12 Things That Get VCs To Write A Check (Backed By 100+ Founder Interviews) | VC Jobs

Most people have no idea what VCs look for......

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: 12 Things That Get VCs To Write A Check (Backed By 100+ Founder Interviews).

Quick Dive:

How Do You Tell A Compelling Story About Your Company To Investors?

Idea validation framework (backed by 100+ founder interviews).

Why investors have backed Perplexity AI startups?

Market Sizing Guide For Founders.

Major News: TikTok Building Photo-Sharing App, Sam Altman Raising $1 Billion For AI Device Startup, Selena Gomez Selling Beauty Brand At $2 Billion & Alphabet Is Reportedly Buying Hubspot.

Best Tweet Of This Week On Startups & Technology.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH RYSE

Take a Peek Behind the (Smart) Curtain

Best Buy has a proven record of placing early bets on home technology products that go on to dominate the market. For example:

Ring - acquired by Amazon for $1.2B

Nest - acquired by Google for $3.2B

Pay attention, because Best Buy just unveiled a new smart-home product in over 100 stores that has the potential for massive returns – RYSE Smart Shades.

RYSE is poised to dominate the smart shades market (currently growing at 50% annually) and they’ve just opened a public offering of shares priced at just $1.50/share. Current shareholders have already seen their value increase 40% year-over-year, with strong upside remaining as they scale into retail.

If you missed out on Ring and Nest, this is your chance to secure your stake in the smart home market.

Invest in RYSE before they become a household name.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

13 Things That Get VCs To Write A Check : (Backed By 100+ Founder Interviews)

Most people have no idea what VCs look for….

When it comes to fundraising, founders often follow a well-trodden path - building a pitch deck, cold-emailing investors, or reaching out to them through LinkedIn. However, without the right strategy, these tactics are unlikely to yield the desired results. To develop an effective strategy, it's crucial to understand the key factors that compel venture capitalists (VCs) to invest in a startup.

Through my work with VC firms and conversations with successful founders who have raised money from leading VCs, I've found 12 key things that can help you get VC funding:

The Right Fit

Successful VC fundraising starts with identifying the right fit. VCs often "advertise" the types of startups they're interested in through various channels like social media, podcasts, and newsletters. As a founder, pay attention to these signals - they indicate the areas VCs want to fund. By reaching out to investors already excited about your space, you can save valuable time and increase your chances of securing investment.

A Growing Market

Some markets are growing faster than others.

A VC's job is to pick which ones will vs won’t. This is why AI is attracting so much capital right now. Founders should make it clear that they're early to a market that will be big.

A Big Vision

VCs understand that the startup landscape is highly competitive, with the vast majority of new ventures ultimately failing. However, they also know that a small percentage of startups have the potential to deliver outsized returns - as much as 1000x their initial investment.

When seeking VC funding, founders should not focus on pitching a "safe bet." Instead, the goal should be to sell VCs on a big vision - an opportunity that has the potential to disrupt the market and generate massive growth.

A Unique Insight:

VCs are on the lookout for "asymmetric bets" - investments with outsized potential. To capture their attention, founders need to demonstrate a unique insight that sets their startup apart.

VCs want to see founders who are "zigging" while the market is "zagging" - communicating an understanding of something not widely recognized. By showcasing this distinctive perspective, you can position your startup as a compelling, differentiated opportunity worthy of investment.

The Right Timing

VCs closely monitor market trends to assess the right timing for a startup's product. Being too early can be as problematic as being too late, as seen with Webvan versus Instacart. As a founder, you must ensure you're addressing trends that VCs are currently excited about.

Aligning your startup's offering with the right market conditions and consumer demand can demonstrate you've identified the optimal window, capturing investor attention and increasing your funding prospects.

A Clear Message

VCs see a ton of pitches and decks.

Communicate concisely to stand out. Founders should practice how they talk about their startups over and over.

A Scalable Way To Grow

A great product is essential, but VCs know that sustainable scalable growth is key. While "non-scalable" tactics may work early on, founders must eventually find distribution channels that can support large-scale expansion. When pitching to VCs, demonstrate a relentless focus on identifying cost-effective growth avenues that can acquire customers at volume for significantly less than their projected lifetime value (LTV).

A Strong Moat:

VCs want to see that your startup has a strong moat - factors that will retain users long-term and make it hard for competitors to replicate.

Demonstrate your product is so compelling users won't want to leave, perhaps by highlighting unique features, IP, or powerful network effects. Convincing VCs your business has sustainable competitive advantages is key to earning their investment. But nowadays most founders are afraid to talk about MOAT….

Early Traction

VCs look for early traction as a signal that startups are solving a real problem. This can be evidenced through strong usage metrics or enthusiastic customer testimonials. The ideal scenario is when 40% or more of your users would be "very disappointed" if your product no longer existed.

As a founder, your focus should be on building something people genuinely want, as this early traction can help convince investors of your startup's viability and growth potential.

A Good Reputation

VCs will call your former co-workers to learn about you.

Positive references go a long way to helping close the deal. This signals a founder won't have trouble hiring and retaining good people. Founders should be sure they have good relationships with others.

Relevant Experience

In the early stages, founder-market fit is often more important than product-market fit. Relevant experience allows founders to move with greater speed - the top advantage startups have.

By solving problems they deeply understand, founders can leverage their expertise to navigate challenges more effectively.

VCs recognize that this relevant experience can be a significant competitive edge, as it enables startups to iterate and execute more efficiently than their less experienced counterparts.

Passion for the problem

VCs know startups are gruelling and have seen many founders burn out. To stand out, founders must demonstrate a deep passion for the problem they're solving. This unwavering commitment signals the resilience needed to overcome challenges, convincing VCs to back their vision.

So overall - Why VCs write a check:

The right fit

A big vision

A growing market

A unique insight

Good timing

A clear message

A scalable way to grow

A strong moat

Early traction

A good reputation

Relevant experience

Passion for the problem

With our bi-weekly newsletter (Tuesday & Thursday), we are planning to offer premium content every Sunday. Your feedback will help us create a newsletter that provides maximum value for you…..

QUICK DIVES

1. How Do You Tell A Compelling Story About Your Company To Investors?

Every founder thinks they have an awesome team and technology; the question is, what will investors think?

In fundraising, most founders are tempted to jump straight into PowerPoint to get started.

Don’t do it! Here’s the secret to a great pitch: "It’s not about the slides; it’s about the story."

So how do you tell a compelling story? - First, figure out which type of story you should be telling and make that narrative into a sandwich, emphasizing the key point at the beginning and again at the end.

Next, use your problem and solution statements to emotionally and intellectually engage your audience, and be sure to adequately address all the expected areas in the deck.

With all that in mind, you’ll be ready to follow three simple steps to craft your winning deck. Choose The Right Story To Tell.… Read More Here

2. Idea Validation Framework -

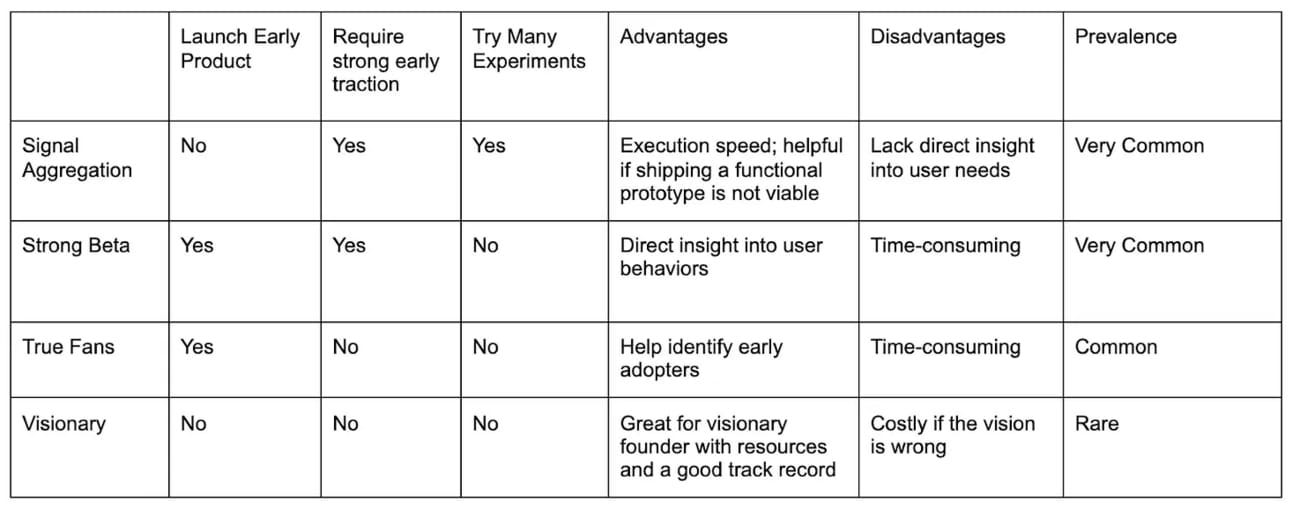

Most ideas, especially in B2C, get validated in one of four ways:

Signal Aggregation → Conduct experiments to gather data before launching (landing page tests, etc).

Strong Beta → Run a small-scale beta and hit established benchmarks that are good for your vertical

True Fans → Find people who will be very disappointed if your product goes away.

Visionary → The least common. You have a vision for something, build it, and it ends up working out. Typically includes some combination of the other.

This framework defines the differences between each path to validation..

3. Why Investors Have Backed Perplexity AI startups?

Ryan Hoover, founder of Product Hunt shared a tweet on why investors backed this hot consumer AI startup.

4. Market Sizing Guide For Founders.

A startup’s potential scale is bound by its future market size, and consequently “What is your market size?” is one of the determining questions that most VCs ask early-stage entrepreneurs.

Why does market size matter?

How to estimate your market size?

What is the exact definition of market size?

When should market size be estimated?

Remember - an entrepreneur’s clarity of thought and enduring ambition as more important than the market size number in a pitch deck. The objective of market sizing is to show that you are targeting a big market opportunity that you understand deeply.

Startups have many unknowns and market sizing is a rough estimation, so keep it simple.

Based on a peer VC survey, “it seems that many investors do not like to define TAM/SAM/SOM terms.” So when presenting your market sizing, explicitly state your methodology rather than assume universal definitions..… Read More Here

Join 17000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

TikTok is developing a new photo-sharing app called "TikTok Notes," - to compete With Instagram. Read Here

Jony Ive and Sam Altman are in talks to raise $1 billion for a new AI device startup. Read Here

Selena Gomez, the singer and actress selling her Rare Beauty brand at around $2 billion. Read Here

Terraform Labs Pte. and co-founder Do Kwon were found guilty of fraud in a US lawsuit linked to their 2022 collapse, causing a $40 billion loss in investor assets. Read Here

Alphabet, the parent company of Google, is in talks with its advisors about making a potential offer to acquire HubSpot. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

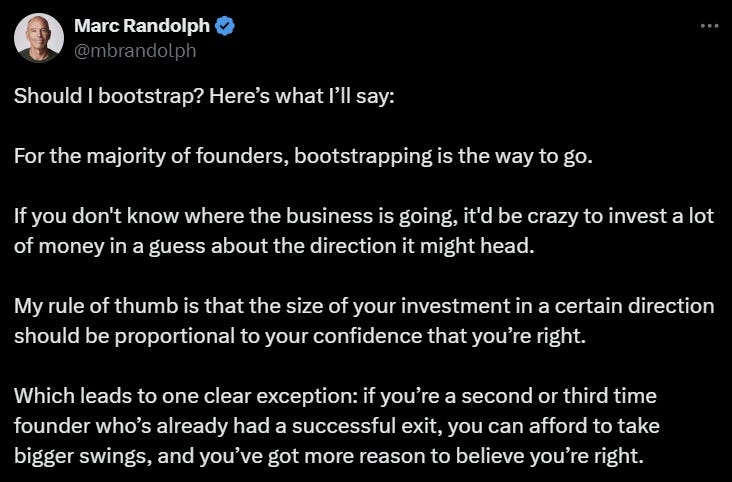

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Investment Analyst - Forum Venture | USA - Apply Here

Marketing Manager - Matrix partner | India - Apply Here

VP of Finance - Project A | Germany - Apply Here

Partnerships Manager - Techstars | USA - Apply Here

Investment Manager - Wellington | Germany - Apply Here

Senior Associate, Environmental Sustainability - Impact Engine | USA - Apply Here

Analyst VC - stage - 574 Venture | France - Apply Here

Accelerator Lead - Techstars | USA - Apply Here

Investment Associate - Transpose Platform | USA - Apply Here

Early Stage Investor - ASIF Venture | Netherland - Apply Here

Program Associate - Techstar | USA - Apply Here

Investor - 01 Advisor | USA - Apply Here

Head of Recruiting - 25madison | USA - Apply Here

Operations Assistant - Level UP Venture | USA - Apply Here

Marketing Intern - She Capital | India - Apply Here

Investment Team - Lok Capital |India - Apply Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to daily VC job updates, VC learning resources, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Will Meet You on Tuesday!

Happy Thursday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team

Apparently storytelling trumps even product at an early stage, once one has enough data, the rest they say is story. A very insightful write up. Thanks for sharing.