How startups really succeed or die: it all comes down to these two laws. | VC & Startup Jobs.

In AI, models aren’t moats, Startup legal document pack & Fake product-market fit.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How startups really succeed or die: it all comes down to these two laws.

Quick Dive:

In AI, models aren’t moats — but these are.

Startup legal document pack – essential legal docs for founders.

Y-Combinator: these are signs of fake product-market fit.

Major News: OpenAI inflated o3 benchmark claims, Microsoft researchers create super‐efficient AI, Google loses adtech monopoly case & Former Y Combinator president Geoff Ralston launches new AI ‘safety’ fund.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

We're gonna need a bigger moat by CBInsights.

OpenAI’s o3, GPT-4.1, and o4-mini Our take on what’s powerful, what’s practical, and what’s still TBD.

Winning at seed investing isn’t just about when to buy, but increasingly also when to sell.

Getting founders some early liquidity can benefit VCs.

When engineers say "that'll take months!"

Build a consulting business before you build a product business.

We bought HUNDREDS of billboards in San Francisco, for our open source product.

Investor Data Room Guide & Templates for Founders.

All-In-One Guide to Venture Capital interview questions (And how to answer them).

The AI Model Flood Plus: Meet your new AI alien best friend.

Excel Template: Early Stage Startup Financial Model For Fundraising.

SaaS Startup Financial Model: All-in-One Excel Template.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

300+ Australian angel investors & venture capital firms contact database (Email + LinkedIn Link).

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

For marketers: Skip the AI hype, get real results. Join 10,387+ marketers learning the AI tools and prompts that drove 40% better performance.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

🤝 An AI-Driven, FDA-Cleared Solution for PTSD Nightmares

NightWare is transforming PTSD treatment by using AI-powered, FDA-cleared technology to interrupt severe nightmares caused by PTSD—improving sleep quality and the lives of veterans and trauma survivors.

NightWare is positioned to scale rapidly in a surging market:

$25.3B U.S. sleep disorder market ($13.2B PTSD segment)

1,500+ devices already prescribed ($7M+ lifetime sales)

80%+ gross margins

The investment round closes in less than two weeks—secure your stake today.

Disclaimer: This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How startups really succeed or die: it all comes down to these two laws.

Most startups don’t fail because they ran out of money. They fail because they scaled something that wasn’t working.

They poured fuel on a system that quietly turned each $1 into less — and by the time they noticed, it was too late to pull back.

Behind this pattern are two laws most founders never name, but almost all learn the hard way.

Law 1: Capital compounds what already exists

If the foundation is solid, capital accelerates growth. If the model is flawed, capital accelerates decay. That’s it. Capital doesn’t bring insight, clarity, or product-market fit. It only fuels what’s already working — or already breaking.

Most startups use capital in two ways: to experiment or to scale.

The first rarely needs much money. The second demands confidence in a working engine — one that consistently turns $1 into more than $1. But many founders, often under pressure from investors, skip the experimentation stage and race straight to scale. They try to turn a hypothesis into a company. When that hypothesis doesn’t hold up under scale, the startup implodes — slowly at first, then all at once.

Law 2: All positive systems eventually hit diminishing returns

Every system that generates value eventually plateaus. That marketing channel you cracked? It saturates. The high-converting landing page? Stops performing. The sales playbook? Works great for the first team, then falters as you scale. What was once a $1 → $5 return becomes $1 → $1.50. Then $1 → $0.90.

By the time founders realize this, they’re already sprinting. Budgets are locked. Headcount is up. Growth targets are public. Stopping feels riskier than pushing forward.

This is where most startups quietly slip into decline: they continue to invest in what used to work, burning cash in the hope that momentum will fix the trend line. But compounding doesn’t care about hope. If your formula is slipping into the red, more capital only speeds up the failure.

Vanity value vs. intrinsic value

There’s a dangerous temptation to rationalize value where there isn’t any. A proprietary data set, a large IP portfolio, a growing user base — these sound like long-term advantages. But if they don’t translate into real, compounding value, they’re distractions.

Just because something feels expensive to build doesn’t mean it’s valuable. And just because something’s hard to measure doesn’t mean you should pretend it’s working.

Startups often convince themselves they’re creating future value, when in reality they’re just spending. This is why venture capital is such a poor validator. The presence of funding doesn’t mean you’ve built something meaningful. It just means someone else placed a bet.

What declining ROI looks like

Founders usually don’t notice the shift from compounding gains to diminishing returns — until it’s too late. Here's what it tends to look like in practice:

Adding more features that increase complexity but offer less value

Expanding into customer segments that churn faster and pay less

Pouring money into once-great marketing channels that are now saturated

Hiring sales reps who perform worse as training and focus get diluted

Scaling customer support while quality quietly drops

Hiring more people into bloated teams that ship less

Letting executive focus thin out across too many priorities

Each of these starts as a sensible growth decision. Each erodes the formula just a little. Then the next dollar you invest returns less than the one before it — and you're still expected to grow faster.

Why founders ignore the warning signs

It’s hard to admit when something stops working. There’s pressure to keep moving, keep hiring, keep growing. Capital creates inertia. Once you commit spend, reversing it feels like failure.

And once you’ve raised money at a high valuation, you’re not just building a company — you’re trying to hit targets someone else set.

Startups don’t often die from one bad decision. They die from failing to acknowledge a slow decay — and compounding that decay at scale.

How VCs fuel the problem

Venture capital incentives don’t always align with building sustainable businesses. VCs want growth, because growth creates paper markups. Those markups help them raise their next fund.

The obsession with momentum often leads founders to prioritize appearance over substance.

When founders chase the next round instead of solving for real value, they optimize for fundraising, not fundamentals. It creates a cycle where spending is aimed at short-term goals, and the engine underneath is ignored until it breaks.

What founders can do differently?

If there’s one thing I’ve seen work repeatedly, it’s discipline. The best founders don’t skip the messy early stages. They run small, cheap experiments. They don’t spend until they’ve proven a formula. They stop when a channel goes negative.

They know it’s better to slow down and reorient than to speed up in the wrong direction.

Good experiments don’t require big teams or big budgets. They require focus. And clarity. Instead of chasing growth, the best teams chase understanding: how do we actually turn a dollar into more than a dollar — again and again?

If the answer isn’t clear, they pause. They test something else. They ask better questions: Would we rather grow 20% efficiently or 30% inefficiently? What are we learning? Where are we guessing? How confident are we, really?

That’s the game: respecting the laws of startup physics. Build a system that creates real value. Know when it stops. Be brave enough to change course — before the compounding works against you.

All thanks to Eric Palley for sharing these two law of startup.

Also with expert team we have curated

Excel Template: Early Stage Startup Financial Model For Fundraising.

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

FOR FOUNDERS WANTING TO GROW…

🚀 Ship faster. Scale bigger. Win more.

Urban Dynamics is accelerating startups to ship & scale faster. Stay focused on what matters — building features — and stop worrying about the pain of cloud, security, DevOps, and more.

Take advantage of our Product Scalability Workshop for Founders – a dedicated 1-hour workshop tailored to you and scaling your startup fast⚡️availability is limited.

Reserve your slot for April now →

PS - Attending Google Cloud Next? If so, join our community newsletter & Slack to meet up with our team 👋

📃 QUICK DIVES

1. In AI, models aren’t moats — but these are.

AI is having its 2021 moment again. Deals are getting done at crazy valuations, and companies with barely any revenue are being priced like the next Google. We saw this before. We know how it ends.

Rex Woodbury, in his recent article, breaks it down brilliantly — how much of today’s AI excitement is noise, and what signals are actually worth paying attention to. So sharing few points and my opinion on it.

Valuations are frothy — again

Startups are raising rounds at 50x, 100x revenue — sometimes with no revenue. And just like 2021, that’s not going to end well for most. The math doesn’t work unless you grow insanely fast and sustain it. A lot of these companies will quietly raise down rounds or shut down in the next few years.

ARR isn’t what it used to be

AI revenue today is messy — it’s not predictable, it’s not always recurring, and churn is real. So when people start throwing ARR multiples around like we’re still in SaaS land, be skeptical. As Rex points out, not all ARR is created equal.

The 3 real signals to watch: Talent, Brand, and Feedback Loops:

Talent

Great companies attract great people. Then those people attract more talent. Rex calls this the “talent vortex” — and it’s real.

If the early team is filled with A-players, the bar stays high. But if you compromise early, it gets harder to fix later. And if you say talent is your top priority, your calendar better show it.

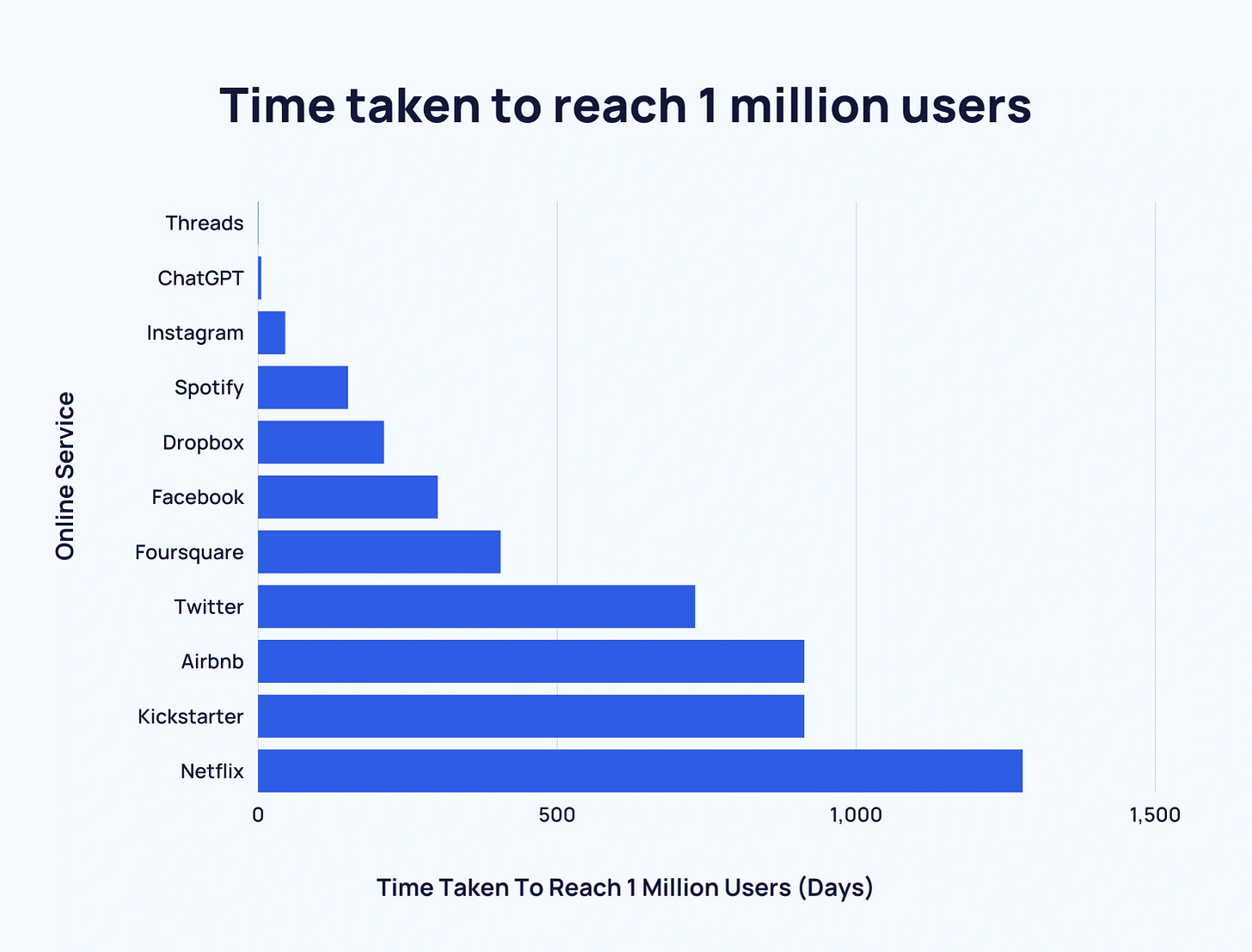

Brand

Brand isn’t just about a pretty website. It’s how people talk about your company when you’re not in the room. ChatGPT didn’t just win with product — it won with presence. Runway’s been loud and smart about building their brand.

Meanwhile, a technically strong company like Kling barely registers. Attention compounds.

Feedback Loops

This is the quiet moat. Everyone’s using similar models — but the edge is in the data. Notion knows how people work. Replit learns how people code. Character.ai sharpens its tone based on billions of interactions.

The tighter your product-feedback loop, the smarter your product gets. And that advantage adds up over time.

There’s a lot of noise in this market, and it's easy to get distracted by valuations, flashy demos, and the hype cycle.

In a market where everyone has access to the same models, the real differentiation comes from three things:

The quality of people you hire and surround yourself with

The strength of your brand and how people talk about you

The tightness of your product’s feedback loops

These are the signals that compound quietly — and the ones that actually build a moat. Ignore them, and all you’re left with is noise.

You can read the detailed article here: Models Aren't Moats - Three Signals Amongst the AI Noise.

2. Startup legal document pack – essential legal docs for founders.

Starting a company is exciting, but many founders overlook the legal side—until it’s too late. Whether it’s splitting equity, raising funds, or hiring your first team member, having the right legal documents in place from day one can save you from serious issues down the road.

Why These Documents Are Critical

Legal paperwork isn’t just about compliance—it protects your business, your team, and your investors. Proper documentation ensures:

Founders are aligned on ownership, roles, and responsibilities.

Investors trust your startup, making fundraising smoother.

Employees and contractors don’t walk away with your IP.

Your company doesn’t collapse due to a legal dispute.

Many early-stage startups raise funds or start hiring without any legal foundation, creating problems that can kill deals or cause internal conflicts later.

Common Mistakes Founders Make

Skipping Founder Agreements

Many co-founders start with a handshake deal. Without a Founders' Agreement or Restricted Stock Agreement, things get messy if someone leaves or equity splits aren’t clear.Not Incorporating Properly

Choosing the wrong structure (e.g., LLC instead of C-Corp) can make it harder to raise VC funding. Investors prefer Delaware C-Corps because of standard protections and tax advantages.No Vesting Schedule for Founders

Without a vesting schedule, a founder who leaves early keeps all their shares—even if they stop contributing. A 4-year vesting with a 1-year cliff is the standard setup to prevent this.Fundraising Without Proper Documents

Raising money without a SAFE note, convertible note, or term sheet can lead to legal disputes, unexpected dilution, or even losing control of your startup.Not Securing Intellectual Property (IP)

If employees or contractors build your product without signing an IP Assignment Agreement, they own the IP, not your company. This mistake has killed acquisition deals and lawsuits have followed.Forgetting Data & Privacy Compliance

If you collect customer data, you need a Privacy Policy and Terms of Service—especially if you serve users in California (CCPA) or the EU (GDPR). Failing to do so can lead to heavy fines.

To avoid these mistakes, you need the right legal documents in place from day one. The Startup Legal Document Pack was created with input from experienced startup attorneys, legal associates, and venture capital firms to make sure you’re using up-to-date, investor-approved templates.

You can access all the essential templates—from incorporation docs to fundraising agreements—in our Startup Legal Document Pack.

3. Y-Combinator: these are signs of fake product-market fit.

Nowadays - It's pretty common for companies to claim they've nailed product-market fit when, in reality, they're quite far from it. I'd argue this is a major cause of downfall, especially for post-seed companies.

Many founders often face a dilemma where they believe that they have achieved product-market fit based on some factor, but honestly, it’s just a "Fake Product-Market Fit." What are those factors?

Firstly, some founders believe they've hit the jackpot when they secure funding from impressive individuals or renowned funds. The thought is that if these influential people or funds chose their company, it must mean they have product-market fit. This belief is surprisingly widespread.

Secondly, there's a trend where companies manage to raise substantial amounts, even before having a product that people truly love. Interestingly, instead of focusing on users and improving the product, founders often shift their focus to building the company, which is usually not the best move.

Thirdly, there's this phenomenon we call "magical thinking". It involves ignoring obvious facts or not bothering to measure crucial metrics that would reveal whether product-market fit exists. For instance, not understanding churn or the payback period after acquiring a customer. If you're not aware of these numbers, it's easy to convince yourself that you've achieved product-market fit when you haven't.

Lastly, there's a tendency for people to delude themselves into thinking they've achieved product-market fit simply because they don't want to face the idea that they might need better engineering or product improvement. Admitting that improving the product is challenging, they find it easier to just believe their product is already good.

Most of the founders fell into this trap of ‘Fake Product Market Fit’. Not only this - one of the most common misconceptions is that

“Product-Market Fit Means Only You've To Build A Product That Your Users Want.

In reality - Product-market fit typically feels like your product is gaining traction with profitable usage.

”your product is attracting users, and word of mouth or advertising channels are working well. Users love your product, and they're sticking around.

However, there's a catch.Parts of your product that you didn't build to scale are starting to break. It could be software components or operational aspects, but something is faltering because it wasn't designed for this level of success.”

You might be thinking what’s this profitable usage about?

“It means these users are the ones you want, and economically, they make sense. You're not spending a lot for a user who only brings in a fraction of that cost. There's no crazy three-year payback period or anything like that.

So, for genuine product-market fit, we need both these components:

a product that's breaking in a good way due to increased usage

users who align with the economics you desire.

To achieve genuine product-market fit, founders need to determine if they have a real connection between their product and the market, instead of a fake one.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New VC Launch

Founders Fund has closed a $4.6 billion growth fund, up from its previous $3.4B fund in 2022, signaling renewed VC bullishness. (Read)

Andreessen Horowitz acquires Turpentine podcast, hires Erik Torenberg as general partner VC podcaster and On Deck co-founder Erik Torenberg joins a16z as GP, bringing his Turpentine show with him. (Read)

Major Tech Updates

OpenAI previously claimed its o3 AI model scored over 25% on the challenging FrontierMath benchmark, but independent tests by Epoch AI found it performed closer to 10%. (Read)

Microsoft researchers introduced BitNet b1.58, a language model engineered specifically to minimize power consumption and memory footprint during operation, making it highly economical for various devices. (Read)

OpenAI’s latest reasoning models, o3 and o4-mini, outperform in coding and math but hallucinate more frequently than older models like o1 and GPT-4o, with o4-mini hallucinating nearly 48% of the time on PersonQA. (Read)

Chinese e-commerce apps DHgate and Taobao skyrocketed in U.S. App Store rankings after viral TikTok videos explained how many luxury goods originate from Chinese factories. (Read)

New Startup Deals

1Fort, a NYC-based company providing an AI platform for business insurance, raised $7.5M in funding. (Read)

Booked it, a London, UK-based provider of booking, marketing, CRM, and loyalty solutions, raised £2.5M in funding. (Read)

Goodfire, a San Francisco, CA-based AI interpretability research company, raised $50M in Series A funding. (Read)

Risa Labs, a Palo Alto, CA-based oncology AI company, raised $3.5M in funding. (Read)

Toku, a San Francisco, CA-based provider of an account receivable SaaS platform, raised $48M in Series A funding. (Read)

Vizzy, a London, UK-based talent platform provider for global brands, raised £3.65M in Seed funding. (Read)

Crux, a NYC-based capital markets technology company, raised $50M in Series B funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Analyst - MongoDB Venture | USA - Apply Here

Program Manager - Genera8tor | USA - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Venture Capital Associate - Acumen | USA - Apply Here

Investment Associate - 888VC | India - Apply Here

Venture Capital Intern - Bosch Venture | USA - Apply Here

Sales Manager - Lunicorn Venture | UK - Apply Here

Associate and Analyst positions - 12 Flags | India - Apply Here

General Counsel - Playground Global | USA - Apply Here

VC Summer Associate forgepoint capital | USA - Apply Here

Ventures Analyst / Associate - Plug and play tech center | USA - Apply Here

Analyst - Tower Research Venture | USA - Apply Here

Investment Intern - Signature Venture | Germany - Apply Here

Analyst Artha Group | India - Apply Here

Pre-Seed Deep Tech Investor - MFV Partner | USA - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator