How To Determine If You Have The Product-Market Fit - From a16z & Sequoia Capital. | VC Jobs

The AI Plateau Is Real - S Curve & Customer Buying Readiness Framework...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How To Determine If You Have The Product-Market Fit? -From a16z, Sequoia Capital’s Partners…

Quick Dive:

The AI Plateau Is Real By Gordon Ritter and Wendy Lu (Emergence Capital).

S.P.A.D.E. Framework- A technique for making difficult decisions.

The Buyer's Pyramid: Understanding Customer Readiness To Buy Your Product.

Major News: Softbank Raised $1.86 Billion To Invest in AI, LinkedIn Co-Founder's Startup Raised $45 Million, Marc Andreessen's a16z Launches Private Equity Fund & Fearless Fund Co-founder Step Down.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH PAPERMARK

Share Your Pitch Deck or Data Room With a Trackable Link

Papermark is a modern document-sharing infrastructure with built-in page analytics and full white labelling. It is a free and open-source alternative to Docsend.

Why to use Papermark?

For investors:

To create unlimited branded data rooms

To share one link to the whole data room

Set NDA agreements and link permissions

For founders:

To track the time investors spend on each slide of your deck

To avoid downloading, sharing and have full control over the link

To share one link to the branded data room with all fundraising docs

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

How To Determine If You Have The Product-Market Fit? -From a16z, Sequoia Capital’s Partners…

People often say funnily, "Product-market Fit is like porn...when you see it, you just know."

In qualitative terms ...

When the customers aren’t quite getting much value out of the product/service, word of mouth isn’t spreading, usage isn’t growing that fast (spikes in the months where you advertise), press reviews are kind of “blah”, the sales cycle takes too long, and most of the deals never close

Most startups that have raised ($5-$10 Mn) Series A funding, assume they’ve got a product-market fit, just because they’ve raised funding. They're wrong, why do you think 70% of startups that raised Series A still fail, because the no.1 reason was lack of PMF!

You have it ...

On a high level, you've found product market fit when you can repeatably acquire customers for a lower cost (CAC) than what they are worth (LTV) to you

Elizabeth Yin (Hustle Fund)

“You can always feel when Product/Market Fit is happening. The customers are buying the product just as fast as you can make it - or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company's account.

You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.” - Marc Andreessen

When product-market fit occurs something magical happens, all of a sudden your customers become your salespeople i.e. they sell for you - Josh Porter.

What metrics to track and analyze, whether you've achieved the Product/Market Fit?

Let's delve into quantitative metrics of finding Product/Market Fit:

A. Product/Market Fit Metrics for SaaS Businesses

David Rusenko recommends that founders offering SaaS should track the below 6 metrics to evaluate Product/Market Fit:

Returning Usage (Day 1,3,7,30 retention): Look at people who sign up to your site/app and then look at the number of people who return back within 1,3,7,30 day/s. This should indicate whether things are working or aren't.

A Net Promoter Score (NPS) of > 50 means you’re doing well.

Paying Customer Renewal Rates or Retention: Renewal rate is defined as the number of people who are eligible to renew and what percentage of people actually renewed is a lot better metric than churn. Churn rate (Churned customers / total customers) is a lot easier to measure, but it can be deceiving at times.

Growth Rate: Consistent growth of at least 15% in MRR and ARR is a strong indicator of Product/Market Fit. Irregular spikes, flattening, or declining growth are some of the red flags to watch for.

Market Share: How quickly are you gaining/losing the market share?

Customer Lifetime Value (CLV) vs. Customer Acquisition Costs (CAC): A ratio of 3X and a CAC payback of < 18 months is ideal for SaaS startups.

B. Product/Market Fit Survey

Rahul Vora in this article shares how he used a "simple survey" to assess whether his venture (Superhuman) has achieved the Product/Market Fit. Here's how you can replicate it:

Survey all your users with this simple question:

Q. How disappointed would you feel if you could no longer use our product/service?

Very disappointed

Somewhat disappointed

Not disappointed

The magic number that indicates the Product Market Fit is when > 40% of users respond as “very disappointed.” The companies that struggle on the same can barely even touch 40%.

51% of Slack users responded that they would be very disappointed without Slack, revealing that it had indeed attained product/market fit.

C. Retention and Customer Love

Rajan Anandan MD, Sequoia Capital recommends two simple methods to evaluate, whether you've achieved the product/market fit:

The retention curve is what percentage of your users keep coming back over some time while using your product/service.

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

a. Declining Curve (dark grey line), let's say you’ve launched a consumer internet app on day 0, and every week your retention rate declines by 10%, which essentially means that by the end of 3rd month, all your initial users would have churned, then that's a declining curve, which indicates that you don’t have a product-market fit.

b. Flattening Curve (orange line) is actually good, although it kind of varies depending upon the category (HealthTech, EdTech, etc.,) but generically speaking if the retention curve flattens between 20%-40% that could be quite good.

c. Finally the best one is the Smiling Retention Curve (green line), which means that retention drops but then as time goes on you keep reactivating users, which indicates that you're getting close to your product-market fit.

C2. Do Customers Love You?

Net Promoter Score (NPS) is a metric that organizations use to measure customer loyalty toward their brand, product or service. NPS works by asking your customers a single question: "How likely are you to recommend our products/services to others?"

NPS = % Promoters (score 9-10) - % Detractors (score 0-6)

If the magic score is = 70% or more, then you have an amazing product-market fit. But if the number declines to 40% or below, then you don’t have it. It's that simple!

What if you don't have a Product/Market Fit?

Encourage founders to continue to talk to customers, care about their customers, learn about their problems, and solve them effectively - Michael Siebel, Partner-YC.

Most founders seek ineffective shortcuts to achieve Product/Market Fit (PMF) i.e. hiring a ton of engineers, bringing on senior executives, running after key partnerships, etc. These shortcuts never work.

If you don't have Product/Market Fit, keep your burn low, and keep iterating fast with a lean team. You may get pressure to spend from your VCs (this usually happens), push back hard - Elizabeth Yin, Co-founder of Hustle Fund.

If you haven't reached Product/Market Fit, avoid growing your team above 10 people. Post-raising a seed round, most founders are tempted to grow the team. Smaller teams can adapt/iterate much quicker - Immad Akhund, Co-founder & CEO, Mercury.

QUICK DIVES

1. The AI Plateau Is Real By Gordon Ritter and Wendy Lu (Emergence Capital).

Imagine asking an LLM for advice on making the perfect pizza, only to have it suggest using glue to help your cheese stick — or watching it fumble basic arithmetic that wouldn’t trip up your average middle school student. Such are the limitations and quirks of generative AI models today.

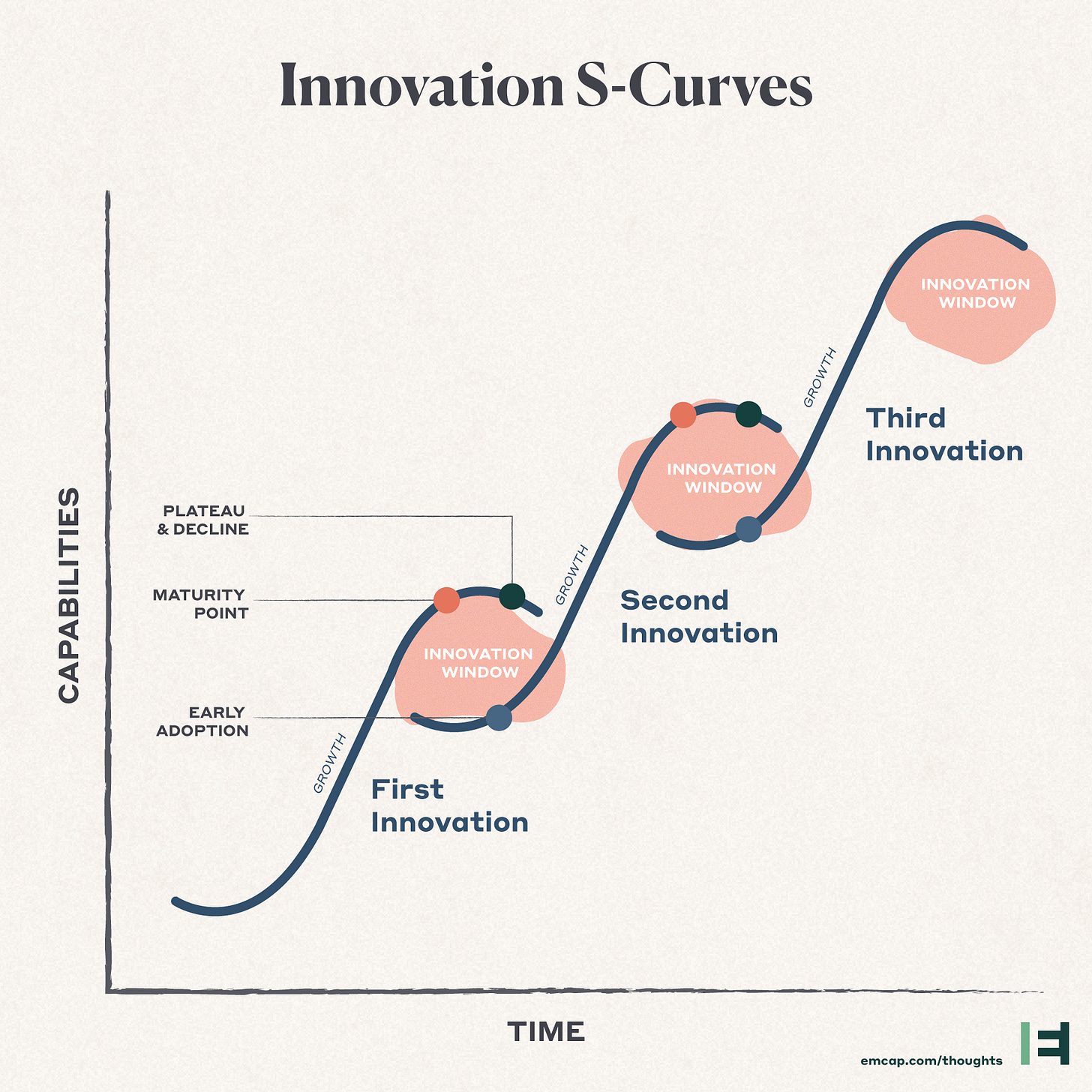

Technological progress often follows an S-curve pattern, characterized by slow initial growth, rapid acceleration, and eventual plateau.

Source: Emergence Capital

This is evident in various innovations throughout history, such as TCP/IP, web browsers, and mobile apps. Each of these experienced periods of explosive development followed by relative stability.

Similarly, generative AI models, despite their current limitations, are likely in the early stages of their own S-curve.

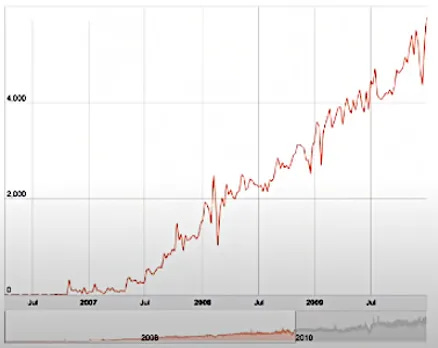

Initially, progress was rapid, with each new release from companies like OpenAI, Anthropic, Google, and Meta offering significant improvements. However, recent advancements have become incremental, suggesting that current AI models are approaching a plateau in performance. Consider this chart of performance increases of OpenAI’s flagship model:

Source: Emergence Capital

This slowdown in progress indicates that the field may be nearing the limits of current approaches like reliance only on public data. We believe we understand what’s caused AI to plateau, and what is needed to make the next jump: Access to the next frontier of data, which is of higher quality and relevance.

To achieve this, startups should engage experts, leverage latent data within business apps, capture data in context, and secure proprietary models.

Gordon Ritter (General Partner at Emergence Capital) and Wendy Lu (Principal at Emergence Capital) have shared the practical approaches to accessing this kind of data and jumping to the next S curve.

2. S.P.A.D.E. Framework- A technique for making difficult decisions.

Gokul Rajaram is a board member at Pinterest and Coinbase who previously held exec roles at Meta and Google. He created an awesome framework he calls S.P.A.D.E. for making difficult decisions.

Image Source: Planio

Setting → What, when, and why are we doing?

People → Who is responsible, who should consult, and who should approve?

Alternatives → Create a feasible, diverse, and comprehensive list

Decide → Collect feedback, get approval, and make the call

Explain → Call a commitment meeting (if necessary) and broadcast your decision

The catalyst for this framework was a conversation with Google CEO Eric Schmidt, who interrupted a presentation Gokul was giving and said “STOP, who is responsible for this decision?” Three different people raised their hands. He then said, “I’m ending this meeting right now, and don’t come back until you have a clear decision-maker.”

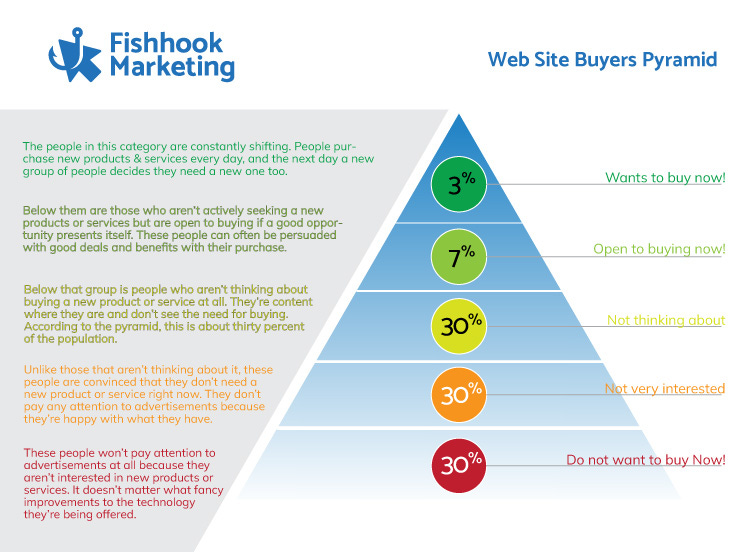

3. The Buyer's Pyramid: Understanding Customer Readiness To Buy Your Product.

“Figuring out” your startup’s TAM is somewhat useless. Most of the time it’s made up (TAM - Totally Made-Up Number) or at least very generous, and everyone knows it. But the real sin about TAM is that it’s just one giant number.

Sure, you have SAM and SOM as well but those aren’t much better. They don’t tell you anything actionable like, for example, how ready to buy your market is.

The Buyer’s Pyramid does, though, and I’ve found it pretty helpful. It’s broken down into five states a potential customer can be in:

Buying / ready to buy

Open to buying

Not thinking about buying

Don’t think they’ll buy

Know they won’t buy

The numbers below are just arbitrary. What I like about the framework is that you can use different strategies for each distinct user group, track performance with simple tagging when potential customers are in your funnel, and audit whether you’re spending your time and money most effectively with sales and marketing.

Join 29000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

LinkedIn co-founder Eric Ly’s startup KarmaCheck, has raised $45 million in a funding round led by Parameter Ventures. More Here

SoftBank Group Corp. has raised $1.86 billion through dollar and euro bond sales, marking its largest foreign-currency debt offering by a Japanese company this year. More Here

SoftBank's Vision Fund 2 plans to invest $10-$20 million in Perplexity AI at a $3 billion valuation as part of a $250 million funding round. More Here

ByteDance, TikTok's parent company, has quietly launched Whee, an Instagram-like photo-sharing app, in 71 countries. Despite minimal marketing, Whee has gained about 23,000 downloads across iOS and Android platforms. More Here

David Sacks, Mike Maples, Jason Calacanis, Sam Lessin, Garry Tan, and Walter Isaacson Invested $5 Million In an AI license marketplace startup - Created by Humans. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Partner - In Q Tel | USA - Apply Here

Investment Manager - Polymath Venture | Mexico - Apply Here

Program Associate - Techstar | USA - Apply Here

Investor Relation Support Assistant - AP Venture | UK - Apply Here

Principal - Woven Capital | Japan - Apply Here

Program Manager - Generator | USA - Apply Here

Startups Operations Coordinator - Station | USA - Apply Here

Investment Analyst -Navam Capital | India - Apply Here

Manager, Partner Success - Rev 1 venture | USA - Apply Here

General Manager - Techstar | USA - Apply Here

pre-MBA Analyst - Healthquad | India - Apply Here

Analyst - Titletwon tech | USA - Apply Here

Community Owner - Rocket Capital | India - Apply Here

Investment Analyst - Edge Case Partner | USA - Apply Here

Venture Partner - Erez Capital | USA - Apply Here

🧐 Must Read Articles To Break Into VC:

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….