What if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think. | VC Jobs

Jeff Bezos' Heuristic for Hiring & Template to build VC Fund deck to raise Millions From LPs

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: What if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think.

Quick Dive:

Your Product's Untapped Growth Opportunity Advice From Former VP Growth Instacart, Instagram.

Jeff Bezos' Heuristic for Hiring.

How do you build a VC fund deck to raise millions from LPs?

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Qualcomm Wants to Buy Intel, Google CEO Sundar Pichai's $120 Million AI Fund, FedEx Firing 22,000 Employees & Former Apple Designer New AI Startup

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

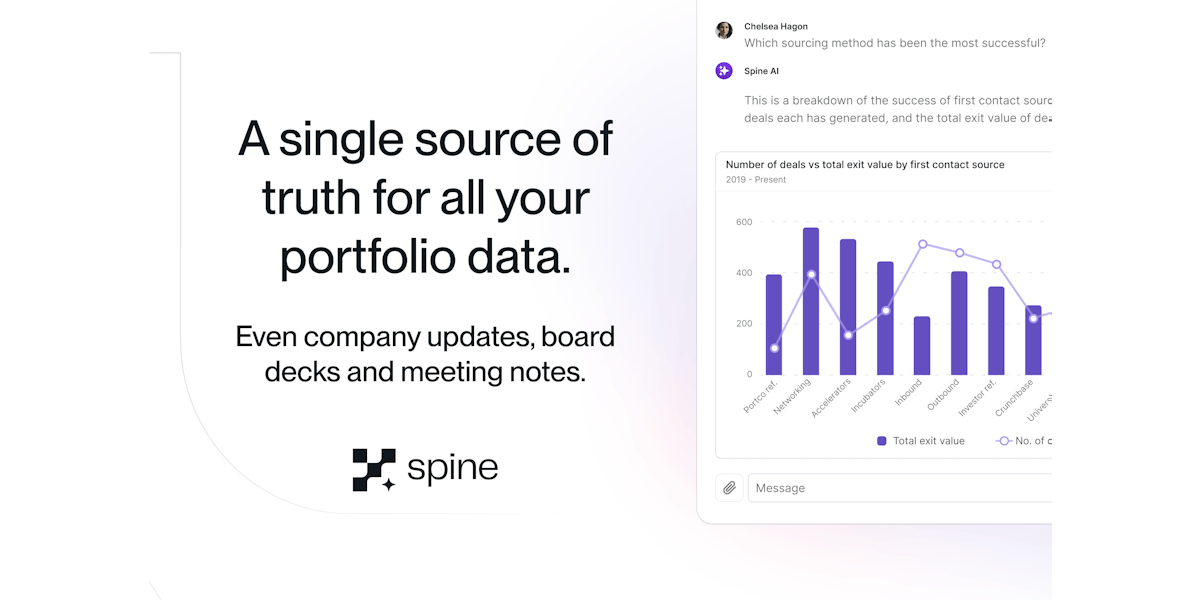

A MESSAGE FROM OUR PARTNER: SPINE AI

Portfolio monitoring simplified with reliable AI

Custom reports that integrate structured data—such as performance metrics—with the context for informed analysis. Automatically surface insights from board decks, meeting notes, and company updates. Transparent referencing ensures reliability.

Streamline collaboration for quarterly reporting and valuation analysis, with a consolidated view.

→ Get comprehensive insights with Spine AI.

PARTNERSHIP WITH US

Reach 58,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S DEEP DIVE

What if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think.

If you are fundraising or looking to fundraise for your startup, you will see such types of annoying questions from VC :). Not only this, you will find some other things like - I don’t think this can be a venture scale business, We’d be interested when we see a bit more traction, Come back when you have a lead etc… and most founders don’t know how to think on this questions and proceed with it.

So in this post, I will try to answer how you can think about above mentioned questions:

What if Google Builds It?

You will find a lot of VCs asking this question where Google substitutes with Amazon or Facebook or any other big company.

It’s a valid question - this shows your startup edge and how will you win. Here are a couple of answers that may help:

Too big to care: These giants are so huge, your "little" idea might not even catch their eye. They're busy chasing bigger fish.

Slow movers: Big companies are like big ships - they turn slowly. You're a speedboat. You can zip around, change direction fast, and give customers exactly what they want before the big guys even start their engines.

Proof you're onto something: If a big company notices your idea, it means you've found a real problem to solve. That's exciting!

People will pay for better: Even if Google makes a free version, many folks will happily pay for a product that actually answers the phone when there's a problem. Just look at companies like Mixpanel or Superhuman - they're doing great against free Google stuff.

Show off your speed: Can you build things faster than the big company? Can you make your customers super happy? Focus on that. It's your secret weapon.

Remember, being small and quick can be your superpower. Use it to outmanoeuvre the giants!

I don’t think this can be a venture-scale business

Previously I shared my thought process on how investors think about this particular question, let me know to share more info here

Not every business needs venture capital (VC) money. It's like rocket fuel - great if you want to go to the moon but overkill for a quick trip to the store. VCs are looking for companies that can grow incredibly fast and become huge. They want to turn their money into a fortune, and fast. We're talking about businesses that can make $100 million a year in just five years. That's a wild ride, and it's not for everyone.

But here's the funny thing: it's really hard to predict which ideas will explode like that. VCs often think they know, but they're wrong all the time. They might ignore a business selling stuff online, thinking it can't grow big enough. But what if it's the next big thing, like Stitch Fix?

So, if you're thinking about chasing VC money, ask yourself: Do I really want to build a massive company? Can I handle hiring tons of people and working like crazy? If that sounds exciting, great! Think about how you'll grow your business super fast. How will you double or triple your sales each year?

But if that sounds like too much, don't worry. There are other ways to get money for your business. You could talk to individual investors, try crowdfunding, or look into loans based on your revenue. These options are becoming more popular and might be a better fit for your dreams.

The most important thing is to be honest with yourself about what kind of business you want to build. There's no shame in staying small or growing slowly if that's what makes you happy. Just make sure you're chasing the right kind of money for your goals.

We’d be interested when we see a bit more traction

When a VC tells you they want to see "more traction," it's like they're saying, "I'm not sure about your business, but maybe if you grow more, I'll change my mind." The problem is, most VCs can't really tell you exactly how much growth would convince them. If you suddenly made $100 million, sure, they'd all jump on board. But what if you grow to $100,000 a month in a year? Well... it depends. VCs like to keep their options open, so they'll always want to "check in later" unless you're clearly terrible or a scammer.

It's frustrating, right? But here's how to handle it: Don't waste time trying to convince these fence-sitters. Put them in your "not interested" pile. Keep sending them updates, sure, but focus on finding investors who believe in you right now. You're better off meeting tons of investors and quickly figuring out who's actually excited about your idea.

Remember, it's like dating. You don't want to spend months trying to convince someone to like you. You want to find someone who's into you from the start. So get out there, talk to lots of investors, and find the ones who get that spark in their eyes when you explain your business. Those are the folks you want on your team.

Don't get hung up on the maybes. Keep moving, keep pitching, and the right investors will show up. It's a numbers game, so play it smart and don't let the "show me more traction" crowd slow you down.

Come back when you have a lead

When a VC says, "I'm in once you have a lead," they're basically saying, "I don't want to take the risk, but I don't want to miss out either." It's like they're waiting for someone else to give your idea a thumbs up before they jump in.

But here's the thing - "lead" can mean different things to different VCs. Some want to see most of your money raised. Others just want to know the deal terms. And some are looking for a big investor to take charge and join your board.

So, what do you do? First, get clear on what they mean by "lead." Don't be shy - ask them straight up.

If they just want to see most of the money raised, you've got options. You could bring together a bunch of smaller investors without a traditional lead. It's called a party round, and it's pretty common these days.

If they're just after the terms, you can set those yourself. Create your own deal on a simple agreement like a SAFE or convertible note.

But if they want a big-shot lead investor who'll take a board seat and run the show, that's a whole different ballgame.

The key is to not get hung up on these "maybe" investors. Keep moving, keep hustling. Build your round in whatever way works for you. Remember, there's more than one way to skin a cat - or in this case, raise some cash.

Don't let the "we need a lead" crowd slow you down. If your idea's good and you keep pushing, you'll find the right investors who believe in you from the start. That's who you want on your team anyway.

That’s it.

What are the annoying things that you feel VC ask/say to you? Feel free to share in a comment.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. Your Product's Untapped Growth Opportunity - The Adjacent User Theory By Bangaly Kaba (Former VP Growth @ Instacart, Instagram)

The Adjacent User is someone who is interested in your product but faces challenges in fully using it. It’s a methodology for driving growth by focusing on the users who are aware of a product and have tried using it but are not able to successfully become engaged users.

These users are on the periphery of a product's current user base and represent untapped potential for growth.

Many founders miss this thing, which leads to not capturing full market share…

Why Focus on Adjacent Users?

Solving for the Adjacent User is critical for a few key reasons:

It captures the true potential of a product's current market fit. There is often a gap between a product's current retention and its hypothetical maximum retention, which can be unlocked by enabling Adjacent Users to successfully experience the core value proposition

The impact compounds over time. Enabling Adjacent Users to adopt a product not only changes the engagement of near-term cohorts but also flows through to create an impact for all future cohorts of users, affecting retention, acquisition, and monetization

It provides a different way to focus product efforts. Most product teams know their existing users well, but the challenges that potential users face in adopting a product increase over time. Dedicating a team to understanding, advocating for, and building for the next set of users prevents growth from stalling.

Identifying Adjacent Users

Adjacent Users are those who are circling around the primary thresholds a user must cross to become an engaged, core user. At each threshold, there are users who have an equal or greater chance of not crossing over and drifting away

For example, on Instagram, the key thresholds are:

Not Signed Up → Signed Up

Signed Up → Activated

Casual → Core Usage

At each stage, there are users who struggle to progress, and solving their problems enables the product to capture more of that audience and grow

Challenges in Focusing on Adjacent Users

There are a few factors that often lead teams away from focusing on Adjacent Users:

Focusing too much on power user personas leads to building for yourself or your friends rather than the next set of users

Using personas as the wrong tool, as they tend to describe current users rather than forecasting who the next users will be

Trying to hit a home run every time by going after bigger markets of new users, rather than fulfilling the potential of the current product-market fit

How to Focus on Adjacent Users

To start focusing on Adjacent Users:

Get visibility into who they are and why they are struggling, by laying out multiple hypotheses, choosing which one to focus on strategically, and experimenting to validate and learn

Understand who is successful today and why, to identify vectors of expansion

Build empathy for the Adjacent User by experiencing the product in their conditions, watching them use the product, talking to them, and visiting their environments

By focusing on Adjacent Users, startups can unlock the true potential of their current product-market fit and drive sustainable growth over time. I would highly recommend checking this article by Andrew Chen.

2. Jeff Bezos' Heuristic for Hiring

Jeff Bezos says he hires people only if they pass 3 separate bars:

Can the person do exceptional things?

Does he admire them?

Will the person raise the effectiveness of the team?

You can get answers to all three of these questions in a single, 30-minute interview if you ask the right questions.

I would highly recommend reading - Smart Management by Jochen Reb to learn more about it.

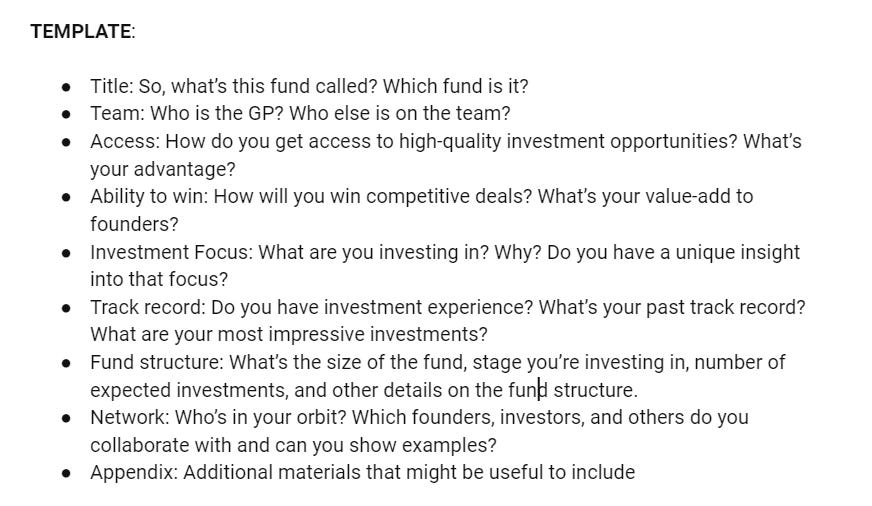

3. How do you build a VC fund deck to raise millions from LPs?

Previously, I shared VC fund decks that raised $500 million from LPs. I received many queries about what the format should look like and what emerging fund managers should consider before building a VC fund deck. So, I'm sharing a few points that might be useful to emerging VC fund managers:

The purpose of your pitch deck is to convince LPs of your ability to make outlier investments: Your pitch deck should break down how you do this effectively.

Your pitch deck is the place to tell the most clear, concise, and convincing version of your fund’s story

“Showing” is better than telling. Use examples, numbers (e.g. past performance metrics), screenshot evidence of how you’ve helped, and other visuals to add credibility to your deck. These can be very memorable and help create a more objective narrative.

Let others speak to your strengths and establish social credibility. As with GPs investing in startups, many LPs value social proof, consciously or subconsciously. Highlight positive quotes from founders you’ve backed, testimonials from strong references, and LPs already committed to investing in your fund.

After considering these points, you can use the following template to create a VC Fund deck:

Also, if you are a solo GP, I would highly recommend checking the thread by Nichole Wischoff (Founder & GP of Wischoff Ventures) on what it takes to raise a VC fund round. Even check out the comments and replies on this thread.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Grok’s image generator, Black Forest Labs, a Freiburg, Germany-based AI startup founded by former Stability AI engineers, is reportedly closing a $100 million funding round at a $1 billion valuation. (More Here)

Google CEO Sundar Pichai announced a $120 million Global AI Opportunity Fund. (More Here)

FedEx uses AI to deliver 'high-quality service' after firing 22,000 humans. (More Here)

Former Apple Designer Teams Up with OpenAI to Create Next-Gen AI Device. (More Here)

Qualcomm recently approached Intel about a potential acquisition, which would be significant given Intel's historical dominance in the chip industry with its x86 processor technology. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

“The truth is that no business plan survives a collision with a real customer. So the trick is to take your idea and set it on a collision course with reality as quickly as possible.”

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Venture Scout - Get fresh venture | Canada - Apply Here

Principal - Amazon Industrial Fund | USA - Apply Here

Ventures Associate, AI Investing - point 72 venture | USA - Apply Here

Associate - Arthur Venture | USA - Apply Here

January 2025 - Growth Equity Investment Internship - Fartech | France - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Associate - M12 | USA - Apply Here

Marketing Manager - Microventure | USA - Apply Here

Portfolio Analyst Intern - Plug and Playtech Centre | USA - Apply Here

Fundraising and Investor Relations Analyst cube venture - Colombia - Apply Here

Intern - Climate & Sustainability Council - IVCA | India - Apply Here

Internship Investment Analyst (Clean Energy) - Egnie New Venture | France - Apply Here

Venture Capital Intern - Pender Venture | CANADA - Apply Here

Venture Capital Manager - Microventure | USA - Apply Here

Platform - Operations Associate - Systemeq Capital | UK - Apply Here

Chief of Staff - Village Capital | USA - Apply Here

Analyst - Angels Network - D2C Insider | India - Apply Here

🧐 Exclusive Resources & Tips For Aspiring Venture Capitalists by VC Partners

There are a lot of requests to access our all-in-one VC Interview guide (how to answer). So we are offering a 50% discount for only 15 aspiring venture capitalists. Grab it now..

Looking To Break Into Venture Capital?- Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team