Understand All About SAFE | AI’s $200B Question: Long Term’s Good, Short Team Messy! | VC Remote Jobs and More

Understanding SAFE Aggrement - No Equity & No Debt | AI’s $200B Question | VC Remote Jobs

📢 Today At A Glance

Focus On: Understanding SAFE Aggrement

Featured Article: AI’s $200B Question: Long Term’s Good, Short Team Messy

Major News In Startups: VCs Tell Startups to Pump Brakes on IPO Plans, Health IQ Backed by A16Z Bankrupt & More

This Week’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝In Partnership With: Decko

Get Your Pitch Deck Ready With Decko 💡

I wanted to share about an amazing platform called DECKO! If you are a founder & raising a fund for your startup, they can help you with this.

Decko has an experienced team that helps you create top-notch pitch decks by connecting you with experienced VC investors who shape your content.

Trust me, I have worked with Decko’s Founder and if you are raising funds for your startup, Decko's will be great for you!

📢 Understanding SAFE Agreement: No Debt and No Equity!

If you're a startup founder looking to raise funding, you've likely explored different investment options like equity, various types of debt, and convertible notes. Typically, these options fall into the categories of equity or debt instruments. However, there's another choice, SAFE - Simple Agreement for Future Equity. Unlike traditional instruments, SAFE doesn't fit neatly into either the debt or equity category, and it doesn't involve accruing interest.

You might have heard of SAFE, but let me delve deeper into it to explain each term thoroughly. This way, you'll be well-prepared to approach investors and raise funds through a SAFE Note in the future.

Source: Google Images

SAFE takes the legal form of Compulsory Convertible Preference Shares (CCPS) which is convertible at a future Equity Pricing/ Valuation Round, dissolution, Merger & Acquisition, or at the end of 3 years from the date of issue, whichever is earlier

5 Different Types:

Fixed Conversion at a future date

Valuation Cap, no discount

Discount, no valuation cap

Valuation Cap & Discount

MFN (Most Favored Nation)

Let’s take a simple example:

Seed Round:

Let’s say SAFE Investor invests $25,000 with a $5m Valuation Cap, 20% Discount

Scenario 1: Series A:

Pre-money valuation of the company $10m

Number of Shares= 2m

Share Price= $10m/ 2m= $5

Option 1:

SAFE Investor Choosing Shares at 20% Discount

Share Price= $5*(1-20%) = $4

SAFE Investment= $25,000

Total Number of Shares = $25,000/ $4= 6,250

Option 2:

SAFE Investor choosing $5m valuation cap

Share Price= $5* ($5m Valuation Cap/ $10m pre-money valuation)= $2.50

SAFE Investment= $25,000

Total Number of Shares= $25,000/ $2.50= 10,000

SAFE Investor will apply the Valuation Cap option; which would convert at $2.50/ share.

Finally, the total number of Shares for SAFE Investor= 10,000

Share Price at Series A $5

Share Value of SAFE Investors= 10,000*$5= $50,000

SAFE Investment= $25,000

Unrealized Return= (($50,000- $25,000)/ $25,000)* 100%= 100%

Scenario 2: Series A:

VC Firm Invests at a Pre-Money Valuation = $6 Million

Total number of shares 2m

Share Price= $6 m/ 2m= $3

Option 1:

SAFE Investor Choosing Shares at 20% Discount

Share Price= $3*(1-20%) = $2.4

Total Number of Shares= $25000/ $2.4= 10,417

Option 2:

SAFE Investor choosing $5m valuation cap

Share Price for SAFE Investor= $3* ($5 Million Valuation Cap/ $6 Million pre-money valuation) = $2.5

Total Number of Shares= $25,000/ $2.5= 10,000

SAFE Investor will apply the Discount option; which would convert at $2.4/ share.

Total number of Shares for SAFE Investor= 10,417

Share Price at Series A= $3

Share Value of SAFE Investors= 10,417*$3= $31,251

SAFE Investment= $25,000

Unrealized Return= (($31,251- $25,000)/ 25,000)*100%= 25%

The higher the Valuation Cap in the iSAFE round, the better it is for the Founder, resulting in a lower dilution of Equity provided the Founders are confident to close the next round at a higher than the valuation cap.

MFN Clause:

Let’s say SAFE A has an MFN Provision.

If a new SAFE B is issued, the company has to tell SAFE A about it.

If the terms of SAFE B are better for the investor than SAFE A, then SAFE A can ask for the same terms as SAFE B.

That’s it, I hope this helps you to understand the SAFE Note. If you need the Excel template that we used here. Join our community and get access to our resources.

Join 5900+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

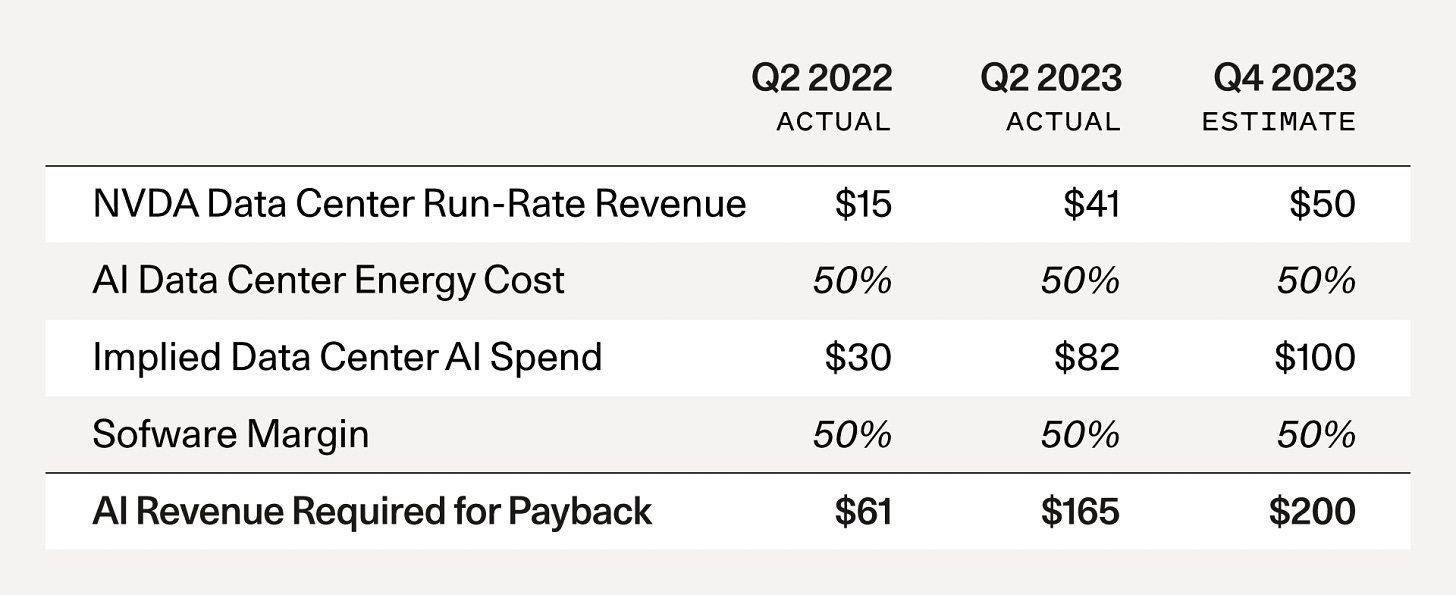

📢 Featured Article: AI’s $200B Question By Sequoia Capital

I have come across this interesting article - “AI’s $200B Question” where they mentioned that GPU capacity is getting overbuilt. Long-term, this is good. But in the short term, things could get messy. So sharing the summary and my takes on this article.

“In the fast-paced world of AI, the recent surge in Generative AI, spurred by Nvidia's impressive earnings, has shifted the industry into high gear. Notable consumer launches like ChatGPT, Midjourney, and Stable Diffusion, alongside Nvidia's success, have ignited massive investments in GPUs and AI training.

Source: https://www.sequoiacap.com/article/follow-the-gpus-perspective/

However, a critical question looms:

what's the end goal for all these GPUs? Who benefits, and how much value needs to be created to justify this frenzy?

Consider this: ‘For every $1 spent on a GPU, $1 must be spent on energy costs. With Nvidia's projected $50B GPU revenue, it implies $100B in data center expenses. Plus, end users like Starbucks, Tesla, and others need to earn a margin, making the total revenue requirement astronomical. Much of this expenditure comes from tech giants like Google, Microsoft, and Meta, raising concerns about whether these investments align with genuine customer demand or are speculative.’

Although companies like OpenAI, Microsoft, Google, Meta, and others are generating significant AI revenues, there's still a substantial gap to fill. This creates a massive opportunity for startups to innovate and create genuine value for end customers. The focus needs to shift from infrastructure to creating products that people love, use daily, and are willing to pay for. With the infrastructure in place, the challenge now lies in harnessing AI's power to change lives, emphasizing customer satisfaction as the key to success.”

If you want to read the full article - here is the link.

📰 Major News: VC Highlights & Massive Funding Updates

VCs Tell Startups to Pump Brakes on IPO Plans Read Here

Health IQ Backed by A16Z Bankrupt Read Here

An increasing number of new VC funds. What does it mean? Read Here

Why Fund Managers and Partners Are Quitting VC Firms In India Read Here

Down rounds are rising. History shows things could get much worse Read Here

Subscribed To: VC Daily Digest Newsletter and join 2500+ Avid Readers For Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox. 🚀

🗞️ Weekday’s Must Read On: Startup, Technology & VC

The Future of Silicon Valley Read More (Venture Capital )

What does it take to raise capital, in SaaS, in 2023? Read More (Startups)

Startups Fail All The Time, But Many Could Fail Better By Thinking Beyond the VCs and Founders Read Here (Startup)

Building a Generational Business Databrick by Databrick Read More (Technology)

Why Do VC Firms Want an Option Pool Before the VC Round? Read More (Startup)

Building Applications with AI - Lessons from LangChain, Hearth, & Context.ai Read More (Technology)

Decoding Term Sheet: Liquidation Preference | Participation & Non-Participation Rights (Venture Capital)

💼 Venture Capital Remote Jobs & Internships

Vorverk Venture - Analyst Internship | Remote - Apply Here

Harlem Capital - Winter 2024 Internship | Remote - Apply Here

Initialized Capital - VC Partner | Remote - Apply here

Summer Associate - Early Bird Venture | Remote - Apply here

Senior Associate - Third Derivative | Remote - Apply Here

Venture Partner - Mobility Fund | Remote - Apply Here

Pulsar VC - VC Fellow | Remote - Apply Here

Join our VC Enthusiast Community - VC Crafters - A Community For VC Enthusiasts To Learn, Collaborate, Network and Craft Path To VC.

🙀 Get access to VC Career Resources - Curated By Leading Venture Capitalists! Get It Yours - here

📦 Share VC’s Newsletter

Refer a friend to gain access to our venture resources. 🎊

Get Venture Capital and Investors Database. for 4 referrals

Get Access To private Slack for 10 referrals

Get On a 30-minute call for 15 referrals ( To Discuss fundraising, breaking into VC funds, making a pitch deck, building a newsletter and others)

✍️Written By Sahil | The Venture Crew Team