How to Build an Investor CRM (With a Template) | VC & Startup Jobs.

Founders get gosted by VCs? & B2C Startup Idea Validation Framework.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How to Build an Investor CRM (With a Free Template)

Quick Dive:

Why Do Founders Get Ghosted by VCs — And How to Handle It?

B2C Startup Idea Validation Framework.

How Should I Split Equity With A Part-Time Co-Founder?

Major News: Amazon developing its own AI ‘reasoning’ model, Judge rejects Musk’s attempt to block OpenAI’s for-profit transition OpenAI plans to charge up to $20K/Month for AI ‘agents’ & Apple launches new MacBook Air with M4 chip.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

How to write a cold email to investors by Y-Combinator.

How Duolingo works: 14 years of big learnings in one little handbook.

How to negotiate your first term sheet – A step-by-step guide.

Startup opportunity: Build an AI Email Agent.

50 most viral hook patterns extracted from 46,606 TikTok.

Ready-to-go financial modelling template to build your startup financial model that every investor wants to see.

Paul Graham's framework to get startup ideas.

Meco is the best free web app used to read newsletters in distraction-free systematic ways.

Elon Musk’s ‘Algorithm,’ a 5-step process to dramatically improve nearly anything, is both simple and brilliant.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Matt Gray on 9 ways to get more clients.

Angel Investor Josh Payne on 10 red flags he looks for.

For AI Enthusiasts: Must-have resources to stay updated on AI tools, read by MIT students and tech professionals from OpenAI and NVIDIA.

🤝 FROM OUR PARTNER - FLOWER TURBINES

Webinar with Kevin O’Leary & Dr Daniel Farb - A Shark’s Take on Flower Turbines’ Wind Innovation

Join the conversation between Flower Turbines' CEO, Dr Daniel Farb & Kevin O’Leary (aka Mr Wonderful) as they discuss Flower Turbines’ approach to small-scale wind energy technology, the company's vision, progress, and the factors attracting investor interest in this renewable energy approach.

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How to Build an Investor CRM (With a Free VC-Approved Template!)

Our controversial take: A great fundraising process is only 20% about pitching.

The other 80% is all about organization.

Yep, you heard that right.

Your pitch, the thing you’ve spent weeks refining and rehearsing, is only a small part of successful fundraising.

“What the heck do y’all mean by the organization?” - you, probably

If you’re talking to dozens (or even hundreds) of investors, keeping track of who they are, what stage they’re at, and what you last discussed is impossible to do from memory. That’s where an investor CRM (Customer Relationship Management) system comes in.

Some founders use tools like HubSpot, Salesforce, or Pipedrive, but you don’t need fancy software. A simple Google Sheet can do the job. What matters is that it helps you track key details, follow-ups, and next steps—so no potential investor falls through the cracks.

Walking through an investor CRM

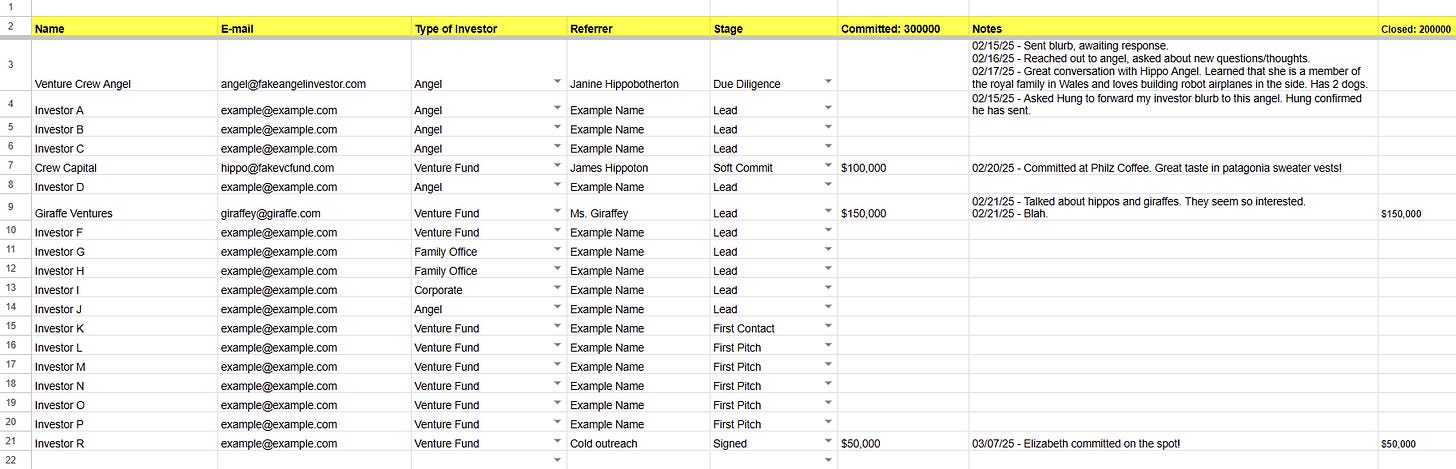

This spreadsheet may look like a lot at first. But a CRM is way simpler than you might think.

Basic contact info

To kick things off, add the names and email addresses of the investors that you already know.

Then add the names and email addresses of prospective investors that you would like to build stronger relationships with.

Type of Investor

In the next column, label what type of investor they are (angel investor, venture fund, etc). This will help you tailor your messaging accordingly.

Referrer

The referrer is the person who introduced you to the investor listed in your CRM.

So if ABC sent an email to introduce me to an investor, ABC is the referrer in this example?

This is crucial because your team can see where your leads are coming from. Plus if the introduction is a mutually beneficial one, we get a chance to reach out to the referrer again to say thanks.

Add their names in the next column and let’s keep moving.

Stage

What stage are they at in terms of considering an investment in your company?

These stages can be customized to your situation… but for simplicity, let’s define the stages that most funds used during our fundraising process.

Lead – When someone offers to refer somebody new to you but you haven’t made contact yet.

First Contact – This stage is the first time you both have been able to officially engage. Someone might have sent an email introduction and they may have reciprocated back saying, “Yes, let’s meet!”

First Pitch – This is the first meeting you have with them to pitch your company.

Due Diligence – This comes after the pitch when they’re considering investing. It’s normal for investors to ask to see more materials to help them make a decision.

Soft Commit – This is when they are interested in investing and have given you a dollar amount they want to put towards your company. This is purely a verbal commitment, nothing official, but a positive sign to move them into the next stage.

Signed – This is when the confetti drops from the ceiling because you have received a full commitment from this investor. Whooot!!! 🎊

Rejected and Ghosted – These are the stages where they reject your pitch or never return your messages. But remember, it’s not over yet. There’s still an opportunity to maintain the relationship or even invite them to your biweekly/monthly investors update. They may convert into investors down the road.

Committed

If they have given you a verbal commitment of a certain amount they want to invest, include this number in the Committed column.

Above, you can see three investors committing a combined total of $300,000 as an example.

Notes

The Notes section is the most critical part of the CRM.

It summarizes what you talked about during your calls or emails. Add as many notes as you can along with the dates of each interaction.

These notes are crucial because fundraising is a team sport.

Tracking everything helps your team understand the context of the relationship. So when they interact with this person, they know where each investor is in the process, and can pick up right where their teammate left off.

Closed and Next Contact

Next, we have a Closed column to show how much money you have closed.

This is your time to celebrate your hard work being paid off. Launch the confetti. Take out a bottle of champagne. You deserve it.

Ok, time to get back to work. The last part of the CRM is a Next Contact column. This is a reminder for yourself on when you should reach out to this person again.

So if you're still in the due diligence or soft commit phases, set a clear date here on when you should follow up.

If people have committed, we recommend getting aggressive and following up every two or three days. This shows that you’re committed to making this work and are certain you have given them all the materials they need to feel unblocked on making a decision.

For the people who have rejected or ghosted you, you should keep reaching out.

Remember a rejection is never truly a rejection until you get a hard “no”.

So your investor CRM is a critical tool for successful fundraising.

All your contacts are in one place with detailed information

All the interactions your team has had with each person are tracked so everyone is on the same page

It tracks where everyone is in the fundraising process and gives reminders on when to follow up.

Start your investor CRM as soon as possible. Like, now.

There are paid CRM tools out there to track opens and clicks on emails. But to keep things simple, we recommend starting with a basic spreadsheet.

Here’s a template you can use for your fundraising journey.

Also if you are looking for a verified investor contact database, fundraising guide & cap table guide check out here to access all resources.

A MESSAGE FOR FOUNDERS - HIGHLY RECOMMEND

📢 RNO1 Has a Message for You: Your Digital Presence Should Drive Results

Your website or app isn’t just a digital asset—it’s the foundation of your brand’s success. At RNO1, we don’t just design; we create Radical Digital Experiences that captivate users, drive conversions, and fuel business growth.

Whether you need a bold new website, an intuitive app, a high-impact SaaS platform, or a data-driven marketing strategy, we help brands break through the noise and dominate their industries.

What We Deliver:

✔️ Branding & Identity – Your brand should do more than stand out—it should make a statement.

✔️ Web & App Development – Future-proof platforms built for speed, scalability, and success.

✔️ UX/UI & Product Design – Seamless, high-converting digital experiences users love.

✔️ Go-To-Market Strategy – Position your brand to win with a strategic roadmap.

✔️ Performance Marketing – SEO, PPC, email & social strategies that turn traffic into revenue.

We’ve helped Airbnb and Dentsu scale their digital presence and powered startups that secured $100M+ in funding and hit $1B valuations.

Let’s build something extraordinary. Reach out today →

📃 QUICK DIVES

1. Why Do Founders Get Ghosted by VCs — And How to Handle It?

Recently came across a LinkedIn post from LightSpeed Venture Partner on the same topic as the title. So thought I to share some insights and how to handle this situation as a founder.

Why VCs Ghost Founders

Time Constraints – Investors prioritize high-potential startups. Writing rejections takes effort, so many don’t bother.

Overload of Pitches – With thousands of pitches, some VCs use automation, while others ignore cold outreach altogether.

Busy Schedules – Fundraising, portfolio support, and industry events often push deal responses down the priority list.

Red Flags That Lead to Rejection

Lack of Market Awareness – Investors expect founders to acknowledge risks and competitors.

Unrealistic Claims – Overpromising without proof turns off investors.

Weak Team Dynamics – Founding team tension or missing key skills raises concerns.

Dishonesty – Misrepresenting metrics or partnerships will get you blacklisted.

Negative Attitude – Speaking poorly of past investors or competitors is a red flag.

How Founders Should Respond

Follow Up Once or Twice, Then Move On – No response means no interest.

Seek Feedback Elsewhere – Other investors might provide clarity.

Build Real Relationships – Warm intros work better than cold emails.

Refine Your Pitch – If ghosting is frequent, rethink your positioning. You can even check out Marc Andreessen's framework on things to do when VCs say no.

VC ghosting isn’t personal—it’s how the industry operates. Instead of chasing silence, focus on building, networking, and finding investors who truly see your vision.

Also if you are struggling to find the right investors, my team has built a verified investor contact database covering the US, India, Africa, Australia, and UK investors. You can check it out here. Also if you need help with pitch deck storytelling, you can explore our all-in-one guide here.

2. B2C Startup Idea Validation Framework.

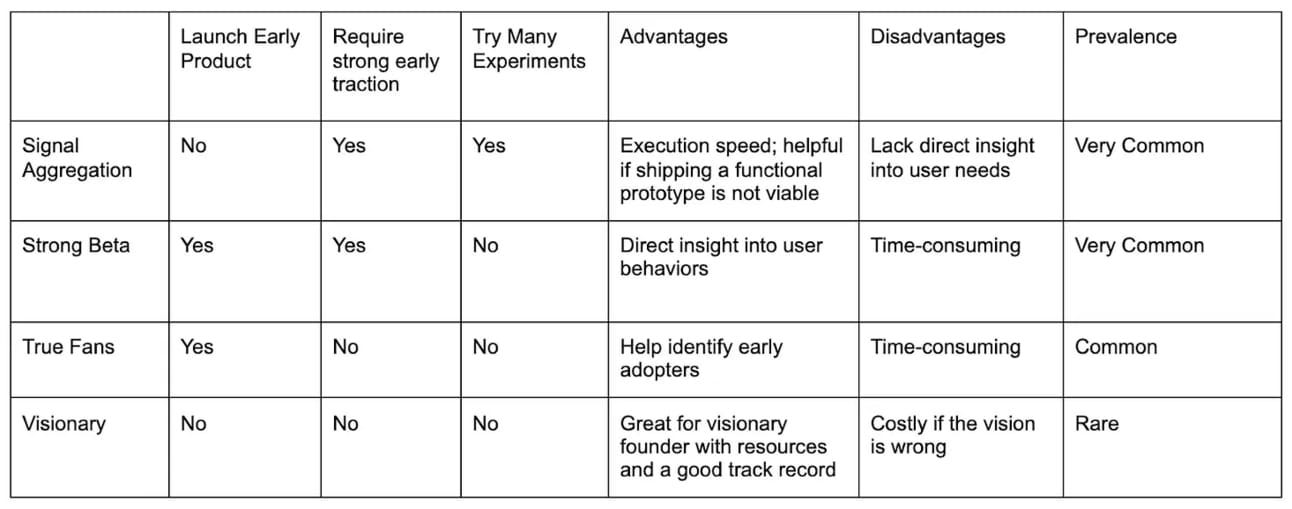

Most ideas, especially in B2C, get validated in one of four ways:

This framework defines the differences between each path to validation.

Signal Aggregation

Founders should test an idea's viability through small experiments that provide evidence (signals) of potential success before building a full product. Common signals include landing page sign-ups, social media engagement, ad click-through rates, and customer interview feedback.

Strong Beta

Achieving strong early traction with a beta product is another popular validation approach for founders. Success metrics vary across industries, e.g., high user numbers and retention for consumer social apps, and healthy revenue for B2C marketplaces.

The process typically starts with a hypothesis for solving a problem. The founder builds a basic version to test the hypothesis. Beta products are often rudimentary, lacking polish, due to the emphasis on speed over perfection. This approach aligns with the lean methodology of launching quickly and iterating based on feedback.

True Fans

This approach is similar to the Strong Beta approach, as it involves launching a beta product. However, instead of focusing on significant traction metrics like revenue or user acquisition, the founder seeks to identify a small group of fanatic users who deeply love the product despite its limited features. The key is finding 20-50 users who would be disappointed if the product were to go away. These passionate fans, rather than large user numbers, serve as the validation signal.

Visionary

This approach is the least common among the founders interviewed, as it requires a clear vision and plan for the product from the outset. Typically, the founder has a close personal connection to the problem being solved and a strong understanding of what needs to be done to address it.

3. How Should I Split Equity With A Part-Time Co-Founder?

Yesterday, I received an email from a founder asking about equity distribution. He is working full time, while his co-founder is only part-time, and he wanted to know the best way to split equity in this situation.

I figured some of you might be in a similar position, so I’m sharing my response here.

See, when you're building a company, equity in the business is a highly valuable asset. In the early days, you don't have much (or any) revenue, probably don't have a big audience, and may not even have a fully built-out product yet.

Equity is the one thing you can offer to potential investors and employees.

(Friendly reminder that equity = ownership in the company. So if I have 25% of the equity in your business, I own 25% of your company.)

It's super important that you don't give away too much equity in the business, especially in the early days.

Partly because any equity you give away means that you (the founder) will have less ownership over your own business. Equity will translate to dollars when you IPO or get acquired, so you want to maintain enough equity to stay motivated to keep working on the business.

But prospective investors also care deeply about how many people are on your cap table. If you give a bunch of equity to someone who isn't working on the business full-time, that's a bad look. It means there will be less room on your cap table for more strategic partners.

It's best to save that equity and allocate it to people who can meaningfully help push the business forward -- like investors (through capital and strategic help), key employees, etc.

Now, back to the question. If you have a co-founder who is not working full-time on the business, it doesn't make sense to give this person a ton of equity in the business because they aren't 100% focused on the success and growth of the company.

We view part-time co-founders as akin to an active advisor. Therefore, I recommend allocating equity in the 2-15% range.

15% would be incredibly generous

Super active, hands-on advisors are typically granted < 5%

Non-active advisors are typically granted < 1%

Former co-founders who have contributed about 1-2 years typically end up with ~10-15% equity since they didn’t vest their full potential.

That’s it.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Foundation Capital, a Palo Alto, CA-based venture firm, closed a $600M Fund XI, 20% larger than its previous $500M fund. (Read Here)

LoftyInc Capital, a Lagos-based venture firm, closed a $43M first close for its third fund, LoftyInc Alpha, targeting late-seed and Series A startups in Africa. (Read Here)

Researchers from Hao AI Lab at the University of California San Diego tested AI models on Super Mario Bros., with Anthropic’s Claude 3.7 outperforming other models like Google’s Gemini 1.5 Pro and OpenAI’s GPT-4o. (Read Here)

Amazon is working on an AI reasoning model similar to OpenAI’s o3-mini and DeepSeek’s R1, set to launch as early as June under its Nova brand. (Read Here)

OpenAI is reportedly developing specialized AI agents with pricing ranging from $2,000 to $20,000 per month, per The Information. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

HealthTech Associate - MunichRe Venture | USA - Apply Here

Senior Associate - Adam Street Partners | USA - Apply Here

Associate - Novo Holdings | USA - Apply Here

Fund Operations Intern - Startmate | Australia - Apply Here

Associate - Omerse Venture | USA - Apply Here

Student Venture Scout - Boomerang Venture | USA - Apply Here

Program & Events Manager - Plug and Play Tech Center | USA - Apply Here

Content Manager Bessemer Venture Partners | USA - Apply Here

Investor Relations Analyst - Truebridge Capital Partner | USA - Apply Here

Ventures Associate - Plug and Play Tech Center | USA - Apply Here

Platform Manager - Equal Venture | USA - Apply Here

VC Fund Operations - ITI growth opportunities fund | India - Apply Here

Analyst - Vine Venture | USA - Apply Here

Portfolio Manager - SeaX Venture | Thailand - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator