Why it's Better To Raise Less Capital In The First Funding Round? | Finding Early Adopters For Your MVP! | VC Remote Jobs & More

Why it's Better To Raise Less Capital In The First Round? | How To Find Early Adopters For Your MVP? By Y-Combinator Partner | VC Remote Jobs

📢 Today At A Glance

Deep Dive: Why it's Better To Raise Less Capital In The First Round?

Featured Tweet: How To Find Early Adopters For Your MVP? By Y-Combinator Partner

Major News In Startups: VC Firm turned down $300M+ From LPs, Boston based VC Firm Shutting Down After Raising $570M & More

Weekday’s Must Reading on Startups, Venture Capital & Technology

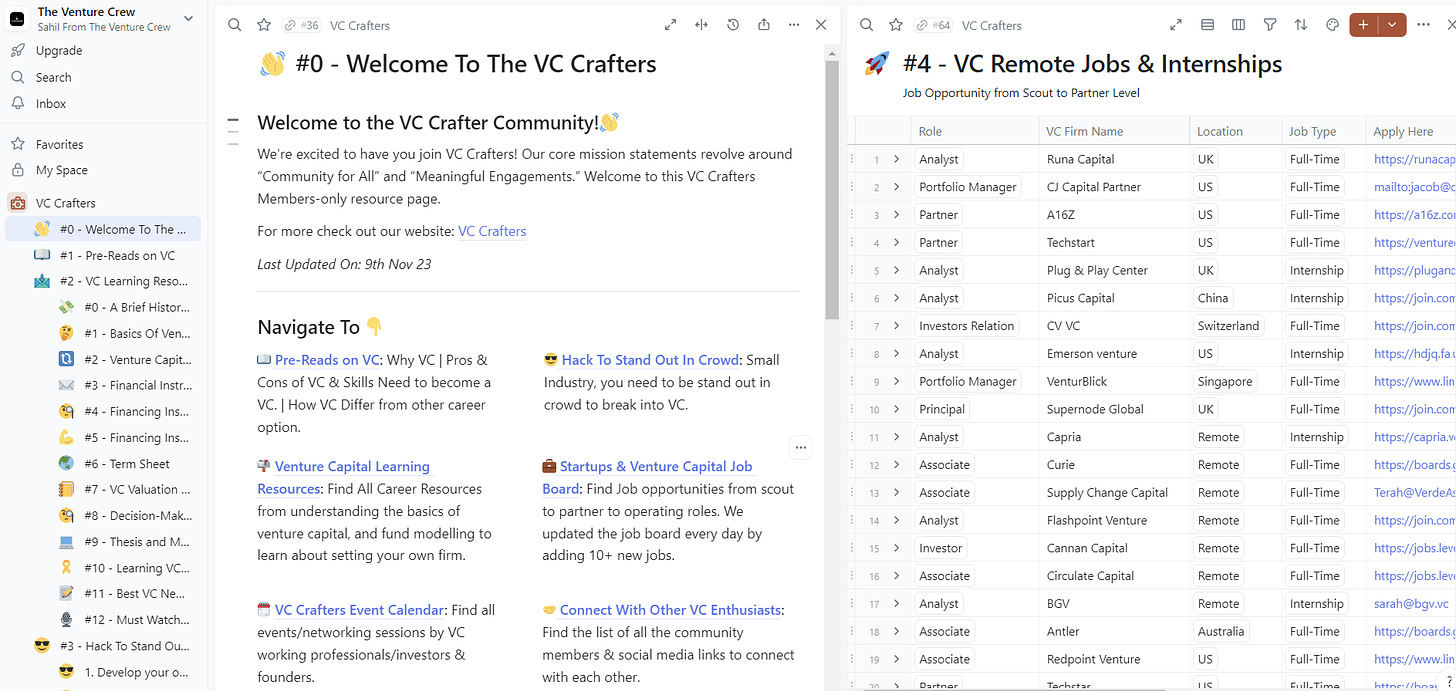

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝In Partnership With Thunder.vc

Thunder's Team Has Helped Secure $100M+ In Debt and Equity For Startups At All Stages. 💡

Negotiating a term sheet? or Want to learn about VC term sheets?

👉 Download Thunder.vc's free guide on the Top 10 Terms to Negotiate in a Term Sheet for raising venture capital.

Thunder.vc is a tech-enabled investment bank that has helped companies secure over $100M in capital. Try the free tools for founders - VC Finder Tool and Debt Finder Tool.

🤝 Partnership With US!

Want to promote your startup to our community of 20,000+ entrepreneurs and investors? Check our media kit here & fill out the form. We’ll reach out to you!

Why It's Better To Raise Less Capital In The First Round?

There’s a quick litmus-test conversation any early-stage VC will have with the founder and it’s one that you should be as prepared for as your elevator pitch. It goes something like this …

VC: “How much money are you raising?”

Founder: “$8–10 million”

VC: “What’s your current burn rate?”

Founder: “$250k / month.”

VC: “So at a constant rate of burn rate you’d be raising enough for 2.5–3 years. Why are you raising so much?”

Founder: “Um. Let me check my plan.”

Usually, that’s the point in the meeting where a VC realizes that this meeting isn’t going to go very well.

So what are the investor’s expectations & how can the founder generate the funding amount? For more, you can read our previous newsletter write-up.

But most of the time - it’s found that - generally, founders go for larger amounts during fundraising. This mistake is generally made by the first-time founder. Experienced founder knows why raising less during the initial funding round is better.

So why it’s better to go for a smaller round in the initial funding round? Let’s dive deep into it and understand it with a simple example.

Nowadays it’s common for founders to raise SeriesA financing even to hire talent or work further on their MVP. Typically, in this stage, the startup will have acquired one customer, ready to pay for its MVP with a guarantee that it will become a bigger customer if it works on the MVP.

At this stage, the founder has an ESOP (Employee Stock Option Pool).

Assuming that it has issued 1.5 Mn shares, out of which 0.5 Mn are ESOP, it raises capital for $300k from an investor to hire a couple of employees to work on MVP.

It finds an investor to fund $300k at a pre-money valuation of 1.3 Mn.

Pre-money price/share = 1.3 / 1.5 = 0.87

At 300k, the investor gets 0.346 Mn shares (0.3/0.87)

Post-money valuation at the end of Series A = 1.6 Mn (1.3+0.3)

Suppose - The startup will grow at 95% next year and then go for 6 Mn funding. The reason is that its PMF (Product Market Fit) is validated and has a big customer contract. Now it wants to SCALE.

It drafts a pitch deck, gives projections of 90%, 85%, 75% and 70% in the next 4 years, and assumes a probability of a sale by a strategic buyer in the 5th year.

At the end of 5 years, it projects 20.4 Mn in revenues, and at a 2x multiple (looking at its peers), it arrives at an exit valuation of 40.8 Mn.

At a 50% hurdle rate, it arrives at a post-money equity value of 12.1 Mn (40.8/(1+50%)^3).

Pre-money value = 12.1-6 = 6 Mn.

Pre-money price / share = 6 / 1.846 = 3.3

Thus, a new investor will get 1.214 Mn shares for his 4 Mn investment, and if the earlier investor wants to invest 2 Mn, he has to buy shares at 3.3/share to get 0.606 Mn shares. In addition to 0.346 Mn shares of Series A, he has 0.953 Mn shares.

The benefit for the founder is that he can raise more capital (6 Mn against 0.3 Mn), but he has diluted his ownership from 81.3% to 40.9% (50% dilution).

However, had he raised 1 Mn in Series A against 0.3 Mn, his ownership would dilute from 56.5% in Series A to 28.5% in Series B.

So, what's the takeaway here?

1. Start Small, Stay Nimble: In the early stages, your startup is still evolving. You might need to pivot or adapt to changing market dynamics. Raising less capital early on gives you the flexibility to make strategic adjustments while retaining control.

2. Small Beginnings, Bigger Rewards: As your startup proves its worth, you'll attract more customers and orders, which will naturally drive up your valuation. When you eventually seek funding for scaling, you'll dilute fewer shares because your pre-money valuation will have risen.

In simple terms, raising less initially allows you to grow smarter and stronger. It's not about how much capital you raise but how strategically you use it.

Remember, it's like planting a seed - nurture it wisely, and watch your startup grow into a mighty oak.

🤝 Need Your Suggestions

Feel free to share your opinions / reply to this email with suggestions.

Featured Tweet:

How To Find Early Adopters For Your MVP? By Michael Seibel

"The first version of your product is for people who have their hair on fire!”

Michael Seibel, Partner at Y-Combinator shared an interesting perspective on who will be your early adopters for MVP and how to find them… Read More Here

📰 This Week’s Major News: Venture Capital, Funding & Tech

This VC Firm Turned Down Over $300M from LPs Read More

Boston-based VC Firm Shutting Down After Raising $570M Read More

Google’s Gemini Demo Was Faked Read More

Elon Musk Raising $1B For New AI Startup Read More

Fintech Startup Once Valued at $450M Shutting Down Read More

Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? - Subscribed To Venture Daily Digest Newsletter and join 7500+ Avid Readers🚀

🗞️ Weekend’s Read On: Startup, Technology & VC

'You Can’t Raised Funding Without Using Old Sales-Marketing Funnel’ : Y-Combinator Read More (Startups & VC)

How Did The Great Startups Like Airbnb or Instagram Make Pivot Decisions? Read More (Startups)

Steve Jobs On Importance Of Product People In A Company. Read More (Startup)

The most important metrics for SaaS funding in 2024 Read More (Startups & SaaS)

How Does Airbnb Build Around Design Thinking? Read More (Startups)

How To Hire An Early Team For Your Startup? By Sam Altman Read More (Startups & Early Hiring)

Join 12,700+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Remote Jobs & Internships

Summer VC Internship - Point 72 Venture | USA - Apply Here

VC Associate - Allocator One | Austria - Remote - Apply Here

Investment Intern - 186 Venture | USA - Apply Here

Summer Associate - Translink Capital | USA - Apply Here

Venture Scout - LVLUP Venture | USA, Remote - Apply Here

Head of Investors Relations - Modern Venture | USA - Apply Here

Manager - Okta Venture | USA - Apply Here

Venture Capital Intern -Presence Capital | USA, Remote - Apply Here

Venture Capital Intern - Moonshots Capital | USA - Apply Here

Investment Associate - Techstars | USA - Apply Here

Investment Summer Associate - In-Q-Tel | USA - Apply Here

Portfolio Impact Associate - Stepstone Venture | USA - Apply Here

Get Access to Curated VC CV/Resume Template - Download Here.

Join our 150+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

👉Download Thunder.vc's free guide on the Top 10 Terms to Negotiate in a Term Sheet for raising venture capital.