What Founders Should Ask VCs In Fundraising Meetings? | VC Jobs

Framework To Find Pricing Strategy Working? & Product Stickiness Framework...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: What Founders Should Ask VCs In Fundraising Meetings?

Quick Dive:

Promise-market fit is an early signal that product-market fit is possible. Why & How?

5 Simple Frameworks to Determine If Your Pricing Strategy Is Working.

Product Stickiness Framework: Triggers, Constraints, and Rituals.

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: OpenAI Reportedly In Talks to Raise $1 Billion, Midjourney ‘Getting into Hardware’ After Neuralink Engineer Hiring, Musk's X Developing Zoom Competitor & Apple Cuts 100 Jobs In Digital Service Group…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER

Venture Curator Opens 3 Slots to Help Founders Build Pitch Deck

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch deck. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

PARTNERSHIP WITH US

Want to get your brand in front of 53,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

What Founders Should Ask VCs In Fundraising Meetings?

Top-performing founders know a key secret: when meeting with VCs, don't just focus on securing their money—focus on learning from them.

Most VC meetings won't end with a check, but that doesn't mean they're a waste of time. Each meeting is a chance to build your company using the insights you gain from the VC, not just the funding you might receive.

Remember, investors have seen countless startups, invested in many, and have a broad view of the market. That experience is incredibly valuable, and it’s right there in front of you. They hear and see things that you might not. This wealth of knowledge is yours to tap into—you just need to ask the right questions.

Yet, many founders make the mistake of only asking, “How long will it take to get a response?”

I’ve noticed that some founders approach VC meetings as if the investors are above them, rushing through the meeting like it’s a rapid-fire round. Don’t do that. Approach the meeting with the right mindset: come in as an equal, ready to collaborate and engage in meaningful discussion.

Here are a few of my suggestions for making the most of your VC meetings:

Spend the first part of the meeting explaining what you know about your business—focus on sharing insights, not just pitching. The majority of the time should be used to ask the VC questions and engage in a collaborative dialogue.

Aim for a ratio like this: If you have 10 minutes, explain for 4 and discuss for 6. If you have 30 minutes, explain for 8 and discuss for 22. If you have an hour, explain for 12 minutes and discuss for the rest. Keep a large appendix in your deck for reference during the discussion.

To help founders get into the right mindset, I’ve pulled (Shared by GP) together a few questions that have seen in pitch meetings. These are questions every founder should consider asking when meeting with VCs. We’re sharing them to encourage founders to start real conversations and build genuine relationships with investors—from the very first meeting. Remember, these relationships could last decades, even if the VC doesn’t invest this time.

More than just asking these questions, it’s crucial to approach meetings with a mindset focused on learning and finding the right fit between the founder and the VC.

How you phrase things can make a difference. Try asking from the perspective of “this company I’ve shown you,” as that’s how the VC views it.

Understanding How Your Company Is Perceived

You have a busy schedule and many meetings. What made you want to take this one? What were you hoping to learn?

Does my deck accurately reflect the business as I’ve described it today?

How would you describe this business to your partners?

What concerns might your partners have when they review this business?

How does this company fit within your current portfolio?

Turning the Tables

Is there anything you think I’m underestimating or being overly optimistic about?

What are the main risks or barriers to success you see? Any concerns that might lead you not to invest?

Based on what I’ve shared, do you see any patterns (good or bad) from similar businesses?

How many companies have you seen targeting the same sector?

Have you seen similar businesses succeed or fail recently?

How common is this idea? Have you encountered anything like it before?

Does this startup remind you of any successful companies? Any analogies that come to mind?

Are there companies this startup could naturally partner with now or soon?

Is anything in this business aligning with trends you’re seeing elsewhere?

Now that you’ve heard more about the business, what sectors would you place it in?

Does our TAM (Total Addressable Market) calculation make sense to you?

Here’s how we calculated TAM—do you see another way to approach it?

Could we redefine our market to make it larger, like Airbnb going from home rentals to hotels?

What do you think of the niche we’re targeting? Is there a sub-segment where you see strong potential?

Do you think this could be a billion-dollar company? Why or why not?

I’m considering adding a few smaller checks from angels and advisors to this round. Can you think of anyone who would be valuable to advise me, even if you don’t invest? (I’m not asking for an introduction.)

Besides your firm, who do you think would be the ideal investor for this type of business? Does anyone specific come to mind? (Again, not asking for an introduction.)

If you had someone else help you evaluate this company, whose opinion would you trust?

I know the chances of you investing are slim, but out of curiosity, who else do you think I should be talking to?

What’s the main metric that would prove this is a solid business?

What traction metrics would make investing a no-brainer? Where do we stand on the proof ladder based on what you know?

What’s your experience with companies using the distribution channels I’m planning to use? What lessons have you learned from them?

If this company is worth $2B in the future, what path do you think it would have taken to get there?

On a scale of 1 to 10, how strong do you think our founder-market or founder-product fit is?

Based on our meeting, do I seem like the kind of person who can make this business succeed?

How does my team compare to other teams you’ve invested in?

What are the strengths and weaknesses of the team I’ve built so far?

Who would you recommend adding to this team within the next year?

What cultural traits do you think are essential for this company’s success? Should we be aggressive, careful, highly compliant, rule-breaking, sales-driven, or tech-driven?

The best meetings VCs have with founders are collaborative, not one-sided pitches. They feel like conversations between equals, setting the stage for a potential 7-10-year partnership to build something great.

When you ask VCs about your company, listen to their feedback without becoming defensive. Embracing criticism and overcoming the fear of rejection can make the fundraising process far more valuable.

Consider using some of the questions from this list that resonate with you and will help you gain deeper insights into your business from the VC’s perspective.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. Promise-market fit is an early signal that product-market fit is possible. Why & How?

If you’re a regular reader of this newsletter, you’ve probably read some of our articles on how to determine whether you’ve achieved Product-Market Fit.

If you look at the timeline below (shared by Lenny), you’ll see that companies like Notion, Airtable, and Figma took over three years to hit Product-Market Fit. It takes years to find Product-Market Fit, so what’s the sign that you should keep going

A good first clue is "Promise market fit"…..

I completely agree with Dani Grant (CEO, Jam). However, how to get a clue on “Promise market fit”

Promise market fit occurs when potential users express interest in your product's value proposition, even before the product is fully developed or launched. The key indicator can be -

Landing Page Engagement

Users share your landing page, subscribe to updates, or show interest in signing up

Indicates your value proposition resonates with them

Early Sign-Ups and Payments

Users willingly sign up for waitlists or pay for early access

Suggests genuine belief in your product's promise

User Feedback and Iteration

Early user feedback aligns with your product's promise

Iterating based on feedback refines your offering to better meet market needs

Referral Activity

Users refer others to your product

Organic word-of-mouth signals perceived value

Social Media Buzz

Positive mentions, shares, and discussions on social media

Indicates your product has struck a chord with your target audience

Interest from Influencers or Industry Leaders

Key figures express interest or engage with your product

Validates your offering's promise and attracts a broader audience

While following this indicator, don’t fall into the trap of fake Product-Market Fit. These early indicators will help you stay on course and achieve true Product-Market Fit.

2. 5 Simple Frameworks to Determine If Your Pricing Strategy Is Working.

Startup pricing strategies evolve as companies grow through three main stages -

Pre-PMF companies prioritize rapid adoption and feedback, with founders typically owning simple pricing models that optimize for usage over revenue.

Early PMF firms shift focus to repeatability and revenue, introducing more complex pricing owned by product teams or early GTM hires, often using preset tiers or bundles.

At scale, companies maximize value capture with dedicated pricing teams and deal desks, introducing sophisticated elements like varied commitment structures and multiple pricing models. They're more willing to walk away from suboptimal deals and may eliminate legacy discounts. Square's journey from simple flat pricing to a more nuanced approach as it grew illustrates this evolution, showing how pricing strategy can align with and support a company's overall brand promise and market position.

However at every stage, One of the hardest parts of managing pricing is knowing whether or not your strategy is having its desired effect. The reason for this is simple – for the deals you’ve won, it’s nearly impossible to know how much money you might have left on the table based on the customer’s ultimate willingness to pay, and for deals you’ve lost, it’s possible your product’s functionality, or any number of other complications, might have been the primary culprit. For self-serve pricing, it’s difficult to measure which prospects may have dropped out of the funnel due to pricing vs. which felt they were getting the bargain of the century. The list of complexities goes on.

