Frameworks to prove your market is big enough for investors. | VC & Startup Jobs.

Consumer Subscription Trifecta, Are You Building Zombie Startup? & Successful ESOP Plan

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Frameworks to show investors your market has billion-dollar potential.

Quick Dive:

Consumer Subscription Trifecta: What makes consumer AI subscriptions work?

8 Signs Your Startup Is a Zombie and how to avoid it.

Antler’s framework to create a successful ESOP plan for your early-stage startup.

Major News: Musk’s xAI raising $20B at $120B valuation, Google exec tells judge only Google can run Chrome, Top OpenAI researcher denied U.S. green card, Microsoft launches Recall and AI-powered Windows search & More. Inbo

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

When every employee becomes an Agent boss by Tomasz Tunguz.

Four years of running SaaS in a competitive market.

Startup legal document pack – essential legal docs for founders.

Your first growth hire.

The only startup valuation guide you need as a founder.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Startups still aren't businesses.

The forecast model every startup needs (with template).

The hidden trap of going viral: why it brings the wrong users.

Disclaimer: AI-Generated Responsibility versus transparency in the AI era.

AI 100: The most promising artificial intelligence startups of 2025.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

Avoid this AI design trap.

AI isn’t only a tool—It’s a whole new storytelling medium.

5 interesting learnings from Freshworks at $800,000,000 in ARR.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, and reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

For marketers: Skip the AI hype, and get real results. Join 10,387+ marketers learning the AI tools and prompts that drove 40% better performance.

FROM OUR PARTNER - VENTUROUS

🤝 The Fastest Way to Hire Healthcare Execs With Venturous.

Your startups don’t need another hiring backlog. They need traction.

Venturous connects your portfolio startups with pre-vetted, proven healthcare executives—whether fractional, full-time, or advisory. They've done it fast, effectively, and with zero upfront fees.

Why VCs and operators love it:

Fractional or full-time execs matched in days, not months

Partner-only discounts for your portfolio companies

No upfront fees, ever

You invest in potential. Venturous helps unlock it—one hire at a time.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Frameworks to show investors your market has billion-dollar potential.

The second most common reason VCs pass on a startup is some version of "the market isn’t big enough."

For a VC to deliver strong returns across their fund, they usually need at least one investment that turns into a multi-billion-dollar company. Because of that, most VCs want to believe that every company they invest in has the potential to reach that kind of scale—even if they know it won't happen every time.

The challenge is, that many of the most exciting startups don’t look big enough early on. They’re often going after markets that don’t exist yet, or they’re tackling a niche that seems small—but could actually be huge with the right approach.

So, if you’re a founder on the VC path, how do you counter investors’ concerns about market size?

I recently came across a post by Rob Go (co-founder of NextView) from 2015 that's still incredibly relevant. He outlined different approaches founders can use to frame their market opportunity better—and I thought it was worth sharing a few keynotes and my own thoughts on it.

Some of these approaches are more left-brain (logical and analytical), while others are right-brain (emotional and intuitive).

Both types of thinking are important—and it’s good to remember that investors, especially those making team decisions, often come at this question from multiple angles.

1. Top-down, but build it brick by brick

Most market-size stories start top-down. “The marketing software space is worth $X billion, so it’s clearly a huge opportunity.” That kind of framing works especially well if you're going after a big, existing market. It's simple, and most investors default to it.

But a more thoughtful way to present it is by starting top-down and then adding detail—brick by brick. Show how the opportunity can actually be bigger than it looks. For example:

You can expand into new geographies

You have potential to upsell or introduce premium pricing

The overall market is growing

There are logical adjacent verticals or complementary products you can expand into

This approach won’t rescue a tiny market, but it’s a great way to help investors see the upside if they already believe the core market is meaningful.

2. Bottoms-up demand

Top-down logic breaks down fast when you're creating something new—especially if the market doesn’t quite exist yet.

Here, the better move is a bottoms-up analysis. Start with the number of potential users, make reasonable guesses about what they'll pay, what share of them you could capture, and go from there.

But expect some pushback—on things like:

How you define and segment your users

Whether your market share assumptions are realistic

The fact that these are still educated guesses

You can address those concerns by showing data: how much money people already spend to solve the problem today, or an ROI calculation that makes your product a “no-brainer.”

Also remember: this kind of story works better if you're solving a real pain—not offering a nice-to-have. Painkillers sell better than vitamins, even if the vitamin’s benefits are clear.

3. Riding a mega-trend

Another way to win over investors, especially when the current market looks small, is to align yourself with a major trend.

If an investor believes a mega-trend is happening—say, AI transforming workflows or climate tech becoming mainstream—it becomes easier to believe that your startup can ride that wave:

Either the market itself will expand massively

Or your company will grab outsized share because it’s perfectly positioned

When investors believed “software is eating the world,” they were more open to funding vertical tools that looked niche, because they expected big shifts and rapid adoption.

Without a mega-trend behind you, you’ll often need to be 10x better or cheaper than incumbents just to get attention.

4. The power of analogies

Analogies can be powerful—but only when they click. If the investor gets it, it sticks.

But don’t just throw out big names or past exits. Think deeply about what the analogy is really saying. For example, pointing to Evernote or Sunrise as comps sounds good on paper—but the reality is most of those companies exited for relatively modest sums and were often acquired for strategic reasons by a handful of buyers.

So ask: does the analogy highlight strength and scale—or weakness and exit limitations?

The best analogies either:

Tie your startup to a macro shift (“As cloud computing enabled Salesforce, mobile-first tech will enable [your startup]”)

Or connect the founder DNA—“These founders are obsessed with product in the same way the Notion team was early on” (though that kind of connection usually emerges from relationship, not pitch decks)

5. Scope expansion

This is the classic “we’re starting with X, but it leads us to Y, which is huge” story.

There are two flavors here:

The bank shot – where X isn’t a huge business on its own but gets you into a position to build Y. VCs are cautious about this unless you’ve already got serious traction. To make this work, scale X quickly and efficiently, then use the customer base or network effects to unlock the real value in Y.

The solid base – where X is already a decent, sustainable business. It might not be a unicorn, but it can deliver solid returns and doesn’t burn tons of capital. That gives you optionality to chase bigger wins later. Investors love this because it balances risk and reward: 5–10x potential with a shot at 20x+ if things break right.

6. Making a future bet

Sometimes the best strategy is to shift the conversation from today’s market to what the future might look like.

This works well when your core belief is bold and clear. For example, in the rental or sharing economy: “People spend thousands on things they barely use. We believe the future is less about ownership and more about access. That shift will unlock billions in new value.”

This kind of thinking can make a market that looks small today suddenly feel inevitable—and massive.

Two Final Thoughts and Reminders

1. Margins shape how big “big” needs to be.

If you're building a high-margin business—like SaaS or a marketplace with clean take rates—your revenue doesn’t need to be sky-high to justify a billion-dollar valuation. Investors will often use 10x+ revenue multiples for these businesses.

But if your margins are thin, the revenue target has to be much higher to reach the same valuation. So when you're doing your market size math—especially using a bottoms-up approach or comps—make sure you're adjusting expectations based on your margins.

2. Who might buy you matters (a little).

You usually don’t want to lead with “here’s who might acquire us”—most investors are betting on category-defining outcomes. But if you're in a space where the market size is uncertain or the plan includes a bank shot, it helps to know there are strong potential acquirers in the wings.

Investors rarely make decisions based on downside protection alone—but knowing that a company is in a category where decent exits have happened can nudge someone off the fence when the upside case is still developing.

FROM OUR PARTNER - PORTLESS…

🥃 Struggling with tariffs? Unsure about upcoming changes? Let’s talk!

With Portless, you only pay tariffs after your customers pay you - so your cash always moves faster than your costs.

✅ Defer tariffs until orders ship (no upfront costs)

✅ Free up working capital for growth

✅ Sell smarter - turn inventory into cash faster

Stop letting tariffs tie up your cash - sell smarter with Portless.

Schedule a risk assessment and leverage tariff deferment today →

📃 QUICK DIVES

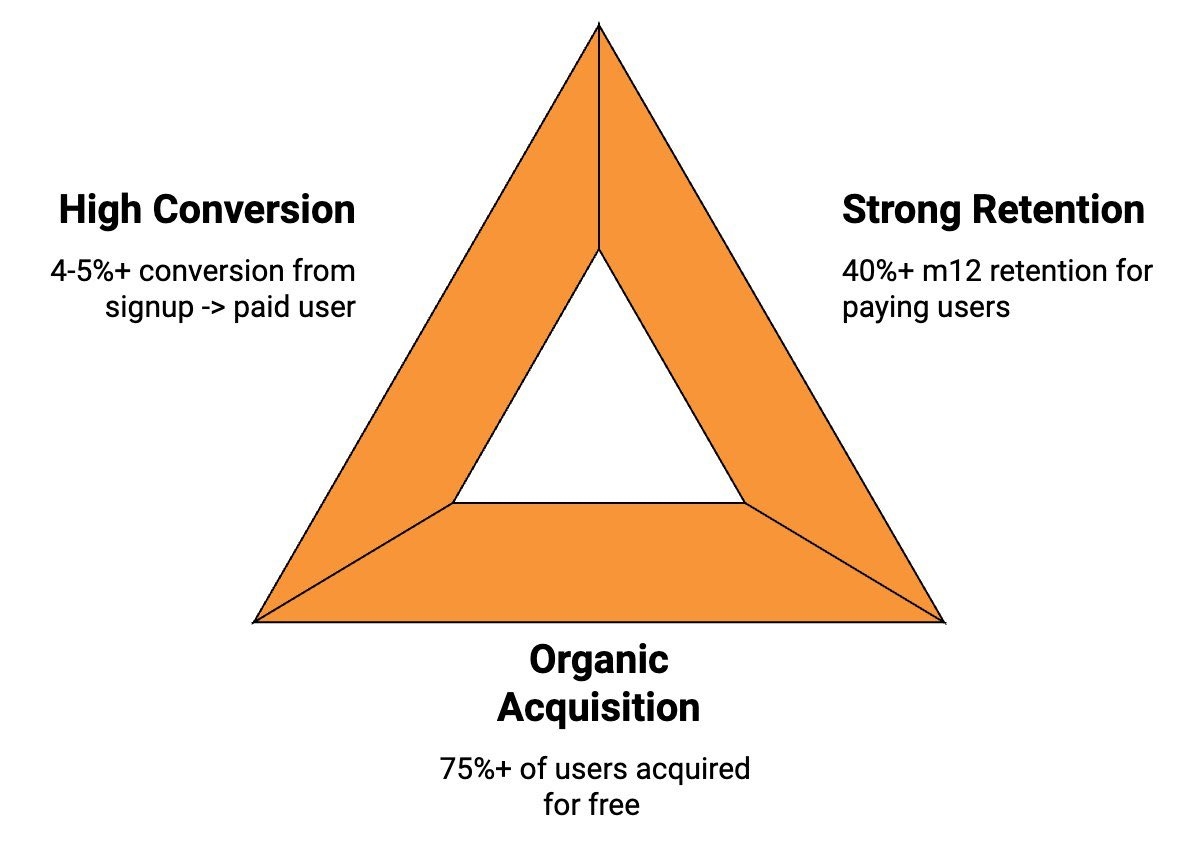

1. Consumer Subscription Trifecta: What makes consumer AI subscriptions work?

After working with founders in the Consumer AI space - Olivia, a partner at a16z, noticed a clear pattern that makes subscription businesses work. She shared -

Most successful companies nail at least two of these three metrics, but the truly exceptional ones hit all three:

High Conversion (4-5%+ from signup to paid)

Strong Retention (40%+ of paying users still active after 12 months)

Organic Acquisition (75%+ of users coming in for free)

Let's break down what happens when you have different combinations:

High Conversion + Strong Retention (but paid acquisition): You can make money and potentially turn a profit, but everything hinges on managing your customer acquisition costs (CAC). Your growth will be limited by how quickly you can recoup your marketing spend.

High Conversion + Organic Acquisition (but poor retention): You'll build both users and revenue, but low lifetime values are your Achilles' heel. There's not much room for error since each customer isn't worth as much in the long run.

Strong Retention + Organic Acquisition (but low conversion): You'll grow your user base quickly, and people love your product. The challenge? Turning that love into revenue. You've built a great product, but haven't quite cracked the business model yet.

The Dream Scenario - All Three: This is what investors get excited about. You have a business that fills itself with users, converts them efficiently, and keeps them around. Even if these numbers dip as you scale beyond early adopters, you have enough cushion to stay healthy.

Think of it like a bucket - you want it to fill itself (organic acquisition), not leak much (retention) and contain something valuable (paying users). Hit all three, and you've got something special.

2. 8 Signs Your Startup Is a Zombie and how to avoid it.

Knowing when to quit and when to stick with it is a key skill for all startup founders.

Even the best investors in the world aren’t right all the time. So most investors apply a portfolio approach (Simple word — Broad Portfolio) to spread their risk and increase the chances of backing a billion-dollar opportunity — Power Law Guys….

In any investor’s portfolio, you have three types of startups: the dogs, the stars, and the zombies.

Dogs run out of cash before finding a scalable business model. These companies return nothing to the investors.

Stars are the home runs — the investments that generate 10x returns and make up for all the dogs.

Zombies are companies that are neither dogs nor stars. They make revenue, perhaps enough to break even, but not enough to generate a huge return for investors. Their growth seems stagnant and they can’t consistently generate more revenue than costs. They are constantly raising money, are focused more on investors than on customers, and rarely have a unique value proposition that generates exponentially more value for customers than existing solutions.

Investors see zombie startups as no longer attractive, and not worth a follow-up investment — which can be the kiss of death for those companies.

What Creates a Zombie

If you have read a book by Seth Godin titled The Dip: A Little Book That Teaches You When to Quit (and When to Stick).

Godin’s main idea is that to be the best in the world, you must quit the wrong stuff and stick with the right stuff. In the case of startups, it says that after some initial traction, there comes a dip.

From there, one of two things happens:

The dip bounces back and starts to trend upward to scale, or the dip turns into a cliff and never bounces back. Godin proposes that at the bottom of the curve — in the dip — founders have to choose to double down or cut their losses.

The ability to know when to hold them and when to fold them is the difference between dogs and stars. Zombies happen because some founders get caught up in the dip, and neither flame out nor take off to greatness.

How to Tell If Your Startup Is Doomed

Many signs can alert a founder (or investor) that a startup is stalling and zombie-bound. But the following signals can show that you may be in a zombie phase:

You don’t want to get out of bed in the morning.

You don’t want to go out in public for fear you’ll have to explain what you do.

You haven’t hit 10 per cent week-over-week growth on any meaningful metric (revenue, active users, etc).

You’ve been working on the same idea for more than a year and still haven’t launched.

You’ve launched a consumer service and have less than 2 per cent week-over-week growth in signups.

You’ve launched an enterprise service and have less than 2 per cent week-over-week growth in the revenue pipeline.

You are the CEO and hole yourself up in the offices so you don’t have to talk to employees and can read TechCrunch.

You’ve hired consultants to figure out revenue, culture, or product in a company of less than 10 people.

What You Can Do About It

Accept it. Call it a day, or as some founders choose to, flame out big. Double down on your efforts and fail large instead of quietly fading away.

Pivot one of the parts of your business model. To become a startup unicorn, you likely need an exponential advantage in one of these areas to shift from zombie to star (think: Netflix offers 10x the entertainment of a movie theatre for less than half the cost). There are lots of examples of how a pivot evolved from a zombie into a star: Yelp, YouTube, PayPal, Flickr, Groupon, and Shopify.

Organize an acquihire and make lemonade from your lemons. Sometimes, others can leverage what you have built to drive growth in their business. This is often done through an acquihire (buying a company as a means of hiring that startup’s people). While this may not be an optimal outcome, it is often the best choice for zombies.

Unlike on the TV show The Walking Dead, zombie status isn’t forever. There are examples of startups pivoting and becoming stars (and many more examples of startups pivoting and becoming dogs).

But what’s more important is that the decision you make is making a decision. Do not delude yourself.

3. Antler’s framework to create a successful ESOP plan for your early-stage startup.

Early-stage startups struggle to attract talent when competing with bigger companies' high salaries. The key? Smart use of ESOP (employee stock options).

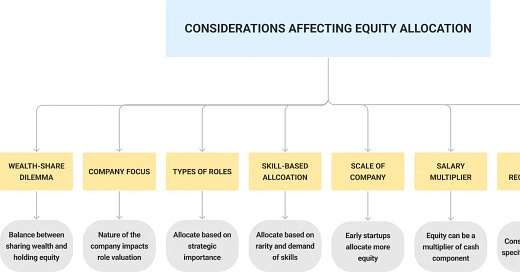

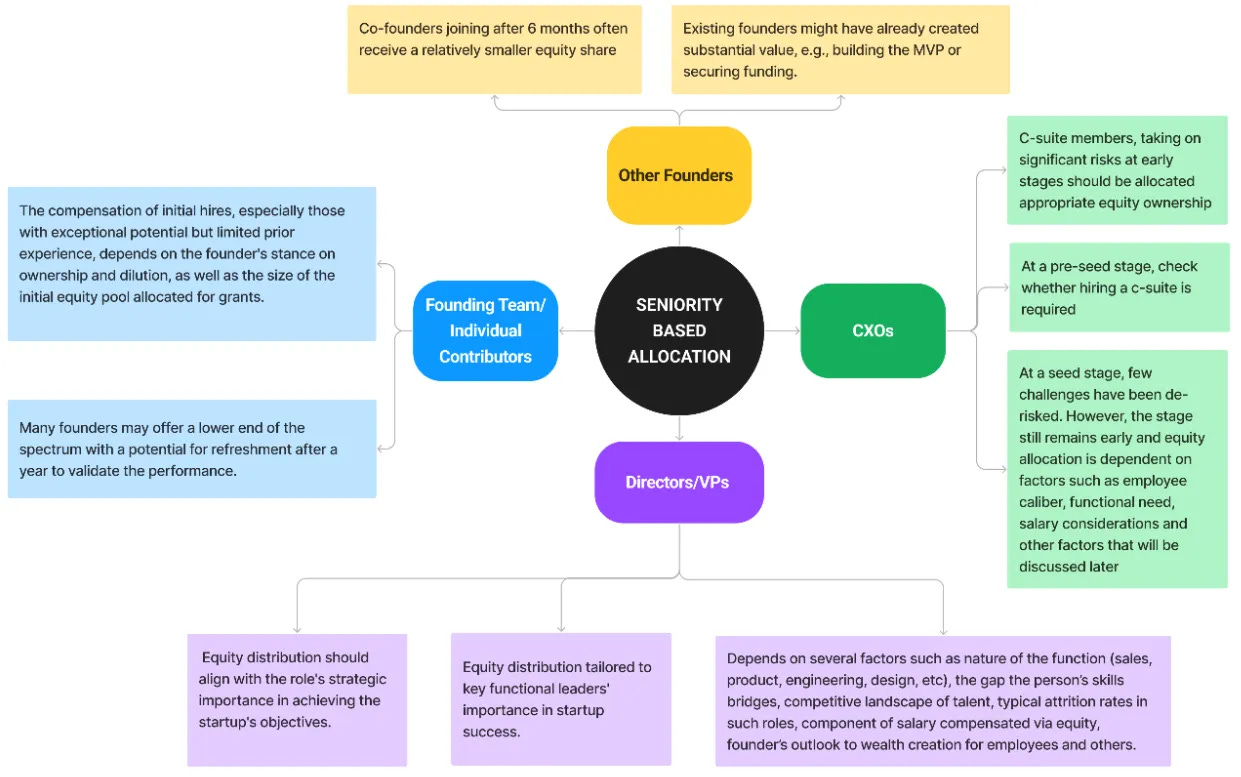

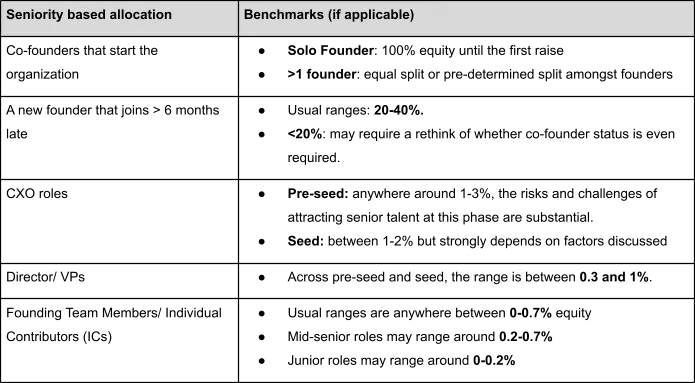

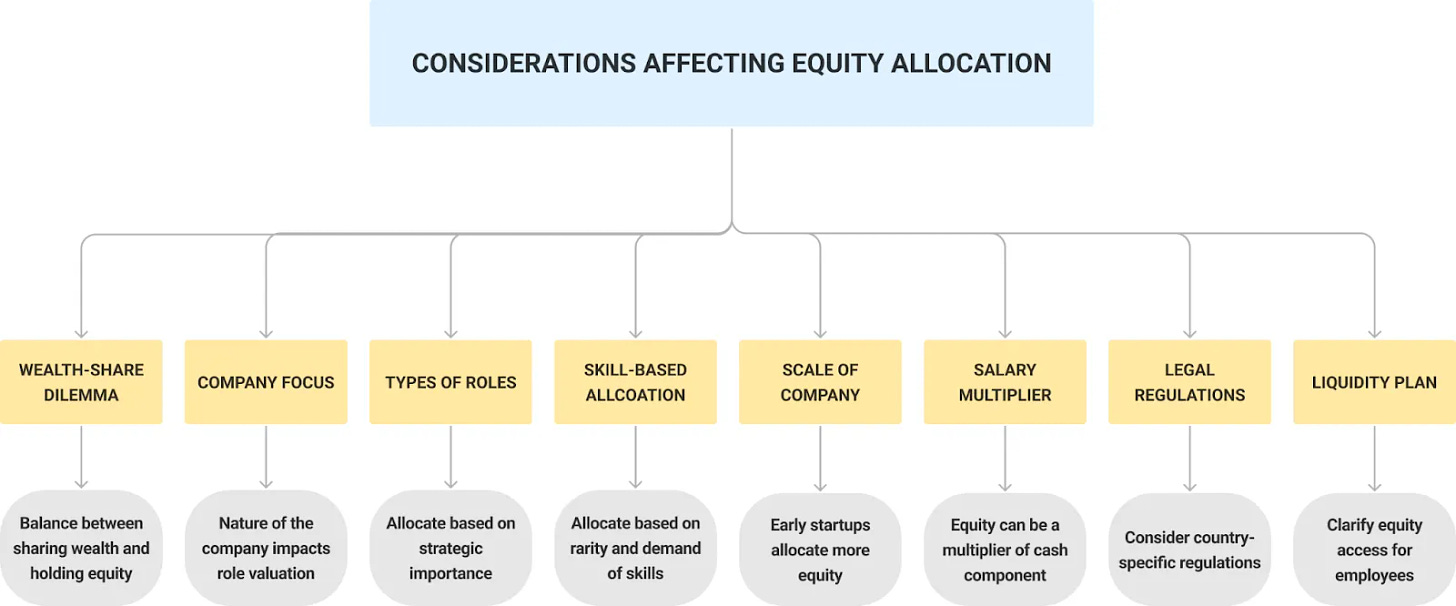

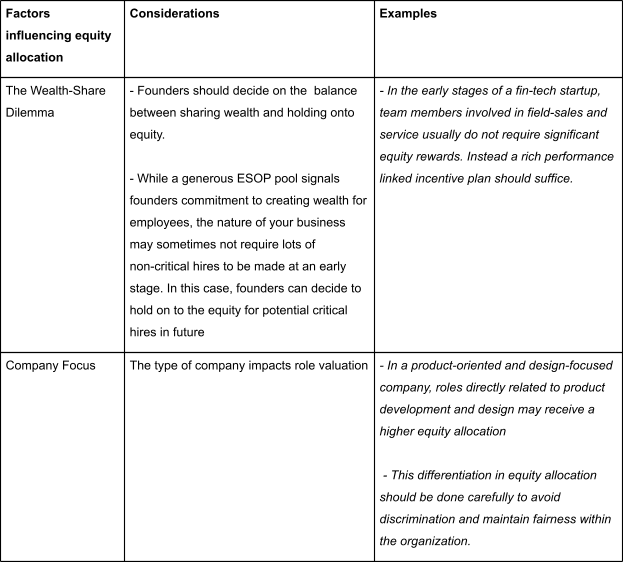

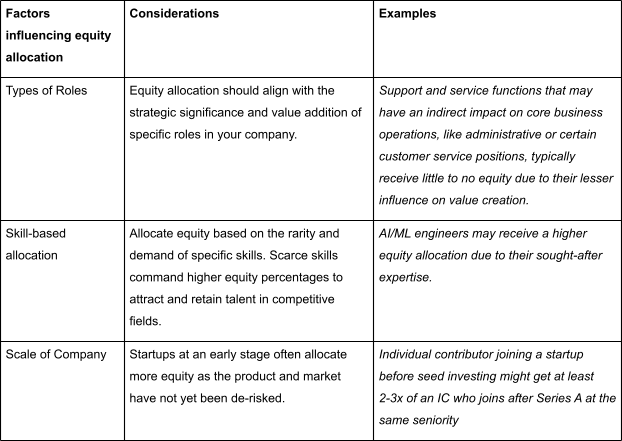

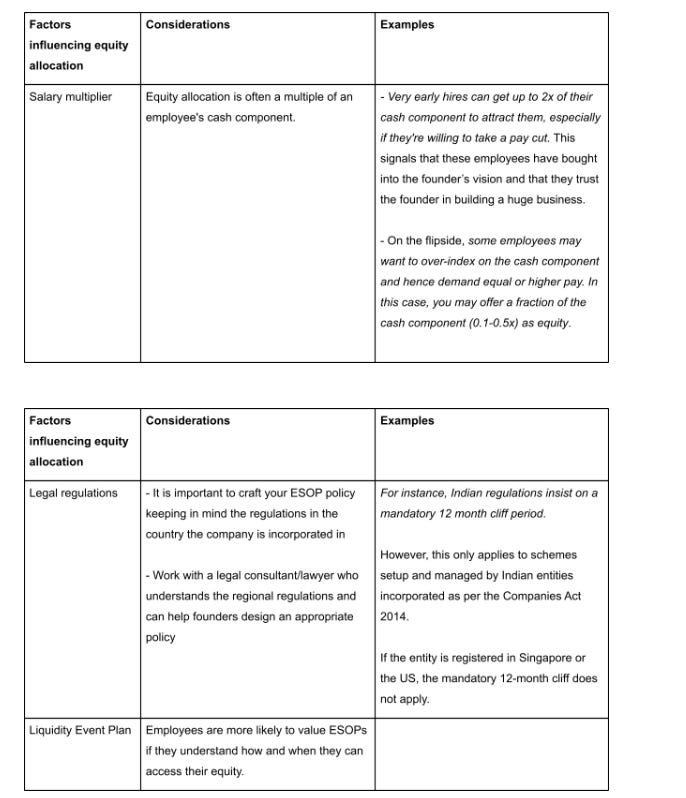

The trick is balancing equity with cash compensation. Antler shared a few decision-making frameworks that can help you design a successful ESOP plan:

It's important to note that there is no one-size-fits-all approach and there are several factors beyond the seniority levels of employees that need to be considered before rolling out employee equity.

Equity allocation is a complex yet critical aspect of building a startup's team. Antler has interviewred several portfolio founders and early-stage people success leaders to learn about what are some of the best practices in arriving at the right quantum of ESOPs for a critical hire. You can check the detailed write-up on Antler’s website.

Also, we have created some resources that might be helpful to you:

Building cap table as a founder: template to download.

Startup legal document pack – essential legal docs for founders.

The only startup valuation guide you need as a founder.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Intel Capital, the venture arm of Intel, will remain internal after all, reversing earlier plans to spin it out as an independent firm. (Read)

Major Tech Updates

Huawei is advancing the development of its new AI chip, the Ascend 910D, and seeking Chinese companies as testing partners, according to the Wall Street Journal. (Read)

Alibaba launched Qwen3, a new family of AI models ranging from 0.6B to 235B parameters, with most models available for download via Hugging Face and GitHub under an open license. (Read)

Apple is reportedly developing AI-powered smart spectacles, similar to Meta's Ray-Bans, as part of an effort to incorporate Apple Intelligence into additional wearable devices following internal research. (Read)

Alphabet's CEO Sundar Pichai revealed that Waymo is contemplating the future possibility of making its self-driving automobiles available for individual consumers to buy directly. (Read)

New Startup Deals

Elon Musk’s xAI is reportedly in early talks to raise $20 billion, valuing the company at over $120 billion — second only to OpenAI’s $40 billion raise. (Read)

WineFi, a London, UK-based wine investment platform, raised £1.5M in Seed funding. (Read)

Manus AI, a China-based startup building tools for AI agents, raised $75M in funding at a ~$ valuation of $500m. (Read)

MagicBlock, a Singapore, CA-based real-time engine provider for decentralised games and applications on Solana, raised $7.5M in Seed funding. (Read)

Symbiotic, a Berlin, Germany-based universal staking startup, raised $29m in Series A funding. (Read)

Theo, an NYC-based provider of a network connecting on-chain capital to global markets via trading infrastructure, raised $20M in funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Venture Fellows - Kalea Venture | UK - Apply Here

Innovation Program Manager - Caret Capital | India - Apply Here

Venture Capital Analyst - 137 Venture | USA - Apply Here

Visiting Analyst - Alstin Capital | Germany - Apply Here

Principal - Fitch Group | USA - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Venture Analyst - AO Venture | Australia - Apply Here

Executive Assistant - Enkadon Capital | UK - Apply Here

Investment Analyst - Endiya Parrtnes | India - Apply Here

Investment Intern - Signature Venture | Germany - Apply Here

Analyst Artha Group | India - Apply Here

Investment Analyst - Endiya Partners | USA - Apply Here

Events and Operations Intern - Plug and Play Tech Center | UK - Apply Here

Analysts - Artha Group | India - Apply Here

Summer Intern, Talent Team - a16z | USA - Apply Here

Pre-Seed Deep Tech Investor - MFV Partner | USA - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator