Netflix Co-founder's 'The Canada Rule' For Building Successful Startups 🧐 | Pre-Money Valuation Growing 💹| VC Remote Jobs

“Dry Powder” is being used in Convertible bridge rounds....😵

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Netflix Co-founder's 'The Canada Rule' for Building Successful Startups.

Quick Dive

Pre-money valuations are still growing across most stages in Europe.

Quantitative Perspective On Q1’2024 US VC Market.

“Dry Powder” is being used in convertible bridge round.

Featured Article:

Marc Andreessen, "When the VCs say “No”...Major News:

SoftBank’s $118 Billion Arm Problem, Tesla's Rivals Facing Negative Reviews, Moonshot AI Raised $1 Billion & More.VC Weekly Board: Founder & Investors Community Announcement…

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

“Can You Send Us Your Data Room?”

Infamous last words from a VC you never heard from again. Sound familiar?

Don’t fall prey to giving away all your data for nothing in exchange.

Download Thunder’s Data Room Sharing Playbook to know when to send what to investors to maximize their engagement with your fundraising round.

Thunder.VC is a tech-enabled investment bank that has helped companies secure over $100M in capital.

Try our free tools for founders, like our VC Finder Tool and Debt Finder Tool, which have helped 100’s of companies secure over $1B in financing.

Partnership With US: Promote your startup to our community of 22,500+ entrepreneurs and investors. Fill out the form, our team will reach out to you….

TODAY’S DEEP DIVE

Netflix Co-founder's 'The Canada Rule' for Building Successful Startups.

It’s possible to drown in opportunity. When you’re building a startup you think anything is possible, and it’s easy to fall victim to shiny object syndrome by chasing too many opportunities at once.

To avoid this, Netflix co-founders have a strategy that every founder can follow - that’s “The Canada Rule”. What does it mean? Why is this strategy called ‘The Canada Rule’ and How does Netflix use this strategy to build business?

The Canada Rule Says -

For a company, instead of blindly chasing down every compelling opportunity, you need to have the discipline to stay focused on the one or two most important things.

While it may seem like a straightforward strategy the most important thing- is how can someone identify the most important things for their startup. let’s understand this with the Netflix story…

This story was shared by Netflix co-founder, Marc Randolph

“ Today, Netflix has customers in nearly every country in the world, but that wasn’t always the case. In fact, for our first 12 years, we limited our services to the United States.

When we started, we simply didn’t have the infrastructure, or the money to serve international markets. Those first few years we had a couple of guys in a bank safe hand stuffing envelope, and our entire business model was based on US postage rates.

Nonetheless, we thought frequently about expanding into Canada. It was close, the regulations were easy, and the postage and transport costs were low. When we ran the numbers, we saw that we could probably get an instant revenue bump of about 10 per cent.

But we didn’t do it.

Why? Two reasons:

First, we knew it was inevitably going to be more complicated than it looked. Because French is the main language spoken in some parts of Canada – and required by law to be used in those regions – we would have translation headaches. Canadians use a different currency, which would have complicated our pricing. And the fact that Canada also calls that currency a “dollar” threatened to be a communications nightmare. Postage was different, too, so we would have to use a different envelope.

In other words, even something seemingly simple was bound to be a huge pain in the ass.

But the bigger reason for staying out was simpler -

If we took the amount of effort, manpower, and mind-power Canadian expansion would require and applied it to other aspects of our business, we’d eventually get a far greater return than 10 per cent. Expanding to Canada would have been a short-term move, with short-term benefits.

It would have diluted our focus.

We called this The Canada Principle and it served as a constant reminder to us to make sure we didn’t run around chasing what appeared to be low-hanging fruit, all the while taking our eyes off what was truly important in scaling our business.”

So it’s a reminder for every founder out of there to not run toward low-hanging fruits and to focus on the most important thing (Value Adders and easy to scale).

Even Paul Graham Follows “The Canada Rule”. In this video, he shared this strategy with examples of Apple and other companies.

“Startups should follow ‘The Canada Rule’ by focusing on serving a very specific customer by building a small, but intense fire.

Rather than thinking about expanding in various markets, they should capture their geography as much as possible with a large market share.

Take Apple, for example. Back in the day, they kicked off by selling just 500 Apple-I computers. Fast forward, and now they're ruling the business world. The trick is to find a small group of people who want your product like crazy. Like, they'd be genuinely bummed if you stopped working on it.”

So, Paul's advice is to throw a virtual party with these early users and focus entirely on making them super, duper happy.

It's about quality over quantity at the beginning.

He even suggests treating your first user like your VIP client. Imagine if Sam Altman (yeah, the bigwig from Y Combinator) hired you to create an email app just for him. Your mission: Make Sam happy.

The logic is simple but powerful. If you can create something that deeply satisfies a few people, chances are it'll resonate with a whole bunch more. It's like planting the seed for future success. Sure, there are plenty of other steps to get right as you grow, but this initial focus on a small group's happiness is the foundation for that crazy, wildfire-like growth.”

So don’t run toward low-hanging fruits and try to focus on the most important thing in your startup.

If you want me to answer your questions on fundraising and product building in the upcoming newsletter, feel free to post your questions in this form.

TODAY’S QUICK DIVE

Pre-money valuations are still growing across most stages in Europe.

Europe's venture market saw many valuation corrections last year, but the median pre-money valuation increased yearly across most stages. A report from the pitchbook says -

The median pre-money valuation in the UK & Ireland for venture-growth companies was up by 4.8% YoY, showcasing resilience in this region.

In the late-stage VC, the median deal value increased by 11.7% YoY, indicating positive growth in the stage.

Pre-seed stage demonstrated strength with a 4.0% YoY increase in median pre-money valuation, highlighting resilience in this segment.

Seed-stage deals saw a mixed trend with a 5.3% YoY increase in median deal value but a 9.2% decline in median pre-money valuation.

Despite an overall decline in VC markets, the aggregate post-money valuation for companies valued at €1 billion or more only decreased by 2.3% in 2023, showing resilience in this segment.

Despite some declines in valuations, there are still highly valued companies in sectors like AI, indicating ongoing robust activity and deal appetite More Here

Quantitative Perspective On Q1’2024 US VC Market

A recent study by Pitchbook shared an interesting perspective on the current state of the US VC Market -

Market Performance: VC fund returns decreased by 22.7% from their peak in Q4 2021, reflecting a correction in valuations 30. Additionally, VC investment volumes in Q4 2023 were down by 61.8% compared to the same period in 2021.

Investment Trends: In Q4 2023, deal activity in the VC market saw significant declines, with buyouts, growth equity, and VC investments decreasing by -47.8%, -44.9%, and -61.8%, respectively, compared to 2021.

Fundraising Challenges: VC fundraising faced notable challenges, with LP commitments down in VC vehicles. This led to a decrease in available capital for startups, resulting in belt-tightening and down rounds.

Investor Power: Fund managers gained more negotiating power in the VC market due to the dearth of available capital, potentially resulting in higher-quality deals being executed.

Unicorn Creation: In 2023, 45 new unicorns were created in the VC market, while 23 unicorns exited the club. This indicates a more realistic approach to valuations and market dynamics.

Overall, the VC market in the US experienced significant shifts in performance, investment activity, and fundraising in 2023.

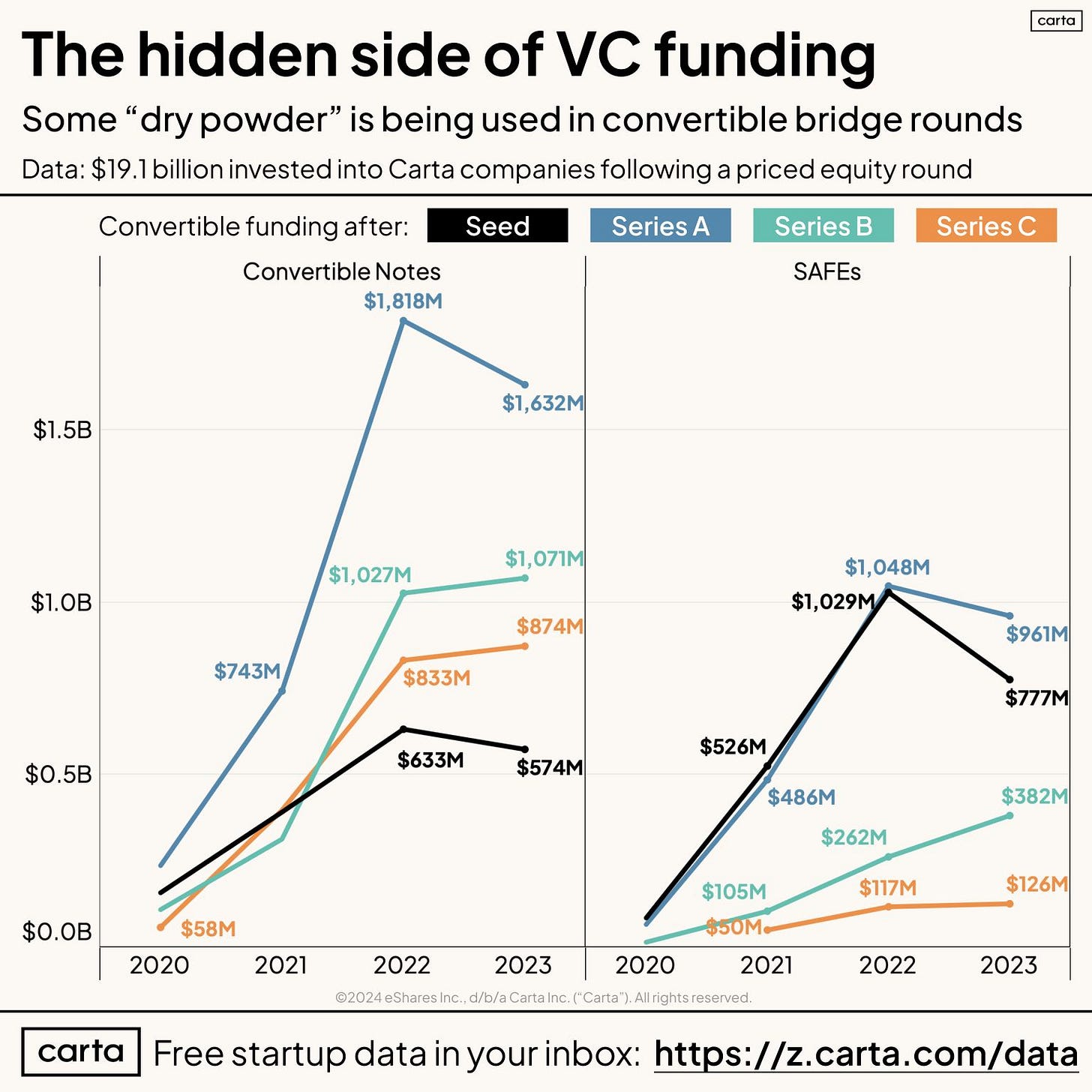

“Dry Powder” is being used in Convertible bridge rounds.

A recent analysis by Carta - shows that VCs use dry powder to fund bridge rounds.

Founders and VCs did an unprecedented amount of creative financing last year.

Raising a priced VC round was tough. So what did thousands of founders do instead?

They raised an extension/bridge round using convertible notes or SAFEs.

Again, all of these convertible financings happened AFTER a company had already raised the primary round.

In 2020, $58M went into Series C companies on convertible notes. Just 3 years later, that number ballooned up to $874M.

With the messiness of seed-stage trends, a lot of cash is moving to those companies through SAFEs or notes even after a priced round.

But Series B and C? That suggests a serious inability to raise primaries and represents a pretty large and uncertain bet by founders and investors on those middle-growth scaleups. So we get a little bit of the answer to "Where will all the dry powder go?"

FEATURED POST

When the VCs say “No”...

One 'no' doesn’t mean anything—the VC could just be having a bad day.

If you meet with five, or six, or eight VCs and they all say no, it’s not a coincidence. There is something wrong with your plan. Many founders come across posts like 'Startup founder secures funding after pitching to 100 VCs' and feel motivated to pitch to as many investors as possible.

However, what these founders often overlook is that those who successfully raised funding after numerous pitches to VCs retooled their plans every single time.

Meeting with more VCs after a bunch have said no is probably a waste of time. Instead, retool your plan—which is what this post is about..… Read More Here

— Marc Andreessen

Join 14500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

SoftBank's $118 Billion Arm Monetization Problem. Read More

Federal Trade Commission investigating potential antitrust violations in Amazon's and Google's investments in Anthropic. Read More

Sequoia Capital is attempting to remove Michael Moritz, its former leader, as the chair of fintech firm Klarna. Read More

Call of Duty League team owner suing Activision Blizzard for $680 million. Read More

Capital One plans to buy Discover Financial Services in an all-stock deal. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9500+ Avid Readers!

VC’s WEEKLY BOARD

We are planning to launch a verified founders & investors community….

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Program Manager - Plug and Play Tech Center | USA - Apply Here

Program Manager - Plug and Play Tech Center | Canada - Apply Here

Biotech Investment Analyst - Claris Ventures | Italy - Apply Here

Junior Analyst - Climate Investing - New Zeland - Apply Here

Managing Director - Conexus Venture Capital | Canada - Apply Here

Investment Analyst - Panacea Innovation | UK - Apply Here

Investment Analyst - DeepTech & AI - PeakXV | India - Apply Here

Venture Capital Analyst Intern - Clay Capital | UK - Apply Here

Investment Analyst - Panacea Innovation | UK - Apply Here

Portfolio Engagement Director - Toyota Venture | USA - Apply Here

Life Sciences Senior Associate - General Catalyst | USA - Apply Here

Technical VC Analyst - Superseed venture | UK - Apply Here

Portfolios Manager - Prime Venture | India - Apply Here

→ Looking to break into VC / Want Daily Updates on VC Job Opportunities? Join VC Crafter 👇

Join our 250+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Tuesday!

Happy Thursday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team