How Should Founders Think About 'Runway'? – Sequoia Capital | VC Jobs

Building Fundraising Data Room & Evaluate Quality of Startups’ User Growth.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Emerging Startups / AI Tools of the Week

Deep Dive: How Should Founders Think About 'Runway'? – Sequoia Capital

Quick Dive:

a16z Partner’s Framework to Evaluate Quality of Startups’ User Growth.

What to Include in a Data Room for Investors? - Don’t make this mistake..

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Y-Combinator Backed its First Defense Startup, Telegram CEO Pavel Arrested In France Airport, Meta just cancelled its Vision Pro competitor & Swiggy looking for a $15 Billion IPO..

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER: BLAZE

Discover high-intent leads and personalize outreach with AI

Is it becoming harder and harder to get positive responses to your outbound email? Blaze turns online signals like social interactions into sales and $$$, helping you find new customers.

Blaze helps you stand out from the crowd and reach the right leads at the right time with:

AI-powered signals like who's evaluating your competitors, investing heavily in AI or recently announced a relevant strategy pivot

Personalized DM sequences on LinkedIn and X leveraging AI to generate more relevant messaging that resonates with your target’s strategic priorities

An AI agent-managed unified inbox, enabling you to scale your lead gen without hiring more sales reps or SDRs

PARTNERSHIP WITH US

Want to get your brand in front of 53,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

EMERGING STARTUPS / AI TOOLS OF THE WEEK

Don’t Miss These..

Meco: An app that organizes newsletters from Gmail and Outlook, offering a dedicated reading experience with features like grouping, filtering, and bookmarking. It helps declutter your inbox and enhances newsletter consumption, available for free on iOS and the web. (Try Meco For Free)

Podwise AI: AI-powered tools offer summarization to grasp podcast essence in minutes, mindmaps to visualize the content structure, and outlines for quick key points. Notable quotes and accurate transcriptions enhance understanding and searchability. (Try Podwise for free)

TODAY’S DEEP DIVE

How Should Founders Think About 'Runway'? – Avoid These Common Mistakes

Founders often view runway as just a number or equation, but VCs expect them to think beyond that. Sequoia Capital shared a framework on how founders should approach the runway. In this write-up, we will discuss...

Runway Reality

What is your runway right now? How should you calculate it?

How should you think about how much runway you need?

How do you extend your runway if you need more?

Let’s deep dive into this….

The basics: What is a runway?

It’s your cash balance divided by your monthly burn.

If you have $10M in cash and $0.5M in burn, you have 20 months of runway

But it gets a little more nuanced than that. The cleanest way to look at your cash balance is net cash, which is the cash you have on your balance sheet minus any debt you’ve drawn.

If you have $10M in cash but you’ve drawn $5M in venture debt, you really have $5M of net cash and you should use that number to think about your runway.

But why? The reason is that debt is borrowed money. It’s not yours. You owe it to a creditor. Similar to how you make personal budget decisions based on your assets minus whatever debt you owe, you should think about your company’s cash position the same way.

The TLDR is that having a line is a helpful lifeline when you’re facing a cash crunch, but drawing it comes at a cost. It makes it harder to raise your next round. It comes with covenants which means debt holders can own more and more of your company. It can be a negative signal, and it can generate a lot of overhangs.

That said, one of our recommendations, if you are tight on cash, is to secure a venture debt line and just not to consider it part of your runway. Ideally, you don’t draw on it unless absolutely necessary, with eyes wide open to the tradeoffs

Monthly burn—this is different from your net income.

Net income is an accounting concept. Burn is cash in minus cash out.

It takes into account things that aren’t in your monthly P&L: for example, if you have to buy inventory upfront, or if you have capex outlays upfront, or for a subscription company if you collect upfront on yearly contracts—all of these things impact your cash burn. It’s critical to have a very tight grip on what your cash burn is. There may be ways to reduce the gap between EBIT and free cash flow—maybe that means paying your suppliers a little later or collecting revenue earlier.

If you have a lumpy business, meaning you have to provide cash upfront to build out capital expenditures or you’re purchasing inventory, it’s existentially important to have a very detailed understanding of your expected cash outlays. If you’re not careful in managing and forecasting these outlier expenses, then your runway can turn out to be 3 months when you thought it was 15.

One more thing: Runway is not static.

Just because you have 8 years of runway doesn’t mean you can forget about it and assume you’re fine. As your revenue and expense base change, your runway can change very quickly. You want to stay focused on the burn number. You should be calculating your runway every single month and watching that number religiously.

A Mental Framework For Founders - Runway and Milestone

If you are reading this newsletter, previously I have mentioned “You are raising fund not to increase your runway, but to achieve your milestone”

As a founder, how should you look at this graph? Suppose you and your CFO put your heads together, and your best guess for how cash changes over time looks something like this chart.

This is your cash-out point. 12 months before that, it’s time to think about raising again.

Runway doesn’t come in a vacuum. It’s intimately tied to meeting valuation milestones.

Imagine you’re driving your car on the freeway and running out of gas. What matters is not how many gallons of gas you have in your car, but whether it’s going to last you until you reach the next gas station. Think about what your goal is for your next fundraising. Maybe it’s an up round. Maybe it’s a flat round. Maybe it’s a down round. Maybe it’s to reach a cash flow positive.

Whatever your goal is, which is a conversation between the leadership team and the board, there is some valuation milestone attached to achieving that goal. Figure out what metrics or “fundamentals” get you to your goal. Maybe it’s ARR. Maybe it’s Gross Profit. This is the green line on this chart.

The rough mental framework is that well before you run out of cash, you need to make sure you have the fundamentals in order to meet your next valuation milestone.

These two lines are intertwined (Previous image). There’s a delicate balance in your scenario analysis between investing in growth and burning cash in order to make sure that you are leaving enough runway to meet the next milestone. It’s important to hope for the best but plan for the worst as you are plotting out how to make the math work.

Raising your next round on pure story is not enough anymore.

That worked when the capital was plenty, but investors are now going to care about your metrics, and more importantly your financials. So it’s important to make sure that you are focused on getting that valuation milestone to the right place.

Now, you’ve done the exercise of figuring out your runway versus your metrics and valuation fundamentals. There are three possible scenarios for your runway situation:

Bucket 1: <12 months of runway, when it is existential to focus on your runway

Bucket 2: 12 months of the runway but not enough to raise a flat round based on rational metrics: Here it’s critically important to focus on the runway.

Bucket 3: Enough runway to raise a flat round, up round or reach cash flow positive: Stay the course and continuously optimize.

Some founders are in Bucket 1. A few are in Bucket 3. But many are in Bucket 2. If we can emphasize one point in this writeup it’s this: many founders may think they’re in Bucket 3 but are actually in Bucket 2.

The financials that you have to reach to cover your next round have changed. The bar has been raised. Many of us are 3-4 years away from reaching our last valuation, with less than that amount of cash. In that case, it’s critically important to focus on managing the runway, even if you have years of runway remaining.

So - how to extend your runway?

If you take us at our word that all probably need more runway than thought, the question is: How do you get it?

Like many things in business, it's very easy to say and it's very hard to do.

The first step in getting very tactical is to understand your current state.

This means looking deeply into your P&L. If you're talking about runway, that means you're losing money every month. So you have to figure out where the net loss comes from. Once you’ve identified the specific places in your P&L causing your burn, you can start thinking about which dollars yield efficient growth and which are not as helpful

To understand which parts of your P&L need to be addressed, begin with the big picture and break it down into parts. Starting with net loss, you can break that into two parts: gross margin and opex.

Then break each of those down into component parts: ○ What are all the drivers of your gross margin? What is the cost of sales, etc? ○ What are all the drivers of compensation opex and non-compensation opex? How much of the opex is dedicated to computer hardware, hosting and subscriptions, etc? ● Keep breaking it down until you have a detailed view of the components that contribute to total net loss.

Once you’ve identified the important contributions to your burn, you can plot them in terms of their burn impact on the y-axis. Then there’s the ease of execution:

how easy is it to address and how big an impact does it have? Unfortunately, you’re not likely to find many items that are high-impact and easy to execute. Changes that extend your runway a lot will almost certainly be difficult. This plot is important because it will set your roadmap for the actions you take to extend your runway

Once you understand the levers available to impact the runway, you can use them to set a goal. Your goal should be oriented around how long it’s going to take for you to reach a rational milestone. Let's say your goal is a flat round. Given the market conditions, for many of us that’s going to take us three years.

To unpack why that is:

Say you hypothetically raised your last round at a billion dollars, and you have five to 10 million of ARR.

if you want to raise your next round at a billion dollars, you might need 75 to 100 million of ARR, which might mean you need to grow about 10 to 15X.

It takes time to do that. It very well might take three or four years

If it takes three years, recommend you have four years of runway. The reason: as mentioned earlier, you want to raise 12 months before running out of money. Generally, investors view it as a bad sign to have a very short runway, so you want to avoid being in this situation when raising a round. So the time you need to hit your goal plus 12 months is the ideal runway that would suggest.

One recommendation: When you decide how long it will take to reach your goal, be very realistic. Use public comps and ask the toughest board member. Ask her what it will take to reach a flat round based on rational milestones, and then add 12 months.

So now you've taken the steps to understand where you are, and you’ve broken down your P&L to understand where the money goes. You've plotted your options in terms of ease-to-execute versus burn impact. And you’ve set a goal based on rational milestones.

So let's say hypothetically you need to cut your burn from $3 million a month to $2 million. We don’t want to sugarcoat this: It's going to be hard. Of course, a people-related cut is the hardest decision any leader makes. Beyond this, you may face many challenging and nuanced decisions:

If you're a global company, you might need to reevaluate certain markets.

If you're a company that's relied on a marketing or sales investment in order to grow, you might have to reevaluate your strategy.

You might have to increase pricing. This is scary, especially if you don’t have time to fully test the value proposition.

The big thing to remember is this: If you take the steps necessary to extend your runway in line with rational milestones, confident you and your whole company will be better on the other side.

So Overall :

You likely need more runway than you think.

Ultimately, your next round will be based on your metrics, which is going to be reflected in your financials.

Be real about what bucket you're in. Think most companies are in Bucket 2, which is more than 12 months of cash, but need to make some changes.

You have what you need to win. You can execute and we're here to help you do that

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. a16z Partner’s Framework to Evaluate Quality of Startups’ User Growth

Oftentimes you’ll find a new startup that presents their growth curve, which might look something like this – up and to the right! This is great. Time to invest, right?

The problem is, you don’t know where it’s going to go.

In the long run, this curve might go in a direction you may not want it to go – perhaps it’ll plateau. Perhaps it’ll even collapse. Or you may find that it’s going to continue going up and even hockey-sticking.

How do you predict the future? Is it working and will it sustain? Will it even accelerate?

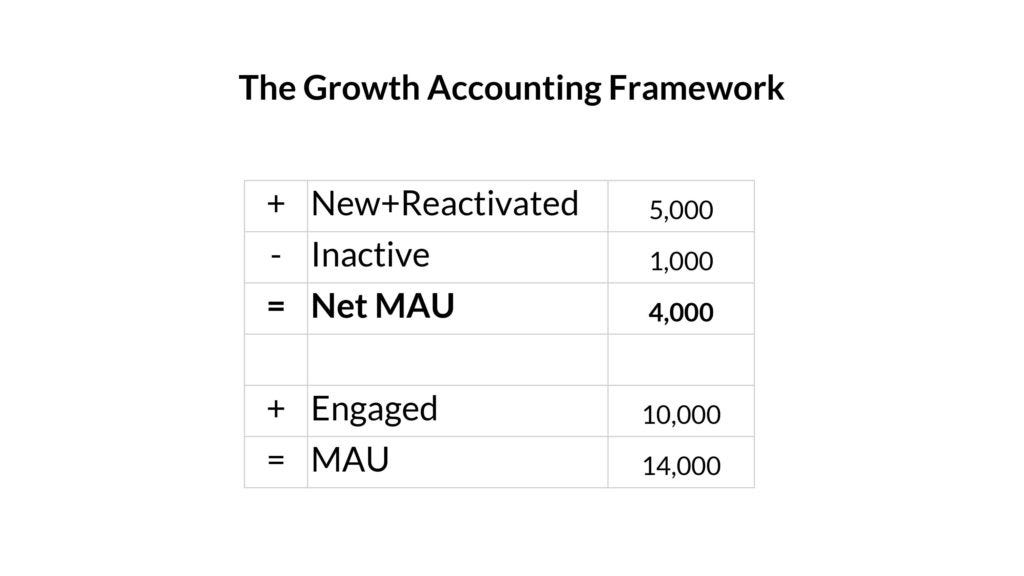

Andrew Chen shared a framework to tackle this called - the Growth Accounting Framework.

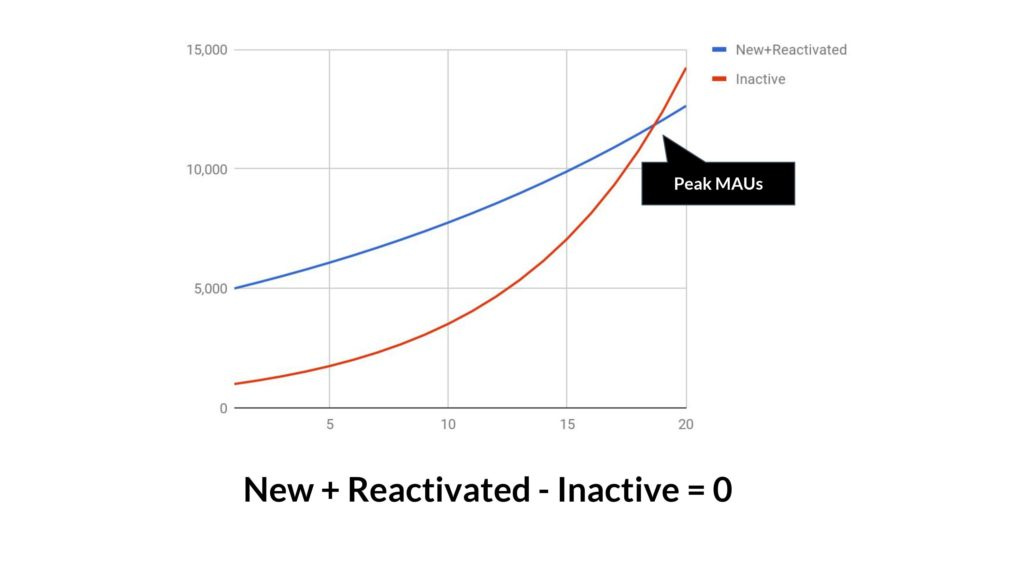

The Growth Accounting Framework looks something like this – within each time period (say a week, or a month) – you’ll add some users, reactivate some folks who had previously churned, and some go inactive. You add this up and it’s the “Net MAU” for a product – the difference between each time period.

If your positive terms (New+Reactivated) are smaller than your negative terms (the number who become Inactive) then you stop growing, and the whole thing goes negative. Let’s look at each term:

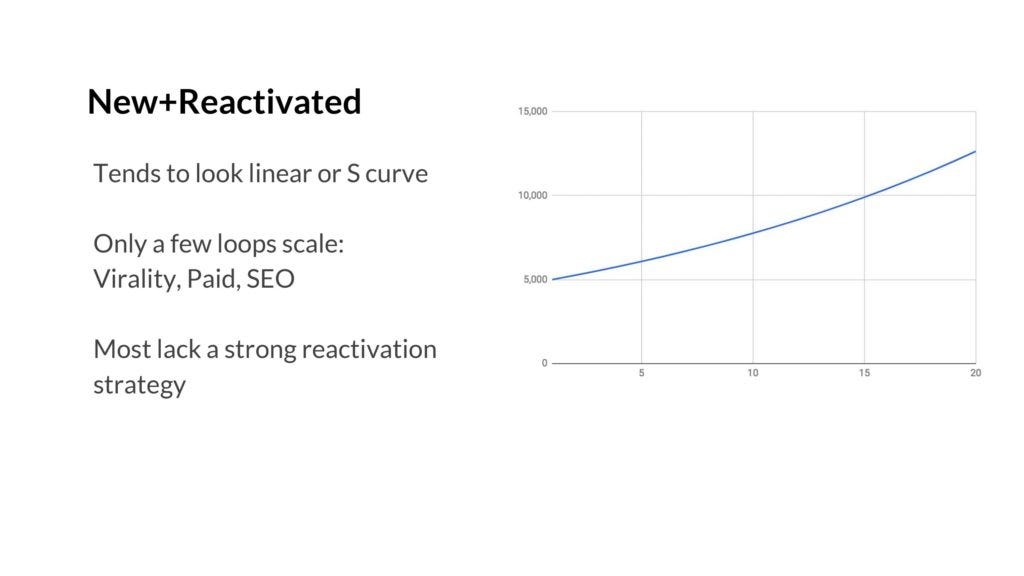

New user acquisition typically follows a linear or S-curve pattern.

It's challenging to scale indefinitely because most acquisition channels have natural limits. Paid ads become more expensive, viral loops saturate your market, and even the most effective strategies plateau eventually. Reactivation of old users can help, but it's usually a smaller factor than new user acquisition.

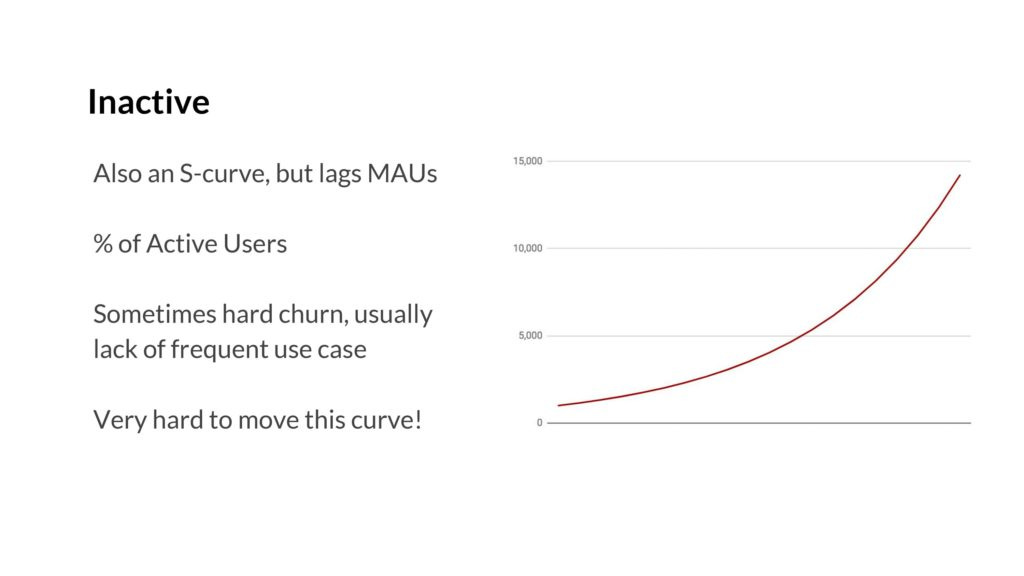

The curve for users becoming inactive is interesting.

It also follows an S-curve, but it lags behind the acquisition. This makes sense - you can't lose users you don't have. As your user base grows, so does the potential for churn.

The tipping point comes when the number of new and reactivated users equals the number going inactive.

This is when you hit peak MAUs, and it's a critical moment to watch for. From this point, growth either flattens or declines.

While we've used MAUs as an example, this framework applies to various metrics like active subscribers or recent purchasers. The underlying principles remain the same.

If you’re following all of this, it’s already a pretty profound insight. We’ve moved from looking at a single curve that might have been growing and decomposed it into its underlying terms, and shown how a curve that’s been going up and to the right for a while might go flat the next month. And why. That’s important.

I highly recommend checking this long article by Andrew Chen.

2. What to Include in a Data Room for Investors? - Don’t make this mistake.

As a first-time founder, you might find yourself in a similar situation - excited about a positive response from a potential investor, but suddenly faced with an unfamiliar term: "data room."

A data room is essentially a secure, organized collection of documents that provide detailed information about your company. It's a tool for due diligence, allowing potential investors to dive deep into your business's financials, operations, and potential.

In early-stage venture deals, data rooms play a crucial role at two distinct stages of the investment process.

Stage 1: Pre-Term Sheet

At this point, investors typically have limited information about the company, relying mainly on the pitch deck, website, and publicly available data. They request access to a preliminary data room to perform a quick spot check and gather material for internal discussions with their partners.

This Stage 1 data room helps investors validate their initial interest and prepare for more in-depth conversations about the potential investment.

Here’s a list of the 5 sections and types of content you’ll want to include in your stage 1 data room:

Business Summary / Company Overview

Purpose: provide an overview of the problem you are solving, your solution, and competitors - make it easy for the investor to create a deal memo

Docs to include:

1-page business overview

Links to your company website and social platforms

A PDF copy of your current pitch deck

Traction / Product Market Fit

Purpose: provide data that proves you’re solving a real problem - better yet with a solution to a problem that a lot of people have and are willing to pay meaningful dollars for

Docs to include:

Market sizing - bottom-up or top-down TAM backed by relevant up-to-date data from reputable sources

Customer / User data - how many customers or users do you currently have, how engaged are they

Competitive positioning / Unique Selling Proposition (USP)

Customer acquisition data - CAC, CAC payback

Financials

Purpose: provide a financial overview of your business from the day you started to the present day with forward-facing projections. If you don’t have a financial model built, I highly recommend you check out Sturppy. Sturppy’s is used by 4,000+ startups and allows founders to build an investor-ready financial model without being an expert on finance or financial modelling.

Docs to include:

P&L / Income Statement, Balance Sheet, Cashflow Statement, Financial Projections 1-3 years in the future

Team & Roles

Purpose: provide an overview of your team, their experience, and the roles they play in your business

Docs to include:

Brief profiles on each team member, their role, their prior work experience, their time with the company, and links to their social channels (LinkedIn)

Cap Table

Purpose: provide an overview of who owns equity in the business today.

Docs to include:

Cap table summary

Stage 2: Post-Term Sheet

After receiving and negotiating a term sheet, you enter Stage 2 of the data room process. This stage is crucial for streamlining due diligence before any final agreements are signed. It's wise to create a separate, more detailed data room for this phase, rather than just expanding your Stage 1 room. This approach gives you better control and flexibility, especially when dealing with multiple investors at different stages.

Here’s a list of additional sections and content you’ll want to include:

Entity Formation Documents

Purpose: These documents are mostly needed by the legal team and are the set of documents used to certify your business’s good standings. These docs are going to fluctuate based on where your business is incorporated and the type of business entity you’ve chosen. If you’re a startup in the US, 9/10 if you’re raising venture, you’re going to be established as a Delaware C-Corp

Docs to include:

Shareholder certificate documents

Local/state/federal business licenses/letters of good standing

Articles of incorporation

Bylaws, Tax ID number, Operating agreement between founders, Shareholder meeting minutes/board minutes, Annual meeting notes/minutes

Customer & Partner Contracts

Purpose: Material agreements will vary from company to company based on the nature of the business but the general gist is to include anything that could significantly impact the business

Docs to include:

Standard terms of service or use between your business and customers

Any agreements or understandings between your company and others with obligations exceeding $25K

Property leases (real estate and personal)

Licenses of any company IP to 3rd parties

Proof of Intellectual Property

Purpose: If your company has IP and that was part of the pitch, you’re going to have to show proof of that IP. This includes patents, trademarks, copyright, design

Docs to include:

Evidence that you have the right to the IP that you’re developing

Patent information (proof of filing / issuing)

Trademark registrations

Copyrights

Full cap table documents

Purpose: If you’ve followed this guide, you’ve already shared a summary of your cap table. At stage 2 you’ll likely need to divulge additional details such as:

Docs to include:

Details of previous fundraising rounds or liquidity events

Shareholder certificates

Vesting schedules

ESOP details

Tax Filings

Purpose: Proof that your company is in good standing with the IRS

Docs to include: Tax History, Previous filings, Previous audit statements and any third-party financial evaluations

Information on Any Outstanding Litigation

Purpose: This one is key…failure to divulge pending or outstanding litigation can and will likely result in a very bad outcome for you and your business. Be honest here, have a hard conversation with the investor at this stage in the process.

That’s it.

Join 32000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Pavel Durov, the founder of Telegram, was arrested at Le Bourget airport in Paris, reportedly due to an investigation into the platform's moderation practices. (More Here)

Y Combinator backs Ares Industries, its first defence startup, aiming to create low-cost cruise missiles. (More Here)

Meta cancels La Jolla, its high-end mixed reality headset project intended to rival Apple's Vision Pro. (More Here)

Swiggy, backed by SoftBank, is preparing for an IPO targeting a $15 billion valuation to raise $1-1.2 billion, potentially making it one of India's largest IPOs this year. (More Here)

Andrew Ng is stepping down as CEO of Landing AI to launch his own AI Fund of $120 Million. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

A hack to use when asking people to intro you to investors

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Partner 22, Content Marketing, Investor Relations - a16z | USA - Apply Here

Venture Partner - Web3 & Blockchain - Taisu Venture | USA- Apply Here

Investment Associates - Beyond Venture Partner | India - Apply Here

Corporate Partnership Manager - Plug and play tech centre | Netherlands - Apply Here

Ventures Analyst | Energy - Plug and Play tech centre | Brazil - Apply Here

Investment Associate - Koch Disruptive Tech | USA - Apply Here

VP of Finance - Advaita Capital | USA - Apply Here

VC Analyst - E15 VC | Hongkong - Apply Here

Venture Capital Investor - Pascal Capital | USA - Apply Here

High School Internship (Venture Analyst) - 1435 Capital Management | USA - Apply Here

Venture Capital Finance Manager - Xora Innovation | USA - Apply Here

Investment Manager - Rakuten Capital | Japan - Apply Here

Principal - Woven Capital | Japan - Apply Here

Managing Director - In-Q-Tel | Australia - Apply Here

🧐 Exclusive Resources For Aspiring Venture Capitalists by VC Partners

How do you source interesting startups for a VC interview? - Read our detailed writeup that can help you to find the startup for a VC Interview.

We have launched our all-in-one VC Interview guide (how to answer) for aspiring venture capitalists. For the first 50 aspiring venture capitalists, we are offering a 50% discount. Check out here…

A framework for thinking about the role of a venture capitalist has five distinct functions:

Find: Finding the best companies to invest in

Decide: Deciding which companies to invest in, given the firm’s investment strategy

Win: Winning deals by being a preferred choice for founders

Help: Helping companies succeed by supporting them post-investment

Exit: Navigating towards a great exit, maximizing return on investment

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

Thanks, Blaze for sponsoring today’s newsletter.

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team