Why Your Startup Idea Isn’t Big Enough for Some VCs? | Sam Altman Strategy - To Find The Right Problem To Solve? | VC Remote Jobs & More

VC Prefer To Invest In Big Ideas! | Solving the Right Problem - By Sam Altman | VC Remote Jobs

📢 Today At A Glance

Focus On: Why Your Startup Idea Isn’t Big Enough for Some VCs?

Featured Article: “How to Find the Right Problem to Solve?” - Sam Altman Strategy

Major News In Startups: SpaceX's Starlink Ready For Public Debut & FTX Founder Guilty - Sentence Of 115 Year In Prison

This Week’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝In Partnership With : Portless

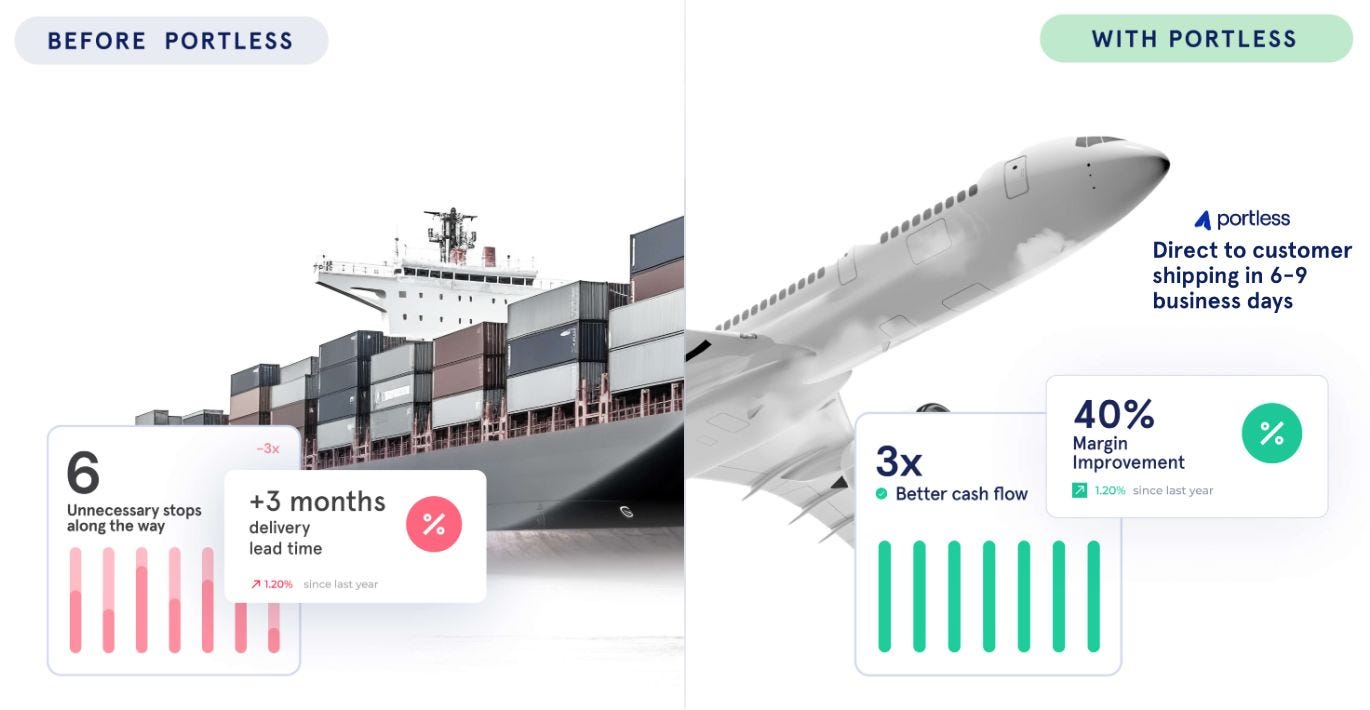

Improve Your Gross Margins By Up To 40%!💡

Facing inventory headaches this Q4 season? Dreading those long 45-60-day waits for product arrivals?

Portless is the fulfilment game-changer for e-commerce brands. 🚀

👉 Why Portless?

✅ Direct Shipping: From China to customers in just 6-8 days, covering 55+ countries.

✅ Domestic Feel: Custom packaging, local tracking from carriers like USPS and Canada Post.

✅ Cost-Effective: Slash those cargo shipping and customs fees (thanks to Section 321!). Boost your gross margins by up to 40%!

✅ Cash Flow Positive: No more tied-up cash flow in inventory. Relieve yourself of frozen cash within a couple of days.

Don't juggle with overstocks, stockouts, or let cash flow suffer. With Portless, enjoy fast 3-5 day replenishments on your most popular items and take control of your inventory this holiday season.

📢 Why Your Startup Idea Isn’t Big Enough for Some VCs?

Investors often tell founders that their startup doesn't align with their investment thesis or some generic response like “not this time (not investing this time)” leaving most founders confused.

This week, I had a call with a founder who asked me the same question: What do investors mean by 'you are not the perfect fit, this time?’ There are several reasons for this, such as the startup not aligning with the investor's thesis in terms of industry, funding amount, or other factors.

One common reason for rejection is when investors believe that the startup is not big enough for venture capital (VC) investment. But what does this mean?

During pitch sessions, investors focus on one key question: "Can this startup become worth a billion dollars?" If they don't see that potential, the startup is often rejected.

Let's understand - why VCs are inclined to invest in big ideas.

Source: Google Images

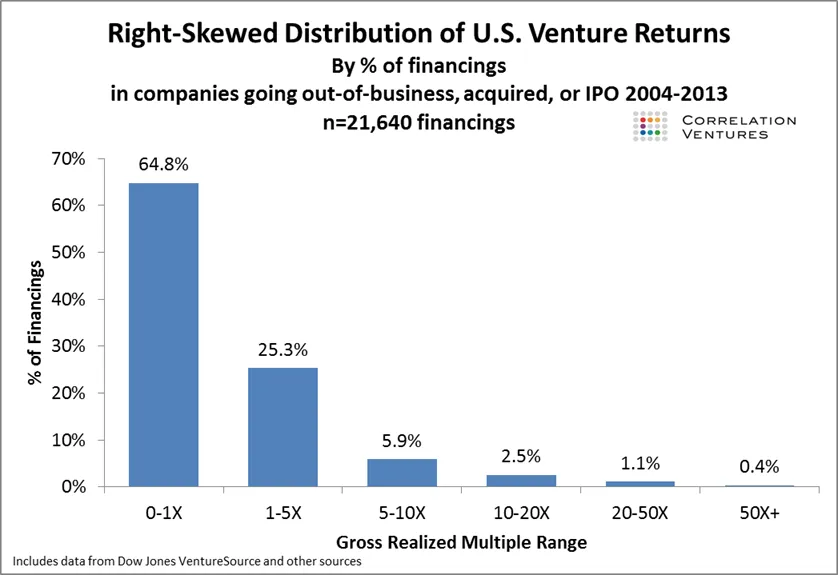

VC functions with a power law, the majority of a fund’s returns come from a small percentage of investments.

Because of this, Venture Capital need to know if a single investment can return the entire fund. What does it mean? Let’s understand this 👇

Fig: Power Law In Venture Capital

As Bill Gurley said “Venture capital is not even a home-run business. It’s a grand slam business.” This is where the Return The Fund (RTF) analysis comes into play.

Look at the below Data from 2004-2013.

https://www.sethlevine.com/archives/2014/08/venture-outcomes-are-even-more-skewed-than-you-think.html

If we assume an exit distribution, over 60% of a fund’s investments are 0–2x their money, With the remainder falling between 2–5x, a “unicorn” type 10x+ outcome can put a venture fund into the desired 3x fund returns that put them among the top performers in VC.

Your 1–3 investments that “return the fund” and probably even more (the grand slam), are what will make or break you, While the other 2x-5x investments create additional alpha.

Let's understand the math behind the Return The Fund (RTF) to get a better idea.

The math for an RTF analysis is pretty simple:

Fund Size / % owned at exit = Minimum Viable Exit

To get a clear idea - let's take an example of an autonomous vehicle startup built on the blockchain, X raising a $2M seed at a $10M Post money valuation (Selling a 20% stake).

VC Fund A is a $50M seed fund investing $1M.

$1M/$10M valuation = 10% ownership

In order to return the fund, X must exit for (50/.1) = $500M

But over the period, Fund A wasn't able to invest in the next rounds (not maintain pro-rate thing ) so their stake got diluted. Assume dilution by 20%.

With this dilution by 20% - the real return of the fund number is $625M ($50M/.08). So in order to pass RTF (Return To Fund) analysis, VC Fund A must believe that X will exit for at least $500M and more realistically $625M. This is for some small funds like seed.

Now let’s look at a larger fund model.

VC Fund B is a $250M fund investing $1M in X.

$1M/$10M valuation = 10% ownership

Return to Fund calculation: VC Fund B has to believe that X will exit for $2.5B ($250M fund / 10% stake).

Assume this fund is able to invest in further rounds and able to get 5% extra which makes the stake 15% at exit.

VC Fund B has to believe that X will exit for $1.66B ($250M/15%) in that increased ownership scenario.

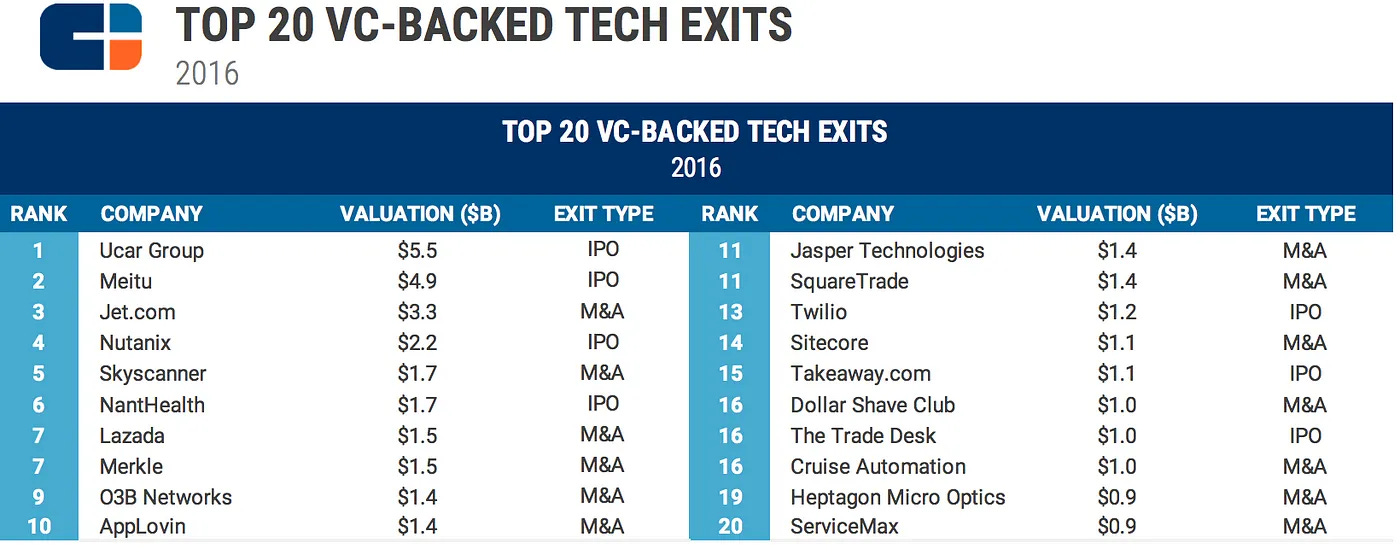

But does the company really exit at $1.66B or more? What’s the past data say? -

Let's look into this. If you look at data on equity ownership at exits, the image below:

Data till 2016 - on VC Backed Startups Exit

As an investor, the difference between a company exiting for $500M vs. $2.5B is not trivial. Less than 10% of all VC-backed exits in 2016 were $500M+, per CB Insights.

As a founder, this trickles down to thinking about their potential investor’s philosophy. While some startups are built to exit in the 100 of millions of dollars, Larger funds could push through their natural exit points in order to go for broke and hit a grand slam which is unlikely to occur. Return to the fund (RTF) is a good barometer, but just one data point in the Due Diligence Process.

It is a quick way to gut-check ownership and investment size and also allows investors to think about how they will need to build their positions over time. But while this thought process is generally useful, like all things in startups, there are outliers.

🤝 Advertise in The Venture Crew’s Newsletters

Want to promote your startup to my community of 14,000+ entrepreneurs and investors? Reply “advertise” and I’ll share my media kit.

Featured Article:

“How to Find the Right Problem To Solve?” - YC Strategy

One of the most common reasons for startup failures is founders attempting to solve the wrong problem. About 99% of founders choose the wrong problem to solve which leads to the failure of a startup from the first day itself.

Successful founders, on the other hand, choose the right problem to solve. Each founder has their own experience in identifying the problem, but most of them are not aware of how to determine if it is the right problem to solve.

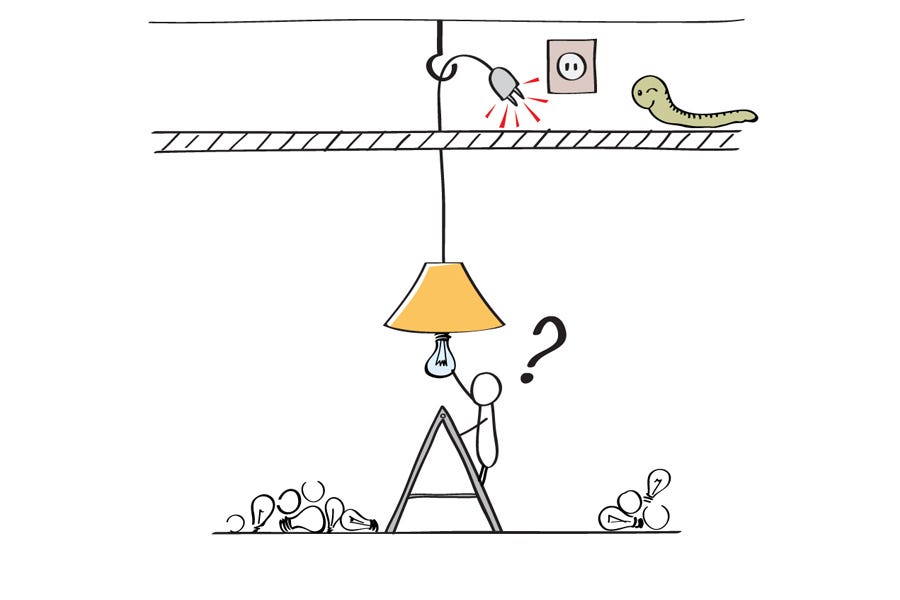

Source: Google Images

So, Y-Combinator shared a practical approach to finding - whether a founder solving the right problem or not. YC Shared that…..

Find the Problem which is —

Popular

Growing

Urgent

Expensive

Mandatory

Frequent

Let’s decode each one of these:

Popular: Find A Problem that a lot of people are facing. You should avoid problems with only a small number of people are facing.

Growing: Find the problem which is growing, so a large number of people will face problems in the coming time.

Urgent: The problem needs to be solved very very quickly.

Expensive To Solve: If you’re able to solve it then you can charge a lot of money for potential.

Mandatory: Problems that are mandatory right so people can see the problem and use your product/service.

Frequent: over and over again (— people are gonna encounter the problem over and over again and often in a frequent time interval.

A successful startup has one of the aspects in their problem and even some have multiple aspects, But the most important thing they have is Frequency as it gives opportunities to convert some of the parts (which is generally the large part of it).

Every day, we share small forms of articles on Medium. If you want to stay updated, feel free to visit our Medium profile and read more here.

🛠️ Want To Break Into VC?

Join our 100+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly Events By Investors and founders! Join Now

📰 This Week’s Major News: VC, Funding & Tech Updates

SpaceX's Starlink Ready For Public Debut Read Here

FTX Founder Guilty - Sentence Of 115 Years In Prison Read Here

Jeremy Grantham's investment bubble gains extend to his venture capital phase Read Here

Andreessen Horowitz Plans to Launch a $3.4B Fund Read Here

This Robotics Startup Got Funding From All Unicorn Founders Read Here

Subscribed To, VC Daily Digest Newsletter and join 6500+ Avid Readers For Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox. 🚀

🗞️ Weekend’s Read On: Startup, Technology & VC

3 Things Founders Should Prioritize Early to Ensure a Successful Exit Read More (Venture Capital)

Strategies for Startups to Outmaneuver Competition in a Turning Economy Read More (Startups & Venture Capital)

How Much Should Quotas Increase Next Year? Read More (startups & technology)

How to Raise Money By Paul Graham Read More (Startups & Venture Capital)

You’re Wasting Your Time Trying to Build an Audience Read More (startups)

Join 7700+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Remote Jobs & Internships

Impact Investment Associate - Education Impact FUND | Remote - Apply Here

CPA - Venture Capital & Foreign Investors Experience - Alpha Impact | Remote - Apply Here

Associate, Analyst and Intern - Eliant Advisor | India - Apply Here

Junior VC Analyst - Aera VC | Singapore - Apply Here

Investors - MIT Investment Management Company | US - Apply Here

Platform Analyst - Cavlary Venture | Germany - Apply Here

Community Manager - M31 | Remote - Apply Here

Marketing Intern - Connecticut | USA - Apply Here

Investment Manager - Circulate Capital | Remote - Apply Here

Join our 100+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly Events By Investors and founders!

You’ll get access to:

👉 Boost your e-commerce business with Portless

Fast direct shipping, custom packaging, and up to 40% higher gross margins this holiday season!

📦 Share VC’s Newsletter

Refer a friend to gain access to our venture resources. 🎊

Get Venture Capital and Investors Database. for 4 referrals

Get Access To private Slack for 10 referrals

Get On a 30-minute call for 15 referrals ( To Discuss fundraising, breaking into VC funds, making a pitch deck, building a newsletter and others)

✍️Written By Sahil | Venture Crew Team