How Successful Startups Solved the Chicken and Egg Problem: A Case Study of Tinder, Uber and Airbnb! | VC Jobs

When (and When Not) to Fight Your Competitors & How Great Tech Companies Capture Long-Term Value.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How Successful Startups Solved the Chicken and Egg Problem: A Case Study of Tinder, Uber and Airbnb!

Quick Dive:

How Great Tech Companies Capture Long-Term Value.

Market Command Matrix: When (and When Not) to Fight Your Competitors

15 Steps to Know If Your Company Can RETURN a VC Fund.

Major News: Anthropic’s new AI can control your PC, Major publishers sue Perplexity AI for scraping without paying, Bessemer, Index, and a16z alum launches $350M VC Fund & Apple may stop Vision Pro production by end of 2024.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER MECO

The Best Free New App For Newsletter Reading.

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco you can enjoy your newsletters in an app built for reading while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox).

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

You can try the experience for free and available on iOS and the web (desktop).

Over 30k readers are enjoying their newsletters (and decluttering their inboxes) with Meco - try the app today!

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Partnership With Us: Get your brand in front of 62,000+ founders, investors, executives, and startup operators.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Y-Combinator Guide To Seed Fundraising. (Read)

Rethinking Startup Equity: Three Critical Lessons for Founders - Advice From Altman. (Read)

Is Freemium the Right Choice For Your Company? (Read)

How Do VCs Make High-Quality Investment Decisions? (Read)

A step-by-step guide to writing a hero section that converts. (Read)

5 copy rules from a man who made $1 billion in revenue with his words. - Gary Halbert. (Read)

Ilya Sutskever's top 30 must-read research papers. (Read)

How to do great work by Paul Graham? (Read)

What Makes a Good Product-Market Fit? (Read)

Harvard Innovation Labs: The Path to PMF. Here's the 6-hour, 91-slide workshop for Harvard Innovation Labs on the path from $0-$1M and B2B product-market fit. (Read)

TODAY’S DEEP DIVE

The Chicken and Egg Problem: Tinder, Airbnb & Uber Case Study

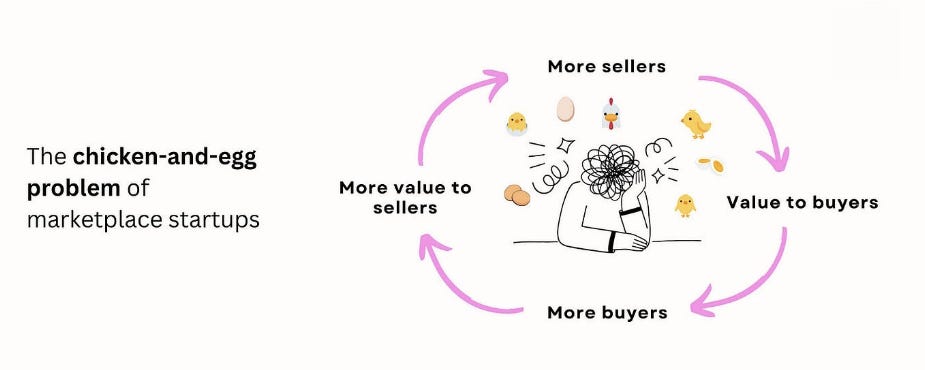

When you are launching a two-sided platform, you need supply and demand. And it creates a big problem for founders, putting a high barrier to entry. You need to find not just users, but two different types of users (which is x2 times harder).

Users on one side of the business model find the platform useful only if the other side also exists.

For example, people buy video game consoles only if there are games they can play. Game developers make games for a console only if there are enough people who use it.

A lot of founders have this question- How to solve The Chicken and Egg problem? So We have reviewed several very popular marketplaces, that everybody knows, to show how they successfully addressed this issue.

Tinder. 15,000 first users

Everybody heard about Tinder. Today (in 2024) Tinder facilitates over 13 million matches daily. But how it was in the first days of service? How did they overcome the nightmare of all marketplaces? Here is an interesting story behind it.

Whitney Wolfe, Co-Founder of Tinder, packed her suitcase and set off to travel around the country.

In each city, she made a presentation to the women's communities, motivating them to register in the app, and explaining how it's cool and useful.

Then she gave presentations to male communities, showing the app that is full of those local girls, who already registered.

When Whitney returned from a trip, 15,000 first users already used the application.

“Her pitch was pretty genius. She would go to chapters of her sorority, do her presentation, and have all the girls at the meetings install the app. Then she’d go to the corresponding brother fraternity—they’d open the app and see all these cute girls they knew...”

In 2014 Whitney left Tinder and founded Bumble (the biggest competitor of Tinder).

Dating? This girl knows how to make money on it.

Airbnb. 6,000 first users

Today Airbnb is a huge company with a $95B valuation. But in 2008 they were just starting with an idea of air beds and breakfasts for strangers. And like all marketplaces, they faced The Chicken and Egg problem:

Landlords are not interested in adding their apartments to the service without visitors.

Tenants have nothing to rent on the platform.

How did Airbnb get out of the situation? (it’s already a legendary example)

They created a script that scanned all landlord’s offers on Craigslist and collected their emails.

Then the same script sent a letter on behalf of a pretty young girl who "liked the apartment so much" and asked the owner to add his apartment to Airbnb.

So Airbnb quickly acquired 60,000 first landlords, which solved The Chicken and Egg problem.

What’s more, they made it easy for users to post listings on Craigslist through Airbnb with one click.

Later Craigslist closed this backdoor for collecting emails, but the main idea in the approach. If you need first users, you can simply copy them from somewhere. Besides, such holes appear regularly at many services. You just need to check such opportunities.

Uber

Uber’s story began in Paris in 2008. Two friends, Travis Kalanick and Garrett Camp, were attending the LeWeb, an annual tech conference the Economist describes as “where revolutionaries gather to plot the future".

Rumour has it that the concept for Uber was born one winter night during the conference when the pair was unable to get a cab. Initially, the idea was for a timeshare limo service that could be ordered via an app. After the conference, the entrepreneurs went their separate ways, but when Camp returned to San Francisco, he continued to be fixated on the idea and bought the domain name UberCab.com.

To get their first drivers, Travis cold-called black car drivers and offered to pay them an hourly rate while they tried out the platform. 3 of the 10 drivers that he called, agreed to give it a try.

Then, to incentivize passengers, they offered free rides at local events in the tech-savvy San Francisco community and worked hard to make each experience the best it could be. According to Kalanick, word of mouth was the biggest driver of sales and Uber spent almost nothing on traditional marketing.

“I’m talking old school word of mouth, you know at the water cooler in the office, at a restaurant when you’re paying the bill, at a party with friends — ‘Who’s Ubering home?’ 95% of all our riders have heard about Uber from other Uber riders.”

— Travis Kalanick

“When someone sees the ease of use, the fact that they press a button on their phone and in under 5 minutes a car appears, they inevitably become a brand advocate.”

Entering new markets.

Since Uber’s main competition was taxicab companies, the startup researched which cities had the biggest discrepancy between supply and demand for taxis. They then launched during times when that demand was likely to be the highest, for example during the holidays when people tend to stay out late partying. It also ran promotions during large concerts or sporting events, when big crowds of people all needed cabs at the same time, and an individual might be more likely to take a chance on an unfamiliar company named Uber.

In that way, the company acquired a large group of customers in one swoop. “First, they figured out how to get a bunch of customers all in one night, when the demand was high. Then, they made sure this first group of users had a great experience and brought in the next wave of customers via word-of-mouth,” says Teixeira. The company banked on the fact that once users realized how easy it was, it was only a matter of time before they started using it to go to work, then shopping for groceries, and so on.

Launching in situations of high demand and low supply also helps startups acquire the right type of customers—those early adopters who might be more forgiving of a company while it works out the kinks.

But what is the secret?

Besides the fact that you need first users (and you see that startups use different hacks how to get these users on the board, creativity should help you overcome this problem too), you have to satisfy these users with your service.

It can be quality, speed, usability, great support, etc. A long list of possible options. But the main idea - make your customers really happy.

Some founders say that getting your idea off the ground “it's a numbers game”. But it’s not. It’s a way how you treat your first customers. Do they stay happy by sharing your link with all their friends, or writing a 1-star review in App Store?

Paul Graham, Co-Founder of Y Combinator, wrote a famous essay

“Do things that don’t scale” where he described all the main things for early-stage startups. He said:

“All you need from a launch is some initial core of users. How well you’re doing a few months later will depend more on how happy you made those users than how many there were of them.”

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

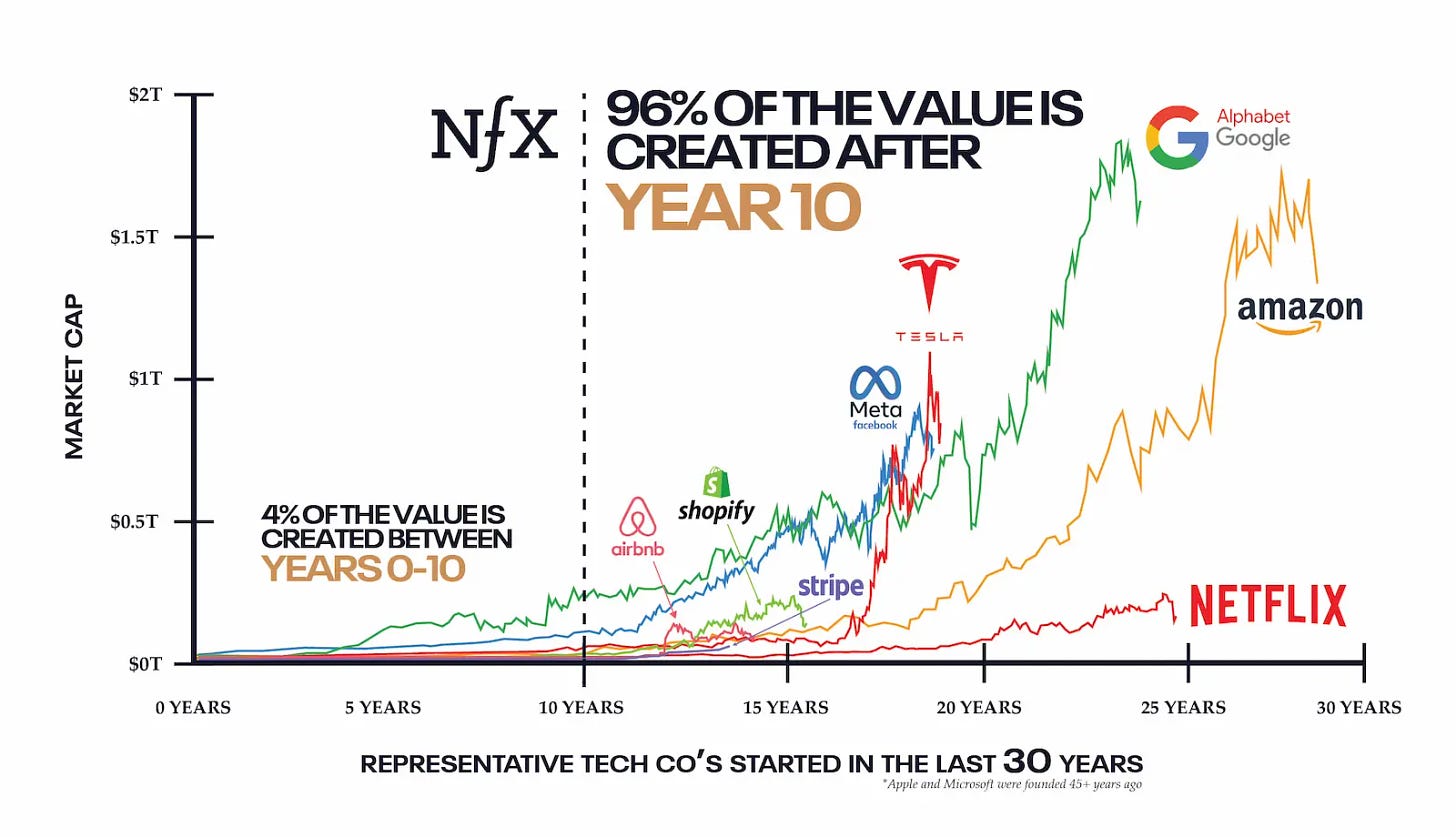

1. How Great Tech Companies Capture Long-Term Value.

There is an article titled 'The Durability Formula' by NFX. I feel many founders overlook building companies that last. I'm sharing some key points and my thoughts on this.

Remember most of the real value in tech companies isn't created in those exciting early days but in the long run. The catch? You can only capture the value in the long term if you design for durability from day one.

What’s the Secret of Lasting Companies?

Think of durability like a recipe with five key ingredients:

Network Effects (making your product more valuable as more people use it)

Economies of Scale (getting stronger as you get bigger)

Brand Power (building emotional connections)

Embedding (becoming essential to your customers' operations)

Intellectual Property (protecting your innovations)

Let's break these down and explore the questions you should be asking yourself.

Network Effects: Making Your Product Sticky

Remember this golden rule: a "multiplayer game" beats a "single-player game" every time. Think about it - isn't Facebook more valuable because all your friends are there? Here are some key things to consider:

Does your product get better when more people join?

Have you solved the chicken-and-egg problem of getting those first users?

Where's your "white-hot centre" - that core group of super-active users?

Watch out for potential pitfalls too. Can users easily switch between your platform and competitors (like drivers do with Uber and Lyft)? Are users trying to bypass your platform for direct deals (like happens with freelance marketplaces)?

Economies of Scale: The Beauty of Getting Bigger

This is where math becomes your friend. As you grow:

Can you negotiate better deals with suppliers?

Do your costs per unit go down?

Can you outspend competitors on marketing because your economics work better?

Think Amazon - they can offer lower prices while still making money, which makes it really hard for others to compete.

Brand: The Emotional Moat

Here's where human psychology comes into play. Apple users don't just buy phones - they buy into an identity. Ask yourself:

Do people feel like they're part of something special using your product?

Would users feel like they're "downgrading" if they switched to a competitor?

Does your brand carry social proof that makes decisions easier for customers?

Embedding: Making Yourself Indispensable

This is particularly powerful for B2B companies. Once Workday or Salesforce is integrated into a company's operations, good luck trying to rip it out. Consider:

How painful would it be for customers to switch away from you?

Are you becoming their "system of record"?

How many of your products are they using?

Intellectual Property: Your Technical Moat

While software patents might not be super effective (things move too fast), this becomes crucial in bio and tech. If you're in these spaces, you need to think about:

Your patent strategy

Clean ownership of your IP

Any university or government grant obligations

Building for the Long Haul

Here's what it all comes down to the real value in tech companies comes from compound growth over many years. But you can only capture that value if you build durability into your company's DNA from the start.

Think of it like building a house - you need to lay a solid foundation before you can add all the fancy stuff. The most successful founders I know spend serious time thinking about these durability factors early on. They know that as their companies grow, these factors make them increasingly difficult to compete with.

Remember: You're not just building for today or next year - you're building something that should get stronger over time. Start with durability in mind, and you'll be setting yourself up to capture the kind of compound value growth that creates truly exceptional companies.

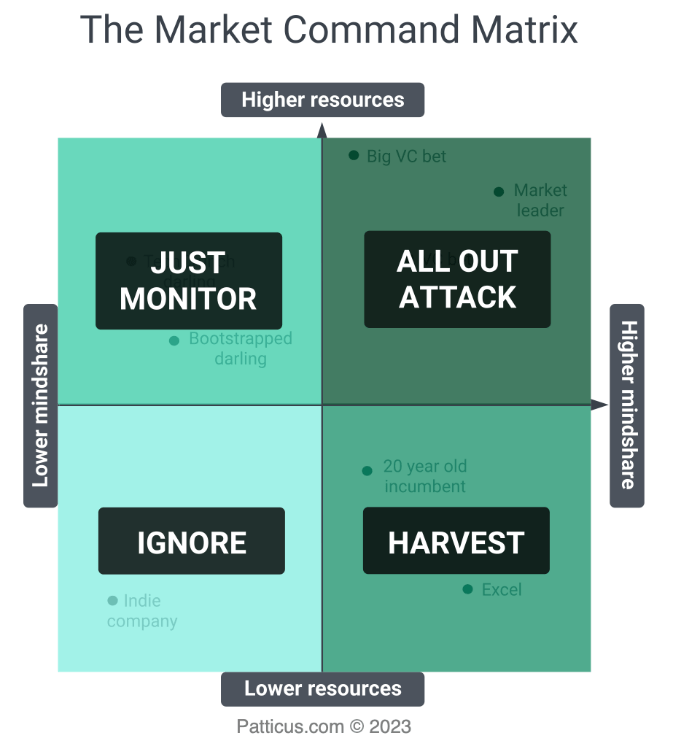

2. Market Command Matrix: When (and When Not) to Fight Your Competitors

Patrick Campbell sold his startup, Profitwell, for $200 million last year — and it was entirely bootstrapped.

Since then he’s started sharing a lot of primary research he’s commissioned into topics that there isn’t a lot of ground truth data on. Most recently, he shared his competitive research playbook and shared this framework — the market command matrix:

The y-axis represents how much of a competitor’s resources they’re piling into your market, and the x-axis represents how aware customers in your market are of the competitor.

The big text in each quadrant is what you should do in response. While the placements on the matrix aren’t exact (for example a “big VC bet” could have dramatically more or less mindshare depending on what stage they’re in), Patrick’s recommendations are good.

Note that he only recommends you take action against the two quadrants on the right — the competitors who your target and/or existing customers are likely to be aware of.

Another note: “all-out attack” may mean exploring partnerships when you both have leverage in different parts of the market — it doesn’t mean burning all your money on paid ads.

He also includes free playbooks on how to handle competitors in each quadrant — the full article is worth a read.

3.15 Steps to Know If Your Company Can RETURN a VC Fund.

Whenever I share this calculation with founders, they often ask why it's important for them to understand it. My answer is always the same: this simple concept will help create accurate financial projections and instil confidence in investors. Let's explore how this works:

1/ Why is this important

VCs have LPs (investors), they raise capital from them then say they will return it in 7-10 years and we plan to 2-3x it.

2/ How Simple math - example below:

$50m fund needs to return $150m from its investments. A fund usually invests 2-3% of its fund into each company ($1.25m)

3/ Run the math $1.25m for roughly 25 companies for $31.25 for initial checks then save the rest for follow-on checks.

Now we have to decide on ownership needed to return the fund at the exit

4/ A seed VC typically has a minimum ownership of 5-10% ownership

Let's go with 8%

Valuation is determined by check and ownership

$1.25m at 8% ownership is typically an average of $15m post

5/ Before we focus on the exit value we need to factor in dilution because other investors will invest in the company after us to get it to a larger valuation at exit or IPO

We typically see 40% dilution at the exit as seed investors.

6/ So at the exit, we know that our 8% will be closer to 4.8% and need to have $50m to return the fund

Let's run the math

7/ $1.25m at 8% for $15m post

To get to $50m - $50m/4.8% = $1bn~

So every company that the fund invests in needs to have $1bn in value at exit to return it

8/ So why should a founder know this? Well a founder can run this math themselves and understand what each investor expects from them by knowing their fund size and ownership minimum

9/ This helps the founder keep goals, updates and business decisions aligned with investors

10/ So a founder can now figure out what type of growth is needed to get to that desired exit value of their investors.

A founder can now create accurate financial projections and give the investor confidence.

11/ In most scenarios getting to $100m in rev of 7-10 yrs is the sweet spot since many companies get acquired or IPO above 10x their rev

12/ But wait what happens if an investor has a larger fund? Well that means they expect your company to have a much larger exit value (could be 2 5 or even 10 billion) This is good to know as a founder

13/ Some large multistage funds only invest in a company if they see it having $1bn in revenue or $10bn in valuation

Which is why VCs say "NO" so much and typically only invest in 1% or less of the deals they see

14/ This math can also help you understand why a VC may pass on investing in your company

They may do that math and think your market is too small

If you do your math and prove that the market is big enough you will make your fundraising journey much easier

15/ So please do the math on your own company to see if it can return an investor fund and if it can't - think about increasing your pricing or choosing a similar market that's bigger.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Bessemer, Index, and a16z alum launches $350M VC Fund. (Read)

How Anthropic's AI is mimicking human computer use, and (Read)

Why OpenAI just hired its first chief economist. (Read)

The brewing battle between Perplexity and major publishers. (Read)

Reddit's CEO drops a bombshell about the platform's AI training 'arms race.' (Read)

Apple's surprising Vision Pro production halt. (Read)

The tragic story is shaking up the AI chatbot industry. (Read)

OpenAI loses a key policy expert while Apple secretly plans a gaming revolution. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this.

Investment Analyst (Software) -January Capital | Singapore - Apply Here

Value Creation Manager - CDP VC | Italy - Apply Here

Investment Manager - R3D3 Venture | USA - Apply Here

Part-Time Visiting Analyst, Spring 2025 - Backing mind | Sweden - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

Visiting Analyst - Growth Investments - Redalpine | Germany - Apply Here

Partner Success Trainee - PLug and ply tech centre | Spain - Apply Here

Associate - Entrepreneur First | India - Apply Here

Investor - Venrock | USA - Apply Here

Research Intern - bLOCKCHAIN CAPITAL | USA - Apply Here

Venture Partner - Erez Capital | USA - Apply Here

NEA Undergraduate Fellow (Early Stage) - NEA | USA - Apply Here

Investment Analyst - India - Apply Here

Venture Capital Analyst Intern - Krystal Venture | India - Apply Here

VC Associate - Breega | UK - Apply Here

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team

Thanks for posting this article. It was a question in the back of my mind for decades. Planning to start a business in software about this time next year, after I finish the Accounting course I'm on. I now have a clearer picture of what I need to do first. Not so much buy or sell, but just build up a roll'o'deck of potential customers and potential coders, together with a website.

Very insightful, the network effect is definitely a very interesting area to deep dive