Y-Combinator Guide: How to Build Your Seed Round Pitch Deck with Better Design? | VC & Startup Jobs

Can your startup return a VC fund? & Do you need a Moat?

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: Y-Combinator Guide: How to Build Your Seed Round Pitch Deck with Better Design?

Quick Dive:

Why do you need a Moat? Why are founders afraid to talk about it?

15 steps to know if your company can RETURN a VC fund.

Major News: Humanoid robots will build iPhones in China, Apple will block TikTok and 11 ByteDance apps, and Meta will launch an edits app after the CapCut ban & More.

20+ VC & Startups job opportunities.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

30 startup ideas to build in 2025.

Signs your perfect pitch meeting was a failure.

SaaS metrics cheat sheet by Joel York.

All-in-One VC fundraising guide for founders.

Sam Altman's guide to startup fundraising: What really works.

Building cap table as a founder: template to download.

MVP is over. You need to think about MVE.

AI’s role in B2B software.

All-In-One guide to pitch deck storytelling - free template & curated resources

For AI enthusiasts: Must-have resources to stay updated on AI tools and trends, trusted by MIT students and tech professionals from OpenAI and NVIDIA.

Ready-to-go financial modelling template to build your startup financial model that every investor wants to see.

An exited founder’s learnings about recruiting an early-stage team.

200+ curated growth marketing resources for founders and marketers.

MarketingAlec: The Best resources for marketers to learn about how to use AI tools and prompt to increase traffic and conversion on your website.

FUNDING RADAR - RESTAURENT

RestauRent is Revolutionizing Private Events

Private event bookings just got a major upgrade - RestauRent, the platform streamlining the process of finding and booking event spaces, has raised $3.4M in pre-seed funding to power its coast-to-coast expansion. With over 1,100 venues listed and $10M+ private events processed, they’re simplifying everything from family gatherings to corporate parties.

Founded by Nick Cianfaglione and supported by a stellar team, RestauRent addresses a massive market need: over 400M private events annually in the U.S. Their intuitive platform connects venues with event planners, offering search filters for location, capacity, and amenities.

Backed by investors like Rogue Ventures, PS27 Ventures, and Collide Capital, RestauRent is poised to lead in a booming market projected to hit $14.1B by 2028.

Want to see how they’re transforming private event planning?

Discover more and follow their journey →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

TODAY’S DEEP DIVE

Y Combinator Guide: How to Build Your Seed Round Pitch Deck with Better Design?

Building a pitch deck for your seed round is a crucial step in your startup journey. It’s not just about putting slides together—it’s about crafting a story that resonates with investors and gets them genuinely excited about your vision.

While there are plenty of guides online about building pitch decks, most of them fall short of offering clear, actionable advice. That’s why I’ve taken the time to dive deep into Y Combinator’s resources, watch hours of their videos, and analyze detailed articles to create this comprehensive and practical guide for you.

Why a Great Pitch Deck Matters

Your pitch deck should achieve two things:

clearly convey the most critical points about your startup and

make it easy for investors to understand and remember your story.

For seed-stage startups, this often means focusing on simplicity and narrative clarity. Remember, at this stage, most startups don’t have extensive data or years of history to share—and that’s perfectly fine. Your goal is to make your story as compelling and concise as possible.

Structuring Your Seed Round Pitch Deck

Creating a pitch deck doesn’t have to be overly complicated. It’s all about telling a clear, concise, and compelling story that investors can follow easily. Here’s how you can structure your deck:

Title Slide

Start strong with a title slide that sets the tone for your pitch. It should include:

The name of your company.

A one-line description of what you do.

Keep it simple and professional. This is your first impression, so make it count.

The Problem

This is where you lay out the real-world issue your startup is solving. A well-defined problem statement is crucial for connecting with your audience.

Focus on the impact of the problem on real people or businesses.

Use a statistic, example, or story to make it relatable.

Avoid overloading this slide with too much text or technical jargon. The problem should be clear and easy to understand.

The Solution

Next, explain how your product or service solves the problem you’ve just described. This is your chance to show why your approach is unique and valuable.

Keep your explanation brief and to the point.

Highlight the concrete benefits of your solution.

If needed, use visuals or diagrams, but avoid cluttering the slide.

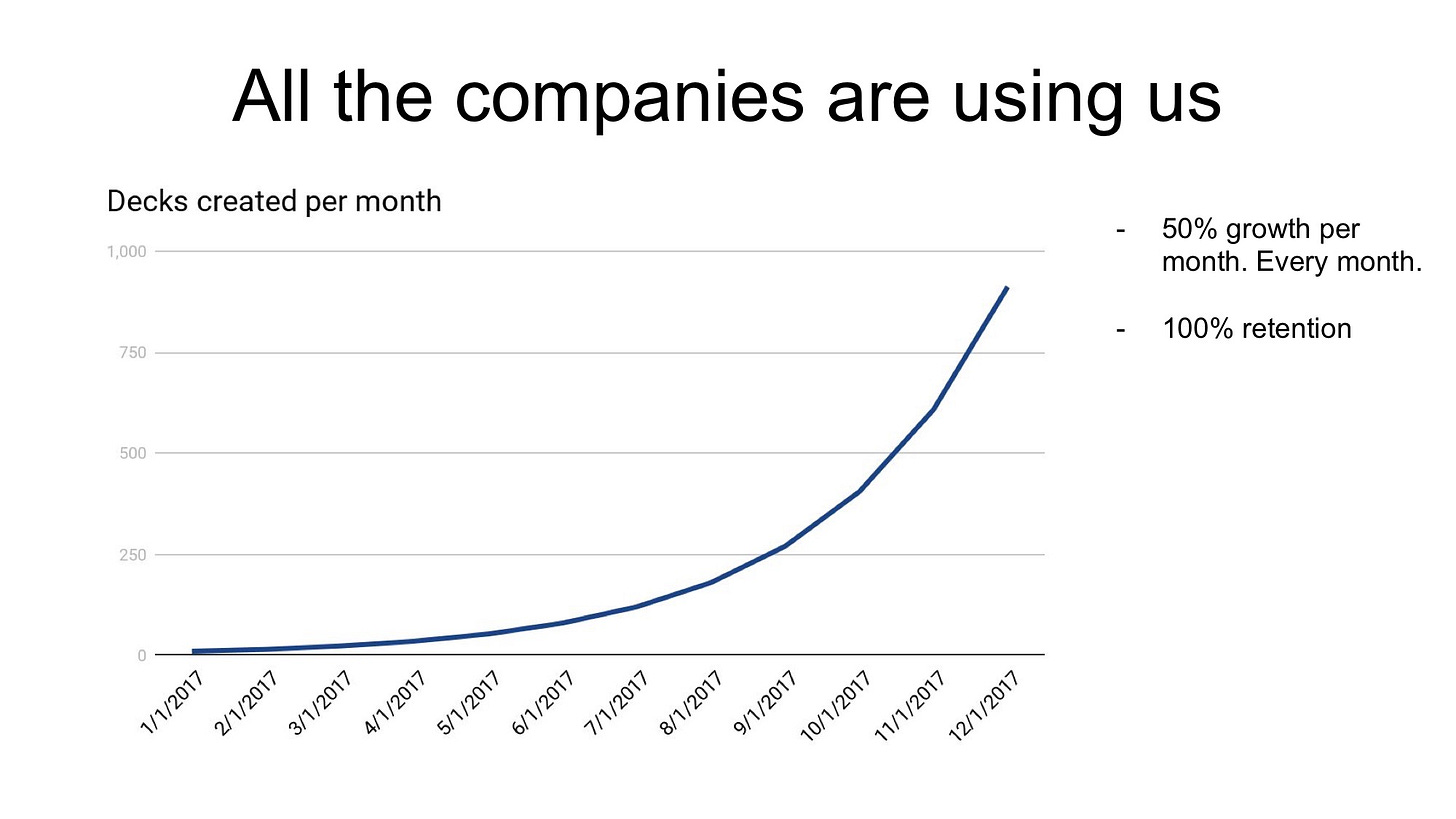

Traction

Investors love to see traction—it’s proof that your startup is making progress. Even if your numbers are early, show them off in a way that’s easy to understand.

Use a chart or graph to showcase key metrics like revenue or user growth.

Add context to explain why these metrics are important.

Keep it honest and straightforward. Smooth growth curves are rare, and that’s okay.

Your Unique Advantage

What makes your startup special? Use this slide to highlight what sets you apart from competitors.

Focus on your unique insights, technology, or approach.

Keep it concise and avoid unnecessary technical details.

Business Model

Your business model is all about showing how you make money. While it doesn’t have to be perfect, it should be clear enough for investors to understand.

Explain your revenue streams and pricing strategy.

If you have any early results, include them here.

Break complex models into simpler components if needed.

Market Opportunity

Investors need to see the potential for scale. Use this slide to showcase the size of your market and the opportunity you’re addressing.

Provide a high-level overview of your Total Addressable Market (TAM).

Use a clean, visual representation to convey scale.

A compelling market opportunity slide gives investors confidence in your startup’s long-term potential.

Team

Your team is one of the most critical factors for early-stage investors. Use this slide to show why your team is uniquely qualified to solve the problem.

Highlight the key strengths and relevant experiences of the founders.

Keep the focus on the people leading the company rather than advisors or extended team members.

The Ask

Wrap up your pitch with a clear “ask.” Be specific about what you need and what investors can expect in return.

State the amount you’re raising.

Explain how the funds will be used (e.g., product development, hiring, marketing).

Outline where you expect to be within a year and how this funding helps you get there.

Remember - even the best content can fall flat if your slides aren’t designed effectively. According to YC, a great pitch deck follows three fundamental principles: Legibility, Simplicity, and Obviousness.

Legibility

Use large, bold fonts with high contrast.

Avoid clutter; each slide should be easy to read, even from the back of a room.

Place key text at the top for better visibility.

Simplicity

Stick to one idea per slide.

Avoid excessive text, diagrams, or branding.

Use visuals sparingly and only when they add value.

Example slide:

Obviousness

Test your slides on someone unfamiliar with your startup. If they can’t understand a slide in seconds, simplify it.

Use captions and labels to make data and visuals explicit.

Avoid distractions like animations or memes.

Avoiding Common Mistakes

To make your deck truly stand out, steer clear of these common pitfalls:

Overloading slides with information: Keep your slides clean and focused.

Using illegible screenshots: Replace them with simplified visuals or bullet points.

Skipping key slides: Ensure you address the problem, solution, and team clearly.

Forgetting the big picture: Focus on the opportunity and how your startup fits into it.

By following these guidelines, you’ll create a pitch deck that’s not only visually appealing but also tells a compelling story. Remember: clarity, simplicity, and obviousness are your best friends. Focus on making your key points memorable, and you’ll stand out to investors.

MUST TRY TOOL - DON’T MISS THIS

🧐 Meco—The Future of Newsletter Reading.

Meco is redefining how readers engage with newsletters by offering a clean, distraction-free platform that makes content consumption seamless and enjoyable. Designed with productivity in mind, it’s the ultimate tool for newsletter enthusiasts looking to escape inbox chaos.

What Makes Meco Unique

Clutter-Free Reading: Move newsletters out of your inbox into a dedicated space.

Seamless Integration: Works effortlessly with Gmail and Outlook.

Customizable Features: Group newsletters, apply smart filters, and swipe through a scrollable feed.

Discover New Content: Explore incredible newsletters through the curated Discover section.

Why Readers Love Meco

Multi-Platform Support: Available on iOS, Android, and the web.

Proven Success: Trusted by over 30,000 readers with 2.5 million newsletters read.

Top Ratings: 4.7/5 on the App Store, with rave user reviews.

Meco’s sleek interface and advanced features transform the way readers consume content. By decluttering inboxes and creating a personalized reading experience, Meco is a must-have app for anyone who values focus and productivity.

Step into the future of newsletter reading with Meco. Try it today and rediscover the joy of focused content consumption!

[Featured your startup in product/ AI tool review. Get in touch today.]

QUICK DIVES

1. Why do you need a Moat? Why are founders afraid to talk about it?

A moat is your startup’s ability to maintain an advantage over your competitors, and investors love to talk about it. It is one of the most important things a founder should get across when pitching.

Peter Thiel agrees - He says startups without a moat are companies that can create a lot of value yet still be worth very little.

In an essay, Packy McCormick argues that the most successful companies are the ones that desperately need moats.

His reasoning is simple: Good ideas get noticed… quickly. The best ideas need strong moats to maintain their advantage and grow fast enough to become dominant.

As a result…

Depth of moat needed = How good your idea is - How hard it is to build.

But what does it mean by a good idea, especially one that's hard to build?

Remember - “Generational companies are not built on the latest technologies but in bold statements.”

What does it mean? Let me break it down for you and show how some of the successful startups like Stripe, Airbnb, and Spotify are perfectly aligned with these statements…

“MOAT” - seems like a new word; in recent times, founders are afraid to talk about the MOAT of their startup.

They don’t want to recall, as most startups or so-called AI startups don’t have a MOAT except those 2-3, you know who I am talking about. Let’s not recall those names but let’s rewind the time when founders used to talk about MOAT. Most of the founders were afraid because they didn’t understand the real meaning of MOAT!!

Just remember it’s not any tech, AI-powered, some API or other things….. So

What’s The Moat For A Startup?

Moats are a set of characteristics (competitive advantages) a company has that make it hard for other companies to compete.

In practical terms, I think about this by answering the question, what can’t a company with $1B sitting in the bank just buy?

The answer? Many things: Community, Trust, Network Effects, Users, etc.

In the past, tech was considered a strong moat since it required large amounts of capital to be built. But the truth is, the level of defensibility provided by tech to startups is at an all-time low and decreasing faster than ever before. Defensibility at a product level is incredibly hard to achieve, let alone sustain.

Features aren’t moats because they can be replicated. And now, as AI starts to spill into software development, software’s marginal cost will dramatically decrease in the upcoming years.

With AI Tech will become an even weaker moat. Code will start to become a commodity.

What’s Your Moat?

One of the most common questions that every founder receives while pitching investors (or founders in general) is ‘What’s your moat?’.

Most of the tech founders try to find a convincing way to explain why the tech they are building is unbeatable, or why the features that they planned to launch are game changers. But none of this matters.

If you want to convince investors on MOAT of your startup. Just ask one question to yourself.

‘Why am I being asked this? What was Airbnb, Spotify, or any other successful company’s moat when they just were getting started? In their origins, what did they have that nobody else had?’

It is just one thing. “A bold statement on how the world should look like.”

“Generational companies are not built on the latest technologies but in bold statements.”

When these are being built, tech only plays a fraction in innovation. The engine that facilitates the creation of new companies is dreaming of better experiences.

Spotify’s moat

For many years the only option for streaming and downloading music was pirating (usually off Piratebay). People got used to scrolling through music pirating websites and were OK with clicking through spam and fake download buttons to get a new music album. It wasn’t a state-of-the-art experience, but it worked.

If you wanted to hear a song, you could. As mentioned in the episode featuring Daniel Ek, founder of Spotify, in Reid Hoffman’s podcast Masters Of Scale, before the foundation of Spotify, ‘music lovers already had the world music at their fingerprints.’

Although seen as a technological breakthrough, Spotify was more of a powerful statement and an unparalleled experience. At the time, it wasn’t built with mind-boggling software. As far as tech goes, Spotify could have been created five years earlier. Spotify was a bold statement and a big bet. People weren’t unhappy with how they were listening to music. They were happy. No one imagined it could get better until someone did. People weren’t pirating music because it was free. It wasn’t an economic hurdle. It was instead a convenience one.

Daniel Ek did something genuinely bold. Although nobody was complaining about the current state of music, he dared to imagine an even better experience. Building a company in an industry where the vast majority is happy with what they currently have, requires an astonishing vision, and blinding determination.

And that was Daniel’s moat. Unlike tech, a vision (the act or power of imagination) or a statement cannot be bought.

Most of the founders don’t find a bold statement for their startup and fail to create a MOAT for their startup!!!

There is also one thing -

Should entrepreneurs always look to solve ‘problems’?

At that time, Spotify was not solving a true, existing problem. It made the experience 100 better, at least. But back then, nobody would have defined listening to music as a ‘problem.’

This is why, in my opinion, one of the most common tips for founders, ‘Talk to users’, should be taken with a grain of salt. Yes, talking to users can help identify customers’ pain points that may otherwise go unnoticed and provide valuable feedback on a product or idea. However, if founders delegate their entire creative process to potential customers, they automatically set a ceiling on what can be built based on users’ wants. And the truth is, people don’t know what they want until they see it.

There are millions of bold statements waiting to be realized. It just takes a brave mind to effectively see around themselves in non-obvious places where things can get 100 times better.

2. 15 steps to know if your company can RETURN a VC fund.

Whenever I share this calculation with founders, they often ask why it's important for them to understand it. My answer is always the same: this simple concept will help create accurate financial projections and instil confidence in investors. Let's explore how this works:

1/ Why is this important

VCs have LPs (investors), they raise capital from them then say they will return it in 7-10 years and we plan to 2-3x it.

2/ How Simple math - example below:

$50m fund needs to return $150m from its investments. A fund usually invests 2-3% of its fund into each company ($1.25m)

3/ Run the math $1.25m for roughly 25 companies for $31.25 for initial checks then save the rest for follow-on checks.

Now we have to decide on ownership needed to return the fund at the exit

4/ A seed VC typically has a minimum ownership of 5-10% ownership

Let's go with 8%

Valuation is determined by check and ownership

$1.25m at 8% ownership is typically an average of $15m post

5/ Before we focus on the exit value we need to factor in dilution because other investors will invest in the company after us to get it to a larger valuation at exit or IPO

We typically see 40% dilution at the exit as seed investors.

6/ So at the exit, we know that our 8% will be closer to 4.8% and need to have $50m to return the fund

Let's run the math

7/ $1.25m at 8% for $15m post

To get to $50m - $50m/4.8% = $1bn~

So every company that the fund invests in needs to have $1bn in value at exit to return it

8/ So why should a founder know this? Well a founder can run this math themselves and understand what each investor expects from them by knowing their fund size and ownership minimum

9/ This helps the founder keep goals, updates and business decisions aligned with investors

10/ So a founder can now figure out what type of growth is needed to get to that desired exit value of their investors.

A founder can now create accurate financial projections and give the investor confidence.

11/ In most scenarios getting to $100m in rev of 7-10 yrs is the sweet spot since many companies get acquired or IPO above 10x their rev

12/ But wait what happens if an investor has a larger fund? Well that means they expect your company to have a much larger exit value (could be 2 5 or even 10 billion) This is good to know as a founder

13/ Some large multistage funds only invest in a company if they see it having $1bn in revenue or $10bn in valuation

Which is why VCs say "NO" so much and typically only invest in 1% or less of the deals they see

14/ This math can also help you understand why a VC may pass on investing in your company

They may do that math and think your market is too small

If you do your math and prove that the market is big enough you will make your fundraising journey much easier

15/ So please do the math on your own company to see if it can return an investor fund and if it can't - think about increasing your pricing or choosing a similar market that's bigger.

We can also download our financial modelling template here.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

UBTech, a humanoid robot maker from Shenzhen, has partnered with Foxconn to use its Walker S1 robots in iPhone assembly, performing complex and precise production tasks.

Meta unveiled Edits, a video editing app launching next month on iOS, positioned as a creator-focused alternative to ByteDance’s CapCut, which was recently removed from U.S. app stores.

Whitney Wolfe Herd is returning as Bumble’s CEO, replacing Lidiane Jones, who is stepping down for personal reasons. The transition will take effect in mid-March.

Amazon has paused all commercial drone deliveries in Texas and Arizona following two crashes of its MK30 drones at a testing site in Pendleton, Oregon.

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

Venture Capital & Startup Jobs

AI Engineer - Linkt | Remote - Apply Here

Associate - S3 Venture | USA - Apply Here

Investment Analyst - Softbank Vision Fund | UK - Apply Here

Accelerator and Sales Director - Plug & Play tech centre | USA - Apply Here

Founding AI engineer | Remote - Apply Here

Junior Level Chief of Staff (DFW) - Sidekick Partner | USA - Apply Here

Investment Associate - Elevation Capital | USA - Apply Here

Marketing Intern - Connecticut Innovation | USA - Apply Here

Director, Finance - Antler | India - Apply Here

Investment Team Programs - Dexter Program | India - Apply Here

Legal Ops - Dragonfly Capital | Singapore - Apply Here

Community Manager - Antler | USA - Apply Here

Investor / Junior Partner - USA Deal Team - Dragonfly | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Thanks for the financial modelling template. It's useful.

Thanks for sharing. One of the best guide I have read so far.