How to Win in a Crowded Market (and Get VCs to Bet on You) | VC & Startup Jobs.

Most Founders Get CAC < LTV Wrong & Questions VCs May Ask You.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital.

🤔 Quick question: If someone handed you $250K to build your startup, what would you do first? Well, this week’s partner, Forum Ventures, is doing just that—they’re investing $250K in startups from idea to traction. If you're building, you’ll want to check this out. In today’s newsletter -

Deep Dive: How to Win in a Crowded Market (and Get VCs to Bet on You).

Quick Dive:

Questions VCs May Ask You - The Only Guide You Need.

Most Founders Get CAC < LTV Wrong—Here’s How to Fix It.

Major News: OpenAI’s ex-CTO, Mira Murati hires OpenAI Cofounder,Apple’s new iPhone SE might be announced next week, OpenAI rebrands itself & Stanford researchers created an open rival to OpenAI’s o1 ‘reasoning’ model.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Jen Abel on when to hire Head of Sales.

Y-Combinator guide: How Much Should You Raise?

How to split equity between cofounders: from Y-Combinator founder.

All-In-One guide to pitch deck storytelling - Free template & curated resources.

The definitive study on founder ownership in VC-backed companies from Carta.

5 things to know when building successful paywalls.

Peter Yang on what software's next chapter is really about.

Financial modelling template to build your startup financial model that every investor wants to see.

Building cap table as a founder: template to download.

A MESSAGE FOR FOUNDERS

📢 From Idea to Traction—Forum Ventures Has Your Back

One of the most common things we hear from early-stage founders is how lonely the journey can feel. As past founders, we know what it takes to get from zero to traction.

Forum Ventures’ accelerator and AI venture studio fast-track that journey with you, guiding and supporting as your partners along the way.

Idea, MVP, or in-market—we’re ready to back you with:

Up to $250K investment

GTM, sales, & fundraising guidance

Intros to 25+ top-tier funds

A community of 950+ founders

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How to Win in a Crowded Market (and Get VCs to Bet on You).

Here’s a well-known secret: VCs don’t love crowded spaces.

If a bunch of companies are chasing the same problem, it means brutal competition for customers, which usually means higher costs and slower growth. Not exactly what investors dream of.

But here’s the flip side—some companies do win in crowded markets. And when the market is big enough, VCs will still invest. The key? They need to believe they’re betting on the right startup.

So, if you’re a founder building in a competitive space, the real question is: how do you stand out?

That’s exactly what we’re diving into today.

To make this real, let’s talk about a space that’s super crowded: AI. (Agree??)

Specifically, AI-powered sales development representatives (SDRs)—tools that help sales teams find and qualify leads faster.

(From my VC friend: We see at least one AI SDR startup every week. There are plenty more out there raising money. So yeah, it’s competitive.)

That said, sales as an industry has a huge total addressable market (TAM), and AI is, well, everywhere right now. VCs want to invest in this space. But only if they believe a startup can return 100 their money. (Can your startup return VC funds?)

Which brings us to the challenge:

How do you prove you won’t stall after some early traction?

How do you avoid insanely high customer acquisition costs?

How do you convince VCs you’re the one to bet on?

The answer: find a market wedge.

The Market Wedge Strategy

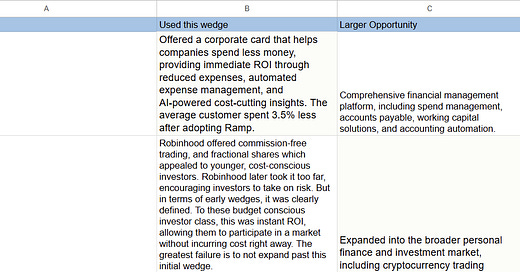

A wedge is simply a strategy to win a large market by initially capturing (1) a tiny part of a larger market or (2) a large part of a small adjacent market.

So if you want to break into a crowded market, don’t try to be “just another AI sales tool.” Instead, specialize.

Example: Instead of being a generic AI SDR, you could be the AI SDR for veterinarians.

Why? Because focusing on a niche:

Gives you a clear target audience with a unique need.

Makes customer acquisition way easier.

Helps you stand out from the sea of generic competitors.

But VCs won’t just ask, “What’s your wedge?” They’ll ask, “How do you grow beyond it?”

Here’s where your expansion strategy comes in:

Vertical Expansion – Offer more services to your niche.

You start with AI-powered sales for vets.

Then add appointment scheduling, inventory management, etc.

Horizontal Expansion – Expand to similar industries.

What other businesses are similar to vet clinics?

Maybe dental offices? Physical therapy clinics?

The key is to show investors that you’re thinking beyond today’s niche and into tomorrow’s empire.

Getting Customers (Without Burning Cash)

A wedge is great. But without customers, it’s just a nice idea. VCs want to see that you can acquire customers efficiently.

If you already have industry connections—amazing. Maybe you:

Come from a family of veterinarians.

Worked in the industry and have built-in relationships.

But what if you don’t have these connections? That’s where partnerships can be a game-changer.

For example, if you’re targeting veterinarians, you could:

Partner with some Medical Association to tap into their network.

Work with private equity firms that acquire vet clinics (and need them to grow).

Get backing from VCs specializing in pet tech, who can open doors.

The goal is simple: show VCs you can acquire customers from day one—without breaking the bank.

Here’s another tip: VCs love learning.

If a founder teaches them something they didn’t know, it makes them way more likely to invest.

That means your job is to be the expert. You should know more about your niche than anyone in the room.

How do you prove that?

Challenge common assumptions: “Everyone thinks X about the veterinary industry, but actually, it’s Y.”

Drop surprising insights: “Did you know 73% of pet owners would pay more for AI-enhanced vet services?” (Okay, I made that up, but you get the idea.)

Offer a fresh perspective: Explain why your approach makes more sense than the status quo.

And don’t shy away from the competition. Yes, the market is crowded—but that’s because the opportunity is massive. If you can prove you understand the market better than anyone else, you position yourself as the founder VCs want to back.

So, if you’re in a crowded space and want to win investors over, here’s what you need to do:

Find your market wedge—a niche that gives you an entry point.

Show how you’ll expand beyond that wedge over time.

Prove you can acquire customers efficiently (without insane costs).

Know your market better than anyone else in the room.

In a crowded market, the loudest voices don’t win—the smartest, most strategic ones do.

So be different. Challenge assumptions. And make it impossible for investors to ignore you.

Who knows? Maybe your AI-powered vet sales tool is the next unicorn. Just don’t forget the little people when you make it big. 😉

RNO1 HAS MESSAGE FOR YOU

🤝 Your Brand Deserves More Than Just a Website

Your brand’s digital experience isn’t just a website—it’s your first impression, your customer journey, and your growth engine. At RNO1, we build Radical Digital Experiences that make brands stand out, scale, and win.

Whether you need a bold website, a seamless app, a high-impact digital product, or a performance-driven marketing strategy, we create digital ecosystems designed for conversion, engagement, and long-term success.

Here’s what we do best:

Branding & Digital Strategy – We craft identities that don’t just blend in, but dominate their space.

Web & App Development – Scalable, high-performance platforms built to evolve with your business.

UX/UI & Digital Product Design – Immersive, conversion-focused designs that turn users into customers.

Go-To-Market & Growth Strategy – Data-driven marketing to drive real business impact.

Performance Marketing – SEO, PPC, social, and email campaigns that fuel brand awareness and revenue.

We’ve built next-level digital platforms for brands like Airbnb, and Dentsu, and we’ve helped startups secure $100M+ in funding and reach $1B valuations.

Your digital presence should do more than just exist—it should perform.

Let’s make that happen. Reach out today! →

📃 QUICK DIVES

1. Questions VCs May Ask You - The Only Guide You Need.

I’ve seen posts claiming that VCs will ask you 250+ questions in a pitch meeting. That’s nonsense. No investor is sitting there running through a checklist that long. (If you know one, let me know—I’d love to meet them.)

Instead, here’s a list of key questions you’re actually likely to face. These are the ones I used to ask while working with VC firms, and I’ve also gathered insights from leading investors to curate this list.:

Team

Tell me a bit about your background and your co-founder(s)’s background.

How do you all know each other?

How long have you worked together and in what capacity?

Why is your team uniquely motivated to solve this problem?

Why did you pick your co-founder?

Who do you need to hire during the next 18 months to be successful?

When was the last time you had disagreed on a business issue? How did you resolve it?

Do the founders have the knowledge to build the technology or would they need outside help?

What does the cap table look like? (equity distribution across founders)

Problem You’re Solving

What is the specific problem you are solving?

How big / serious of a problem is it?

Why is this a problem?

Who has this problem?

Solution / Product

How are people solving this problem today?

Describe your solution to this problem.

What effort / timing is required to switch from a different solution to yours?

(For deeptech) What is unique about the tech? (Do you have any patents / IP / trademarks?)

What is your product roadmap for the next 6-12 months?

Market / Market timing

Why now?

Why hasn’t this worked / been done before?

How big is this specific market?

How many people does it affect?

How much money are people spending to solve this?

What is your unfair advantage?

Who would you see as your key competitor at the moment? Why?

Customer Acquisition / Unit Economics / Go-To-Market

Who is your customer persona?

Who is the end user?

Who is the buyer?

What does a day-in-a-life look like for these people?

How much are people paying today? (range?)

How much do you think you can charge in the future?

How are you currently getting users / customers? (what customer acq channel(s)?)

How do you think you will get users / customers in the future?

How much does it cost you currently to get a user? And in which channel?

How much does your solution/product cost (COGs)?

How much will it cost in the future?

Why do people buy / use your solution?

What is the sales cycle to-date?

How does the product team interact with current and potential customers? If so, how and how often?

Competition

What differentiates your solution from other alternatives?

Who are you more afraid of: Google or another startup?

Who are you most afraid of?

What happens if a Google (or equiv) does this?

Who are the major players?

What is your moat?

Traction

When did you start the company?

How many customers do you have to-date?

Or how many pilots / contracts signed?

When are the start dates of those pilots / contracts?

What are the contingencies?

Or how many LOIs signed? What do those look like?

How much revenue have you generated to date?

(Note: GMV is different from revenue)

As product revenue vs consulting / services revenue?

What are your margins?

Any notable customers?

Any enterprise customers paying big money?

What does retention or churn look like? (if you know)

What does engagement look like?

Any upsells?

When will your company break even in terms of profitability and cash flow?

Fundraising / plans

How much have you raised to date?

At what terms?

Who are your current investors?

How much are you looking to raise?

What are you looking to achieve (milestones) with this round if everything goes well?

Use of proceeds?

Where are you in your round?

Have the current terms been set? And if so, what are they?

What is your burn rate?

What is your top priority for the next 3-6 months?

What are your capital costs? (if capital intensive, like hardware / e-commerce)

Minimum batch sizes / inventory / etc?

Have you secured a lead investor for the round? If so, who and how much is the lead investing?

That’s it. You don’t need to prepare for 250+ questions. Some questions might even feel frustrating—like “What if Google builds this?” or “How does this become a billion-dollar company?” I know many founders get stuck on these and struggle to answer them.

That’s why I’ve put together a solid guide to help you tackle these questions with confidence. You can check it out here.

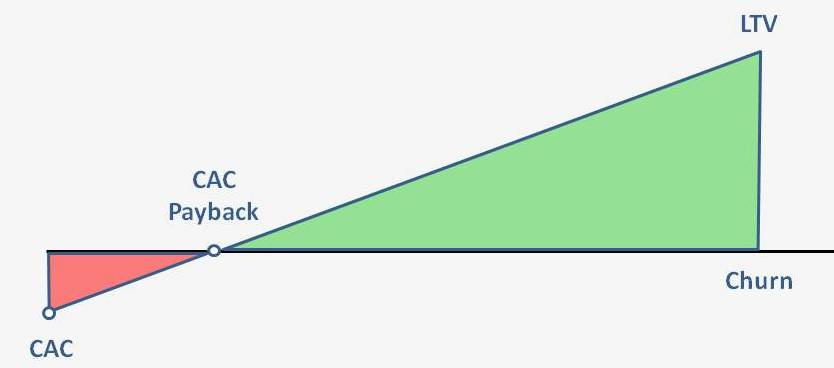

2. Most Founders Get CAC < LTV Wrong—Here’s How to Fix It.

Bret Waters (Entreprenur & Prof. Stanford) shared a short write-up about how his VC colleague thinks founders often misunderstand CAC < LTV and what really matters. Most startups don’t fail because the concept is flawed—they fail because they don’t track it properly.

A business is simple—it attracts customers, delivers value, and makes a profit. But if acquiring a customer costs more than what they bring in, that’s a problem.

Many founders assume customers will come easily and stick around forever, but in reality, marketing is expensive, and churn is inevitable. Optimism fades when the numbers don’t add up. As Hemingway might say, startups go broke gradually, then suddenly.

Investors care about LTV/CAC because it signals how well a business scales. If every $1 spent on customer acquisition returns $5, that’s an engine worth fueling.

Not all customers are equal. Often, 20% of customers generate 80% of profits. Understanding who those high-value customers are and optimizing for them changes everything.

Tracking cohorts is key—customers from Facebook ads behave differently than those from referrals or Google ads. Knowing these patterns helps founders spend money where it actually works.

Then there’s velocity. A high LTV/CAC ratio looks good on paper, but if it takes years to recoup acquisition costs, it’s a problem. Some investors track CACD—how fast an initial investment in CAC doubles. If it takes longer than eight months, growth is too slow.

So CAC < LTV is fundamental, but often misused. Founders need to dig deeper—focus on high-value customers, analyze acquisition sources, and track how fast money returns. Do that, and you’re building something that not only survives but scales.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Hitachi Ventures, a Munich-based corporate VC, secured $400M for its fourth fund to back deep tech startups in AI, energy, biotech, and manufacturing.

GTMfund, led by Max Altschuler, closed a $54M second fund to back early-stage startups at pre-seed to Series A.

Overlap Holdings, a NYC-based venture capital firm, closed its first fund, Overlap Holdings Flagship Fund 1 (OHF1), at $33m.

Cherry Ventures, UK based venture capital firm closed $500M fund to invest in European startups.

Researchers from Stanford and the University of Washington developed s1, a reasoning AI model trained for under $50 using Google’s Gemini 2.0 Flash Thinking Experimental, rivaling OpenAI’s o1 and DeepSeek’s R1 in key benchmarks.

Amazon plans to unveil an upgraded Alexa with AI-powered enhancements, enabling it to handle multiple commands in sequence, a major shift from the current single-request limitation.

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

Venture Analyst - Hearst Venture | USA - Apply Here

Technical Visiting Analyst - Concept Venture | UK - Apply Here

Venture Partner - Dardania Capital | USA - Apply Here

Analyst - MongoDB Venture | USA - Apply Here

Chief of Staff - Voyager Venture | USA - Apply Here

MBA Venture Capital Associate Intern - DRW Venture Capital | USA - Apply Here

Associate - Entrepreneur First | USA - Apply Here

Technical Investing Associate - Capital One Venture | USA - Apply Here

Senior Analyst/ Associate - Insignia Venture Partner | Singapore - Apply Here

Investment Analyst Interns - White Whales | India - Apply Here

Principal - Investment - Baldota Group | India - Apply Here

Investment Analyst - Makia Capital | India - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator