What Makes a Good Product Market Fit Metric? Is Cohort Retention Rate the Best Metric for PMF ? | VC Jobs

PMF = “time to start building scalable acquisition channels” & Pitch Framework

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Trending AI Tools of the Week

Deep Dive: What Makes a good Product Market Fit Metric? Is Cohort Retention Rate the Best Metric for PMF ?

Quick Dive:

A Simple 5 Steps Framework To Determine Your Startup Valuation.

B2C Startup Idea Validation Framework.

Pitch Framework for early-stage founders looking for fundraising.

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Ex-Twitter Chairman Sues Elon Musk’s X for $20 Million in Shares, Cisco Fires Thousands of Employees, Anysphere, a GitHub Copilot rival startup raised $60 million from a16z & More…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER MECO

The Best Free New App For Newsletter Reading.

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco, you can enjoy your newsletters in an app built for reading while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox).

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

You can try the experience for free and available on iOS and the web (desktop).

Over 30k readers are enjoying their newsletters (and decluttering their inboxes) with Meco - try the app today!

PARTNERSHIP WITH US

Want to get your brand in front of 53,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TRENDING AI TOOLS OF THE WEEK

Don’t Miss These AI Tools

Spine AI: Get a customized AI analyst who understands your funds and your data. Ask it questions, and get answers, just like any FundOps analyst. And it shows its work at every step so that you can verify the results. (Try Here for free)

Simple AI: Explore the wonders of AI with Dharmesh Shah, HubSpot's Co-founder & CTO, as he simplifies complex AI concepts into easy-to-grasp insights. (Sign Up For Free)

TODAY’S DEEP DIVE

What Makes a Good Product Market Fit Metric? Is Cohort Retention Rate the Best Metric for PMF?

Product-market fit (PMF) is the mythical goal of early-stage startups — and rightfully so. Once you have PMF you are at that point where you can shift your daily focus from building something people want to getting what you’ve built out into the world and making money.

Despite PMF being the central goal of an early-stage startup, it is not well defined. Almost every definition of PMF I’ve seen from investors and entrepreneurs is different — and often conflicting. There are tons of definitions you will find on the internet -

PMF is your NPS score

PMF is when 40% of your users would be “very disappointed” if they no longer have access to your product

PMF is a feeling

You need a good distribution channel to have a product market fit…..

These are good metrics, but before using them, founders often forget to ask this question:

“What makes a good product market fit metric?’

A strong product-market fit (PMF) metric should signal when your product is ready for broader distribution, without leading you astray. Before reaching PMF, your focus should be on refining your product to better serve your current users. Once you achieve PMF, it’s time to shift your attention toward scaling your acquisition channels.

A good PMF metric should minimize the chances of false positives and false negatives. A false positive could lead you to start scaling too soon, causing you to waste resources on acquiring users who may churn because the product isn’t good enough yet. On the other hand, a false negative could delay your growth efforts, allowing competitors to get ahead or causing you to miss critical milestones, such as securing the next round of funding before your runway runs out.

To summarize, a good product market fit metric:

Will tell you when the product is good enough to work acquisition channels

Minimizes false positives - won’t tell you to work on acquisition channels when the product needs more improvement

Minimizes false negatives - will tell you to on acquisition channels as soon as the product is good enough, to maximize growth

You can use these points to evaluate the other definition of product market fit.

NPS and Growth

Net Promoter Score (NPS) is often used to gauge product-market fit, but it has limitations. While some of the world’s biggest tech companies have poor NPS, they still manage to grow to millions or even billions of users.

This highlights a major issue with using NPS as a product-market fit metric: it can lead to both false positives and false negatives. Just because a product has a low NPS doesn’t mean it can’t achieve massive growth, and vice versa.

Survey-Based Metrics

A popular alternative to NPS is the “40% Rule,” which measures product-market fit by determining whether 40% of users would be “very disappointed” if they could no longer use the product. Superhuman famously used this metric to great success. While this is a stronger indicator of product-market fit than NPS, survey-based metrics have their own issues:

Response Bias: Not all users respond to surveys, so the results you get might not fully represent your entire user base. Those who don’t respond might feel differently than those who do.

Timing: The point at which you ask users this question can skew results. Asking too early may capture users when they are still excited while asking too late might exclude those who have already churned, thus biasing towards users who are more engaged.

Mismatch with Actual Behavior: What users say they’ll do doesn’t always align with what they actually do. They might express enthusiasm for a feature in a survey, but then not use it once it’s launched.

Even though this metric is more reliable than NPS, it’s not foolproof and can sometimes lead to false negatives. You might already have product-market fit even if the survey doesn’t hit the 40% mark.

Distribution and Product-Market Fit

Some definitions of product-market fit include the need for effective distribution channels. However, distribution shouldn’t be a part of the product-market fit criteria. There’s ample evidence that certain distribution channels, like SEO and referrals, generally work for most consumer companies. These channels can provide a competitive edge, though they do require effort and time to scale.

Any product that demonstrates strong cohort retention can be successfully scaled with the right growth strategy. With the right execution, a product with good retention can always find effective ways to grow.

What is the Cohort Retention Rate?

Cohort retention rate is a key metric for understanding how well your product is retaining users over time. Unlike general retention metrics that mix users with different levels of experience, cohort retention focuses on groups of users who joined at the same time. Here's how it works:

Cohort retention rate - This measures the percentage of a group of users (a cohort) who stick around long-term after signing up during the same period.

For example, if you look at a cohort retention graph and see that it levels off at 30%, it means that 30% of users from that cohort are still using the product after a certain period. If the graph doesn’t flatten out at all, it indicates that your retention rate is effectively 0%, meaning users aren’t sticking around long-term.

Why Cohort Retention Rate Matters

As you improve your product, you should see newer cohorts with higher retention rates. To track this progress, you can use a cohort retention "triangle" chart. This chart helps visualize how retention rates change over time with each new cohort.

For example, if you notice that retention improves significantly after a certain date, it’s likely due to product enhancements made around that time. Once you have multiple cohorts levelling off at a certain retention rate, you may have reached product-market fit.

Benchmarks for Cohort Retention

Different types of products have different benchmarks for what constitutes product-market fit.

For consumer products, a cohort retention rate of 25% is often considered the minimum,

while for B2B SaaS products, the floor is typically around 70%.

However, top-performing products often exceed these numbers, with great consumer products achieving over 40% and B2B SaaS products reaching over 80%.

Why Cohort Retention Rate is a Strong Product-Market Fit Metric

Cohort retention rate has several advantages over survey-based metrics:

No Response Bias: It captures data from all users, not just those who take the time to fill out a survey.

Full User Lifecycle: You get a complete view of how users engage with your product over time, rather than just at a single point.

Actual User Behavior: It reflects what users are doing, not just what they say they will do.

While it’s beneficial to use both cohort retention and survey-based metrics, the cohort retention rate is crucial for understanding true product-market fit.

Overall

Actively measure your cohort retention rate using a “triangle” cohort retention chart

Find the retention rate of comparable successful products and set a product market fit goal

Improve your product and watch retention improve with new cohorts!

All credit to Jeff Chang, I highly recommend checking out Growth Engineering Blogs.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. A Simple 5 Steps Framework To Determine Your Startup Valuation

Many founders ask me "How do I know what my startup's valuation should be?" When they're about to go fundraise.

It's an important question, but almost all founders approach it the wrong way.

What founders are asking tends to really be "How much is my startup worth?" But this is an impossible question to answer at the early stages. The right question is "What are the necessary conditions for my next round?"

VCs understand that startups are unlikely to succeed and that there's a good chance they'll never get their money back. You don't need to convince them your startup is worth anything. You just need to convince them you have a plan for getting to the next stage.

Here's my simple 5 step framework for determining your startup's valuation:

Identify your key milestones

Remember, raising capital from VCs relies on hitting milestones that expand your startup's growth potential. At later stages, this is driven by metrics like ARR, active users, retention, and growth rate. But at pre-seed, seed, and Series A, milestones are more narrative-driven.

The first step in planning a fundraiser is understanding what milestones you'll need to hit before your next round. That will shape the growth strategy you pitch to investors now.

2. What's Your Expected Burn

Next, conservatively map out the cash you'll need to burn to hit your milestones. Always assume you'll need 1.5x more than you think, in case things go wrong.

This forces you to think through a full, honest growth strategy. Work backwards from the milestones:

What needs to happen for them to be true?

How long will that take in optimistic, realistic, and pessimistic scenarios?

How much will you need to spend?

Can you move faster or reduce risk by spending more?

Map this out month-by-month against your expected revenue. VCs don't expect profitability, but this shows your total burn and monthly burn rate before your next raise.

3. Your Round Size?

To determine your fundraising size, use this formula:

Fundraise size = expected total burn + (expected burn rate * 12) - current cash

VCs typically want 12 months of runway, so multiply your expected burn rate by 12 and add that to your total burn between raises.

(Your current cash is what's in the bank now.)

Example: Let's say your startup has a burn $50K per month over the next 10 months before you'll hit your milestones for the next round and you have $100K in the bank right now:

$500K + ($50K * 12) - $100K = $1,000,000 round size

4. Calculate Your Valuation

Consider how much of the company you're willing to sell in this round. Generally, startups sell 10-20% per round.

Do an honest risk assessment - more unknowns mean you'll need to be on the higher end. If you don't urgently need to raise, you can negotiate lower.

In our example, let's assume you want to sell 15% for $1 million. That sets our valuation around $6.7 million, or $7 million to keep it simple.

5. Double Check the Markets Right Now

Now look at recent deals in your industry and consider market factors using Pitchbook. Talk to VCs not pitching to get context on whether valuations are "high" or "low" right now.

If valuations are "high" you can be aggressive with your story. If "low", you'll need to rely more on traction and metrics and may need to accept selling more equity than preferred.

In our example, let's assume the markets are "low", so you might have to choose between a $6M valuation or raising less capital than desired. That’s it.

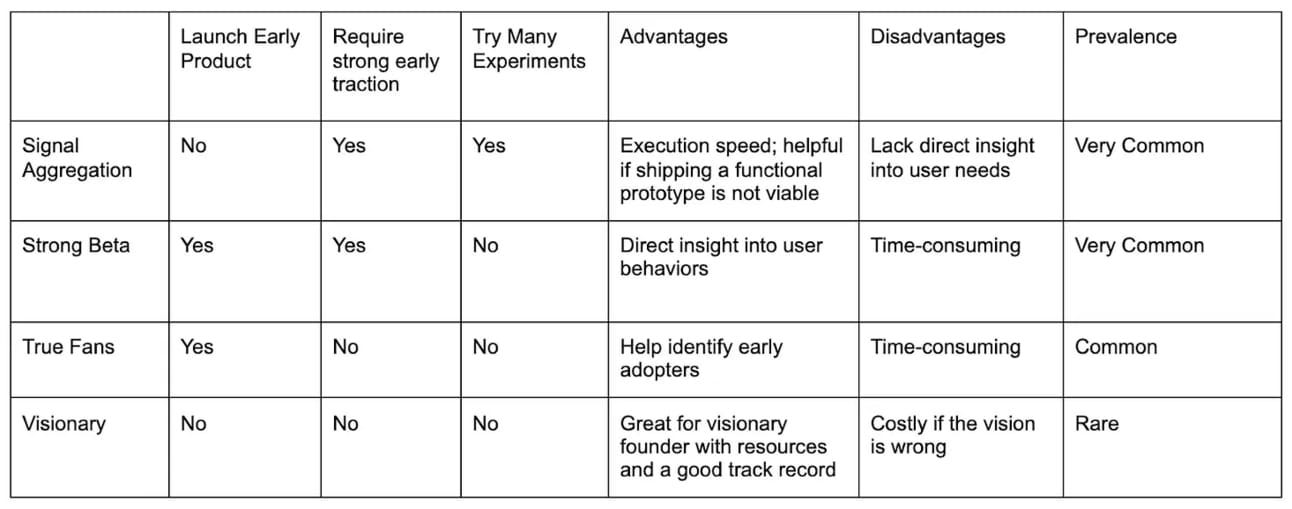

2. B2C Startup Idea Validation Framework.

Most ideas, especially in B2C, get validated in one of four ways:

This framework defines the differences between each path to validation.

Signal Aggregation

Founders should test an idea's viability through small experiments that provide evidence (signals) of potential success before building a full product. Common signals include landing page sign-ups, social media engagement, ad click-through rates, and customer interview feedback.

Strong Beta

Achieving strong early traction with a beta product is another popular validation approach for founders. Success metrics vary across industries, e.g., high user numbers and retention for consumer social apps, and healthy revenue for B2C marketplaces.

The process typically starts with a hypothesis for solving a problem. The founder builds a basic version to test the hypothesis. Beta products are often rudimentary, lacking polish, due to the emphasis on speed over perfection. This approach aligns with the lean methodology of launching quickly and iterating based on feedback.

True Fans

This approach is similar to the Strong Beta approach, as it involves launching a beta product. However, instead of focusing on significant traction metrics like revenue or user acquisition, the founder seeks to identify a small group of fanatic users who deeply love the product despite its limited features. The key is finding 20-50 users who would be disappointed if the product were to go away. These passionate fans, rather than large user numbers, serve as the validation signal.

Visionary

This approach is the least common among the founders interviewed, as it requires a clear vision and plan for the product from the outset. Typically, the founder has a close personal connection to the problem being solved and a strong understanding of what needs to be done to address it.

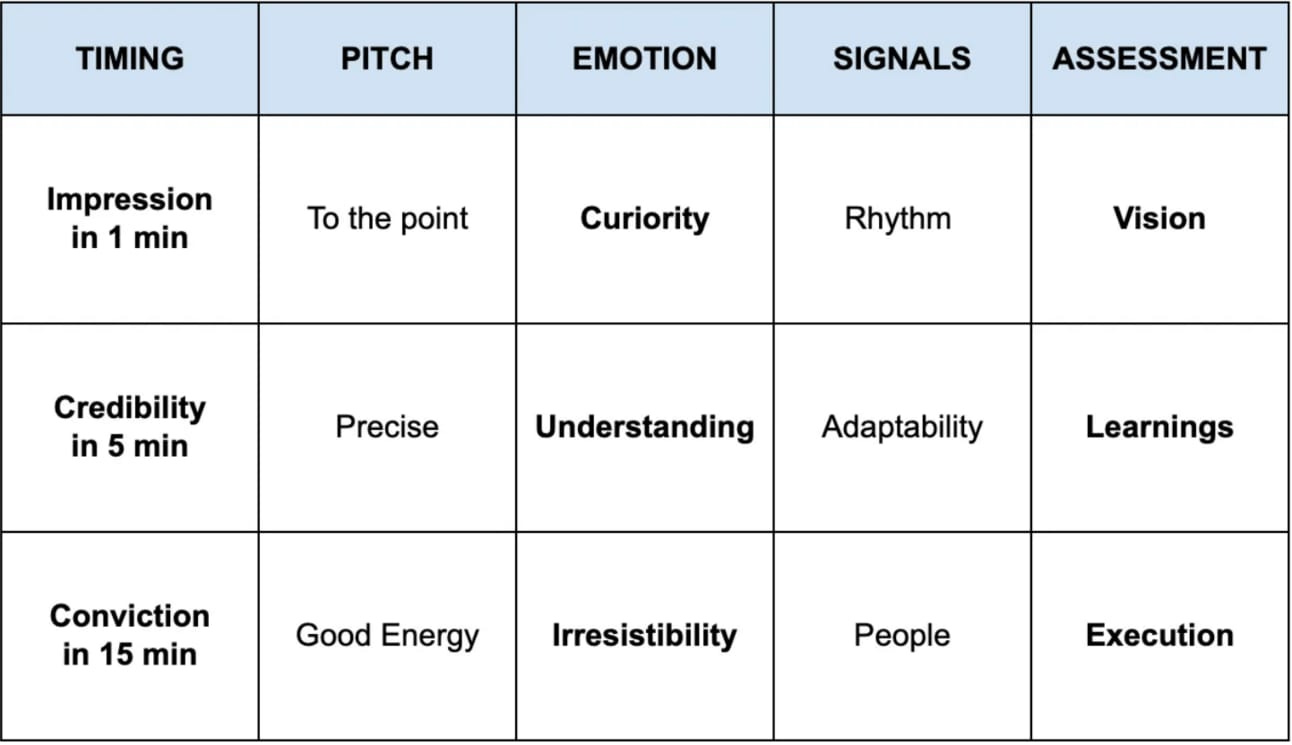

3. Pitch Framework

Have you ever heard an investor say that they can get a feel for how likely they are to invest in a startup within the first few minutes of a pitch, or sometimes even the first minute?

What do they mean by that? And what should you, as a founder, focus on during those first few minutes?

It’s unavoidably subjective to a degree, as each investor may look for different things from founders, but I like this framework from Jean de La Rochebrochard:

Your pitch is about getting the investor from a state of uncertainty to a state of conviction. In the chart above, the “Pitch” column is how you want to speak and deliver information, while the “Emotion” column is what you want the investor to feel (look for body language for signals of this!).

Some important callouts:

The credibility stage is the easiest because it’s largely factual. You either have a relevant and credible background to go after this market or you don’t.

The impression and conviction stages are more subjective — you need to assess on the fly what each particular investor values most from founders.

It’s easier to recover from mistakes in the conviction stage because you’ve already built up some capital from the last two stages of the pitch.

The impression stage is very hard to recover from — so be to the point about yourself, what you’re building, and where you’re at very concisely.

Join 31000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Omid Kordestani, a former Twitter board member, has sued Elon Musk's X (formerly Twitter) for $20 million. (More Here)

Anysphere, a GitHub Copilot rival startup raised $60 million from a16z. (More Here)

Susan Wojcicki, former Google executive and YouTube CEO, has died at 56 after battling cancer. (More Here)

A U.S. court has ordered bankrupt cryptocurrency exchange FTX to pay $12.7 billion in relief to its customers. (More Here)

OpenAI fears users will become emotionally dependent on its ChatGPT voice mode. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 22,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Is it a good idea to build a “user tour” in your app?

How Can I Help You?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Talent Investor Analyst (internship) - Entrepreneur First | France - Apply Here

Investment Manager - Gobi Parnter | Malasya - Apply Here

Ventures Associate, AI Investing - Point 72 venture | USA - Apply Here

Legal Counsel - B tomorrow venture | UK - Apply Here

Partner 36 - a16z | USA - Apply Here

Head of Marketing - Zero Primie Venture | USA - Apply Here

Venture Operations Lead - Newlab - USA - Apply Here

VC Fintech Senior Associate Fintech Industry Haymaker venture - Haymake venture | USA - Apply Here

Part-Time Student at Impact VC - Koppa Venture | Germany - Apply Here

Senior Associate Angel Investment - Qi Venture | India - Apply Here

Portfolio & Operations Coordinator - WTFund | India - Apply Here

Investing Teams - Alumni Venture | USA - Apply Here

Vice President-Investments - Ivycap venture | India - Apply Here

Partner 22, Content Marketing, Investor Relations - a16z | USA - Apply Here

Venture Partner - Biotech - NLC | Netherland - Apply Here

Ventures Analyst - Plug and play tech centre | Brazil - Apply Here

Investment Partner - M12 | USA - Apply Here

🧐 All In One VC Interview Question Guide (How To Answer Them)

Under the “Break Into VC” initiative we have launched our all-in-one VC Interview guide (how to answer) for aspiring venture capitalists.

We have shared some of the popular questions in our “Break Into VC” newsletter. With this, you can access our guide pdf, which contains -

Roles, Related Skills and Reasons for Interest

Intro / About You / Why VC Questions - Include 8 questions and answers.

Previous Professional - Include 7 questions and answers.

Role/Responsibilities/Passion Questions - Include 10 questions and answers.

Potential “Technical” Q’s - Include 13 questions and answers.

Questions You Can Ask VC - 5 questions you can ask VC to stand out from the crowd.

All of these questions and answers are curated from VC partners… So don’t miss this chance to access our resources.

For the first 50 aspiring venture capitalists, we are offering a 50% discount. Check out here…

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Friday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team