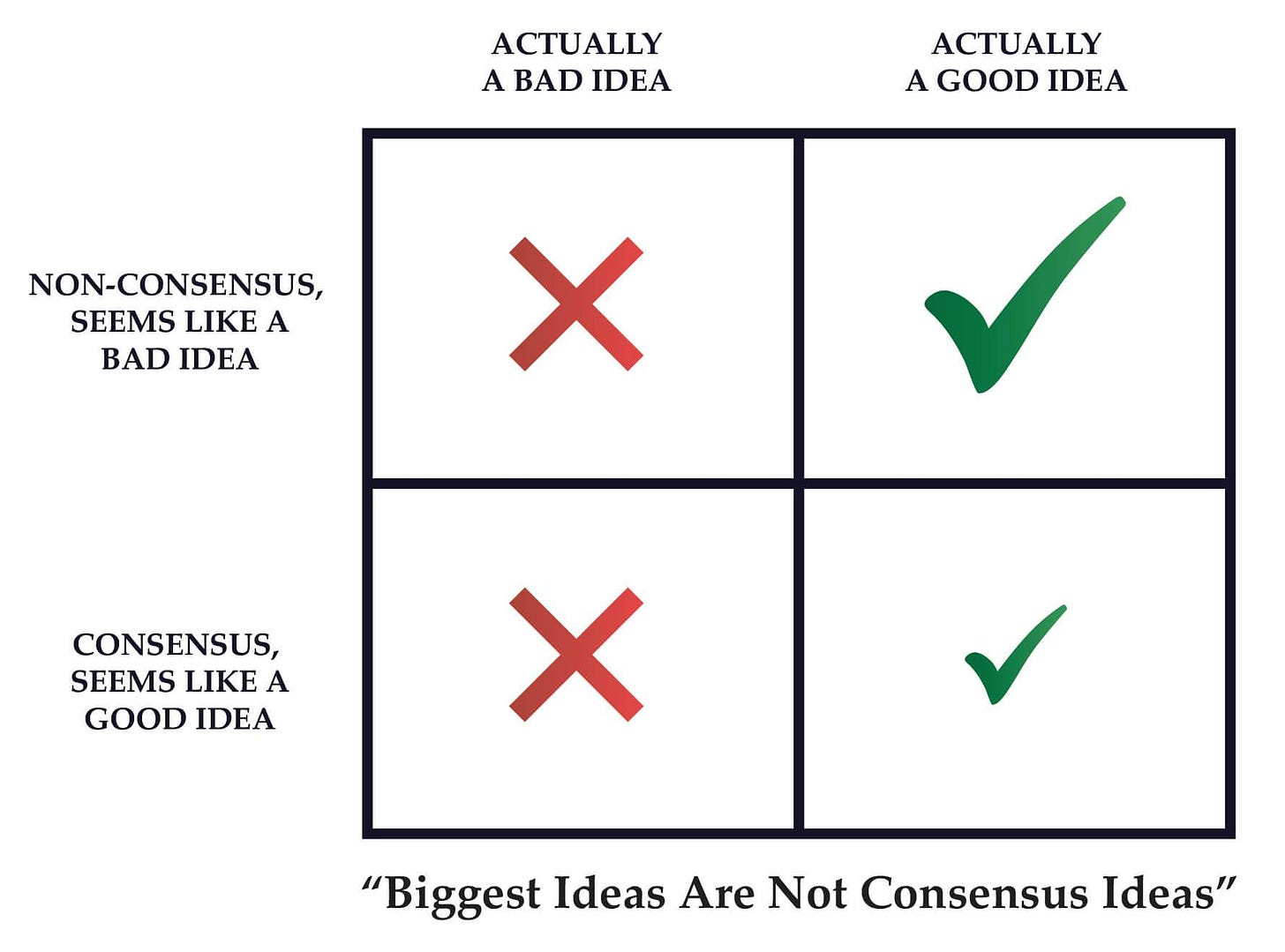

Framework 3: Be Contrarian (and Right)

Breakout ideas often look like bad ideas at first. Why? Because if they were obviously great, everyone would be building them.

This concept — non-consensus truths — separates visionaries from the crowd. Think about Airbnb (strangers sleeping in your home?) or even early Twitter (microblogging in 140 characters?).

The early reactions might include eye-rolls, but that’s often where the white space lies.

If your idea doesn’t sound slightly weird, it might already be too late.

Framework 4: Problem-Solving vs. Opportunity-Creating

Not every great startup begins with a “pain point.” Some ideas open up entirely new behaviours, communities, or experiences.

Facebook didn’t “solve a problem” — it created a new digital social layer.

Slack didn’t just fix email — it shifted how teams communicate altogether.

Games and creator platforms often fall into this category too.

So while “What problem are you solving?” is a useful lens, don’t let it blind you to “What exciting behaviour could this unlock?”

Not every big idea fixes pain. Some create joy, status, identity, or connection.

Framework 5: Market Risk vs. Execution Risk

All startup ideas carry risk — but it’s useful to ask: what kind of risk are you taking on?

Market Risk: You don’t know if people will even want this (e.g., Twitter in the early days).

Execution Risk: You know there’s demand — but can you deliver better than incumbents? (e.g., SpaceX or Lemonade)

First-time founders often lean toward market risk (fewer direct competitors, more room to explore). Repeat founders sometimes choose execution risk — betting on their ability to out-execute in proven markets.

Know which risk you’re taking — and make sure you’re equipped to handle it.

Small differences in early-stage thinking create massive differences down the road. These frameworks can help steer you toward a sharper, stronger idea — one that makes your years of effort genuinely worth it.

If you’re spending your life building something, make sure it’s not just viable — but meaningful.

2. A Hot Take on Using Memos Instead of Pitch Decks From Founder Raised $42 Million.

Tara Viswanathan, founder of Rupa Health, has raised $42 million for Rupa with 15+ term sheets without using pitch decks. What she used to pitch investors instead was a memo.

She strongly suggests founders use memos more (and not always decks), but why

Top secret - Investors love to see memos..

First, one is not better than the other

If you need to explain a key concept (i.e. your product), use a deck.

If you need to explain more than 1 key concept (a complicated market & your product), use a memo. The complexity of a concept determines the format.

Memos force you to think

When you explain your thinking in writing, it forces you to narrate your logic step by step. You can get away with holes in thinking in a deck—with a memo, it’s impossible. Even if you don’t send the memo, writing it is valuable by itself.

Memos do the hard work for investors

By creating a memo, you simplify much of the work for them. All investors need to write internal deal memos to invest in your company. Creating a memo for them simplifies A LOT of that work.

Investment memos are dynamic.

You can include links, videos, graphs, photos, and screenshots using tools like Dropbox. Always allow investors to explore further IF they are interested. Let investors "choose their adventure”.

Pitch decks still have value.

Use a pitch deck in partner meetings—they’re great in 1-to-many settings. Send the memo ahead of time. Use pitch decks to drive the conversation.

Your memo will live on (WAY beyond the fundraising process) ∞

Decks generally need a voice-over, memos do not. This makes memos super valuable resources for recruiting, onboarding new hires, educating the team, etc.

Memos and decks serve different purposes.

Both are valuable. But I’m more and more convinced — writing a memo is insanely powerful. Especially with complex/early markets that are hard to understand.

Wondering how to write an effective investment memo as a founder?

There are lots of formats online. But if you want one that’s trusted and proven, check out the investment memo template by Visible VC—it's one of the best out there for fundraising.

3. North Star Metrics: How to Identify Bad & Good Metrics?

The North Star Metric (NSM) is widely attributed to startup founder, advisor and investor Sean Ellis. It’s a single metric which can align the entire company around an overarching mission whilst simultaneously reflecting the value being delivered to customers.

Look at the mission statements of two of the world’s best-known companies, Google and LinkedIn:

Google – “Google’s mission is to organise the world’s information and make it universally accessible and useful”

LinkedIn – “Connect the world’s professionals to make them more productive and successful.”

The goal of the North Star Metric is to quantify this mission and express it in a way that can be measured and tracked. It is often used as a guiding light for the entire company to rally around – a sort of special key performance indicator (KPI).

Founders often make mistakes in choosing the right North Star metrics for their startups. What is a good North Star Metric?

Which metric, if it were to increase today will accelerate business flywheel? - Lenny Rachitsky

Here are some best practices for deciding on a good North Star metric:

Is it measurable?

It is simple, memorable and easily understood?

Is it a leading (not lagging) indicator of success?

Does it help your customers reach their end goal?

Does it apply to all customers and does it add value to all customers?

What is a bad North Star Metric?

There are also some poor metrics to use as a north star, the most common of which is revenue. Below are some characteristics you should aim to avoid when deciding on a north star metric:

Lagging indicators that show past performance, not future potential.

Metrics are hard for employees to influence or understand their impact on.

Metrics do not reflect customer value delivery, like vanity metrics.

Generic metrics that don't represent your unique business strategy.

Your north star should be unique to your business (or at the least your business niche) and should be an indicator of the problem you solve for customers, and the value provided to them.

Below we have provided examples of North Star metrics from many well-known brands. Notice how they are not all perfect, but generally, all reflect value delivered to the market.

North Star Metrics - if this metric grows, all other metrics will be growing too. Such as engagement, acquisition, and sales. - Adam Wright

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

AI search startup Perplexity has proposed acquiring TikTok’s U.S. operations, pledging to rebuild its algorithm in American data centres with full transparency and open-source access. (Read Here)

Tencent launched its new 'T1' reasoning model, which uses large-scale reinforcement learning similar to DeepSeek's R1 model, and outperformed it on the MMLU Pro benchmark. (Read Here)

Research by OpenAI and MIT indicates that using ChatGPT for "personal conversations" may be linked to increased loneliness, especially among users who engage emotionally with the chatbot. (Read Here)

Microsoft is launching a research project, involving Jaron Lanier, to estimate how individual training examples influence generative AI outputs, aiming to enable data attribution and compensation. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve, for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

Principal - Venture Capital - Stepstone Group | USA - Apply Here

Investment Analyst - Frontier Venture | Remote - Apply Here

Investor Relations (IR) Analyst - Paragon Partner | India- Apply Here

Value Creation Director Open Opportunity Fund | Remote - Apply Here

Program Manager - gener8tor | USA - Apply Here

Summer Associate Skyview Venture | USA - Apply Here

Associate, Investment Funds Rev1 Ventures | USA - Apply Here

Investment Manager - Techstar | USA - Apply Here

Program & Events Manager - Plug and Play tech centre | USA - Apply Here

Ventures Analyst | Health - Plug and Play tech centre | USA - Apply Here

Investor - Founder Collective | USA - Apply Here

Investment Manager - Wix Venture | USA - Apply Here

Content and Design Associate - Eximius Venture | India - Apply Here

Investment Associate - Singular | UK - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator