YC Strategy 'Cash In, Cash Out, Milestones Achieved' To Raise Funding | Peter Thiel On 'Make A Product A Few Love' | VC Remote Jobs & More

YC Strategy Of Raising Successful Funding | 'Make A Product' A Few Love' | VC Remote Jobs

📢 Today At A Glance

Focus On: ‘How Much Should You Raise in Your VC Round? And What is a VC Looking at in Your Model?’ - YC Strategy

Featured Tweet: Peter Thiel “Make a Product a Few Love, Not Many Like, At The Start.”

Major News In Startups: Khosla Venture Launched $3 Billion Fund, Airbnb Acquired AI Startup at $200M & More

This Week’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝 In Partnership With Shortform

Read Nonfiction Books Faster…Like the Pros 💡

If you follow James Clear (Atomic Habits) or Mark Manson (The Subtle Art of Not Giving a F*ck) you’ve seen them writing highly of the book summary service Shortform.

You may be thinking: “No way authors are promoting summary services…that cover their books!”

But after trying Shortform, you’ll understand why. Their super comprehensive coverage of nonfiction books allows you to tackle best-sellers in business, finance, self-improvement, and so much more.

Their guides provide deep insights, exercises, and even counterarguments with sources so you can get a deeper understanding of your favourite subjects.

👉 What’s best is you get all this for the price of 1 book per month, so try it for yourself with a discount!

YC Strategy 'Cash In, Cash Out, Milestones Achieved' To Raise Funding From Investors

There’s a quick litmus-test conversation any early-stage VC will have with the founder and it’s one that you should be as prepared for as your elevator pitch. It goes something like this …

VC: “How much money are you raising?”

Founder: “$8–10 million”

VC: “What’s your current burn rate?”

Founder: “$250k / month.”

VC: “So at a constant rate of burn rate you’d be raising enough for 2.5–3 years. Why are you raising so much?”

Founder: “Um. Let me check my plan.”

Usually, that’s the point in the meeting where a VC realizes that this meeting isn’t going to go very well.

There are many things a VC is looking for in reviewing your business plan but beyond things like the quality of revenue, margins, OPEX and CAPEX -

there’s a simple rule investors generally consider “Cash In, Cash Out, Milestones Achieved.”

Simply put, a VC wants to evaluate how much cash you’re raising and whether this amount is realistic. He or she wants to know how long the money you will raise will last and whether this is long enough to warrant taking a risk on funding you. Finally, the VC wants to know what your progress will look like at the end of this period to know how easy it will be for you to raise your next round.

If you don’t have a firm grasp of these concepts and how a VC thinks your meeting is dead.

Cash In

Cash in. It’s the amount of money you’re raising. A VC is looking for reasonableness. Are you raising an appropriate amount of capital relative to your progress, relative to your team size and relative to your needs?

Of course, the VC is looking to have specificity in how you plan to spend the money you’re going to raise and plans that show a pie chart that says, “25% on marketing, 30% on technology and R&D, 20% on infrastructure, 25% on G&A” do not get funded.

VCs want you to raise the “appropriate” amount of capital, which would be defined as “what is reasonable given your progress to date, your resources and your needs for an 18–24 month period. VCs tend not to want to fund founders who raise too much money in a given round also because they know that sometimes having too many resources will lead to founders burning through cash too quickly.

Conversely, many VCs believe that constraining cash can often lead to increases in creative solutions at a startup.

One entrepreneur refrains Investors sometimes hearing “We want to raise some extra money for M&A activities.” This is a red flag for VCs.

A VC wants to know that you have a solid plan to execute a stand-alone business and if you require capital for an acquisition they’d rather evaluate it at the time rather than over-fund you now. It’s true that some later-stage private equity firms like to fund “roll-ups” (a company that acquires many related companies in its sector), but this is seldom the domain of VCs.

Every VC knows that the amount you raise is often a proxy for your valuation.

VCs in early-stage rounds assume that you will likely take 20–25% dilution for your funding round so if you’re raising $8–10 million they will assume your expectation is $24 million pre at the low-end of the range ($8m x 4 = $32m post money with $8m capital injected buying 25% of the company) and $40 million pre at the high end ($10m x 5= $50m post money with $10m capital injected buying 20% or $40m pre).

So when you say $8–10m is your goal and you aren’t at all thinking about your valuation know that a VC hears “$24–40 million pre-money valuation expectations.” Of course, there are times when 15% dilution is more appropriate and other times it can be 33% but in a first meeting investors just trying to establish general ranges for reasonableness.

If you’ve only ever raised $500k, have limited revenue, have 7 people at your company and aren’t a serial entrepreneur it’s a pretty tall order to imagine going straight to $8–10 million unless your data is very compelling or you’ve otherwise become “hot.” If you’ve raised $3 million previously, have $250k in monthly recurring revenue and 23 staff an $8–10 million round might be more down the fairway.

One big mistake many founders make is asking for an unrealistic amount of money in the fundraiser. VCs will quickly qualify themselves out in what might have otherwise been a chance for you to get them to engage in a process.

Founders should ask for slightly less than they need because if your ask is reasonable and you get multiple firms interested then it’s easy to increase round size and valuation later in the process. Every VC wants to fund a deal that seems to have too much demand. Having too little demand leads to bankruptcy.

A VC won’t necessarily tell you that they find your months of cash unrealistic, your plans not well formed or your valuation out of range — they’re more often likely to tell you, “It’s not a great fit for us at the moment. We’d love to see you again when you have a little bit more traction.” That’s what’s called a “soft no.”

Annoying, I know. But that’s the reality. So it’s incumbent on you to know what a smart business plan and use of cash looks like.

Cash Out

Cash-out is when you’re out of money. In general, it is expected that you’ll be raising 18–24 months of cash in a VC fundraising. If you have a shorter runway than that the time you’ll have to make enough progress to raise more capital is too short.

Assume that you’ll need to be raising for 3–6 months before closing your next round so the last thing an experienced VC wants is you on the fund-raising trail in 6–9 months. Having a minimum of 18 months runway means you have 12–15 months to make progress before the market will weigh in on your progress.

On the other side, VCs often don’t want to see a plan that funds longer than 2 years and seldom do they want to see 3 years.

Sometimes entrepreneurs make claims like, “I’m raising extra cash as a cushion” but this usually falls on deaf ears with a VC. They don’t want you experimenting for many years on their capital — they’d rather you come back to market in 2 years and they can see what you’ve accomplished before deciding whether to give you more money. You might not like this — but if you know it’s how most VCs think it you will be better prepared for your conversations.

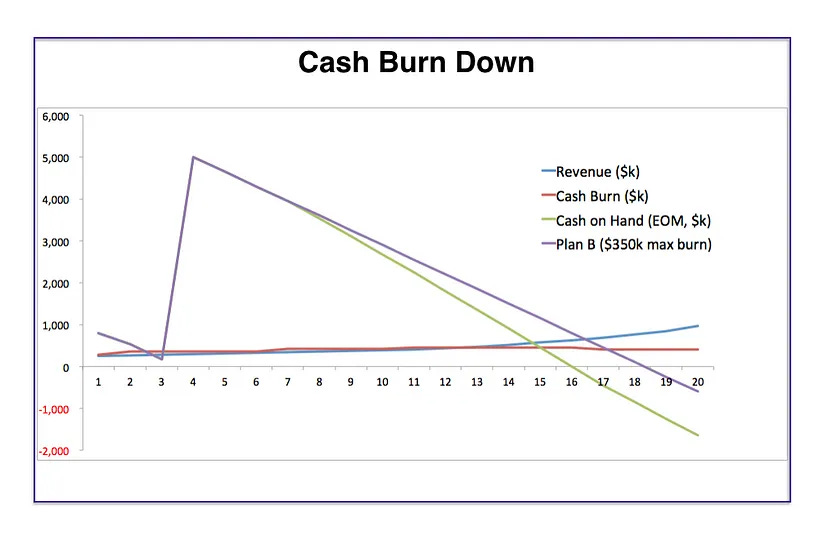

Above is a simple example graphic of a cash burn-down chart that any VC will want to see in a spreadsheet or visual form and doing it on your own will help you internally with scenario planning well before you’re even fundraising.

In the example, we assume that you are raising $5 million by month 4 of your plan. In the normal case, you’d be running out of cash after 16 months or just one year after you raise money. If you consider the “plan b,” which in this case just holds the burn rate constant at $350k and has you out of cash in month 19, it gives you more runway. In reality, this fund-raising plan should take you to month 22, which would be 18 months since you’ve raised.

Milestones Achieved

Assuming a VC has shown interest in your team, your plans, and your market and they believe that you’re raising an appropriate amount of capital, sooner or later they’ll begin thinking about the milestones you would have achieved by the time you’re raising your next round of capital or by the time you’re out of money.

Most VCs lead one round of financing in your company and are looking for other VCs to lead subsequent rounds. Knowing that it’s more likely that an outsider will fund your next round a VC will be thinking the following:

What will you have accomplished by the next time you go out to raise?

Will this be enough for another VC to show interest?

Will these milestones be enough for a VC would pay a higher price in the next round of financing?

If you’re not able to raise from outsiders and I need to lead this round, will you have made enough progress for me to face my partnership and tell them why we should fund an inside round? Will your burn rate be sufficiently low that I won’t worry about the amount of capital you’ll need in the next round of financing?

VCs want to fund innovations but they are also very cognizant of how much firm risk they can take on given the size of their fund and the number of deals they want to do per fund.

🤝 Advertise in The Venture Crew’s Newsletters

Want to promote your startup to my community of 14,000+ entrepreneurs and investors? Reply “advertise” and I’ll share my media kit.

𝕏 Featured Tweet: Make a Product a Few Love, Not Many Like, At The Start.

“Make a Product a Few Love, Not Many Like, At The Start.” - Peter Theil

At an early stage, most founders make the mistake of going for all markets, which leads to the failure of product adoption by customers. Why? Read more here👇

📰 This Week’s Major News: Venture Capital, Funding & Tech

Khosla Venture Launched $3 Billion Fund Read Here

YC Executives Launching $350 M VC Fund Read Here

Airbnb has acquired a secretive new AI startup, GamePlanner at $200M Read Here

Open AI Looking To Raise More Funding From Microsoft Read Here

VC firm thinks that AI automation could resurrect startup valuation Read Here

Subscribed To, VC Daily Digest Newsletter and join 6500+ Avid Readers For Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox. 🚀

🗞️ Weekday’s Read On: Startup, Technology & VC

Use intellectual property to secure debt and equity-based funding Read More (Startups & Funding)

The Venture Capital Blueprint: Fund Returns Modelling Read More (startups & venture capital)

What do VCs look for? 10X return or 10X fund size outcome? Read More (Startups & Venture Capital)

Aaron Epstein On Business Models That Build Winners Read More (Startups)

Join 9000+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Remote Jobs & Internships

Chief Of Staff - First Round Capital | NY - Apply Here

Talent Sourcer VC - First Round Capital | NY - Apply Here

Associate Counsel - 500 Southeast Aisa | Remote - Apply Here

VC Working Student - Antler | Remote (Germany) - Apply Here

VC Associate - Toyota Venture | Remote, USA - Apply Here

Investment Team - Secocha Venture | USA - Apply Here

Technical VC Analyst - Superseed venture | UK - Apply Here

Investment operation Associate - Evolution equity partner | Swiss - Apply Here

Venture Associate - Launch Factory | USA - Apply Here

Join our 100+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

👉 Read Nonfiction Books Faster…Like the Pros - start it with a free trial!

✍️Written By Sahil | Venture Crew Team