How Can This Be A Billion-Dollar Company? - Annoying Questions From VC II. | VC Jobs

North Star Metrics Framework & How to Split Equity between Cofounders ?

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How Can This Be A Billion-Dollar Company? - Annoying Questions From VC.

Quick Dive:

North Star Metrics: Identify Bad & Good Metrics.

How to Not Ask VCs for Money?

How to Split Equity between Cofounders & When You Should (and Shouldn't) Split Equity Evenly?

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Peter Thiel Has Now Sold $1 Billion of Palantir Stock This Year, Softbank Backed Indian Startup Filed For $1.25 B IPO, OpenAI CTO Mira Murati Steps Down & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER

We Write, Design And Model Your Pitch Deck Into a Storytelling Book

Pitch deck creation can feel like a daunting task, especially for first-time founders. From deciding what information to include to ensuring your visuals are on point, there are a lot of moving pieces to juggle.

And if you're not careful, it's easy to end up with a deck that fails to capture an investor's attention.

That's why Venture Daily Digest is opening up a limited number of exclusive slots to provide hands-on support in building a pitch deck that will leave a lasting impression. Our team of experts, designers, and investors will work closely with you to build your pitch deck.

PARTNERSHIP WITH US

Reach 58,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S DEEP DIVE

How Can This Be A Billion-Dollar Company? - Annoying Questions From VC.

After my last write-up, a lot of founders reached out about the frustrating questions VCs often ask — the ones they don’t know how to answer. So, in this piece, I’m going to share some of the most common questions you’ve brought up:

Why hasn’t this been done before?

This might sound like a silly question, and some could say a lazy VC just doesn’t want to do their homework. But really, it’s a smart way to see how you think about trends and changes in your market.

If you believe that markets are efficient, then your opportunity shouldn’t exist. Why? Because if it were that obvious, everyone would have already jumped on it.

So, what’s your special insight? What do you know that others don’t? Is it your deep knowledge of the industry? Is the opportunity sitting at the intersection of two areas that most people don’t understand? Or is it a trend you’ve noticed in a specific group of people that others haven’t picked up on?

Every startup needs to have a solid answer to this. Even investment funds face this question—why is no one else doing what you’re doing? It might be annoying to hear, but it’s a valid question.

So, if a VC asks you this, don’t get defensive. Use it as an opportunity to explain what makes your idea unique and why you’re the right person to take advantage of it. If you can’t answer this question, it might be time to rethink your approach.

Contact us if you like but we prefer warm introductions.

It’s kind of funny that VCs often want warm introductions, yet many VC analysts still reach out cold to startups asking to chat.

My advice? Always aim for a warm referral to a VC if you can. Having a mutual connection really helps in building rapport. However, many newer VCs, especially microVCs, are open to cold emails. Also for most VC firms, about 20% of deals come from completely cold outreach, and see no difference in performance between those and the ones that come through warm introductions.

Looking ahead, I predict that in the coming year, the VC landscape will increasingly accept good cold emails. Sure, most cold emails are poorly written and will be ignored, but if you craft a strong one, you might just catch their attention.

What’s the moat? (for a seed stage)

This can be really frustrating for a seed-stage company since, let’s face it, there’s usually no real moat in place yet.

When you think about it simply, the only true way to create a moat is to make your customers love your product so much that they never want to leave and keep coming back. There are many ways to achieve this. For example, you might offer a better user experience, leverage more data to improve your solution's accuracy or create strong network effects that enhance your product. The path to building this loyalty will vary depending on your idea.

VCs are particularly interested in understanding how you plan to achieve this on a larger scale. This is especially important for companies with commodity products, like those in finance. Competing on price or better deals isn’t sustainable. Instead, VCs want to know how you’ll create a smarter, more appealing product. How will you design your business model to encourage customer retention? They’re more focused on how you envision this five years down the line than on your current situation.

How can this be a billion-dollar company?

The reason VCs are so fixated on billion-dollar companies is simple - the economics of running a VC fund are brutal. Most of the startups in their portfolio will fail completely. So any 1 or 2 winners they have need to make up for all those failures, plus a whole lot more, in order to generate the returns their investors expect.

This means VCs are looking for at least a 100x return on a successful investment. If they invest at a $10 million post-money valuation, say at the seed stage, 100x on that is around $1 billion, before accounting for dilution.

So it all comes back to the question you have to ask yourself - do you really want to be raising money from VCs? Is this the type of business you want to build? One that needs to be a unicorn to justify their investment?

There are other paths, like bootstrapping or targeting a smaller but profitable market. Those may not make you a billionaire, but they can still lead to a great business. It's a very personal decision based on your goals and aspirations as a founder.

The key is to be really honest with yourself about what you want, and what you're willing to do to get there. Don't just chase the VC money because it's available. Make sure it aligns with your vision. Because once you take it, you're locked into their timeline and expectations.

“Yes but what *traction* do you have?” & “Your valuation is so HIGH now!”

It's like the classic Goldilocks story - sometimes you're too early, sometimes too late, and it's rare to be just right.

At first, VCs might say you don't have enough traction. Then, once you gain some momentum or bring in another investor, suddenly you're too late - the valuation is too high for them to get in.

As frustrating as this is, it really comes down to luck, timing, and fit. As pre-seed investors, we face this too. We invest super early, before traction even exists. So we rely heavily on gut instinct about the opportunity. If we're not fully convinced, we'll pass. And if a founder later proves us wrong with traction, we still can't invest because the valuation is out of reach.

It's a bummer, but VCs who miss out feel the pain too. Look at the Uber IPO - tons of VCs lost out on huge gains because they didn't believe in the idea early on.

Gut instinct is huge in this business. To be honest, you only need to be right 20-30% of the time to be considered a great VC. It's like baseball - you strike out most at-bats. Imagine if surgeons only succeeded that rarely - they'd be fired and patients would be dead!

The only exception is multi-stage investors. If they miss your seed round, you can always circle back for a Series A or B. But for early-stage VCs, it's a constant dance of being too early or too late.

That’s it.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. North Star Metrics: Identify Bad & Good Metrics.

The North Star Metric (NSM) is widely attributed to startup founder, advisor and investor Sean Ellis. It’s a single metric which can align the entire company around an overarching mission whilst simultaneously reflecting the value being delivered to customers.

Look at the mission statements of two of the world’s best-known companies, Google and LinkedIn:

Google – “Google’s mission is to organise the world’s information and make it universally accessible and useful”

LinkedIn – “Connect the world’s professionals to make them more productive and successful.”

The goal of the North Star Metric is to quantify this mission and express it in a way that can be measured and tracked. It is often used as a guiding light for the entire company to rally around – a sort of special key performance indicator (KPI).

Founders often make mistakes in choosing the right North Star metrics for their startups. What is a good North Star Metric?

Which metric, if it were to increase today will accelerate business flywheel?

Lenny Rachitsky

Here are some best practices for deciding on a good North Star metric:

Is it measurable?

It is simple, memorable and easily understood?

Is it a leading (not lagging) indicator of success?

Does it help your customers reach their end goal?

Does it apply to all customers and does it add value to all customers?

What is a bad North Star Metric?

There are also some poor metrics to use as a north star, the most common of which is revenue. Below are some characteristics you should aim to avoid when deciding on a north star metric:

Lagging indicators that show past performance, not future potential.

Metrics are hard for employees to influence or understand their impact on.

Metrics do not reflect customer value delivery, like vanity metrics.

Generic metrics that don't represent your unique business strategy.

Your north star should be unique to your business (or at the least your business niche) and should be an indicator of the problem you solve for customers, and the value provided to them.

Below we have provided examples of North Star metrics from many well-known brands. Notice how they are not all perfect, but generally, all reflect value delivered to the market.

North Star Metrics - if this metric grows, all other metrics will be growing too. Such as engagement, acquisition, and sales.

Adam Wright

2. How to Not Ask VCs for Money?

When an investor asks you why you need to raise money, the worst thing you can reply with is that it’s to extend your runway.

Many founders make this mistake...

Remember - Investors care about growth and having a clear set of milestones you think you can hit. They see a lot of opportunities, and the most exciting ones are fires that are already growing that they can throw gasoline on top of.

This is similar to how your customer doesn’t care about your product, they care about the benefit or transformation your product provides for them.

Show them an opportunity that’s growing quickly but could grow faster with some help, rather than one that needs more money to survive a little longer in the hopes of striking gold. The best way to pitch to investors when they ask is to say something like -

"We need $3M to accomplish these 3 critical projects we have planned that will take us from X users/revenue to 5x in 18 months. We need these 4 new positions to pull it off and we already have great candidates for each role that we're in active discussions with."

It's a small detail, but an important one to get right when you're looking for investment for your startup.

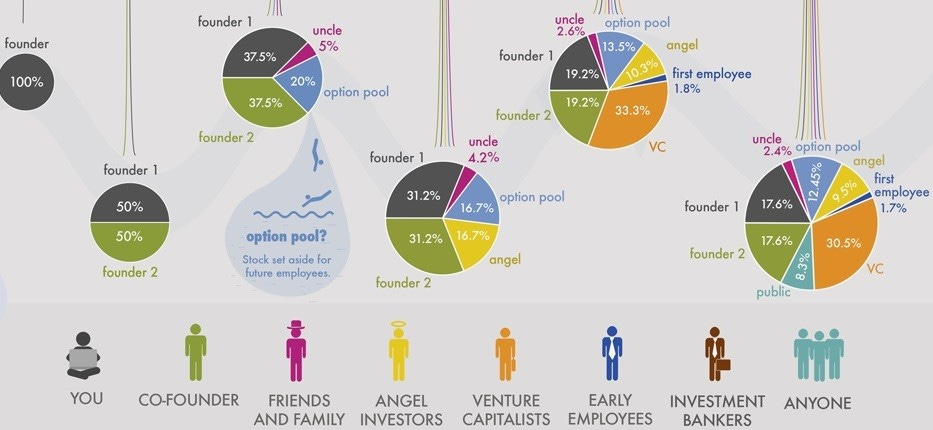

3. How to Split Equity between Cofounders & When You Should (and Shouldn't) Split Equity Evenly?

Founders often ask how they should split equity with their co-founders...

If you search the web on this topic, you will see horrible advice, typically advocating for significant inequality among different founding team members.

A lot of founders follow this trend because of the following reasons:

I came up with the idea for the company

I started working months before my co-founder

This is what we agreed to

My co-founder took a salary for n months and I didn't

I started working full-time & months before my co-founder

I am older/more experienced than my co-founder

I brought on my co-founder after raising n thousands of dollars

I brought on my co-founder after launching my MVP

We need someone to a tie-break in the case of founder arguments

Founders tend to make the mistake of splitting equity based on early work.

All of these lines of reasoning screw up in four fundamental ways:

It takes 7 to 10 years to build a company of great value. Small variations in year one do not justify massively different founder equity splits in years 2-10.

Startups often fail, so the more motivated the founders, the higher the chance of success. Giving founders a larger equity stake can increase their motivation and drive.

Investors view founder equity splits as a signal of how the CEO values their co-founders. Unequal splits can imply that certain founders are not highly valued, which can deter investment.

Dramatic equity disparities can overemphasize the initial idea rather than the team's ability to execute and generate traction. Startup success relies more on execution than the original concept.

Equity should be split equally (or near equally) because all the work is ahead of you. My advice: Split equal (or close to equal) equity splits among co-founders.

These are the people you are going to war with.

You will spend more time with these people than you will with most family members.

These are the people who will help you decide the most important questions in your company.

Finally, these are the people you will celebrate with when you succeed. I believe equal or close to equal equity splits among founding teams should become standard. If you aren't willing to give your partner an equal share, then perhaps you are choosing the wrong partner.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Meta has unveiled its Orion augmented reality glasses, which showcase full holographic capabilities, marking the most advanced AR glasses the company has developed after a decade-long effort. (More Here)

OpenAI Chair Bret Taylor stated that while the board has discussed equity compensation for CEO Sam Altman, no decision or specific figures have been determined. (More Here)

Peter Thiel Has Now Sold $1 Billion of Palantir Stock This Year. (More Here)

OpenAI plans to restructure into a for-profit benefit corporation, reducing non-profit board control to make it more investor-friendly. (More Here)

Alphabet, Goldman Sachs, Bank of Nova Scotia, and other firms agreed to pay a total of $3.8 million in penalties for late SEC filings. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Andrew Chen talks about "founder mode" and "bureaucrat mode" in companies.

Founder mode is when leaders make fast decisions and lead with strong beliefs. But in big companies, "bureaucrat mode" often takes over.

Bureaucrat mode means:

Lots of meetings and committees

Everyone has to agree before anything happens

People who show initiative get in trouble

Simple tasks need many approvals

These start with good ideas like teamwork and including everyone. But they can make it hard to get things done. Some people use these rules to help their own careers instead of the company. They hire more people like them, called "self-replicating bureaucrats."

I highly recommend going through this thread…

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 58,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Want access to our VC interview preparation guide - check out here, we are giving a 30% discount for a limited time. Don’t miss this.

Analyst Volta Circle - USA - Apply Here

Investment Partner - Hivemind capital partner | USA - Apply Here

Investment Manager, Techstars London - Apply Here

Associate - FF venture capital | USA - Apply Here

Intern - Alpaca VC | USA - Apply Here

Investor - Crater Venture | USA - Apply Here

First Hire - The Aligned Fund |USA - Apply Here

Investment Associate, Acumen | USA - Apply Here

Winter 2025 Internship - Harlem CAPITAL | USA - Apply Here

Network Operations Associate - nEXTVIEW VENTURES | USA - Apply Here

Investment Analyst - eLEVATE VENTURE | USA - Apply Here

Senior Investment Analyst - Venture Capital ADP Venture - India - Apply Here

Senior Manager - Coin Venture | India - Apply Here

Business Development (BD) Intern I Asia - TPC Venture | Singapore - Apply Here

Partner 16, Senior Accountant - a16z | USA - Apply Here

2025 Venture Capital Summer Analyst - Stepstone GROUP | USA - Apply Here

Analyst VC - France - Apply Here

Research Analyst kindred venture - USA - Apply Here

Fund Accountant - Blackbird Venture | Australia - Apply Here

Looking To Break Into Venture Capital?- Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team