The Hidden Math of VC: How Investors Actually Calculate Returns. | VC & Startup Jobs.

Product Stickiness Framework, Promise-market fit & Promise-market fit hints at product-market fit.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: The Hidden Math of VC: How Investors Actually Calculate Returns.

Quick Dive:

Product Stickiness Framework: Triggers, Constraints, and Rituals.

Promise-market fit is an early signal that product-market fit is possible. Why & How?

How to Sell Your Business Model to VCs?

Major News: General Catalyst going public—A first for VC, DeepSeek claimed $562K daily revenue. SoftBank is in talks to borrow $16 billion to fund AI & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

SaaS startup financial model: All-in-One Excel template to download.

The Hard Questions Most VCs Can’t Answer.

MVP is over. You need to think about MVE.

All-in-One VC fundraising guide for founders.

Sam Altman's guide to startup fundraising: What works.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

Dickie Bush on how to tighten feedback loops.

Dealroom’s report highlights the rise of value-add investors.

Activant Capital explores why vertical software startups are thriving and what it means for investors.

8 unique paths founders take to reach Product-Market Fit.

Startup opportunity: Build an AI Email Agent.

Elon Musk’s ‘Algorithm,’ a 5-step process to dramatically improve nearly anything, is both simple and brilliant.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Financial modelling template to build your startup financial model that every investor wants to see.

All-In-One guide to pitch deck storytelling - free template & curated resources.

AI resources: Must-have resources to stay updated on AI tools, trusted by MIT students and tech professionals from OpenAI and NVIDIA.

🤝 INVESTMENT OPPORTUNITY WORTH EXPLORING

The "Backdoor" Into the $15.7 Trillion AI Boom — Why Investors Are Backing This Tiny Startup

What if you could invest in the backbone of the AI revolution—before the rest of the world catches on? A Nobel Prize-winning “super material” is poised to disrupt the $600 billion semiconductor industry, fueling the AI boom.

At the forefront is Mivium, a stealth startup armed with patented technology that’s replacing silicon with gallium nitride (GaN), unlocking massive potential in AI computing, EVs, and beyond.

Why GaN Matters:

Higher Efficiency: GaN devices deliver superior efficiency compared to traditional silicon-based semiconductors, enabling more power-efficient electronics and reduced energy consumption.

Faster Performance: GaN semiconductors offer faster switching speeds, higher voltage handling capabilities, and better thermal management, enhancing overall system performance.

Enhanced Power Density: GaN-based systems can handle higher power in smaller form factors, making them ideal for data centres, automotive electronics, and consumer devices.

Why Investors Are Paying Attention:

🔥 Smart Money’s Already In: $4.17M raised out of $5M goal from top-tier investors like James Altucher and Asymmetric Ventures.

🔥 Massive Market Growth: The GaN semiconductor market is projected to grow 10x by 2030, reaching $26.8 billion.

🔥 World-Class Team: Over 100 years of combined experience in semiconductors, with multiple successful exits.

With just 30 days left to invest, this is your chance to get in on the ground floor of a company rewriting the rules of semiconductor technology—and driving the future of AI infrastructure.

Be part of the future—invest today →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

The Hidden Math of VC: How Investors Actually Calculate Returns

When raising funds, many founders struggle to grasp how investors evaluate opportunities. A common frustration is: "Investors passed on our startup because they didn’t think it would deliver strong enough returns."

Previously, we shared a post on how to determine whether your startup is venture-backable, along with a framework for assessing it. This time, let’s dive deeper into the math behind venture capital investing—because understanding how investors think about money can provide clarity on why they make certain decisions.

Rob Go, co-founder of Nextview Ventures, wrote an insightful piece on how venture investors calculate returns. He broke down some key concepts that many founders overlook. I’m sharing a few of his points here, along with some of my own thoughts.

There are plenty of articles online about VC multiples and how they’re calculated. But I’ve always wondered: Do people truly appreciate how difficult it is to generate these kinds of returns? And are they calculating multiples in a way that reflects reality?

At a basic level, a return multiple is calculated by dividing the amount returned by the amount invested.

If a VC invests $10M in a startup and gets back $100M, that’s a 10X return—simple enough, right?

But things get tricky when multiples are inferred from incomplete data. In most cases, only the fund managers know exactly how much was invested and how much was returned. And when you’re working with incomplete data, multiple assumptions come into play.

Here are a few factors to consider when evaluating or estimating returns:

How to Actually Calculate an Investment Return Multiple

One of the most overlooked aspects of calculating VC returns is dilution—every new financing round reduces early investors’ ownership stake.

Let’s walk through a common scenario:

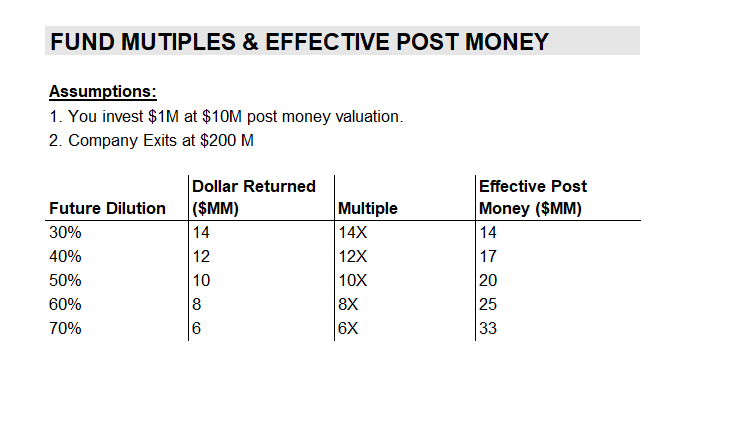

A seed investor puts in $1M at a $10M post-money valuation in a startup’s first funding round. The company eventually sells for $200M.

At first glance, it might seem like the seed investor made 20X their money ($200M / $10M). But in reality, that’s rarely how things play out.

Most startups raise more money as they grow, often at higher valuations. Every time this happens, existing shareholders get diluted. Companies also expand their option pool, further reducing investor ownership.

Here’s what that looks like for our seed investor:

The startup raises another $10M at a $50M post-money valuation.

As part of this round, the company expands its option pool by 10%.

After this financing, the seed investor’s original 10% stake is diluted:

20% dilution from new investors.

10% dilution from the expanded option pool.

The investor’s final stake is now 7% at exit.

So instead of getting a 20X return, their $1M investment turns into $14M—a 14X return. Still great, but quite different from what the simple math suggested.

Another way to frame this:

At the seed stage, the investor paid $1M for 10%. But after dilution, they effectively paid $1M for 7%, meaning their real entry valuation was $14.3M ($1M / 7%).

And this is in a simplified scenario with just one additional round. In reality, most startups raise multiple rounds, meaning dilution continues at each step, further adjusting investor returns.

Below is a sample outcome table for a few scenarios.

What this shows is that the investor’s multiple dramatically changes depending on how many rounds of financing occur after the initial round and the level of dilution of each round.

You can also think about this in terms of effective post-money because it creates a more visceral reaction. If this company goes on to raise multiple financing rounds such that new investors and future employees end up with an additional 50%, the seed investor mathematically invested at a $20M post-money valuation. Still good, but not what you think of as seed-stage prices.

This is why celebrating big financings isn’t always such a great thing. Apart from the screwed-up incentives that can arise from overcapitalized companies, each time a company raises money, all prior investors get diluted, which increases the effective post-money of all the earlier dollars.

Factor in all the dollars an investor puts into a company — not just the initial round.

But one might say that this is precisely why it’s important to invest follow-on capital — it helps you protect your ownership. This is true, sort of, but leads to another misconception about multiples:

One needs to consider all the dollars someone invests into a company at each round, not just the initial round.

The problem with follow-on financings is that they have a similar effect on future dilution. Each time an investor puts money into a follow-on round, she preserves her ownership, but increases her cost basis and effective post money.

Back to our hypothetical company and angel investor that invested $1M at $10M post. Let’s say that the company raises just one more subsequent round of financing which is a $10M at $50M post again. But this time, let’s assume the seed investor decides to “lean in” and write a $2M check at this stage. So, what happens is:

The investor bought 10% of the seed

The investor also bought another 4% at the Series A

The investor invested $3M total

The investor’s seed dollars got diluted by 30%

So, the final ownership is (10% x 70%) + 4% = 11%. Since the investor increased ownership, they did “super-pro-rata” in a company they thought was a winner. The company then sells for $200M.

Quick: Is this investment a 10X for the seed investor who initially invested at a $10M post-money valuation?

The answer is NO. The investor made 11% x $200M = $22M. They invested $3M to get there. So it was a 7.3X with an effective post-money of $27M. Pretty good, but not a 10X return.

This effect is even greater if the investor puts capital into multiple future financing rounds, even if they just keep doing their pro-rata share of the round. The example above is simplistic, and I’d argue that 70%+ of $200M exits happen with more future dilution than this.

A Few Takeaways

Why investment multiples can be misleading

It’s easy to assume that a seed investor putting $1M into a $10M post-money valuation will see a 10X return if the company exits at $200M. But in reality, small changes—like dilution from follow-on rounds—can quickly turn a 20X outcome into less than 10X. And that’s assuming no down rounds or recaps, which make things even trickier.

VCs need bigger exits than most assume

When VCs talk about 10X returns, it’s easy to underestimate the exit size needed to achieve that. Even a 3–5X return often requires a much bigger exit than expected. This creates tension—founders may see a $300M exit as life-changing, while investors push for a billion-dollar outcome.

Larger funds can lower returns

Early-stage funds don’t deploy much into follow-ons at first. But as funds grow, they allocate more capital to later-stage rounds. This raises their cost basis and post-money valuation, making it harder to achieve high multiples—even if they avoid backing total failures.

"Pile into your winners" works in limited cases

This strategy makes sense in two situations: when the winners are multi-billion-dollar companies or when investors double down early before others see the potential. Outside of these cases, the risk of misjudging and raising the cost basis can outweigh the reward.

What top VC firms get right

The best firms do three things:

Focus on backing outliers.

Maintain ownership without overpaying.

Keep fund size reasonable relative to their stakes.

VC math isn’t complex, but truly understanding how returns work is crucial for both investors and founders.

While the math may be simple, I think it’s very important for VCs & entrepreneurs, to understand how returns are calculated.

INVESTMENT OPPORTUNITY FOR YOU

🧐 A $255 Billion Market Opportunity —Why Investors Are Backing Shape Accelerator

This fast-growing health brand is turning heads in the investment world: ShapeAccelerator isn’t just another weight-loss product—it’s an award-winning, science-backed solution with real clinical results and explosive market demand.

Why it matters:

The global weight-loss market is booming, growing at 9.7% CAGR.

Most products lack scientific backing or fail to deliver lasting results.

Why I’m watching:

500% sales growth in 2024, with strong traction.

National media exposure, including CNN, HGTV & a Times Square campaign.

Expanding into Europe & Asia by 2026, signalling global demand.

With 20X ROI potential, this is a rare chance to invest in a science-driven consumer brand at the tipping point of massive growth.

💡 Be part of the next big thing in wellness—invest today →

📃 QUICK DIVES

1. Product Stickiness Framework: Triggers, Constraints, and Rituals.

Many founders believe that a great app idea is enough to make it successful. But it’s not. What truly matters is the stickiness of your product.

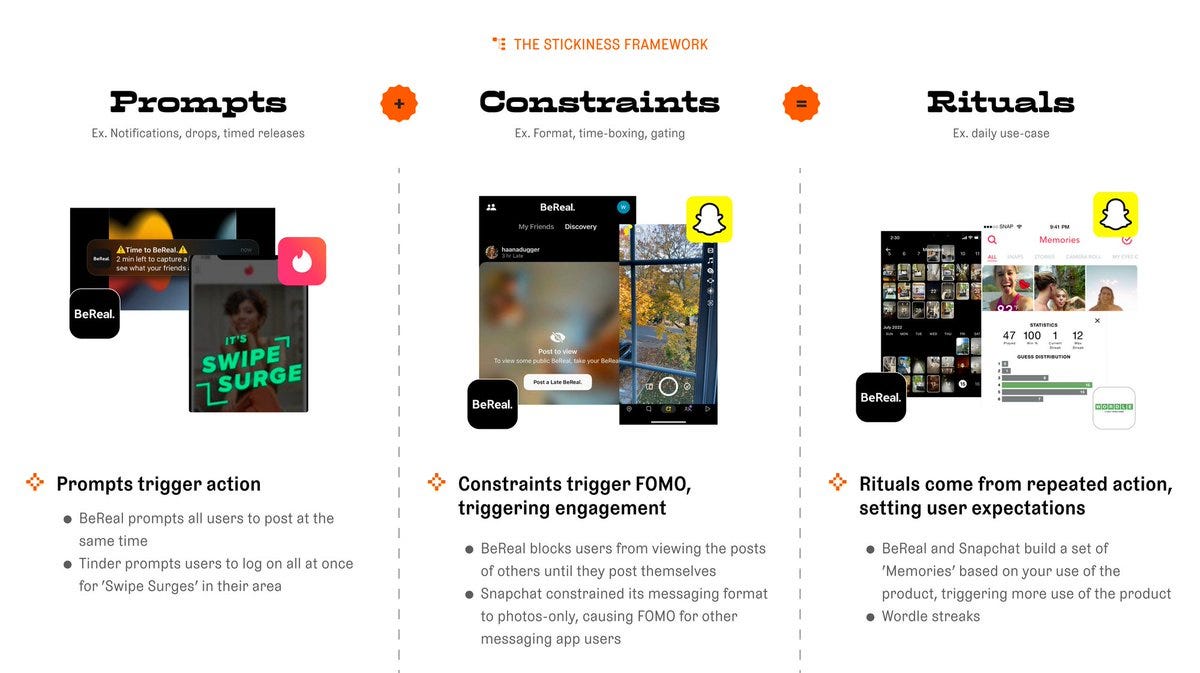

Start thinking about your product in terms of where triggers, constraints, and user rituals exist within it.

The rise of AI means that more user experiences within the best products will be trigger-based, rather than static. And wide open experiences will be less desirable than opinionated, constrained ones.

I love this framework from Greg Isenberg. It’s the new strategy for thinking about how to keep users engaged with your product.

Trigger action with prompts

Ignite FOMO with constraints

Keep 'em coming back with rituals

2. Promise-market fit is an early signal that product-market fit is possible. Why & How?

If you’re a regular reader of this newsletter, you’ve probably read some of our articles on how to determine whether you’ve achieved Product-Market Fit.

If you look at the timeline below, you’ll see that companies like Notion, Airtable, and Figma took over three years to hit Product-Market Fit. It takes years to find Product-Market Fit, so what’s the sign that you should keep going

A good first clue is "Promise market fit"…..

I completely agree with Dani Grant (CEO, Jam). However, how to get a clue on “Promise market fit”

Promise market fit occurs when potential users express interest in your product's value proposition, even before the product is fully developed or launched. The key indicator can be -

Landing Page Engagement

Users share your landing page, subscribe to updates, or show interest in signing up

Indicates your value proposition resonates with them

Early Sign-Ups and Payments

Users willingly sign up for waitlists or pay for early access

Suggests genuine belief in your product's promise

User Feedback and Iteration

Early user feedback aligns with your product's promise

Iterating based on feedback refines your offering to better meet market needs

Referral Activity

Users refer others to your product

Organic word-of-mouth signals perceived value

Social Media Buzz

Positive mentions, shares, and discussions on social media

Indicates your product has struck a chord with your target audience

Interest from Influencers or Industry Leaders

Key figures express interest or engage with your product

Validates your offering's promise and attracts a broader audience

While following this indicator, don’t fall into the trap of fake Product-Market Fit. These early indicators will help you stay on course and achieve true Product-Market Fit.

3. How to Sell Your Business Model to VCs?

When it comes to the business model, it’s not enough to simply describe your pricing. To convince investors, your slide must explain the following:

how you will make money

why that engine will be efficient

how it will turn into a competitive advantage in the long run

And that’s where things get tricky. Many believe the best course of action is stripping the business model slide to the bones and avoiding burdening it with unnecessary metrics and information. The problems begin when some of those metrics and information you leave out turn out to be pretty darn necessary for selling your model to investors.

So here are the 4 mistakes that I see founders make, and ways to fix them:

1. Mistake #1: Treating Your Business Model as a Pricing Slide

Instead of just listing pricing tiers, explain the overall mechanics of your business model, including primary revenue streams (subscriptions, transaction fees, etc.), and the logic/key drivers behind them.

2. Mistake #2: Having Too Many Revenue Streams

Early-stage companies should focus on a maximum of 3 core revenue streams, with 1-2 being the primary focus. Differentiate between current and future revenue sources.

3. Mistake #3: Not Showing Your Competitive Advantage

Highlight the unique competitive edge or "moat" that makes your business model sustainable and de-risks it for investors (e.g., low costs, high margins, effective land and expand motion, scalability).

4. Mistake #4: Not Discussing Business Model Economics

Illustrate the attractive aspects of your unit economics to support your claims, such as low Customer Acquisition Cost (CAC), high Customer Lifetime Value (LTV), favourable LTV: CAC ratio, short payback cycles, and high-profit margins.

Bonus Tip The Ultimate Business Model Slide Investors love a slide that concisely presents the key business model drivers, the path to $100M+ revenue, and verification against the overall market size.

So, keep your business model slide clean, focus on the primary model and key revenue streams, and include a few crucial unit economics metrics to justify your strategy.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

General Catalyst, a venture firm managing over $30B in assets, is reportedly considering an IPO, Axios reported. (Read Here)

DeepSeek boasted a theoretical 545% profit margin, estimating $562K in daily revenue from R1 pricing, while GPU leasing costs stood at $87K. (Read Here)

SoftBank CEO Masayoshi Son aims to borrow $16 billion to expand AI investments, with an additional $8 billion possible in early 2026. (Read Here)

Microsoft will shut down Skype on May 5, ending its 23-year run to focus entirely on Teams, with user data and contacts migrating automatically. (Read Here)

Alphabet's Taara project, developed by Google's X research wing, uses light beams to transmit internet signals over long distances, offering an innovative alternative to traditional fibre optics and satellite methods. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

Principal - Azolla Venture | USA - Apply Here

Growth Associate - B Capital Group | USA - Apply Here

Associate/Senior Associate - Avishkaar Carbon Platform | India - Apply Here

Director of Corporate Development - Aegis Venture | USA - Apply Here

Value Creation Associate Open Opportunity Fund | USA - Apply Here

Analyst, Office of the CEO - Energy Impact Partner | USA - Apply Here

VC Senior Analyst - Toyota Venture | USA - Apply Here

Venture Capital Associate - Connecticut Innovation | USA - Apply Here

Ventures Intern - Applied Venture | USA - Apply Here

Founder's Office - Transition VC | India - Apply Here

Associate - Adam Street Partner | USA - Apply Here

Strategic Venture Capital Investor - Wind Venture | USA - Apply Here

Program Manager - generator | USA - Apply Here

Investor - Pruven Capital | USA - Apply Here

Community Manager - Clean Energy Venture | USA - Apply Here

Investment Specialist - Emvee Group | India - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator