'You Can’t Raised Funding Without Using Old Sales-Marketing Funnel’ : Y-Combinator | VC Remote Jobs & More

How's the old sales-marketing funnel works in fundraising? | “ Y-Combinator Called Me Cockroach During Interview ” Airbnb Founder | VC Remote Jobs

📢 Today At A Glance

Deep Dive: ‘You Can’t Raised Funding Without Using Old Sales-Marketing Funnel’

Featured Article: “ Y-Combinator Called Me Cockroach During Interview ” Airbnb Founder — Why?

Major News In Startups: Tiger Global's 18% Paper Loss, Stability AI Unicorn Startup Looking For Buyers Amid Investors Pressure & More

Weekday’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝In Partnership With Thunder.vc

Thunder's Team Has Helped Secure $100M+ In Debt and Equity For Startups At All Stages. 💡

Negotiating a term sheet? or Want to learn about VC term sheets?

👉 Download Thunder.vc's free guide on the Top 10 Terms to Negotiate in a Term Sheet for raising venture capital.

Thunder.vc is a tech-enabled investment bank that has helped companies secure over $100M in capital. Try the free tools for founders - VC Finder Tool and Debt Finder Tool.

🤝 Partnership With US!

Want to promote your startup to our community of 20,000+ entrepreneurs and investors? Check our media kit here & fill up the form. We’ll reach out to you!

‘You Can’t Raised Funding Without Using Old Sales-Marketing Funnel’

If you read our previous newsletter writeup - Why You Shouldn’t Send Investors All Your Data Too Early In The Process? I shared one of the most counterintuitive fundraising advice from one of the founders who raised $10M in funding for his consumer tech startup.

Extending to that conversation - he shared one more interesting perspective on - how many investors should you talk to in a VC fundraiser and how to prioritize this….. also how to use the old-sales marketing funnel to raise funding from top VCs…. Even Y combinator says that - "‘you can’t raised funds without using old Sales & Marketing Funnel”

Most of the founders make this mistake of not understanding the old sales-marketing funnel in fundraising… So thought to share this conversation with you.. this is a long post, so grab your coffee and let’s deep dive into it..

He shared that -

“Before you set out in fundraising mode, understand that -

fundraising is a sales & marketing process and needs to be managed. Somehow many first-time founders equate “sales” with something that is beneath them.

As a founder, you need to understand that -

“An investors job is to deploy capital and make a return. If you truly believe that you, your company and your products are exceptional and your company will be valuable then you’re actually doing them a FAVOR by helping them invest in your startup.

If you don’t believe in your bones that you’re amazing then it’s no wonder you don’t want to sell them on making the investment.”

Like any sale, you first need to plan your “prospects” and qualify whether or not they’d be a good fit for your product — an investment in your company. You need to figure out how much time to spend with each prospect and you need to rigorously manage your time and the calendar. This is where most founders err.

Most founders prepare a deck, ask a few friends and investors whom to meet, get a few introductions and just wing it.

As a result founders often meet the wrong investors, and waste time on those who ask for more information.

The typical VC process is as follows:

They say there are three rules in property: Location, location, location. In sales there are also three rules: Qualify, qualify, qualify.

Your entire process should be about “testing” whether your prospect has:

Interest

Authority to make a decision

Budget

Is willing to continue spending actual time with you and analyzing you. You can short-hand this as “engagement.”

If an investor isn’t engaging then they’re not suddenly going to get a term sheet. The surest sign a fund-raising process has stalled is when you aren’t getting follow-up meetings or hearing from the VC or hearing from friends that they got a phone call or email asking about you.

If engagement wanes you either need to move that VC to a lower priority or you need to find ways to improve on any of these dimensions (obviously points 2 & 3 might mean you’re meeting the wrong person in the firm).

Moving a VC from an A to a B doesn’t mean they aren’t still your top pick, it just means your chances are less likely and your extremely limited resources should be allocated elsewhere.

One of the most common question that every founder have during fundraising….

How Many Investors Should You Speak With?

Of course, there’s no exact number of VCs you should meet — these are simply guidelines.

For simplicity, assume you’ve raised some money from angels or seed investors and you’re either raising an A round or a B round of venture capital.

Start with a list of approximately 40 qualified investors. So qualified investors mean - they’re all the right: Size, geography, industry focus, capacity available and they have raised a new fund in the last 3–4 years so you know they have dry powder.

If you’re raising a round where a new lead investor would invest $5 million the VC fund must have no less than $100 million and if you’re looking for them to write $15–20 million as the lead their fund realistically should be at least $400 million. If you think you’ll have shared leads fund sizes can be slightly smaller but as a rough guideline assume most Seed/A/B VC funds wouldn’t allocate more than 5% of their fund to a first-time investment.

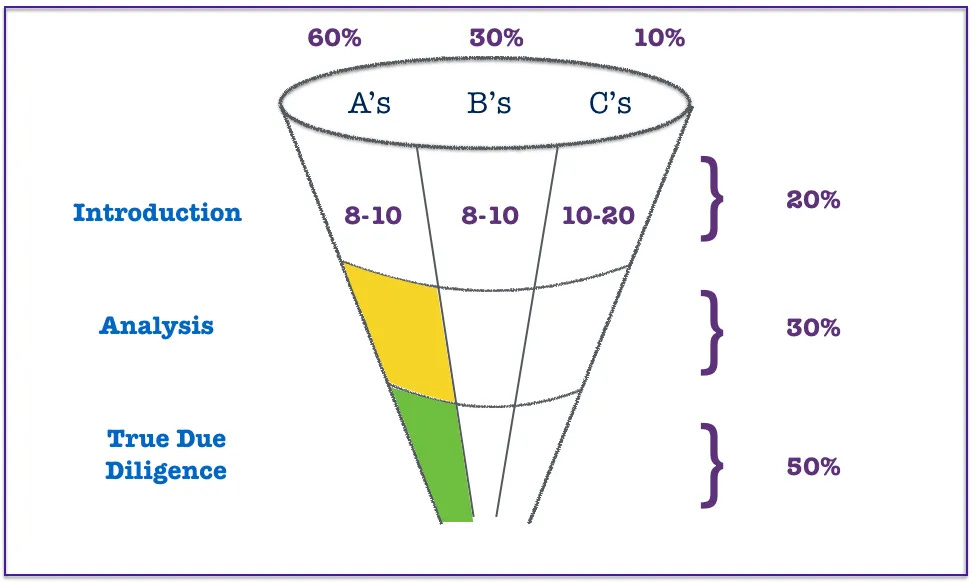

In terms of stack ranking - force yourself to have no more than 8–10 “A’s,” 8–10 “B’s” and the balance of 20–24 should be “C’s.”

An “A” is somebody who would be likely to invest in a company like yours and if chosen is somebody you’d be interested in working with. If you’re not likely to get Sequoia then just because they’re an amazing firm doesn’t mean they go on your A list. If you got a 3.6 GPA in high school, you might WANT to go to Stanford, but it isn’t likely, so you spend more energy on schools you’re more likely to get into. Same with VC.

The A’s are the firms you’re going to work hardest to research, hardest to find high-quality introductions to and make the most effort to engage with. To be clear — your list never stays static. If you have a mediocre meeting with a high-quality prospect and you don’t think they’re likely to lean in they drop to a B or C.

Likewise, if a firm that you don’t think is your top pick suddenly starts engaging and doing work and showing you love you might put them as an A because having an offer is important.

Should You Start with Your “Safety Schools?”

There is some debate about whether you should “test drive” with a few firms before a wider process or whether you just begin the process. People who believe the former believe that you should see the market demand before too many people know you’re “in the market.” There’s some truth in this. It’s such a small industry that if you talk with too many investors people will hear that you’re in the market and quickly know who has passed.

You first take 2 meetings with “safety schools” meaning somebody on your B list and somebody on your C list unless you already have a very strong relationship with somebody on your A list. This gives you good practice for your A meetings and you will have a sense of some likely questions, comments and concerns.

Then begin your process in earnest with up to 8–10 firms. These are the ones that you want and that you also have a realistic possibility of landing. Keeping it to 8–10 helps you manage the public information flow that will be broader if you see 20 firms and also helps you prioritize resources. You can hit a broader group in a few weeks once you know how you did with your initial meetings or perhaps if you did well you can keep your aperture narrow.

Why 8–10 and not just 3–4?

One of the most important aims of a fund-raising process is to keep similar firms at the same stage of your process. If you’re talking with too small of a set and one leans in early and offers you a term sheet and you’re not sure that it’s the firm you wanted to work with it is incredibly difficult to slow them down and say, “We need to finish our process” as you run the risk that they feel played. An investor who doesn’t feel like there is a two-way commitment will eventually walk and look for deals they perceive as a better two-way fit.

Honestly - every VC want you to come to see only me because that means I have no competition and have time to get to know you. But honestly, you should do this before you’re raising. If we feel a mutual connection then VC will make your life easier by offering you a term sheet before you’re even raising.

How Do You Know if a VC is Engaged?

The first meeting is usually with 1–2 people within the VC firm. You might start with a partner in the meeting or it might be a principal or associate. In any event, this is a “screening meeting” or as I’ve called on my graphics an “introduction” to the firm. It’s hard but not that hard to get a first meeting for talented teams who hustle. It’s infinitely harder to get a prompt* second meeting due to rigorous time management on behalf of a VCs. (* VCs will often grant you a second meeting in 9–12 months to hear a progress update).

Many VCs will appear to be super friendly in a first meeting because they are there to learn and get to know you and there’s no upside to being an asshole. Some VCs shared a detailed way why - your startup does not fit in their thesis. When I was raising funding for my consumer tech startup - one of the VCs sent me a friendly note why - my startup was not a perfect fit for their thesis.

I point out that VCs are often friendly in the first meeting because I’ve heard hundreds of founders tell me their first meeting was great only to feel ghosted when there is limited engagement following this meeting.

There is a super simple way to know if a VC is engaged. If you get a second meeting, a follow-up phone call or you know they’re doing actual work then they’re engaged. No VC spends more time evaluating your company unless they know that they at least have some interest.

This is a sales process and your job is to look for “buying signals” — remember: Qualify, qualify, qualify.

Other signs of engagement are: they ask you to meet with portfolio companies (they want feedback on your product and you), they ask you to meet a colleague, they set up a call to go through a product demo / financial walk-through, they ask to speak with customers, etc.

It is NOT necessarily engagement if they ask you to send a bunch of financial information under the guise of “analyzing your firm.” It drives me nuts but many VCs ask for all of this because they figure more data is better than less and they might as well have insight into how your numbers look. You can read more on this data part in our previous newsletter write-up.

If a VC “ghosts you” (i.e. they told you it was a great meeting but then they don’t respond to emails) DO NOT ASSUME it means they’re not engaged. Sometimes — best will in the world — people just get busy. Your job is to push politely until you either get a “soft no” or more engagement.

If you fold simply because they haven’t responded to your last two emails you won’t have success in business development, sales, press, recruiting … anything.

Every important person with whom you want to do business will sometimes go dark on you as self-preservation for other tasks they’re trying to complete.

How Do You Work the “Bottom End of the Funnel?”

Most entrepreneurs make the mistake of allocating too much time to taking new meetings or spending time on the wrong investors simply because they’ll keep meeting with you. Don’t. Keep your eye focused first and foremost on any VCs that are A’s and are in your “analysis” or “due diligence” phases. This is the green and yellow portions of my graphic above which specifically as a reminder to you. Most entrepreneurs don’t put enough effort into these phases.

Sometimes engagement at the later stages seems to go dry. They haven’t said “no” but they don’t seem to be spending a lot of time thinking about whether to progress.

It should be obvious to you. At the end of the process is when they need to decide not only whether they want to invest $5–10 million in your company and take the personal risk of being wrong, but they’re also voting on how they might spend a considerable amount of their time for the next 5–10 years and nobody smart does this lightly.

Your job is to create reasons to spend more time with you and to draw them into engaging because the more time they’re doing work, thinking about you, spending time with you and getting their head around why this could be exciting the more likely they will bring you into a partner meeting or make a final commitment to you.

Some easy hacks to get in front of a VC again if your process stalls

Have them meet key team members they haven’t yet met — particularly if these are people whom the VC would want to know regardless of whether or not they fund your company

Show demos of product that is yet to be released. This requires you to be disciplined and not sure if it is early in the process but a quick message to a VC that says, “I’d love to show you some cool new features we’ve built in that we haven’t shown the market yet — can I get 20 minutes to swing by” is a good way to engage.

Try to create new analyses on cohorts, future revenue projections, competitor reviews, pricing studies, etc. Any information that creates a compelling next meeting is worth doing. With some pre-planning, you might even know what information you show in your first or second meeting and what fragments you save for a follow-up meeting.

Another idea is to ask whether it’s ok to meet another team member of that VC in a 1–1 session to also show them your product. You can’t ask for a generic person — it must be a named individual that has some reason for you to meet. But that’s a chance for you to “land and expand” and build more fans inside the VC firm. It doesn’t have to be a partner — every advocate on the inside if valuable.

Due diligence meetings are the hardest to secure because VCs of course know that these follow-up meetings create obligations for them and if they’re balancing five potential deals and haven’t decided whether or not you’re a fit yet then they don’t meet again easily. As a result, many entrepreneurs take the easy route of taking new first meetings because they’re easier to get, easier to prepare for (you already have a deck) and they feel like progress. Frankly, this is like running a sales campaign and when the last big push to persuade four disparate departments to back you and it starts feeling difficult, you instead start working on selling to different customers.

As dumb as it sounds, this is a very common playbook for entrepreneurs. The bottom end of the funnel is hard. Damn hard. But I’d rather see your time and energy go into creating new artifacts to share with your prospective VCs in the bottom of the funnel than just purely taking too many new meetings.

Why Marketing Helps

In the earliest stages of this post, I mentioned that fund-raising is a “sales & marketing” process but I’ve only spoken about sales. Marketing support is as critical in a fundraising process as it is in a sales campaign. If you’re ever been involved with enterprise marketing you know how important it is to have marketing collateral and to have email drip campaigns to drive re-marketing campaigns to prospects who showed interest but didn’t convert and to run PR so that you stay on top of mind.

If you accept that these marketing techniques are critical in enterprise sales then please understand that they are no less critical in fundraising. When you plan out your fund-raising process you should dedicate some tasks on your GANTT chart to marketing. When VCs are thinking about taking a second, third or fourth meeting it doesn’t hurt that they saw an article about you in the WSJ, Recode or TechCrunch. If you have a friend of the VC who is a customer of your product or an existing investor in your company and they share news of your company in their social feeds it helps to remind the VC that they need to engage.

Every VC just like every consumer of any product likes to think that we aren’t at all influenced by marketing but of course, any behavioural economist can prove to you that we are. As a founder, use this basic knowledge to your advantage.

Why You Need to Keep Feeding the “Top of Funnel”

Having pleaded with you to put more time into the bottom end of the funnel, I do want to encourage you not to completely ignore the top end of the funnel.

In some cases VCs lean into a deal, do tons of work and seemingly get so interested that they are about to submit a term sheet only to have them say “no” at the last minute. Your lead on the deal was likely sincere in his or her interest in you but possibly got shut down when seeking approval.

The problem with putting all of your eggs into this one basket is that if you do get a “no” then you don’t have a well-established pipeline of other prospects who have already gotten through a meeting or two and you end up having to go back to square one and you lose 6–8 weeks, which can be existential for some startups.

It seems obvious that you shouldn’t count on one VC whose process seems to be going well but I’ve seen so many entrepreneurs do this that I want to highlight it and remind you not to let this happen. Even if you are certain that you’re about to get a term sheet you need to keep working a few names in the top end of the funnel all of the way through a signed term sheet. Never just assume that this will come through.

I know you’re likely tired at the end of a process but it’s important to sprint through the finish line. Even if you DO get a term sheet there’s no saying you’re going to like the terms and with no pipeline behind you you’ll likely feel pressured to just say “yes.”

Summary

Fund-raising is a sales & marketing process in which the buyer is a VC and the product is equity in your company.

Any great sales & marketing campaign begins with methodical planning and any great process is run with rigorous time allocation on the most important prospects.

Because many startup founders view “running the business” as their only job and view fund-raising as something that they’re forced to do every 18 months it often doesn’t get the time, attention and resources it deserves. Indeed, fund-raising in its own right won’t make you successful, but being successful at fund-raising can give you a distinct advantage in the market against your competitors who aren’t as good at getting financed as you or have to spend more time in the market.

Plan accordingly. Fundraising is a year-round activity and never ends. Place a small amount of your monthly time allocation to this task. Outside of fund-raising periods, it should still be at least 15% of your time. It’s a large part of the job of a successful CEO.

🤝 Partnership With US!

Want to promote your startup to our community of 20,000+ entrepreneurs and investors? Check our media kit here & fill out the form. We’ll reach out to you!

(15% Discount For Q4 & Q1 Ads) - limited to Dec 11th

Featured Article

‘Y-Combinator Called Me Cockroach During Interview’ Airbnb Founder — Why?

Recently, the Airbnb founder shared his experience of applying for the Y-combinator and getting an interview call with Paul Graham. He shared that - Paul Graham called me ‘Cockroach’ and I took it as a compliment. Why? Read More Here…

📰 This Week’s Major News: Venture Capital, Funding & Tech

Tiger Global's 18% Paper Loss Read More

Unicorn AI Startup Looking For Buyers Amid Investor’s Pressure Read More

OpenAI Launching GPT Store Next Year Read More

Stability AI - Unicorn Startup Selling its Business Amid Investor’s Pressure Read More

Musk Acquired Aerospace Startup Amid Bankruptcy Read More

Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? - Subscribed To VC Daily Digest Newsletter and join 7500+ Avid Readers🚀

🗞️ Weekday’s Read On: Startup, Technology & VC

The most important metrics for SaaS funding in 2024 Read More (Startups & SaaS)

How Does Airbnb Build Around Design Thinking? Read More (Startups)

How To Hire An Early Team For Your Startup? By Sam Altman Read More (Startups & Early Hiring)

Airbnb's Journey Applying For Y-Combinator By Brain Chesky Read More (Startups)

Startup founders going from zero to one have three jobs by Garry Tan Read More (Venture Capital)

Join 12,700+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Remote Jobs & Internships

Head of investors relation - Moderna Venture | USA - Apply Here

Venture Scout - First Momentum Venture | Germany - Apply Here

VC Fellow - Necessary Venture | USA - Apply Here

VC Manager - Octa Venture | USA - Apply Here

Investment Associate - MIG Capital | Germany - Apply Here

Assistant General Counsel - AI Fund | US Remote - Apply Here

Venture Partner - Mindrock capital | Remote USA - Apply Here

Investment Team Intern - Antler | Remote, USA - Apply Here

Investment Associate - Techstars | USA - Apply Here

Investment Summer Associate - In-Q-Tel | USA - Apply Here

Portfolio Impact Associate - Stepstone Venture | USA - Apply Here

Get Access to Curated VC CV/Resume Template - Download Here.

Join our 100+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

👉Download Thunder.vc's free guide on the Top 10 Terms to Negotiate in a Term Sheet for raising venture capital.