Why It’s Hard to Generate a 10X Return on a Startup Investment? | VC Jobs

The problem arises when multiples are inferred from incomplete data....

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Why It’s Hard to Generate a 10X Return on a Startup Investment?

Featured Article: Don't Include Your Startup Valuation Number On The Slide.

Major News: Trump's Truth Social Going Public, Adam Neumann Submitted A $500M Bid, Y Combinator Raising $2 Billion & Exec Fined For Investor Deception on EV Truck.

Best Tweet Of This Week On Startups & Technology.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH VINCENT

Get Smarter About Private Market Investing With Spotlight

Vincent Spotlight illuminates what matters in alternative asset investing, in 3 minutes per week.

Direct to your inbox. Trusted by 70,000+. And free forever.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Why It’s Hard to Generate a 10X Return on a Startup Investment? - VC Maths

(During fundraising, founders often fail to understand how their investors think about money. They always complain, "Investors rejected our startup as it will not be able to deliver them adequate returns on their investment." Previously, we wrote a post on how to determine whether your startup is VC-backable or not, and we shared an example of how to determine it.)

This post goes into detail about the math involved in venture capital investing. It can be helpful for startup founders to understand how their investors think about money. Knowing the financial side of things gives insight into why investors make certain decisions and how they view the business….

There are lots of articles surfing on the internet on VC multiple and ways to calculate it, but every time I wondered if writers appreciate how hard it is to generate these kinds of multiples and how multiples should really be calculated.

Obviously, the way to calculate a return multiple is to divide the amount returned from an investment by the dollars invested.

If I invested $10M in a company and got back $100M, that’s a 10X return. Seems pretty straightforward, right?

The problem arises when multiples are inferred from incomplete data. It’s quite rare that anybody but the fund manager knows the dollars out and dollars returned by a specific investment. And if you have incomplete data, there are usually several things that go into calculating or estimating the return. Here are a few other things to think about.

How to Actually Calculate an Investment Return Multiple

Remember each round of financing further dilutes early investors’ money.

Let’s say a seed investor put in $1M in a company’s first financing round at a $10M post-money valuation. The company ultimately sold for $200M.

So, one might infer that the seed investor made $200M/$10M= 20X their money.

Unfortunately, this is almost never the case.

In almost any outcome like this, the company goes on to raise more money, usually at higher prices. As new investors come on board, all existing shareholders of the company will have their ownership stake in the business diluted. This also happens when a company expands their option pool.

Here’s how that plays out for the seed investors:

Let’s say this theoretical company raises just one more round of financing. It’s a $10M round at a $50M post-money valuation. As part of the round, the option pool of the company is expanded by an additional 10%. After this round, the company has their $200M exit.

In this example, the flow of the math would be something like this:

The seed investor owned 10% after the seed financing. In the next round, the seed investor’s ownership is diluted by 30% (20% due to the new financing and 10% due to the expanded option pool).

So the seed investor’s ownership was actually 7% at exit. Thus, their $1M returns $14M — a 14X return. Pretty great, but meaningfully different from 20X.

Another way to look at it is the effective post-money of the investment.

At the seed, the investor bought 10% for $1M. But when it was all said and done, the investor actually bought 7% for $1M. It was like they invested in the company at a valuation of $1M / 7% = $14.3M.

But most companies do not have a straight shot to a multi-hundred million dollar exit with just a seed and Series A. Most raise multiple rounds, and dilution happens at each round.

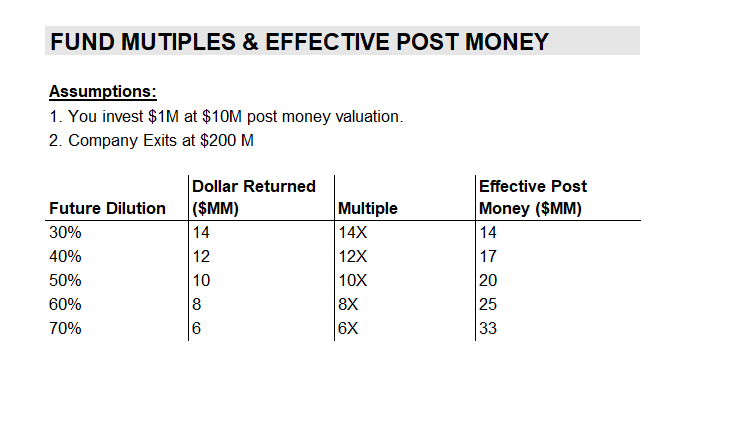

Below is a sample outcome table for a few scenarios.

What this shows is that the investor’s multiple dramatically changes depending on how many rounds of financing occur after the initial round and the level of dilution of each round.

You can also think about this in terms of effective post-money because it creates a more visceral reaction. If this company goes on to raise multiple financing rounds such that new investors and future employees end up with an additional 50%, the seed investor mathematically invested at a $20M post-money valuation. Still good, but not what you think of as seed-stage prices.

This is why celebrating big financings isn’t always such a great thing. Apart from the screwed-up incentives that can arise from overcapitalized companies, each time a company raises money, all prior investors get diluted, which increases the effective post-money of all the earlier dollars.

Factor in all the dollars an investor puts into a company — not just the initial round.

But one might say that this is precisely why it’s important to invest follow-on capital — it helps you protect your ownership. This is true, sort of, but leads to another misconception about multiples:

One needs to consider all the dollars someone invests into a company at each round, not just the initial round.

The problem with follow-on financings is that they have a similar effect on future dilution. Each time an investor puts money into a follow-on round, she preserves her ownership, but increases her cost basis and effective post money.

Back to our hypothetical company and angel investor that invested $1M at $10M post. Let’s say that the company raises just one more subsequent round of financing which is a $10M at $50M post again. But this time, let’s assume the seed investor decides to “lean in” and write a $2M check at this stage. So, what happens is:

The investor bought 10% of the seed

The investor also bought another 4% at the Series A

The investor invested $3M total

The investor’s seed dollars got diluted by 30%

So, the final ownership is (10% x 70%) + 4% = 11%. Since the investor increased ownership, they did “super-pro-rata” in a company they thought was a winner. The company then sells for $200M.

Quick: Is this investment a 10X for the seed investor who initially invested at a $10M post-money valuation?

The answer is NO. The investor made 11% x $200M = $22M. They invested $3M to get there. So it was a 7.3X with an effective post-money of $27M. Pretty good, but not a 10X return.

This effect is even greater if the investor puts capital into multiple future financing rounds, even if they just keep doing their pro-rata share of the round. The example above is simplistic, and I’d argue that 70%+ of $200M exits happen with more future dilution than this.

A Few Takeaways

1) This is why it’s really hard to infer investment multiples from incomplete data.

Someone with only a basic understanding of venture math would think that a seed investor who invests $1M at $10M post would generate a 10X or better return in most $200M exits. But these examples show that it doesn’t take much to turn a 20X scenario into a <10X scenario. All of the scenarios above assume the future financings are up or flat to the prior rounds. They don’t contemplate what happens if there is a down round or a recap along the way.

2) VCs need bigger exits than you think to drive the 10X returns venture model.

When you see data from VCs that talk about 10X returns and the need for 10X returns to drive the venture model, you are probably thinking that the exit size required to generate that 10X is smaller than it really is. Even the 3–5X scenarios require pretty big exits in most cases.

This is why there is some misaligned incentives between founders who might find an exit in the hundreds of millions to represent life-changing money and investors who want the company to keep pushing for an even bigger outcome.

3) This is why venture returns often decline as funds get bigger.

When a fund is getting started, it usually does much less follow-ons in the beginning (especially initial seed funds). When VCs increase their fund size, the rationale is to have more capital for follow-ups. They also need to invest more in follow-ons to deploy that much capital.

But as more dollars are invested in later-stage rounds, this increases the cost basis and effective post-money of the fund’s investment. This often drives down actual fund multiples, even if the investor doesn’t make a lot of mistakes by following on into companies that ultimately fail.

4) The “pile into your winners” strategy really only makes a big difference in two scenarios.

The first is when the “winners” are big, meaning multiple billions of dollars.

The second is when the pile-in happens relatively early. Usually, this happens because the company is under-appreciated. The investor leans in when others don’t believe and gets rewarded for it later.

Apart from these situations, I think it’s somewhat questionable whether that strategy is worth the risk of piling into the wrong companies and the negative effect of increasing your overall cost basis.

5) This is why the very best VC firms do a combination of three things:

Focus on power-law outlier companies.

Buy and maintain ownership cost-effectively.

Keep fund size to a reasonable level relative to their ownership targets.

While the math may be simple, I think it’s very important for VCs & entrepreneurs, to understand how returns are actually calculated.

Shared by Rob, Cofounder of Nextview

FEATURED POST

Don't Include Your Startup Valuation Number On The Slide.

One common mistake that founders make is including the company's valuation on a slide deck.

If you put “raising $5 million at a $20 million valuation” on the slide before you have a lead investor, you’re making a mistake.

You may have an opinion for what valuation you are hoping for, of course, but that will come out as part of the negotiation later on. The amount of money you need is fixed-ish; what you are willing to give up to raise those funds is not.

In the best-case scenario, you find two or three lead investors who end up in a bidding war for the privilege of investing in you…. Read More Here

Join 16000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Trump's Truth Social gets a $5.5B valuation via the SPAC merger, netting Trump $3B for a 60% stake. Read Here

WeWork cofounder and former CEO Adam Neumann has submitted a $500 million bid to buy WeWork out of bankruptcy. Read Here

Fisker, an EV startup, faces delisting from the NYSE due to its stock trading below $1. Read Here

Y Combinator, led by CEO Garry Tan, is reportedly raising $2 billion across three new funds. Read Here

Emad Mostaque, founder and CEO of Stability AI, steps down to pursue decentralized AI. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 10,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Be open-minded…

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Venture Capital Intern - eCAPITAL | Germany - Apply Here

Research Analyst - Positive Sum | USA - Apply Here

Fund Operations - Insignia Ventures Partners | Malaysia - Apply Here

VC Analyst Intern - Educapital | France - Apply Here

Analyst - Credit Innovation | France - Apply Here

Senior Associate Intern - MFV Capital | USA - Apply Here

VC Associate, Growth Team - SpeedInvest | Germany - Apply Here

VC Associate - Speedinvest | UK - Apply Here

Recruiting Operations Specialist - Aartha Venture Fund | India - Apply Here

Associate - Savano Capital | USA - Apply Here

Investment Associate, Healthcare (Pre-MBA) - B Capital Group | USA - Apply Here

Investment Associate - The Production Board | USA - Apply Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to daily VC job updates, VC learning resources, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team