At the earliest stages, your analysis is going to be less sophisticated and will likely centre around listening to customer feedback. As your company matures, you’ll have enough data points to analyze wins and losses, customer cohorts, revenue by segment, and other relevant trends. Here are a few strategies you can employ to get a sense of whether pricing at your company is working as intended:

Ongoing competitive reviews and customer surveys:

Just like you did when outlining your initial pricing strategy, you should continue to track how you price in comparison to your main competitors, and continue to talk to your customers to understand their perception of the value you deliver relative to the price you charge. Some of this feedback may come through via comments in NPS surveys, one-off discussions with account managers or support staff, or other unstructured channels, but we suggest carving out a pricing-specific check-in cadence with a handful of customers from each segment to ensure nothing is too far off the mark.

Routine price increases:

This is the simplest method. You can test pricing increases with a few customers. One popular question especially VCs, like to ask during customer or prospect calls is whether the buyer of a given piece of software would still use it if the price doubled the following year.

While this is an entirely hypothetical scenario, there is an opportunity to implement periodic price increases to gauge how much untapped willingness to pay exists in your customer base. If you’re able to facilitate these increases on a regular basis with limited churn, you have not yet brushed up against the willingness to pay asymptote for your product.

Variance analysis:

Create a scatter plot of all your current customers and their average sale price (ASP). When you segment your customers by certain characteristics—account size, region, number of employees, etc.—are you able to glean any insights about which price point has yielded the most success with a given set of customers? If the plot is all over the place, the answer will likely be no, which would indicate pricing has been more or less ad hoc on a deal-by-deal basis. If there’s concentration around certain pricing bands, your strategy is, at a minimum, consistent. An almost equally important part of the exercise is to identify outliers (on the low or high side of the spectrum) and decide whether they should be trued up in either direction. While those paying particularly high prices relative to their segment may allow you to capture more value and generate more revenue, you run the risk of them talking to other customers and losing trust in your business.

Price realization:

Create a similar scatter plot to the one mentioned above, but instead of ASPs, express your customers’ pricing in terms of per cent discount to rack rate. What’s your median discount across deals of a certain type? 10%? 40%? 95%? Anything consistently above 50% probably tells you you’re starting too high, especially if discounts of a certain magnitude require explicit sets of approvals (more on this below).Sales efficiency and escalation analysis:

Measure the typical number of touchpoints, redline negotiations, and escalations a deal in a given customer segment requires. As you adjust pricing, are you able to observe any impact on how long and arduous it is for sales reps to close deals? If these figures are much more drawn out than your ideal or expected sales cycle, your pricing is likely too high (and vice versa if deals are closing too fast, if there is such a thing!). As you grow, you will look at burn multiple and sales efficiency metrics, which may also signal if the price is too low or high.

Processes like those outlined above may be owned by any number of stakeholders (again, this number is largely dependent upon the company stage). How often you formally revisit pricing is company-specific; for those later-stage companies with dedicated pricing teams, it’s deliberated daily. For pre-PMF companies in heads-down building mode, it’s likely done on an ad hoc basis.

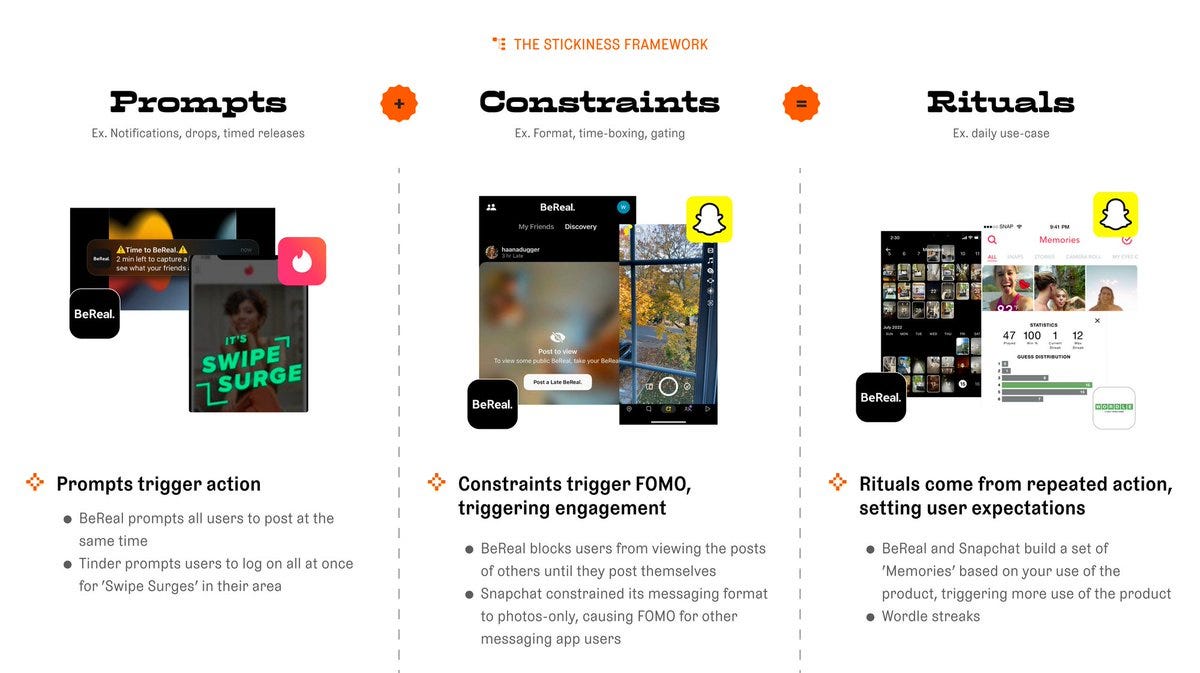

3. Product Stickiness Framework: Triggers, Constraints, and Rituals.

Many founders believe that a great app idea is enough to make it successful. But it’s not. What truly matters is the stickiness of your product.

Start thinking about your product in terms of where triggers, constraints, and user rituals exist within it.

The rise of AI means that more user experiences within the best products will be trigger-based, rather than static. And wide open experiences will be less desirable than opinionated, constrained ones.

I love this framework from Greg Isenberg. It’s the new strategy for thinking about how to keep users engaged with your product.

Trigger action with prompts

Ignite FOMO with constraints

Keep 'em coming back with rituals

Join 32000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

OpenAI is reportedly in talks to raise over $1 billion led by Thrive Capital, pushing its valuation past $100 billion. (Read Here)

Midjourney, the AI image-generating platform with over $200 million in revenue and no VC backing, is expanding into hardware with a new team based in San Francisco. (Read Here)

OpenAI reportedly preparing to launch a new ‘Strawberry’ AI model. (Read Here)

Elon Musk's X is developing a video conferencing tool to compete with Zoom, Google Meet, and Microsoft Teams, with features like instant or scheduled meetings and unique access codes. (Read Here)

Meta to shut augmented reality studio used by third-party creators. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

2025 Venture Capital Summer Analyst - Stepstone Group | USA - Apply Here

Operations Associate - Tokyo - Techstar | Japan - Apply Here

Climate Tech Analyst Intern | Australia - Apply Here

Investment and Operations Associate - Ponderosa Venture | USA - Apply Here

Investment Manager (AI Sector) - Samsung Venture | USA - Apply Here

Senior Associate Earth Foundry | USA (Remote) - Apply Here

VP - Earth foundry | USA (Remote) - Apply Here

Platform Associate entrepreneur roundtable accelerator | USA - Apply Here

Visiting Analyst at Impact VC Koppa venture | UK - Apply Here

Research Associate - Forerunner | USA - Apply Here

Marketing Manager - Matrix Partner India - Apply Here

Associate - Nyca Partner | USA - Apply Here

Investment Associate - Devonshire Investors | USA - Apply Here

Senior Relationship Manager - FrenchFounders | USA - Apply Here

VC Associate/Sr Associate - W Health Venture | India - Apply Here

Financial Accounting Specialist - Forbion | Netherland - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

🧐 Exclusive Resources For Aspiring Venture Capitalists by VC Partners

Breaking into VC through cold outreach? - Advice From a16z VC Professional. Read in our recent break into VC newsletter.

We have launched our all-in-one VC Interview guide (how to answer) for aspiring venture capitalists. For the first 50 aspiring venture capitalists, we are offering a 50% discount. Check out here…

One of the main hacks to stand out from the crowd and break into VC, which you can even start from today, is building your brand. Why does it help you? and How can you do that? Check out our detailed write-up here…

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

Scheduled a call with us to build your pitch deck..

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team