All-In-One Fundraising Resources For Founders. | VC & Startup Jobs.

Problem-Solution Fit vs. Product-Market Fit & Should Your SaaS Go Freemium?

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: All-In-One Fundraising Resources For Founders.

Quick Dive:

Problem-Solution Fit vs. Product-Market Fit: What Early Founders Get Wrong?

The Freemium Dilemma: Should Your SaaS Go Freemium?

How to Create a Founders Agreement That Works? - Template To Download.

Major News: Musk’s xAI lie about Grok 3’s benchmarks?, The biggest crypto theft ever, Vision Pro is getting Apple Intelligence & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

The marketing framework ClickUp used to scale to a $4B company.

How do I avoid giving away too much equity?

Financial modelling template to build your startup financial model that every investor wants to see.

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

The Only Market Sizing Guide Every Founder Needs.

Fundraising is a Tactic, Not a Goal.

How do VCs decide to take a first meeting? & non-obvious fundraising lessons on pitching.

Andrew Chen, a16z partner debugging The Hidden Trap of Going Viral: Why It Brings the Wrong Users.

50 most viral hook patterns extracted from 46,606 TikTok.

Write Your Monthly Investor Update (Email Template Download).

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Alex Lieberman on how pivoting should be more celebrated.

Dickie Bush on how to tighten feedback loops.

For AI Enthusiasts: Must-have resources to stay updated on AI tools, trusted by MIT students and tech professionals from OpenAI and NVIDIA.

A MESSAGE FOR FOUNDERS - HIGHLY RECOMMEND

📢 Pitch Decks That Help Startups Get Funded

Investors expect clear, compelling, and visually stunning pitch decks. That’s where DECKO comes in.

We work with startups to craft investor-ready pitch decks from scratch, designed by VCs and expert designers to help them present with confidence.

What Sets Us Apart?

🎯 VC-backed content—We craft decks investors want to see

🎨 Premium custom design—No templates, fully tailored

📊 Data-driven storytelling—Designed to maximize engagement

📢 Trusted by 300+ startups & VC funds

Venture Crew founders get 10% off!

Just mention The Venture Crew or visit here →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

All-In-One Fundraising Resources For Founders.

In today's deep dive, we will share the top curated resources that will answer all your doubts and upgrade your fundraising journey as a founder.

Initial Decision Making:

Is venture capital the right funding path for your startup? [Read]

What are the alternatives to VC funding you should consider first? [Read]

Are you ready to give up equity and partial control? [Read]

Preparation Phase:

Do you have a compelling story and clear vision? [Read]

What key metrics and milestones should you achieve before approaching VCs? [Read]

Is your financial model and projection ready? [Read] [Template Download]

How much money should you raise? [Read]

Research & Planning:

Which VCs are the best fit for your startup's stage and sector? [Read]

Download the Verified Investors contact database [Read]

What's your ideal target list of investors? [Read]

How do you get warm introductions to these VCs? [Read]

Pitch Development:

What should your pitch deck include? [Read]

How do you craft a compelling narrative? [Read]

What are the key questions VCs will ask? [Read]

If you want to build a pitch deck that attracts investors’ attention. [Scheduled a call with Decko team]

Fundraising Process:

How do you manage investor pipeline and conversations? [Read]

What's the ideal timeline for your fundraising round? [Read]

Find the contact database of 10,000+ US, UK, India, Africa, Europe, France, Australia, and more investors. [Access Here]

How Do VCs Decide to Take a First Meeting? [Read]

How do you create FOMO among investors? [Read]

What Founders Should Ask VCs In Fundraising Meetings? [Read]

Deal Terms:

What key terms should you understand in a term sheet? [Read]

How do you negotiate valuation? [Read]

How do you negotiate valuation? [Read]

Closing the Round:

What's the due diligence process like? [Read]

How do you handle legal documentation? [Read]

What's the typical closing process and timeline? [Read]

Post-Fundraising:

How do you announce your funding? [Read]

What should be your first steps after closing? [Read]

How do you maintain good investor relations? [Read]

I encourage founders to spend enough time reading all these articles. These will help you find the right amount to raise, with negotiations and closing successful funding rounds.

INVESTMENT OPPORTUNITY WORTH EXPLORING

🧐 A $255 Billion Market Opportunity —Why Investors Are Backing Shape Accelerator

This fast-growing health brand is turning heads in the investment world: ShapeAccelerator isn’t just another weight-loss product—it’s an award-winning, science-backed solution with real clinical results and explosive market demand.

Why it matters:

The global weight-loss market is booming, growing at 9.7% CAGR.

Most products lack scientific backing or fail to deliver lasting results.

Why I’m watching:

500% sales growth in 2024, with strong traction.

National media exposure, including CNN, HGTV & a Times Square campaign.

Expanding into Europe & Asia by 2026, signalling global demand.

With 20X ROI potential, this is a rare chance to invest in a science-driven consumer brand at the tipping point of massive growth.

💡 Be part of the next big thing in wellness—invest today →

📃 QUICK DIVES

1. Problem-Solution Fit vs. Product-Market Fit: What Early Founders Get Wrong?

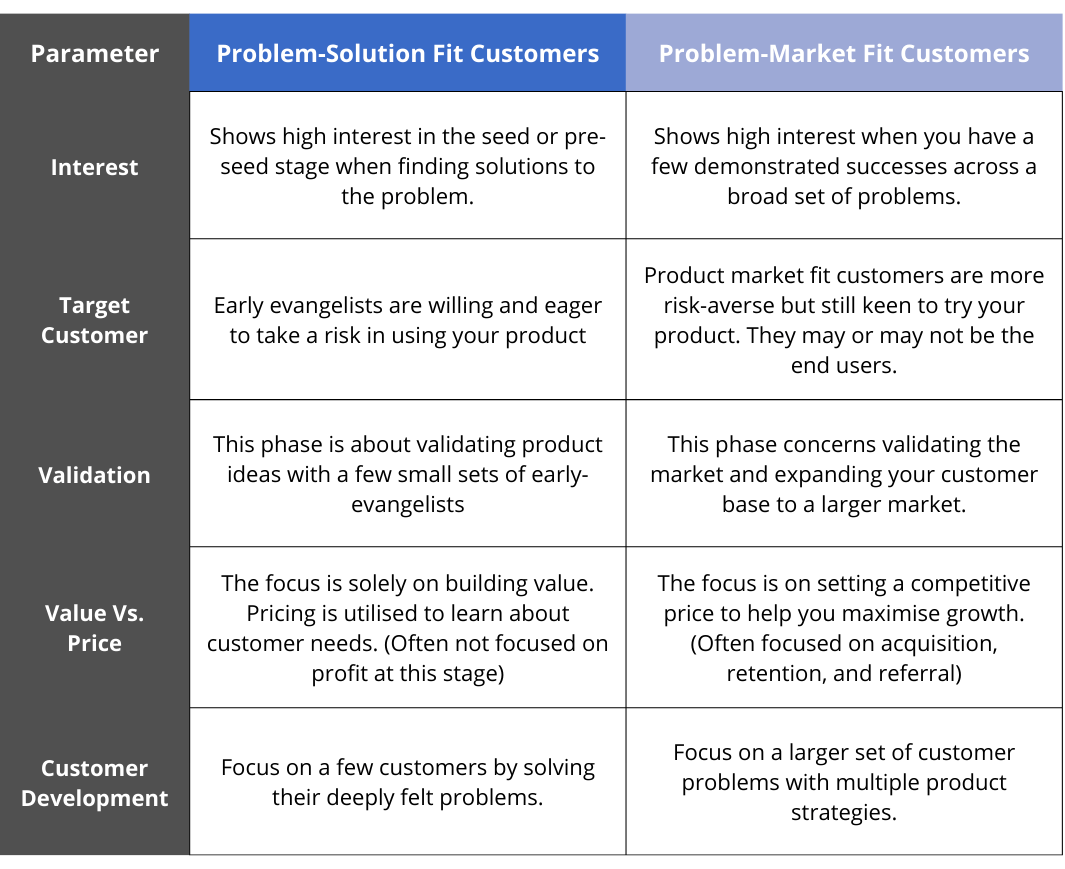

Problem-Solution Fit and Product-Market Fit are often a point of confusion for early founders. On the surface, these two definitions are virtually identical = find a valuable product in a big enough market. However, the solutions in the Problem-Solution Fit stage are often different to those in the Product-Market Fit stage.

This is because Problem-Solution Fit focuses on a tiny group of early-evangelists who are comfortable with missing features, as long as it solves their core problem. (Bad UX, no onboarding, and manual work-arounds are part of the fun!)

Whilst solutions during the Product-Market Fit stage focus on selling your product to a larger mainstream market. These solutions need to have a more robust set of features. (Reliability, Security, Reporting, and a decent UX is a common ask for these customers).

Problem-Solution Fit Example

David Wang, founder of product academy shared this example - “A great example I’ve experienced recently was assessing a content moderation tool for the company I currently work for.

My company is on a mission to create the most trusted destination on the internet. We want to moderate all content hosted on our platform to protect visitors.

Our team scoured the internet to find a tool that fit our requirements. After weeks of searching, we came across a startup that friends in the industry highly recommended. Their product was easy to use, had an AI engine that makes our lives easier, and had a few customers using it - a great demonstration of Problem-Solution Fit!

However, due to the size of our remote-first workforce, information security was a key need for us. We require features like Single-Sign-On and specific security certifications that the startup didn’t offer.

As a result, we ended up choosing another tool with fewer features but focused on a more robust set of features on information security. When we broke the news to the founders, they were disappointed but understood their product wasn’t right for us.

We departed amicably, and the startup will reach out again when they have the security features we require.

Now… could the startup have built the security features that we need? Absolutely.

But more importantly, was my company the right customer for them? Probably not.

They were focused on smaller startups with different sets of needs. To change their product just for my company would’ve meant overheads that were not worth it for them.

The moral of the story is that “everyone” is not your customer.

When you’re trying to find a Problem-Solution Fit, your customers must be your “early-evangelists”—these are customers that would scream and shout about your product.

Once you’ve found a strong base of “early-evangelists" you can move into a bigger market to find Product-Market Fit.

Here is a quick comparison between your PSF customers vs your PMF customers:

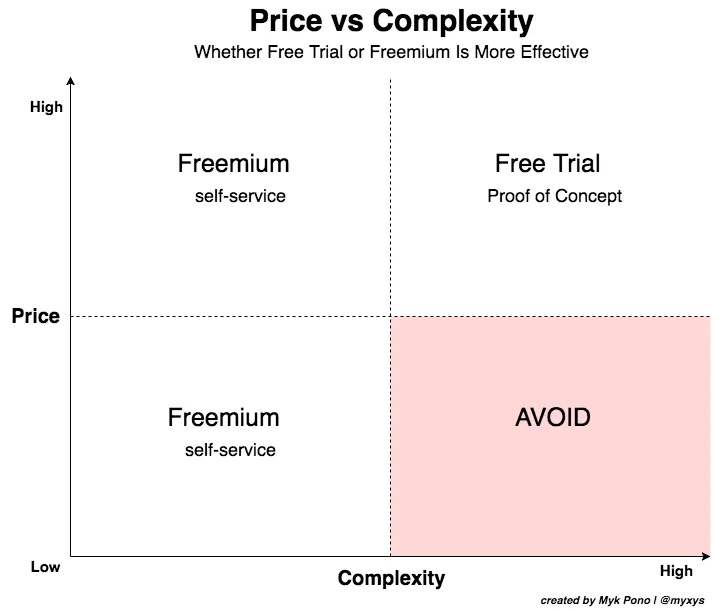

2. The Freemium Dilemma: Should Your SaaS Go Freemium?

Deciding whether to offer a freemium model is a common dilemma for founders. Many try out freemium strategies, but not all SaaS companies can replicate the success of Dropbox or Typeform.

Done wrong, freemium can end up cannibalizing your paid user base while also draining your company’s precious engineering and customer support resources.

So how can you determine if it's the right move for your company? The most reliable way to find out is through A/B testing. However, getting solid results can take a long time, especially if you're looking at the impact on virality and your viral cycle is six months or longer.

If you can't wait that long or aren't set up for a full A/B test, consider these "Three Factors for Freemium Strategy":

Does your paid plan have a gross margin of 80–90%?

If you have a lower gross margin — for example because your product is not fully self-service, requires extensive customer support or is extremely costly in terms of tech infrastructure — freemium will probably not work for you.Does your free plan attract the right audience?

If your free users are too different from your paying users, your free-to-paying conversion will be low — and you’ll risk developing your product for the wrong audience.Is your product inherently viral?

If your answer is no, that doesn’t make it a complete no-go, but it does mean that it’s much less likely that freemium is right for you.

In the end, freemium only makes sense if a certain percentage of your free users do one of three things:

Eventually, convert to paid,

Refer paying customers, or

Provide the kind of valuable feedback that will improve your product.

A freemium product that fails to achieve any of these effects will merely saddle you with extra costs and distract you from servicing your most important users.

Also, there is one interesting article on why companies fail with freemium. I highly recommend checking it out, it’s worth reading.

3. How to Create a Founders Agreement That Works? - Template To Download.

Starting a business with co-founders is like embarking on a long road trip together. While the journey can be more enjoyable with partners who complement your skills, even the strongest relationships need ground rules. This is where a founder agreement comes in.

Simply put, a founders agreement is a legal contract between company founders that sets clear guidelines for their business relationship. Think of it as a roadmap that outlines everyone's rights, roles, responsibilities, and expectations from day one.

Why You Need One

While not legally required, having a founder agreement is crucial because it:

Prevents misunderstandings by getting everyone on the same page

Provides a clear structure for handling disputes

Shows potential investors you're serious and well-organized

Protects both your business and personal relationships

As Simon Bacher, CEO of Ling, puts it: "My wife and I co-founded our startup, and we saw a founders agreement as essential - think of it like a prenup for your business."

Key Components of a Strong Founders Agreement

1. Basic Company Information

Company name and founders' details

Business mission and goals

Ownership structure

2. Roles and Responsibilities

Each founder's specific duties and areas of authority

Clear job titles and their limitations

Flexibility for role changes as the company grows

3. Decision-Making Powers

Voting rights

Process for major decisions (hiring, firing, strategic changes)

How to handle deadlocks

Veto powers

4. Equity and Vesting

Each founder's ownership percentage

Vesting schedule (typically four years with a one-year cliff)

Conditions for receiving full rights to shares

Compensation plans

5. Commitments and Resources

Expected time commitment from each founder

Initial capital contributions

Intellectual property rights

Other resources (industry connections, expertise)

6. Exit Planning

Conditions for dissolving the company

What happens during an IPO

Handling of unvested shares

Non-compete and non-solicitation terms

Now that you know what goes into this document, here are a few founder’s agreement templates and examples to help you craft your own.

University of Pennsylvania Law: Includes provisions about ownership structure, transfer of ownership, decision-making and dispute resolutions, representations and warranties, and choice of law

Harvard Business School: Includes provisions on ownership, competition restriction, and exit situations

You’re going to go through many ups and downs with your partners. Creating a founders agreement is an excellent way to ensure you’re all protected throughout your business journey.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Cherryrock Capital closed its $172M Fund I to back Series A and B startups, particularly diverse founders. (Read)

OpenAI employees accused xAI of misleading benchmark results for Grok 3, arguing that its comparison omitted OpenAI’s o3-mini-high score at “cons@64,” a setting that improves accuracy. (Read)

OpenAI expects 75% of its data centre capacity to come from SoftBank-backed Stargate by 2030, moving away from Microsoft, its current primary provider. (Read)

Apple confirmed that its generative AI platform, Apple Intelligence, will arrive on Vision Pro in April via visionOS 2.4, bringing text and image generation tools like Rewrite, Proofread, and Image Playground. (Read)

OpenAI has banned several accounts linked to a Chinese surveillance tool that used ChatGPT to develop sales pitches and debug code for monitoring anti-China protests in Western countries. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

Sr Associate/VP - Novo Holdings | USA - Apply Here

Investment Analyst - Stellaris Venture Partner | India - Apply Here

Business Development Associate - One Planet Capital | UK - Apply Here

Jr. Venture Associate - Spin Venture | UK - Apply Here

Venture Fellow - Iron Key | USA - Apply Here

Investment Manager - Vorwerk Venture | Germany - Apply Here

Vice President, Communications - Softbank Vision Fund | UK - Apply Here

Managing Director - Connecticut Innovations | USA - Apply Here

Principal - Fitch Venture | USA - Apply Here

Investment Manager - Techstars | USA - Apply Here

Legal Intern - Plug and Play Tech Center | USA - Apply Here

Ventures Associate - Aerospace - Plug and Play Tech Center | USA - Apply Here

Investment Intern - Revavia | UK - Apply Here

Director of Investor Relations - Navitas Capital | USA - Apply Here

Analyst - Lewis | USA - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator