All-In-One Fundraising Resources For Founders. | VC Jobs

Timeline to reach Unicorn Status, Avoid Startup Dealth Spiral & How much you can raise?

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: All-In-One Fundraising Resources For Founders.

Quick Dive:

How Soon Do VC-Backed Startups Reach Unicorn Status?

Mercury Founder Immad Akhund's Framework: How to Avoid a Startup Death Spiral.

Antler’s Cheatsheet: How much can founders realistically raise in their first round?

Major News: Jeff Bezos backs AI chipmaker at over $2.6 Billion Valuation, Intel CEO is out, Tesla gives Optimus robot a new hand, Google hit with another major anti-competition lawsuit & More.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

THE MOST EMERGING STARTUP YOU CAN'T-MISS

Peony: The Smart Way to Share Files

Ever sent a file and thought, "I hope they look at this"? (Yeah, we’ve all been there!) Enter Peony, the startup that’s redefining how we share files. Imagine personalising your attachments with AI and tracking exactly how your audience engages with them. No more guessing games!

Peony is built for founders, VCs, and sales teams who want to make every interaction count. It’s not just about sending files; it’s about creating connections that lead to faster deals.

Partnership With Us: Want to get your brand in front of 66,600+ readers like founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Does your startup logo matter? (Link)

Everything that happened in AI Agents last week. (Link)

Simple way to write a Product Requirements Document (PRD) for your startup. (Link)

The New World for Entrepreneurs By Rick Zullo. (Link)

How I promote my startup if I had 0$ for marketing? (Link)

TODAY’S DEEP DIVE

All-In-One Fundraising Resources For Founders.

In today's deep dive, we will share the top curated resources that will answer all your doubts and upgrade your fundraising journey as a founder.

Initial Decision Making:

Is venture capital the right funding path for your startup? [Read]

What are the alternatives to VC funding you should consider first? [Read]

Are you ready to give up equity and partial control? [Read]

Preparation Phase:

Do you have a compelling story and clear vision? [Read]

What key metrics and milestones should you achieve before approaching VCs? [Read]

Is your financial model and projection ready? [Read] [Template Download]

How much money should you raise? [Read]

Research & Planning:

Which VCs are the best fit for your startup's stage and sector? [Read]

Download the Verified Investors contact database [Read]

What's your ideal target list of investors? [Read]

How do you get warm introductions to these VCs? [Read]

Pitch Development:

What should your pitch deck include? [Read]

How do you craft a compelling narrative? [Read]

What are the key questions VCs will ask? [Read]

If you want to build a pitch deck that attracts investors’ attention. [Scheduled a call with us]

Fundraising Process:

How do you manage investor pipeline and conversations? [Read]

What's the ideal timeline for your fundraising round? [Read]

Find the contact database of 10,000+ US, UK, India, Africa, Europe, France, Australia, and more investors. [Access Here]

How Do VCs Decide to Take a First Meeting? [Read]

How do you create FOMO among investors? [Read]

What Founders Should Ask VCs In Fundraising Meetings? [Read]

Deal Terms:

What key terms should you understand in a term sheet? [Read]

How do you negotiate valuation? [Read]

How do you negotiate valuation? [Read]

Closing the Round:

What's the due diligence process like? [Read]

How do you handle legal documentation? [Read]

What's the typical closing process and timeline? [Read]

Post-Fundraising:

How do you announce your funding? [Read]

What should be your first steps after closing? [Read]

How do you maintain good investor relations? [Read]

I encourage founders to spend enough time reading all these articles. These will help you find the right amount to raise, with negotiations and closing successful funding rounds.

PARTNERSHIP WITH US

We Write, Design & Model Your Pitch Deck.

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

Schedule a call with us today →

QUICK DIVES

1. How Soon Do VC-Backed Startups Reach Unicorn Status?

Ilya Strebulaev (Professor at Stanford Business school) has shared some interesting facts about unicorn startups that you might want to hear:

Most startups become unicorns between years 2-7 after their first funding round. There's a surprising number achieving it quickly: 78 companies in under a year and another 84 in their first full year.

The complete journey to unicorn status, based on new research analyzing 1,955 US companies:

• "Instant unicorns": 78 companies hit $1B in under a year (including ClickHouse)

• Year 1: 84 more companies join the club (Vise)

• Year 2: 119 companies (WeWork)

• Year 3: 123 companies (Neuralink)

• Year 4: 115 companies (Confluent)

• Year 5: 132 companies peak (Databricks)

• Year 6: 105 companies (Notion)

• Year 7: 97 companies (MasterClass)

• Year 8: 67 companies (SparkCognition)

• 9+ years: 34 companies (Strava)

Building a billion-dollar company takes time – but perhaps not as much time as you might think. The data suggests that if you're going to reach unicorn status, it typically happens within the first 7 years after institutional backing.

(Data covers 1,955 US-based VC-backed companies that became unicorns between 01/1997 and 07/2024)

2. Mercury Founder Immad Akhund's Framework: How to Avoid a Startup Death Spiral

In recent years, many companies have faced challenges such as failing to secure investor funding, leading to bankruptcy, layoffs, and other difficulties. To help prevent these situations, Mercury's founder has shared a framework offering unique insights on how to approach such challenges. He explains:

Founders often, fall into this startup death spiral:

Save Money

Leading to Reduced Growth

Leading to Inability to Raise More Money

Back to Step

For most startups, you can save money by reducing spend on advertising or your sales team. When trying to save money this can be an obvious place to cut. This is made worse by the fact that you have to increase your ad spend + sales team to keep growth rates at the same level.

The problem is that when you reduce growth it makes your ability to rise much lower.

For seed-stage companies, you need at least 100% growth and probably more like 200% growth to raise a new round. For later-stage companies, you can get away with less than that but still >50%.

When these companies can't raise new money they go back to trying to save money and hurt their growth further. This can end up being a death spiral that is impossible to escape.

3 points to consider before entering this spiral:

Can you be profitable without raising future money? Reducing growth might be fine in this case

Can you grow in ways that don't require more spending?

Potentially avoid the cuts grow faster and go for broke!

If you are already in this death spiral then you need some sort of hard reset to get out of it. Either a pivot or finding a strong organic (non-paid) growth channel is the solution. No easy answers for this set of companies, unfortunately.

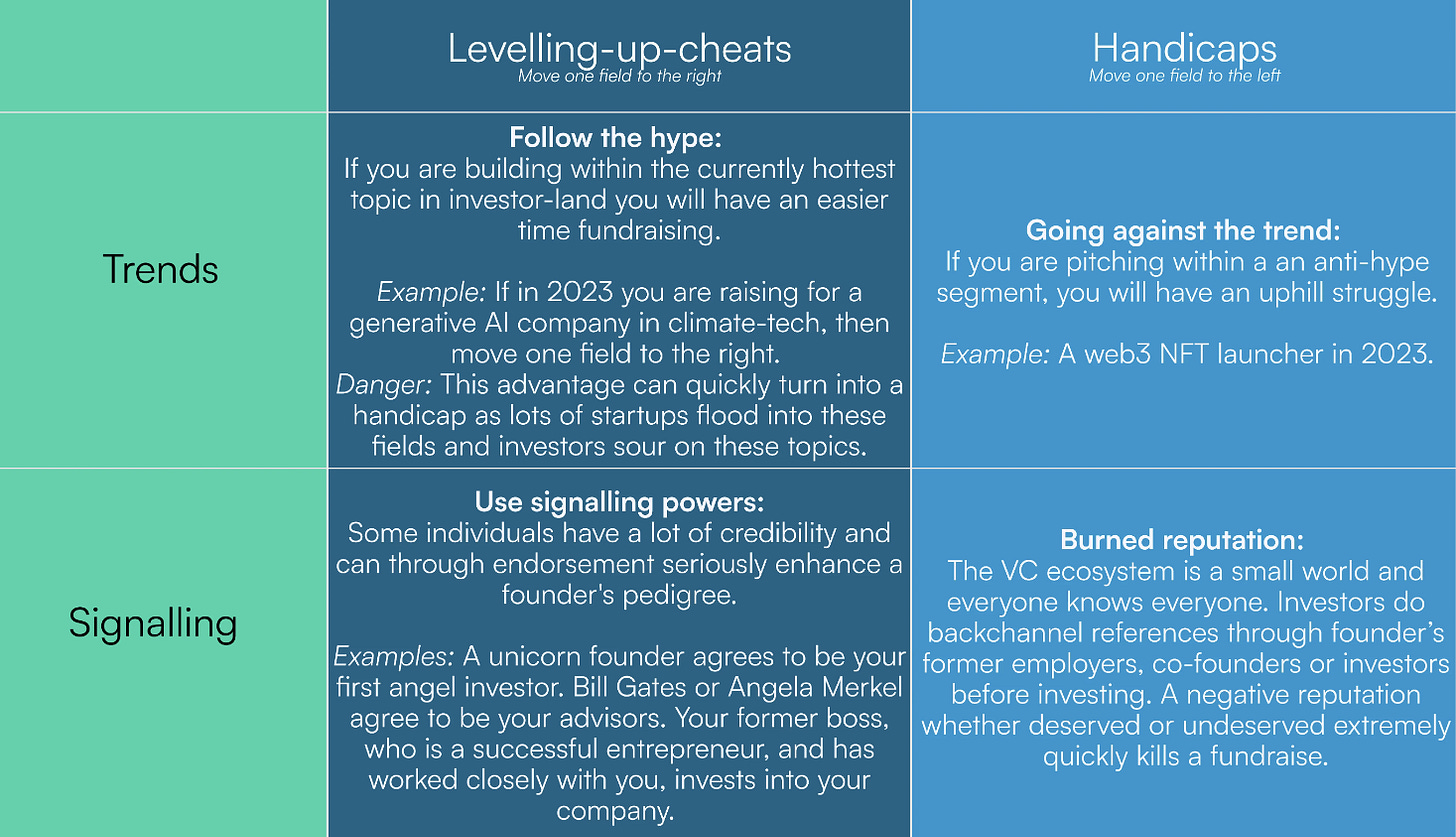

3. Antler’s Cheatsheet: How much can founders realistically raise in their first round?

Antler has shared a cheat sheet to help founders assess their ability to raise capital in the initial funding round -

When it comes to fundraising, two factors can make all the difference: founder pedigree and traction.

Founder Pedigree: The less traction you have, the more your background matters. Investors look at your past to assess whether you can deliver in the future. It's about limiting execution risk.

This isn't necessarily rational. Great founders get overlooked because they don't fit the typical pattern. But with thousands of similar opportunities, it's a real filter for investors.

Traction: Traction beats pedigree. When you present more than just an idea on paper and your product has gained some traction, your ability to raise increases. Lower-profile founders can raise funds when their idea becomes more than just an idea.

Some factors can change the game -

"Levelling up cheats" moves you to one field to the right in the fundraising matrix, potentially increasing your chances. These might include factors like having a strong co-founder, industry expertise, or unique insights.

"Handicaps" move you to one field left, possibly making fundraising more challenging. These could be factors like a lack of relevant experience or a difficult-to-explain product.

There are two must-haves without which you won't be able to raise, regardless of pedigree or traction:

Fundraising-ability: You need reasonable fundraising skills. Networking, sales skills, storytelling, and running a tight process are crucial.

Market attractiveness: Your market must be significant and attractive. In the early stages, it's binary - either investors get excited about the opportunity, or they don't.

Remember

Valuations are a function of capital raised. Assume 15-25% dilution irrespective of the amount raised. For example, if a team raises 800k, the valuation will likely be between 3.2m - 5.3m.

LinkedIn profile beats pitch deck in very early stages. Many investors will check your LinkedIn before deciding on a first meeting or looking at your pitch deck.

When is this wrong?

Numbers are purely directional. They've been validated with experienced investors, but they're not exact.

This model is primarily for software startups. Biotech & Hardware companies play by different rules.

Copycat models are very binary. Experienced teams can attract large funding, while others struggle to raise anything.

Raising from a rich uncle or family/friends who aren't experienced venture investors follows different rules.

Remember, great founders come from all backgrounds. If you don't fit the "classic" profile, you might need to prove more in the beginning, but there are countless examples of founders without traditional backgrounds building awesome companies.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Elon Musk has filed for an injunction against OpenAI, its co-founders, and Microsoft, alleging anticompetitive behaviour and seeking to halt the company's transition to a for-profit model. (Read Here)

The Tesla Optimus robot can now catch high-speed tennis balls, demonstrated through a video showcasing the robot's hand upgrades for precise and rapid catching abilities. (Read Here)

Canadian media companies including Toronto Star, CBC, and Globe and Mail have sued OpenAI for copyright infringement over using their content to train ChatGPT without permission or payment. (Read Here)

Canada's Competition Bureau has filed a lawsuit against Google, accusing it of anti-competitive practices in the country's digital advertising technology services. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 30,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Senior Investment Manager - ZEISS Ventures | Germany - Apply Here

Venture Partner - Web3 - Taise Ventur | USA - Apply Here

Community, Communications, and Project Manager - 10X FOUNDERS | Germany - Apply Here

Investment Associate - Favcy Venture Builder | India - Apply Here

Investor Relations Analyst -B Capital Group - Apply Here

Ventures Analyst - Plug and play tech centre | Germany - Apply Here

Investor Relations Associate - forum venture | USA - Apply Here

Senior Investment Associate - forum venture | USA - Apply Here

Analyst, Office of the CEO - energy impact partner | USA - Apply Here

Startup Investor - primordial Venture | USA - Apply Here

Investment Associate, Material Science & Sustainable Infrastructure - Playground Global | USA - Apply Here

Investment Analyst - Velocity Venture | Singapore - Apply Here

Media & Content Marketing Manager - slow venture | USA - Apply Here

Investment Associate - slow venture | USA - Apply Here

Portfolio Analyst Intern - plug and play tech centre | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)