Don't Send All 'Your Data To Investors' Too Early In The Process: The Counter-Intuitive Fund-Raising Advice | VC Remote Jobs & More

Don't send all data to investors, early! | Secret Hack To Land A Job or Internship At VC Firm! | VC Remote Jobs

📢 Today At A Glance

Deep Dive: Why You Shouldn’t Send Investors All Your Data Too Early In The Process? - The Most Counter-Intuitive Fund-Raising Advice

Featured Article: Secret Hack To Land A Job or Internship At VC Firm!

Major News In Startups: Reddit Going Public, Charlie Munger Dies Aged 99, Whatsapp Billionaire Started $10B Fund With Sequoia Partner & More

Weekday’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

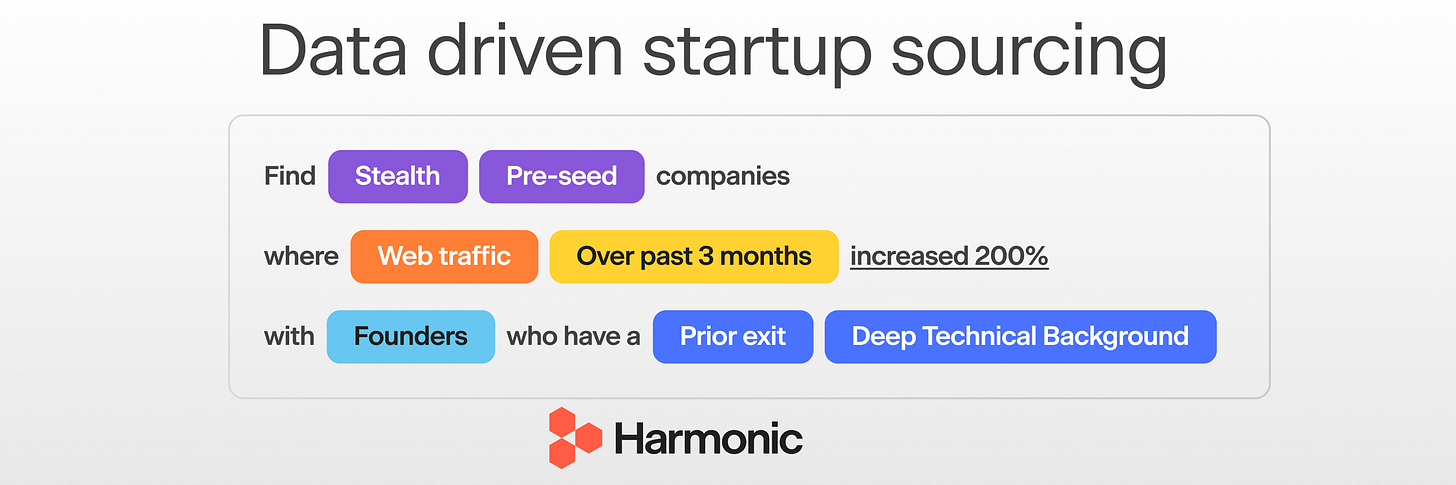

🤝In Partnership With Harmonic.ai

Harmonic - The Sourcing Tool For Data-Driven VCs 💡

Negotiating a term sheet? or Want to learn about VC term sheets?

👉Harmonic AI is the startup discovery tool trusted by VCs and sales teams in search of breakout companies.

Accel, YC, Brex and hundreds more use Harmonic to:

Discover new startups in any sector, geography, or stage including stealth.

Track companies’ performance with insights on fundraising, hiring, web traffic, and more.

Monitor their networks for the next generation of founders.

Why You Shouldn’t Send Investors All Your Data Too Early In The Process? - The Most Counter-Intuitive Fund-Raising Advice

Recently, I had a chat with a startup founder who successfully secured $10 million in funding for his consumer tech startup. He shared some fund-raising advice that flies directly in the face of what most conventional wisdom will tell you.

In this article, I want to pass along the wisdom he shared and highlight common mistakes many founders make when raising funds.

By the end, I hope to show you why his approach is worth considering. Now, let's jump into the main ideas he talked about.

Request to investors: If you have any counterintuative point on this - feel free to share in the comment!

“Data rooms are where fund-raising processes go to die.”

“ Let me give you more context on this - that founder shared with me!

When you raise money from investors you produce information that you are told they want and care about:

A fund-raising deck that articulates your company strategy, plans, team, market, competitors and so forth.

A detailed financial model that shows your anticipated revenue, costs and profits (Income Statement) as well as your balance sheet and cash flow statements.

Your historical trading information including financials and a “customer file” which shows the history of your transactions so that investors can run “cohort” analyses

Customer reference, personal references, key team members, compensation, cap table, stock option plan, etc.

Or if you’re a VC raising from LPs you have to list all of your deals, your investment value, your carrying value, your multiples, your IRRs, TVPIs, DPIs, etc along with net cashflows plus your previous LPAs.

These collective sets of documents form the basis of what somebody looking at investing would call “financial due diligence.”

Getting the first meeting with a VC isn’t easy because each partner at a VC firm gets so many requests for meetings that he/she couldn’t possibly take them all so they tend to prioritize people that were introduced from high-quality sources - Reality…..

But it’s true that - If you’ve got the skills to be a strong entrepreneur then it shouldn’t be too difficult to find people who know a partner at a VC firm and if you can build a relationship with them you can get introduced. I also like to say that while getting a first meeting isn’t easy, it also isn’t that hard.

Getting follow-on meetings is very hard because if the VC wasn’t totally persuaded in the first pitch meeting they aren’t likely to want to commit more time. So what does a VC do when he or she isn’t ready to say “no” or perhaps might like to talk with you in a year but not now? Often they ask for access to your “data room” so they can do an analysis on whether this would be a good investment for them or not.

‘Most entrepreneurs (and VCs raising from LPs) think this means progress. It doesn’t.’ The data room is where your process goes to die.

What happens is that 18–20 firms access the data room and download all of your documents. You feel proud because data rooms have tracking on them so you know exactly who did and who did not access your data. So you sit around and wait for the next call. You convince yourself that it should take 1–2 weeks until they have gone through the data and you’ll get a call but it never comes.

Why?

There are a set of reasons VCs and LPs ask for data and I’m not sure they even always internalize these reasons themselves. I’m going to start with the reasons and then explain how to use your best data to your advantage.

VCs (and LPs) sometimes ask for data because they don’t know what else to do in the process. They don’t have a compelling reason to tell you “no” based on a meeting but they aren’t prepared to meet you again. Asking for the data room is the easiest way to get off the hook for a few weeks while seemingly making progress. They aren’t doing this viciously — they might not even realize that this is why they ask for the data room. But I assure you it plays a big role.

VCs (and LPs) have a vested interest in having more data, whether they want to invest in your company/firm or not. If a VC meets with 40 eCommerce companies and has the data room on all of them (downloaded onto his or her system) then when they DO finally dig in on an investment opportunity they can compare information such as CACs, LTVs, churn rates, margins, etc. against a broad range of similar companies. LPs also do this to VCs so that they get a broad representation of returns data.

Investors often want to see your performance this year in case you come back and look for money next year. Investors love to be able to see what you told them in forecasts in prior years and then compare it with how you actually performed. In this way, investors can make some assessments of how well they should believe your future forecasts that you are showing them a year later.

Investors often DO want to do the first pass of analysis on your company and might genuinely have an interest. But for the most part, this analysis is done by more junior people who can always find a reason in the data to show that you suck. It’s not that they’re particularly negative but the fact is that supporting roles at investment firms are designed to show the partners the risks in deals and the “upside case” always requires huge assumptions to be believed. So junior analysis of your company is also often where initial due diligence goes to die unless you can be sure that the investment partner is also willing to engage.

So Is There Any Good Reason To Create A Data Room And Allow Access To Select Individuals?

No. None!

So WTF Am I Supposed To Do When An Investor Asks For Access To My Data Room If I Don’t Have One?

For starters, you have to realize that fundraising is a sales process.

The buyer is shopping for equity in startups and the seller is looking for cash in exchange for equity and shared governing control of his or her company.

Asking too early for data room access is the equivalent of going into a store to look at clothes, watches, cars, electronics, etc. and then asking to take a brochure home with you.

You are going to “study” the details before making a decision. Yeah, sure. A brochure is an easy out for you in the sales process without being rude. You know that you theoretically MIGHT want to look at the specs of that $5,000 coffee machine one day but in reality, it’s likely to sit in a pile on your desk.”

The consumer tech founder said - “He never thought of this until became the Founder & CEO of the startup company. He did some outbound sales & marketing, responded to some inbound enquiries that came “over the transom” from marketing activities and we responded to RFPs (requests for proposal). He hired a sales coach who helped him figure out how to close more deals. The coach told him to stop responded to RFPs where he wasn’t the person who helped write the specs for the RFPs. The coach told him “If you didn’t help shape the RFP somebody else did and you’ve already lost.

That was a hard pill to swallow since there were so many deals done via an RFP. The coach didn’t think RFPs were a total waste but he said that you need to test every potential buyer for true interest. Normally you are sent an RFP and asked to fill out forms and send it back. If they like your response they call you in for meetings. Coach shared that - “Responding to RFPs is where sales processes go to die.” It felt like heresy. They asked me (the founder) to send them info, how could I do anything else? It would be rude!?!

Sales Coach also instructed him to call the potential customer instead and ask for a meeting. “Just tell them that you’re working on your response but to better understand your ROI calculation and to give them a more precise offer you need to test a few of your assumptions. You’d love a super short meeting to do this.” He said, “If they are not willing to meet then you’re already dead so you’re better off to spend your time with another lead. Any truly interested buyer would give you some time to help you and improve your offer and probably to get to know you better.”

The sales coach taught him that the key metric to whether a sales process is going well is “engagement.”

If they’re giving you time then you owe them more data and if they don’t give you time then you shouldn’t share your data. I tried it, and it worked incredibly well meeting with people (in person, in a web conference or on the phone) is ALWAYS better for you to understand their buyer needs and them to better understand you.

In short, meeting in person gives you a chance to remind the prospective buyer “why they loved you” in the first place and gives you a chance to better share your story.

It’s the equivalent of falling in love with a Tesla in the showroom and if they get you back in the showroom you can remember why you loved them and wanted them and would be happy owning one. Sending the specs can’t do this.”

So How Does This Work In Practice Mainly In the Fundraising Process?

Initial Call

VC: “We enjoyed our meeting. Can you please send us your certificate of incorporation, your Cap Table, your 3-year P&L and last year’s historical trading information?

Entrepreneur: “Sure. No problem. We have all of that. Can we please schedule a 15-minute call next week to quickly walk through your information request so we can best be prepared? I promise not to run over that time allotment.”

If “no” then you know it’s a waste to send the information. What interested party wouldn’t even grant you 15 minutes? “Just send the information and when we analyze it we’ll set up a call” is not good enough. If you have self-respect you’ll say “no” to that request. And frankly, the more you say “no” the more likely they’ll take the call and the more they say “no” the less likely you should want to work with them.

Call Dynamics

Entrepreneur (when on the initial call): “In trying to figure out how to prioritize the information you need, I wanted to best understand your process, what analysis would be most helpful and make sure I get it to you in the right format.” and later, “What do you expect the next step in the process would likely be? How should I best prepare for that?”

Your goal is to learn more about what they are trying to solve with the information and frankly, you’re politely forcing them both to think about what they’d actually do with it (other than ask for it) and they are starting to make subtle commitments to reengage with you.

In the above situation, I would hope that you were able to persuade them just to look at historical data and future forecasts because your cap table, certificate of incorporation, reference list, etc, isn’t valid until later in due diligence.

When You’re Ready to Share the Data

Entrepreneur (post-call, now ready to share data): “We’ve prepared the cohort analysis you requested and we’ll send you the raw data file, too. I have now done our 3-year plan as monthly rather than quarterly as requested. The model is a bit complex — I’d love the chance to come and quickly walk you through our assumptions. It shouldn’t take more than 30 minutes but it’s important to me that you and the partner meet me so you can understand the key drivers before I send it.”

Again, your goal is to trade data for engagement. If they prefer not to meet (they’re rationally trying to be judicious with time) you can politely request that perhaps you just do it on a web conference call (Xoom, Google Hangouts, Skype, whatever.) Each interaction is an opportunity to test whether or not they’re really doing the work and since you have to rigorously protect your time each piece of data should be traded for engagement.

Remember:

In-Person > Web Conference > Phone Call > Email > Data Room

If you run a good process and if the investor is truly interested (even if busy and doesn’t respond as fast as you’d like) then each major step of analysis on their side can be a series of documents you trade in exchange for more proof of engagement.

Reference Calls

Founder shared that - “I do the exact same for reference calls. Many times I’ve been asked for the names of references only to find that they were never called or only 1–2 were called. I love it when investors ask me for references because I know it’s a great chance to DRIVE engagement. How?

I always ask the potential investor, “Would you mind if I contacted someone and organised for him/her to speak with you for 20 minutes?” Most people will say “yes” and now I know you’ve committed to further engagement with my process which is also 20 minutes you’re not committing to somebody else’s process. Presumably your “on sheet” references are big advocates (otherwise you’re in real trouble) so this engagement should go well.

I often send the introduction email and then a second email to the reference to say, “This reference is really important to me. I’d be grateful if you could prioritize it. Thank you!” That way you have an advocate making sure the meeting happens.

But are they just putting a customer reference list in a data room? NFW.”

Summary

There is nothing you can provide in a data room that you couldn’t send via email. Sending the docs via email is less friction than making people come to a data room. And if you break up your diligence documents into related sets of information that map to different stages in the processes then you realize you never send it all at once anyway.

I know the first time you don’t follow the customer’s “rules” for how they want to engage it feels awkward. But remember the brochure you take at a car dealership. And remember that unless you can break out of the traditional process designed to put up walls you will forever be the company sitting in a pile on the buyer’s desk in a stack of brochures.”

🤝 Advertise in The Venture Crew’s Newsletters

Want to promote your startup to my community of 20,000+ entrepreneurs and investors? Reply Advertise, I will send the media kit!

(25% Discount For Existing Subscribers!)

𝕏 Featured Article: Secret Hack To Land A Job or Internship At VC Firm!

Most of you, probably haven't heard about this hack that I am going to share with you and I am sure if you follow this correctly you will definitely land on a VC role. Keep it under wraps!

“Target applying to a new VC firm!” - It's Simple! How To apply? Why New Funds? Email Template? How to find a new fund? Read More Here..

Join VC Crafters- to get access to VC Learning Resources, VC Job Board, & weekly Events By Venture Capitalists.

📰 This Week’s Major News: Venture Capital, Funding & Tech

WhatsApp Billionaire / Former Sequoia Partner's $10B Tech Fund Read Here

A Unicorn startup - Veev Shutting Down its business Read Here

Is Reddit Going Public In 2024? - IPO Season is Back! Read Here

Berkshire Hathaway vice-chairman Charlie Munger dies aged 99 Read Here

Pritzker-backed VC firm 53 Stations launches $190 million fund Read Here

Dataminr, a Unicorn Startup off 20% of Staff Read Here

Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? - Subscribed To VC Daily Digest Newsletter and join 7500+ Avid Readers🚀

🗞️ Weekday’s Read On: Startup, Technology & VC

Predicting VC Success Through Crunchbase Data Read More (startups)

When Do You Know You Have PMF? By Elad Gill Read More (Startups)

Great Ideas Look Bad At Early Stage - By Sam Altman Read More (Venture Capital)

Is Your Start-Up Idea A ‘Tarpit Idea?’ Bad Vs Tarpit Idea? Read More (Startups)

How to Talk About Valuation Numbers When Investors Ask? Read More (Startups & Venture Capital)

Join 12,300+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Remote Jobs & Internships

Operation Coordinator - Techstars | USA - Apply Here

Investment Research Analyst - Malpani Venture | India - Apply Here

Principal - Acumen | US - Apply Here

Partner - a16z | US - Apply Here

Investment Associate - MIG Capital | Germany - Apply Here

Assistant General Counsel - AI Fund | US Remote - Apply Here

Venture Partner - Mindrock capital | Remote USA - Apply Here

Investment Team Intern - Antler | Remote, USA - Apply Here

Investment Associate - Techstars | USA - Apply Here

Join our 100+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

👉 Try Harmonic to find the new startup deal & to track the performance of company….