What VCs look for when you don’t have traction yet. | VC & Startup Jobs.

How to find the right investors, Product discovery framework by YC Founder, Paul Graham’s the fatal pinch.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: What VCs look for when you don’t have traction yet.

Quick Dive:

How to find the right investors for your startup.

Product discovery framework by YC-backed startup founder.

If you've got less than a year's cash left, you need to read this now.

Major News: OpenAI launches a new AI coding agent, Apple’s AI partnership with Alibaba raises alarms, Google unveils an AI coding agent & OpenAI brings its GPT-4.1 models to ChatGPT.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

State of VC-backed SaaS Startups in 2025.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

6000+ European VC Firms Contact Database (LinkedIn Links).

The only startup valuation guide you need as a founder.

Symptoms vs. problems: the trap every founder must avoid.

Excel Template: Early Stage Startup Financial Model For Fundraising.

How the VC industry has built-in barriers to entry for “Emerging Managers”.

Building the agent economy: How cloud leaders are shaping AI’s next frontier.

Book of Scouting Reports: 2025’s AI 100.

Do Early-Stage startups need a financial model for fundraising?

Q1 2025 - US VC Valuations and Returns Report.

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them)

When Will We Pay a Premium for AI Labor? By Tomasz Tunguz.

Investor data room guide & templates for founders

For retail investors: Build lasting wealth with our newsletter! Simplifying investing for beginners and retail investors, we provide actionable insights to help you grow your wealth with confidence.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decksbuilt by experts, and reviewed by investors. Don’t leave funding to chance[schedule a call today →]

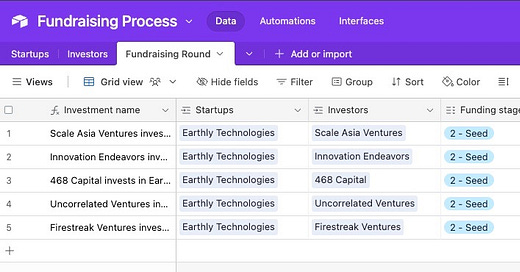

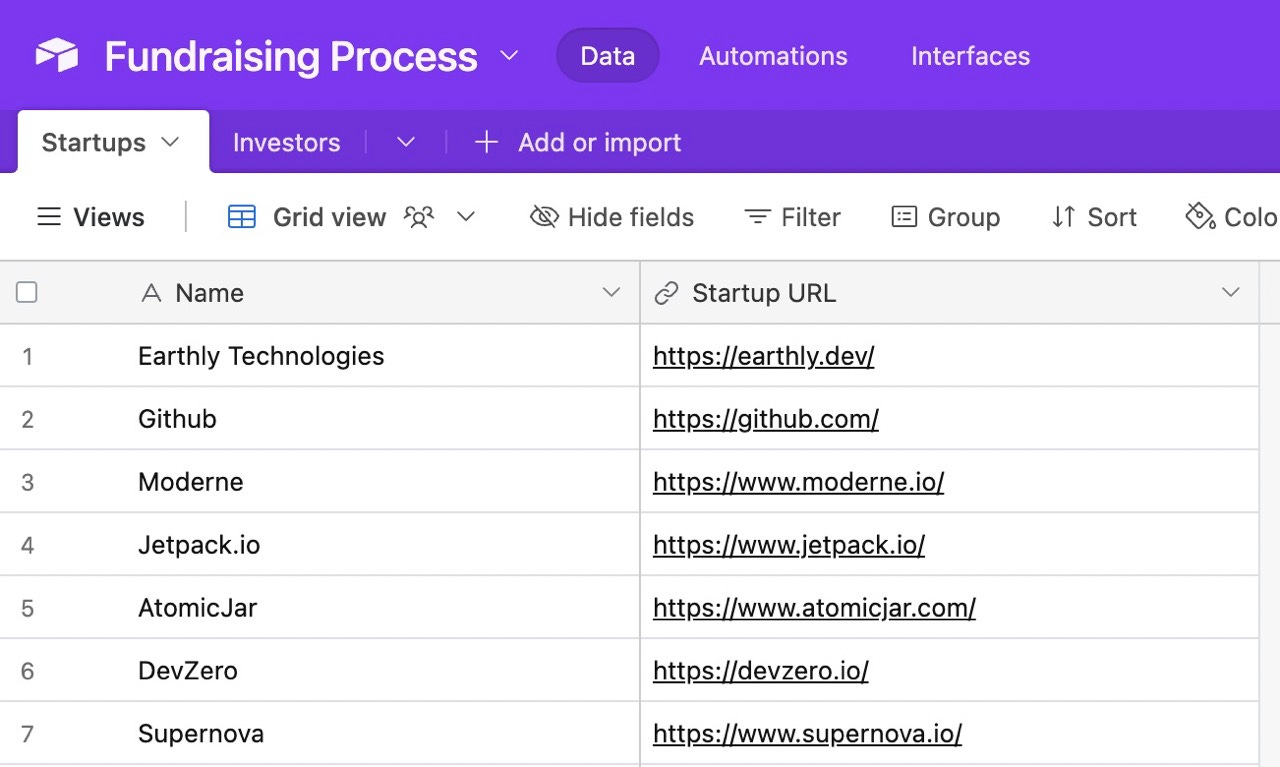

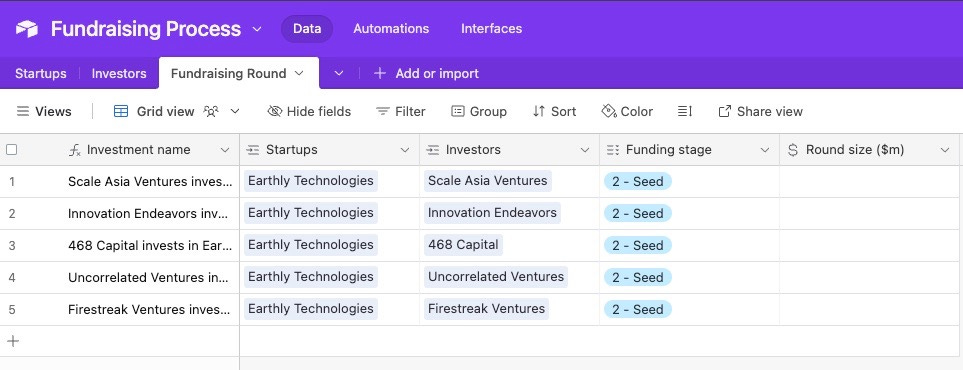

FROM OUR PARTNER - ATTIO

🤝 Why Next-Gen Startups Are Switching to Attio.

Attio is the AI-native CRM built for the next era of companies.

Connect your email, and Attio instantly builds your CRM - with every company, every contact, and every interaction enriched and organised.

You can also use AI research agents for complex processes like finding key decision-makers and triaging leads.

Join industry leaders like Flatfile, Replicate, Modal and more.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

What VCs look for when you don’t have traction yet.

If you're a founder raising capital at the earliest stages, chances are you've heard the question: "What traction do you have?"

And maybe your honest answer is: "None yet." Maybe your product isn’t live. Maybe it’s half-built. Maybe you’re still figuring out your first users.

That’s okay. At the pre-seed stage, investors know that full traction is rare. But what they do want to see is something else something just as important.

Investors don’t just look for traction they look for a plan to get it

Recently, I spoke with a VC fund partner who explained how he thinks about traction when evaluating pre-seed startups: he’s forgiving about the numbers, but not about the thinking behind them.

Yes, pilots, early sales, or case studies help. But more critical is your thesis for how traction will come. Not guesses. Not buzzwords. A clear, reasoned plan.

Because here’s the truth:

A project isn’t a business, until it makes money.

You can build the coolest product in the world, but unless it brings in more money than it costs, it’s not a business. It’s a side project. A prototype. A dream. Investors want to know how you’ll cross that line.

Your GTM plan is your logic map for how your startup goes from zero to something real. It shows that you know who your customers are, how to reach them, and how to keep them.

The worst answer is:

“The product will be so good it’ll grow virally.”

That’s not a plan. That’s hope.

Instead, think like this:

“We’re a B2B SaaS startup targeting HR teams at 50–500 person companies. We’ll start by hiring two AEs to outbound prospects in healthcare and manufacturing, where we already have warm intros.”

“Our initial users are hobbyist photographers. We’ll partner with 5 large YouTube creators in the space to drive our first 10,000 signups.”

See the difference? That’s a thesis. It shows you understand your market and the path to traction even if you haven’t walked it yet.

Founders need to show they’re building a business, not just a product

Investors don’t expect everything to be figured out. But they do expect you to show a clear plan to get there. They need to know you’re not just obsessed with building but equally serious about selling.

If you can show that, you don’t need traction yet. You just need the conviction, logic, and strategy that will lead to it.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

☀️ Off-Grid Power Meets EV Charging—Why Investors Are Backing GoSun

GoSun has sold 175,000+ solar-powered products in 80+ countries. Now it’s tackling EV charging with a new solar innovation: a lightweight rooftop electric car unit that can power 70% of a car’s annual mileage—off-grid, with no infrastructure required.

$ 7 M+ in pre-orders for the EV Solar Charger (pre-production)

Active in a $500B+ market spanning solar, EVs & preparedness

Over $25 M in lifetime sales, with a loyal, global customer base

Led by cleantech veterans with patents across cooking, cooling & charging

With grid instability rising, GoSun’s solar tech offers freedom, resilience, and a chance for investors to power the next wave of clean infrastructure.

Invest in GoSun’s cleantech future →

📃 QUICK DIVES

1. How to find the right investors for your startup.

Crafting the perfect pitch deck is only half the battle. The real challenge? Getting it in front of the right investors.

Many founders build great stories but stumble when it comes to actually finding investors who are a good fit. Here’s a clear, step-by-step guide to building a targeted investor list that increases your chances of getting a “yes.”

1. Define your “investor strike zone”

Before looking for investors, figure out what kind of investor you're looking for. This helps you avoid wasting time on people who’ll never say yes.

Ask yourself:

Where are you based? Many investors have geographic preferences. If your team is 70% in Europe but you're a Delaware C-corp with a U.S.-based CEO, call yourself a U.S. startup.

Do you have any founder affinity? Some investors focus on specific groups—like underrepresented founders, alumni from specific schools, or founders with niche backgrounds.

What’s your industry? Be clear and honest. Don’t call a fintech play a healthcare startup just because it touches healthcare. It’s fintech.

What’s your business model? Are you DTC? SaaS? Marketplace? Investors often specialize in a few models. Knowing your model helps you find the ones who get it.

What stage are you at?

Pre-seed: Building the product, likely no revenue. Raises of $200K–$3M.

Seed: The product is working, with some early traction. Raises of $1M–$15M.

Series A: Significant traction, scaling. Typically $10M and up.

How much are you raising? Be specific. Investors want to know you have a plan and know what it’ll cost

2. Build your investor list

Let’s say you’re building a dev tools SaaS company based in NYC and raising $2M. Here’s how to create a list of relevant investors:

Step 1: List similar companies

Find 15–20 startups similar to yours, not identical, just playing in the same arena. If you’re Lyft, don’t look at Uber’s investors. Look at those in the broader “mobility” or “sharing economy” space.

Use TechCrunch, Crunchbase, etc., to find them. Even you can check out our investor’s database.

Step 2: Find their investors

For each company, look up:

Who invested

At what stage

Who led the deal (usually quoted in press releases or TechCrunch articles)

This gives you a solid top-of-funnel list.

Step 3: Use “Similar Companies” tools

Crunchbase shows “similar companies” for each startup. Use that to discover more companies, then repeat step 2 to expand your investor list.

Step 4: Expand by investor

Once you’ve got ~50 startups and 200 investors on your list, start noticing patterns. Some investor names will show up again and again. These are your power players.

Look up these investors on Crunchbase. See who else they’ve invested in, and who they often co-invest with. Add those names to your list too.

Step 5: Prioritize your outreach

You now have a working list. Time to sort and prioritize:

Who are the most active investors in your space?

Who has the best reputation among founders?

Who’s most aligned with your model and stage?

Ask other founders, reach out at events, and do your homework. The most talked-about investors are usually the ones worth starting with.

Step 6: Use Crunchbase “Hubs”

Some Crunchbase lists are gold. For example: “Developer tools companies with fewer than 1,000 employees.” Use these as sanity checks to make sure you haven’t missed any relevant players.

Final step: Qualify your list

Now cross-check everything.

Do these investors still actively invest?

Do they back your stage, geography, and business model?

Do they lead rounds or just follow?

Is there a specific partner at the firm who’s the best fit?

Overlay this data with your “strike zone” criteria and narrow it down to a high-priority list.

And don’t forget: sometimes investors make exceptions. If you’ve got a strong referral or a unique angle, even someone who technically doesn’t match your profile might still be open.

Yes, it’s work—but it’s worth it

Spend an afternoon doing this well, and you’ll not only build a quality investor pipeline, but you’ll also sharpen your understanding of the space you’re operating in.

Also, you can check out our previous post on building Investor CRM with a free template to download.

2. Product discovery framework by YC-backed startup founder.

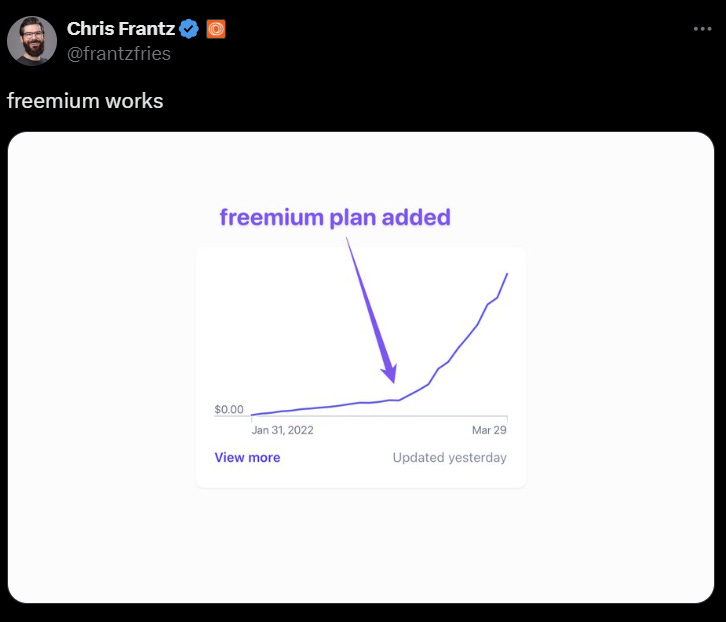

Chris posted this framework in January of 2022.

Since then, he’s founded a YC-backed startup that makes it incredibly simple and easy to send transactional emails and sequences for any company, with a revenue growth chart that looks like this:

Here’s the framework:

Pick a customer you enjoy talking to

Talk to 15 of them to be sure you do (and can get in touch with them)

Ask them to tell you a problem that’s more important than an 8 on a scale of 1-10

If that problem is generalizable, make the smallest MVP you can (no code required, if possible)

Ask the 15 people if they’d pay for what you built, or would pay if you prioritized a certain feature they ask for

Repeat, with 50 new people. If the feature requests you’re getting are too varied, you may be solving the wrong problem.

Super practical and simple, but true! If you can’t find people to pay for your product, you likely don’t have a product that can turn into a business. Click into the thread to read it in full.

3. If you've got less than a year's cash left, you need to read this now.

If you're a founder with less than ~12 months of runway going into 2024, you have to re-read Paul Graham’s The Fatal Pinch. Assume you will NOT get a bridge round, and figure out what other options you have ASAP.

Let me share a key point that every founder should consider while considering their burn rate -

“The "fatal pinch" that happens to a lot of startups. It's when they've got some cash in the bank, but they're bleeding money every month and not growing. They think they'll be fine 'cause they'll just raise more money from investors. Big mistake.

The problem is, that founders often kid themselves about how easy it'll be to get more funding. It's way harder the second time around because:

The company's burning through cash faster now

Investors expect a lot more from companies that have already raised money

The startup is starting to look like a failure

This whole situation is like a nasty feedback loop. Founders think they'll easily raise more money, so they don't try hard enough to become profitable, which makes it even harder to raise money.

To avoid this mess, YC tells founders to act like the money they raise is the last they'll ever get. If you're already in the fatal pinch, you've got three options: shut down, make more money, or spend less (which usually means firing people).

If you decide to keep going, you need to focus on making more money ASAP. This might mean changing what you're selling or doing more consulting-type work. Just be careful not to slide too far into pure consulting.

The good news is, that lots of successful startups have had near-death experiences and survived. You just gotta realize you're in trouble before it's too late. If you're in the fatal pinch, you are.”

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Redpoint Ventures, a San Francisco, CA-based early-stage venture firm, raised a $650M 10th early-stage fund, matching its previous fund from three years ago. (Read)

NYC-based VC firm Work-Bench has closed a $160M Fund IV to invest in seed-stage enterprise software companies. (Read)

Major Tech Updates

OpenAI unveiled Codex, a new AI coding agent powered by a version of its o3 model (codex-1) optimized for software tasks, capable of writing, testing, and debugging code in a cloud-based sandboxed environment. (Read)

MIT has publicly questioned a prominent AI productivity study, stating the institute has no confidence in the reliability or validity of the data it presented. (Read)

The Trump administration and House officials are questioning Apple about its reported deal with Alibaba to integrate AI features into iPhones sold in China. (Read)

AMD announced a $6 billion stock buyback, bringing its total repurchase authority to $10 billion amid slowing AI-fueled market gains and falling share prices. (Read)

New Startup Deals

Algoma, a NYC-based provider of an AI-native real estate development platform that helps real estate developers turn an address into a deal, raised $2.3M in Seed funding. (Read)

Metafoodx, a San Jose, CA-based AI food operations company, raised $9.4M in funding. (Read)

Ascend Cloud, a London, UK-based provider of enterprise-grade CRM SaaS solutions, raised $110M in funding. (Read)

Aikido, a Los Angeles, CA-based AI and care delivery company, raised $60M in Series B funding. (Read)

Sprinter Health, a Palo Alto, CA-based at-home healthcare company, raised $55M in Series B funding. (Read)

Layer, a San Francisco, CA-based developer of an AI application gateway built specifically for game developers, raised $6.5M in seed funding. (Read)

Nekuda, a NYC-based startup building infrastructure for agentic payments, raised $5M in funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Investor Relationship Associate - Bauken Capital | USA - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

General Partner - Inviox Capital Partner | UK - Apply Here

Investment Analyst - In Q Tel | Singapore - Apply Here

Analyst / Associate - Kairon Capital | India - Apply Here

Head of Investor Relations - Continous Venture | UAE - Apply Here

Portfolio Growth - Point 72 Venture | USA - Apply Here

Associate - SpeedInvest | UK - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Investor - Founders Factory | UK - Apply Here

Investor Relationship Manager - Startport Capital | USA - Apply Here

Portfolio Growth - Point 72Venture | USA - Apply Here

Internship - Octopus Venture | UK - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

great take - keep it up!