Signs Your Perfect Pitch Meeting Was Actually a Failure. | VC & Startup Jobs

Investors contact database - Fundraising resources & MVP is over, think about MVE.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: Signs Your Perfect Pitch Meeting Was Actually a Failure.

Quick Dive:

All-In-One Fundraising Resources For Founders Includes Investors Database.

MVP is Over. You Need to Think About MVE.

Coinbase’s Decision-Making Framework.

Major News: OpenAI rolls out assistant-like feature 'Tasks' to take on Alexa, SEC sues Elon Musk, China’s robot dog breaks world record, Blue Origin successfully launches its SpaceX rival.

20+ VC & Startups job opportunities.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

How Perplexity convinced top VCs to back their answer engine?

The pitch deck format that every founder should follow to get on a call with investors.

Andrew Ng on how writing software becoming cheap.

Paul Graham’s rule of thumb for when to launch your product.

Personal finance things to know as a founder.

Ready to go financial modelling template to build your own startup financial model that every investors want to see.

Should founders use memos instead of pitch decks for fundraising?

6000+ European VC Firms Contact Database (LinkedIn Links).

Paul Graham's advice on how to convince investors.

The Broken Venture Capital System A critical look at the inefficiencies plaguing the VC model and potential solutions for a more equitable future.

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link)

A MESSAGE FROM SUPERHUMAN

🤝 Start the Year Ahead With Superhuman

The inbox is where your next big idea takes shape, where partnerships are born, and where your vision grows. But it can also be where your day gets lost. Superhuman helps founders and executives turn the inbox into a place of progress, not frustration.

Designed for speed and clarity, Superhuman gives you back your focus. You’ll spend less time buried in admin and more time building, strategizing, and leading.

Start the year inspired. Try Superhuman free for one month and see how much further your email can take you.

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

TODAY’S DEEP DIVE

Signs Your Perfect Pitch Meeting Was Actually a Failure…

The other day, a founder friend reached out to me, super excited after their VC meeting. "It went amazing!" they said. When I asked why they thought so, they mentioned the investor's positive energy and how they seemed to get the vision. I had to break it to them gently - those weren't good signs.

Here's the reality about fundraising that most founders miss: VCs often communicate their disinterest in really subtle ways. After years in this space, I've noticed some clear patterns that might seem counterintuitive at first. Let me break down all the signs I've seen:

The "Too Nice" Investor: If they're just nodding along without challenging your assumptions or asking tough questions, that's usually not a good sign. Think about it - if someone was seriously considering giving you money, wouldn't they want to poke holes in your idea? Startups are risky, and interested investors want to make sure your thinking holds up under pressure.

The "No Feedback" Meeting: When investors don't offer any constructive criticism, that's often a red flag. The interested ones usually can't help themselves - they'll share ideas about how to make your pitch stronger or suggest product improvements. It's because they're already mentally invested in your success.

The "No Network" Response: Here's something telling - interested investors typically want to derisk their potential investment by getting more data points. They'll connect you with potential customers or other investors in their network. It's not just generosity - they're actually building a case for investing in you.

The "No Sell" Meeting: Remember, capital is everywhere these days. When VCs really want in, they'll spend time selling you on their firm. They'll talk about their network, brag about successful founders they've backed, mention perks like office space, and really emphasize how they could specifically help your company grow. If you're not hearing any of this, they probably don't think they need to compete for your deal.

The "No Homework" Sign: Something subtle that many miss - if an investor isn't doing blind reference checks or reaching out to people who know you, they're probably not serious. When they're interested, they'll do their homework, often talking to people you haven't even listed as references.

The "Valuation Obsession": Here's a counterintuitive one - if an investor is getting really hung up on your valuation, it might be their way of finding a polite exit. Sure, funds have ownership targets, but when they're truly excited about a deal, they'll work to make the numbers work.

The "Junior Partner Loop": If you can't seem to get past junior team members to the real decision-makers, it's often because either your deal hasn't been sold well internally, or there's already a 'no' that no one wants to communicate directly.

The "Vague Next Steps": Each VC firm has their standard process. If you're not hearing clear next steps after a meeting, or getting vague answers when you ask, they probably don't plan on moving forward.

The "Slow Response" Pattern: Hot deals move fast, and investors know this. If you're waiting days for email responses or getting ghosted, they're probably not that interested. Excited investors don't risk missing out by being slow.

The "Data Fishing" Experience: Watch out for investors who keep asking for more data or market opinions without sharing anything about their investment process. Sometimes they're just gathering intel for other deals they're more serious about. If you are regular reader of this newsletter, I have multiple times told to not share all data at once.

The "Unprepared Meeting": If an investor hasn't even read your deck before the call, it's usually a sign they're not that excited about the opportunity. Interested investors come prepared to make the most of their time with you.

Remember though - these are patterns, not absolute rules. The startup world is full of exceptions. But knowing these signals can help you spend your time more wisely during fundraising and manage your emotional energy better.

P.S. One interesting thing I've learned is that many founders lack this insight simply because they've never sat on the other side of the table. It's not about being naive - it's just that the VC world has its own unspoken language that takes time to learn.

STARTUP-TOOL - YOU CAN’T MISS

MVPMatter—Expert MVP Development Services for Startups

Founded in 2023, MVPMatter began as a passion project by two software engineers with the aim to help startups succeed with impactful, cost-effective MVP solutions.

MVPMatter specializes in creating high-quality MVPs (Minimum Viable Products) tailored to help startups launch quickly and effectively. With expert developers and designers, we turn ideas into market-ready products in just 2-4 weeks.

Key Features:

Fast Delivery: MVPs completed within 2-4 weeks.

User Registration & Authentication: Secure sign-up and login.

Core Functionalities: Focused on solving user problems.

Intuitive UI: Clean, responsive design for a seamless experience.

Admin Dashboard: Compatible with headless CMS.

Payment Integration: Simplified monetization options.

Analytics & Tracking: Insights for data-driven decisions.

Built with Top Tools:

React.js for efficient development.

TypeScript for maintainable code.

Tailwind CSS for modern, responsive designs.

→ Ready to launch? Starting at $3,400, build your successful MVP today. Book a free discovery call to discuss your MVP strategy.

QUICK DIVES

1. All-In-One Fundraising Resources For Founders.

Sharing some of the top curated resources that will help you in startup fundraising journey.

Initial Decision Making:

Is venture capital the right funding path for your startup? [Read]

What are the alternatives to VC funding you should consider first? [Read]

Are you ready to give up equity and partial control? [Read]

Preparation Phase:

Do you have a compelling story and clear vision? [Read]

What key metrics and milestones should you achieve before approaching VCs? [Read]

Is your financial model and projection ready? [Read] [Template Download]

How much money should you raise? [Read]

Research & Planning:

Which VCs are the best fit for your startup's stage and sector? [Read]

Download the Verified Investors contact database - US, India, UK, European, France, Africa & Australia. [Read]

What's your ideal target list of investors? [Read]

How do you get warm introductions to these VCs? [Read]

Pitch Development:

What should your pitch deck include? [Read]

How do you craft a compelling narrative? [Read]

What are the key questions VCs will ask? [Read]

If you want to build a pitch deck that attracts investors’ attention. [Scheduled a call with us]

Fundraising Process:

How do you manage investor pipeline and conversations? [Read]

What's the ideal timeline for your fundraising round? [Read]

Find the contact database of 10,000+ US, UK, India, Africa, Europe, France, Australia, and more investors. [Access Here]

How Do VCs Decide to Take a First Meeting? [Read]

How do you create FOMO among investors? [Read]

What Founders Should Ask VCs In Fundraising Meetings? [Read]

Deal Terms:

What key terms should you understand in a term sheet? [Read]

How do you negotiate valuation? [Read]

How do you negotiate valuation? [Read]

Closing the Round:

What's the due diligence process like? [Read]

How do you handle legal documentation? [Read]

What's the typical closing process and timeline? [Read]

Post-Fundraising:

How do you announce your funding? [Read]

What should be your first steps after closing? [Read]

How do you maintain good investor relations? [Read]

I encourage founders to spend enough time reading all these articles. These will help you find the right amount to raise, with negotiations and closing successful funding rounds.

2. MVP is Over. You Need to Think About MVE.

(Hint: V isn’t for viable — it’s for valuable)

Most startups fail because first-time founders either under-invest and create something untested based on gut instinct, or over-invest without validating if it provides value.

The crucial question is not "how can I solve this problem?" but "how can I create a valuable experience that people desperately need and will pay for?"

The example of Thomas Edison's light bulb invention highlights this - existing bulbs were viable but not valuable as they didn't last long. Edison focused on creating a Minimum Valuable Experience (MVE) by making affordable, durable bulbs that provided the illumination people craved.

To identify an MVE, use the A.C.T. framework:

Audience - Deeply understand your ideal customer segment, their behaviours, goals, and what they seek.

Communication - Craft messaging using language and formats that resonate with your audience.

Touchpoints - Design triggers and channels to move your audience to action effectively.

The startup Webflow exemplifies mastering A.C.T. The founders envisioned empowering designers through no-code web design. They intimately knew this audience, positioned Webflow's unique value and gained explosive traction via platforms like Hacker News. Though facing numerous setbacks, their clarity of vision and customer focus ultimately led to billions in valuation.

Startups must relentlessly pursue creating meaningful experiences, not just viable products. Continuously adapt based on audience feedback. Success stems from this laser focus on delivering an MVE that genuinely improves customers' lives in ways they'll pay for. Must recommend reading this article by Pete Sena.

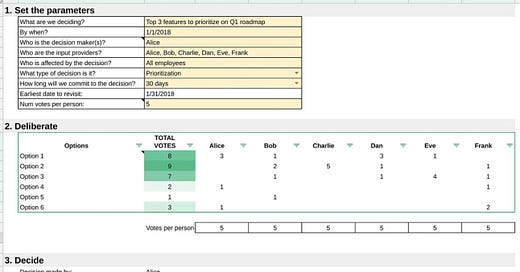

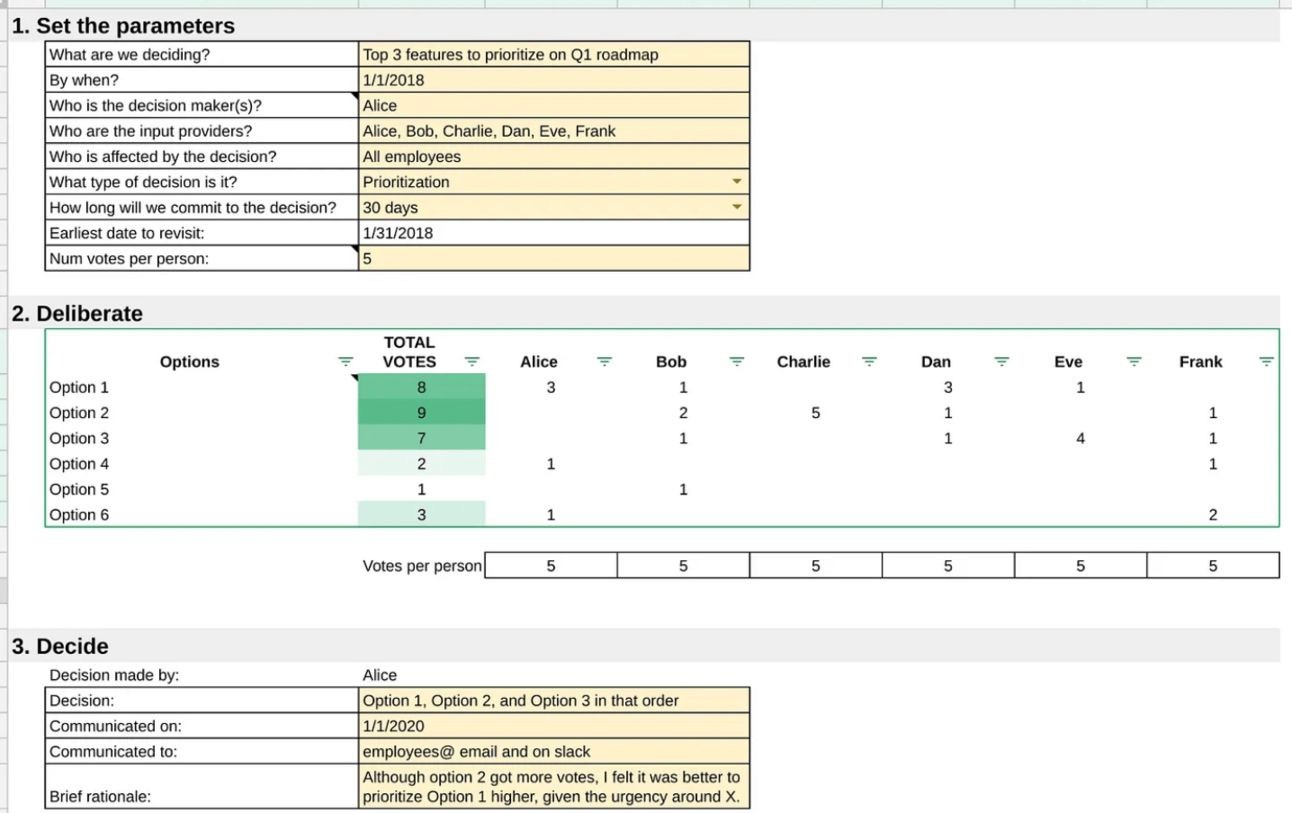

3. Coinbase’s Decision Making Framework.

Low-risk decisions should be made pretty quickly. For high-risk decisions, a decision-making framework can be helpful.

I’ve seen a lot of decision-making frameworks. But I like this one from Brian Armstrong, the founder of Coinbase because it works both for quick 15-minute live meetings and over multi-week strategic decisions.

This framework can be used to decide:

Whether to hire a candidate

What to prioritize next in a product roadmap

Whether to buy or sell a company

A new name for a product or team

And more…

Here’s the template to implement this framework and here’s how to use it.

You might think this template looks overly simplistic, but what I like about it is that it’s just meant to record the context around the decision and provide a clear voting framework.

It forces the actual decision-making process to happen through live conversation. And no matter what you’ll end up with a clear, numerical score for the option that you collectively favour.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Insight Partners, a New York-based VC firm, raised $12.5B across its Fund XIII, a second Opportunity fund, and a dedicated buyout co-invest fund. (Link)

Nvidia introduced three NIM microservices under NeMo Guardrails to enhance AI agent safety—targeting content safety, conversation focus, and jailbreak prevention. (Link)

China’s robot dogChina’s robot dog, The Black Panther 2.0 robot, weighing 83 pounds and standing 2.07 feet tall, set a new world record by running 100 meters in under 10 seconds. (Link)

OpenAI has introduced a new feature called Tasks, making ChatGPT function more like traditional digital assistants by allowing it to handle reminders and scheduled prompts. (Link)

François Chollet, creator of Keras, and Zapier co-founder Mike Knoop have launched Ndea, a startup focused on building AGI. (Link)

The SEC has filed a lawsuit against Elon Musk, accusing him of not disclosing his ownership of over 5% of Twitter stock in early 2022, which allowed him to buy shares at lower prices. (Link)

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

Venture Capital & Startup Jobs

AI Engineer - Audience AI | Remote - Apply Here

Operations Associate - Techstars | USA - Apply Here

VC Internship - Fuel Ventures | UK - Apply Here

AI Engineer - Tabs | Remote - Apply Here

Sr Investment Analyst - Maximal Capital | India - Apply Here

Ventures Associate - Fintech - Plug & Play Tech Center | USA - Apply Here

Investment Associate - Outlier Venture | UK - Apply Here

Investment Analyst - Early-Stage - PeakXV Partner | India - Apply Here

Product Designer - Typeface AI | USA - Apply Here

Investment Principal - Quantum Light | UK - Apply Here

Associate - Omerse Venture | USA - Apply Here

Artificial Intelligence Engineer Intern - Baz AI | USA - Apply Here

Investment Associate - Elevation Capital | USA - Apply Here

Marketing Intern - Connecticut Innovation | USA - Apply Here

Managing Director - Generator | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator