The forecast model every startup needs (with template) | VC & Startup Jobs.

Hidden trap of going vial, is freemium right for your product, DIBB framework.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: The forecast model every startup needs (with template).

Quick Dive:

The hidden trap of going viral: why it brings the wrong users.

Is freemium right for your SaaS product? Ask these 3 questions.

Spotify’s DIBB framework features for better decision-making.

Major News: Ex-WeWork CEO Adam raises $100M for rental house startup, Tesla begins supervised robotaxi tests, US asks judge to break up Google & Meta releases its CapCut rival Edits globally.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Y-Combinator's framework to build a successful MVP.

Investor data room guide & templates for founders.

Tokenization as a SaaS liquidity option by Tomasz Tunguz.

Startup legal document pack – essential legal docs for founders.

How to Predict the Future Like Kevin Kelly: He was early to the internet, VR, crypto—and now AI.

Obsessing over onboarding for 10+ years — The architect of Superhuman's onboarding shares his playbook.

Verified 2700+ US angel investors & VC firm contact database (email + LinkedIn link).

Are you ready to raise VC?

Excel Template: Early Stage Startup Financial Model For Fundraising.

A definitive guide to marketing attribution.

Building Cap Table As A Founder: Template to Download.

How startups really succeed or die: it all comes down to these two laws.

How dbt Labs Built a $4.2B Software Business out of a Two-Person Consultancy.

The Always-On Economy: AI’s Real Impact in the Next 5-7 Years.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, and reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

For marketers: Skip the AI hype, and get real results. Join 10,387+ marketers learning the AI tools and prompts that drove 40% better performance.

INSIDE VC: THE MUST-JOIN EVENT FOR 2025 TRENDS..

🚀 What does market consolidation mean for venture capital in 2025?

Mercedes Bent, Venture Partner at Lightspeed, and Brian Murphy, Lead Data Scientist at Salesforce Ventures will share their perspectives with Affinity in an exclusive webinar on May 8.

As the investment landscape shifts, they'll break down key dealmaking trends, what top firms are doing differently, and how to position your firm for success.

Don’t miss this chance to gain exclusive insights. Register now →

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

The forecast model every startup needs (with template).

Running a startup can feel like captaining a boat through a storm. You’re blindfolded. The compass is broken. And you’re mostly guessing.

That’s where a financial forecast model comes in. First thing - it won’t tell you the future. But it will help you see what’s coming, make smarter decisions, and stretch your cash in the right direction.

If “building a financial model” sounds complex, overwhelming, or like something you’ll “do later”... good news: is it doesn’t have to be. We’ve created a straightforward forecast model template you can copy, customize, and actually use.

Let’s walk through why every founder (yes, even early-stage) should have one—and what to focus on.

Why you need a forecast model—even if you’re still pre-product

1. Cash is oxygen

Forget “cash is king.” For startups, cash is air.

Without it, you’re done. A forecast model helps you project income and expenses across time, so you’re not surprised when the runway gets tight. Instead of reacting when you're gasping, you’re making moves ahead of time.

2. Speak the language of money

Investors. Board members. Loan officers. Even vendors.

They all want to see that you’ve got a handle on your finances. A forecast model helps you show—not just say—that you’re building with a plan. It proves you’re not winging it, even if it feels like that some days.

3. Get better at saying no

Startups are full of decisions that sound exciting: “Let’s ramp up ads!” or “Let’s hire three more engineers!”

But can you afford to do that and still build the product? A forecast model helps you understand tradeoffs, prioritize resources, and stay focused on the metrics that matter.

4. Know what really moves the needle

Whether your goal is acquisition, profitability, or that next funding round—your forecast helps you zoom out and see what truly impacts your outcomes.

For example: improving retention by just 5% might move revenue way more than launching that new feature you’re debating.

So... what actually goes into a good forecast model?

Let’s break it down into five core sections you should focus on, especially in the early stages:

1. Customer acquisition

Think about how you attract new customers. Break it into clear channels like:

Performance marketing: Ads, paid campaigns, etc. (Track CAC!)

Sales team productivity: Deals won per rep.

Organic growth: SEO, word of mouth, referrals.

Start simple—don’t overcomplicate with 10 variables per channel. Use broad assumptions, then refine with real data over time.

2. Customer retention

Acquiring a customer means nothing if you can’t keep them. Your model should reflect how long customers stay, and when they tend to churn.

Use cohort analysis or a basic monthly churn rate. Ask:

Do customers stay longer if they activate early?

Are certain channels bringing in stickier customers?

Retention is also your best indicator of product-market fit.

3. Revenue

Revenue should be tied directly to customer activity:

For SaaS, it’s subscription price × active customers.

For marketplaces, it could be volume × take rate.

Start with average revenue per user (ARPU), and evolve into more granular views as you scale.

4. Expenses

Your biggest expense? People.

Use a headcount plan to map out salaries, hiring timelines, and team functions. Other key categories include:

COGS: Hosting, inventory, services delivered.

Marketing spend: Performance + brand.

Tools & software: Scale with team size and complexity.

Office, travel, services: Keep it lean unless proven otherwise.

Don’t default to “% of revenue” unless you have no better data. You control your budget—make it intentional.

5. Cash flow + runway

At the end of the day, it’s about how long your cash lasts.

Forecasting your runway (how many months you can operate before running out of money) helps guide:

Fundraising timelines

Hiring plans

Growth investments

Always stress-test with multiple scenarios:

Best-case (aggressive growth)

Base-case (reasonable assumptions)

Worst-case (conservative path)

Tips to get started (without burning out)

Start simple. This isn’t a Wall Street IPO model. It’s your startup’s guiding tool.

Update monthly. Compare forecast vs. actuals. Adjust your assumptions.

Don’t aim for perfection. Aim for utility. It’s better to have a rough, usable model than a flawless one that sits unopened.

Think of it as a living document. Not a one-time exercise.

Remember your forecast model = your strategy, in numbers

You don’t build a model because investors ask. You build it to understand your own business better. To make smarter decisions. To align your team. To spot problems early and act on them.

“The real magic happens when you strike a balance between planning and doing.”

You can use this financial model template to create one for your startup.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

🥃 The Future of Premium Spirits—Why Investors Are Backing Spearhead

Africa is underrepresented in the $100B+ global spirits industry—Spearhead is changing that.

Their award-winning portfolio spans gin, vodka, whisky, and agave—crafted with African ingredients and already sold in 2,000+ retail locations across the U.S.

$1.1m revenue in 2024, with 22% YoY growth.

Earned Gold medals for Bayab, Sango, and Vusa in global spirits competitions

Featured by Disney, Marriot, Hyatt & More

Solar-powered production and strong ESG mission

And seen its founders named Food & Wine Magazine’s 2023 Drinks Innovators of the Year

With rising global demand and a unique category position, Spearhead is building the next big premium spirits brand—and opening a rare early-stage investment opportunity.

📃 QUICK DIVES

1. The hidden trap of going viral: why it brings the wrong users.

Recently, I came across a tweet by Andrew Chen where he discussed how founders often fall into the trap of chasing virality, only to end up with a flood of low-quality users. It resonated with me, so I thought to share my thoughts and a few key points on this.

Every founder dreams of their product going viral. A flood of new users, signups spiking, your app trending on Reddit and X—it’s the fantasy, right? But when it happens, reality hits differently.

It starts slow. A small group of loyal users finds your product. They give feedback. You iterate. Feels good. Then, one day, a funny video about your app blows up. A major influencer shares it. Signups skyrocket. Feels even better. But then, the Looky-Loos arrive.

The Looky-Loo Problem

LOOKY-LOO (noun): A person who checks something out with no real intent to use it seriously.

Going viral doesn’t just bring more users—it brings the wrong users. These aren’t your ideal customers; they’re tourists. They try the product, poke around, maybe share a meme, and then vanish. Your DAUs spike, but retention doesn’t. Your revenue doesn’t. Your support inbox? Flooded with nonsense.

Suddenly, you’re dealing with international users who don’t fit your market, edge cases breaking the product and chaotic community interactions. If your growth is built on Looky-Loos, it’s not real growth—it’s noise.

Easy Come, Easy Go

The growth that happens fast usually disappears just as fast. Here’s what happens next:

The traffic spike dies down after a few days.

The new users don’t stick around.

Engagement drops. Conversion rates tank. Your metrics look worse than before.

You scramble to create another viral moment—only to realize you can’t manufacture lightning twice.

Traction isn’t just about more users. It’s about high-intent users—people who genuinely want your product and will stick around long-term.

What Works

Instead of chasing virality, focus on growth that’s durable, scalable, and valuable:

Durable Growth: Users who keep coming back. Look at D1/D7/D30 retention, not just DAUs.

Scalable Growth: Repeatable acquisition channels—referrals, SEO, paid marketing—not just one-time spikes.

Valuable Users: Not all users are equal. Focus on those who engage deeply, pay, and spread word-of-mouth.

When Spikes Can Work

Some situations where a viral moment can be useful:

Waitlists: Filtering users before letting them in keeps quality high.

Raising VC Money: A spike in traction can help close funding but don’t build a business expecting virality.

Products Built for Churn: Some apps (e.g., AI photo generators) expect short-term use and monetize aggressively upfront.

Network Effects: If even 1% of a viral audience sticks, they can kickstart a community or marketplace.

Focus on the Right Users

Going viral might feel great, but it’s not a business strategy. Real traction comes from gradual, consistent growth with users who care. Instead of chasing DAU spikes, build something people love—because love, not virality, is what makes a product last.

Also if you really want to learn about building real virality products that last long, I would highly suggest checking this podcast - Nikita Bier’s Playbook for winning at consumer apps.

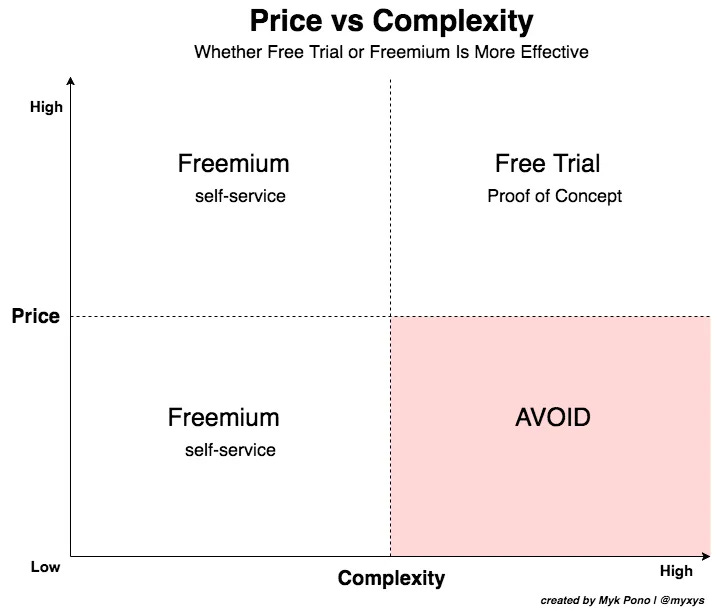

2. Is freemium right for your SaaS product? Ask these 3 questions.

Deciding whether to offer a freemium model is a common dilemma for founders. Many try out freemium strategies, but not all SaaS companies can replicate the success of Dropbox or Typeform.

Done wrong, freemium can end up cannibalizing your paid user base while also draining your company’s precious engineering and customer support resources.

So how can you determine if it's the right move for your company?

The most reliable way to find out is through A/B testing. However, getting solid results can take a long time, especially if you're looking at the impact on virality and your viral cycle is six months or longer.

If you can't wait that long or aren't set up for a full A/B test, consider these "Three Factors for Freemium Strategy":

Does your paid plan have a gross margin of 80–90%?

If you have a lower gross margin — for example because your product is not fully self-service, requires extensive customer support or is extremely costly in terms of tech infrastructure — freemium will probably not work for you.Does your free plan attract the right audience?

If your free users are too different from your paying users, your free-to-paying conversion will be low — and you’ll risk developing your product for the wrong audience.Is your product inherently viral?

If your answer is no, that doesn’t make it a complete no-go, but it does mean that it’s much less likely that freemium is right for you.

In the end, freemium only makes sense if a certain percentage of your free users do one of three things:

Eventually, convert to paid,

Refer paying customers, or

Provide the kind of valuable feedback that will improve your product.

A freemium product that fails to achieve any of these effects will merely saddle you with extra costs and distract you from servicing your most important users.

Also, check out this interesting article on why companies fail with freemium. I highly recommend it — definitely worth a read.

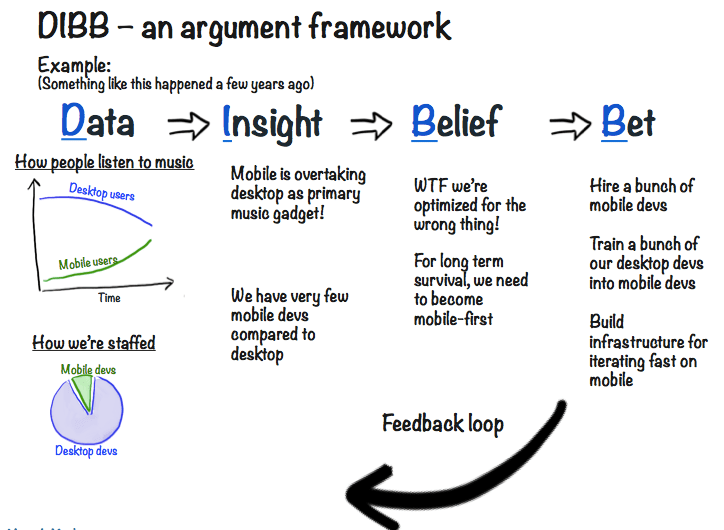

3. Spotify’s DIBB framework features for better decision-making.

Spotify created the DIBB Framework to help align its entire organization around a consistent decision-making process. It helps founders derive insights from their data and identify the right calculated risks to take.

There are four parts to it:

Data → Gather and analyze accurate data that are relevant to the problem you’re solving

Insight → Look for patterns, trends, and insights in the data to inform decision-making

Belief → Create a hypothesis based on your insights and gain conviction

Bet → Test your beliefs with action and define expected outcomes

What I like about this is that it feels very similar to what founders naturally do: collect data points/trends, identify an opportunity, gain a conviction, and then take a shot at it.

Not all of your bets will work out, but that’s ok — you shouldn’t expect them all to. The important thing is that each bet is focused on driving your startup’s North Star goals.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

Invest in Sembly AI, The Future of AI Workplace Tools.

Invest in Sembly AI. 70+ investors have already contributed over $380,000. 1000+ B2B clients, ProductHunt #1 of the day.

Join us & help shape the future of work! →

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

VC podcaster and On Deck co-founder Erik Torenberg joins a16z as GP, bringing his Turpentine show with him. (Read)

Major Tech Updates

The US government requested a judge mandate Google sell its Chrome browser, fearing artificial intelligence advancements will further entrench the company's online search dominance significantly. (Read)

Meta’s new free video-editing app Edits is now available globally on iOS and Android, offering creators AI tools, effects, watermark-free exports, and content organization features. (Read)

Tesla anticipates revealing reduced quarterly earnings, possibly intensifying calls for CEO Elon Musk to dedicate more attention to the company instead of his government advisory role. (Read)

OpenAI plans to release a benchmark-topping, open-source reasoning model by early summer, led by VP of research Aidan Clark; the model will be “text in, text out” and optimized for high-end consumer hardware. (Read)

The EU fined Apple €500M and Meta €200M for allegedly violating the Digital Markets Act, accusing Apple of restricting app payment options and Meta of forcing users into ad targeting or paid subscriptions. (Read)

New Startup Deals

Flow, the rental housing startup from ex-WeWork CEO Adam Neumann, has raised over $100 million in new funding at a $2.5 billion valuation, per Bloomberg. (Read)

Alternative Payments, NYC-based B2B payments and checkout infrastructure provider, raised $22M in funding. (Read)

Amplifier Security, an Atlanta, GA- and San Francisco, CA-based autonomous user security company, raised $5.6M in Seed funding. (Read)

Push Security, a Boston, MA-based cyber security company which specializes in identity attacks in the browser, raised $30M in Series B funding. (Read)

Northwood, a Los Angeles, CA-based company that builds and operates ground stations that communicate with satellites to download and process data, raised $30M in Series A funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Investor - Founders Factory | UK - Apply Here

Venture Associate - Capital Facory | USA - Apply Here

VC Summer Associate forgepoint capital | USA - Apply Here

Associate / AVP - City Ventures | USA - Apply Here

Investor - Griffin Gaming Partners | USA - Apply Here

Venture Capital General Partner - ELM Street Partner | USA - Apply Here

Ventures Analyst / Associate - Plug and play tech center | USA - Apply Here

Portfolio Manager - Octopus Venture | USA - Apply Here

Analyst - Tower Research Venture | USA - Apply Here

Associate - Crescenet Enterprises | USA - Apply Here

Venture Analyst - AO Venture | Australia - Apply Here

Investment Analyst - Endiya Parrtnes | India - Apply Here

Investment Intern - Signature Venture | Germany - Apply Here

Analyst Artha Group | India - Apply Here

Events and Operations Intern - Plug and Play Tech Center | UK - Apply Here

Summer Intern, Talent Team - a16z | USA - Apply Here

Pre-Seed Deep Tech Investor - MFV Partner | USA - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator