Y-Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M.

Build pitch deck using Y-Combinator framework.

👋 Hey, Sahil here — Welcome back to Venture Curator, where we explore how top investors think, how real founders build, and the strategies shaping tomorrow’s companies.

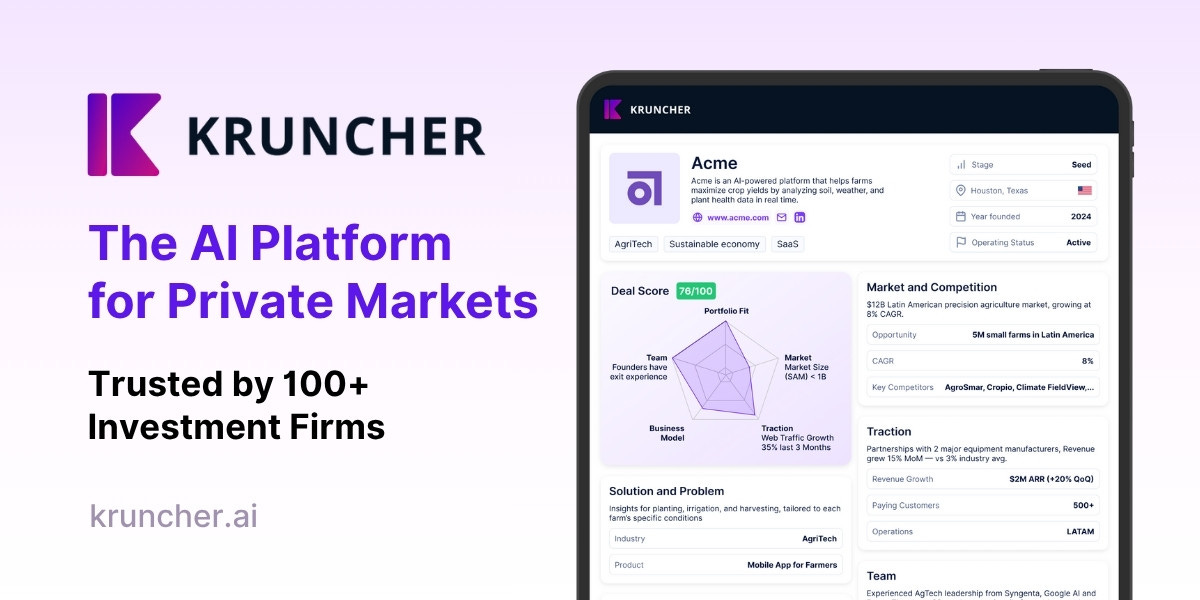

FROM OUR PARTNER - KRUNCHER

🤝 Kruncher: The Most Comprehensive AI Platform for VCs & PEs

Kruncher AI powers the entire deal lifecycle with intelligent data that drives better decisions with:

Automated deal screening with 10× more data points and 90% less noise

Auto-generated company reports featuring 300+ configurable signals

Five hours of research, summarised in a self-updating report

Investment memos created in under 2 hours instead of 3 days

Continuous monitoring of the growth and KPIs of your watchlist and portfolio companies

All of the above in a single source of truth.

Register for free and try Kruncher - First 5 reports on us →

🤝 PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

VENTURE CURATORS’ FINDING

📬 My Favourite Finds

Media Posts:

Startup legal document pack – essential legal docs for founders. (Link)

Jason Freedman on common Series A planning conversations right now (Link)

Jimmy Acton shares Vinod Khosla’s brutally honest quote about investors (Link)

Want a SaaS idea that sells? Borrow it from 1-star reviews. (Link)

Microsoft: AI ‘business agents’ will kill SaaS by 2030. (Link)

3 myths about going public that should die (Link)

10 things this failed founder wishes they would’ve done differently (Link)

Reports/Articles:

The AI application spending report: where startup dollars really go. (Link)

When you’re really ready to launch: a founder’s framework. (Link)

How smart companies can thrive amid uncertainty. (Link)

Why big ideas are built in temperate climates. (Link)

The Startup valuation guide for founders: the only guide you need. (Link)

How to show value in AI product onboarding. (Link)

What investors ask and how to answer: A practical Q&A prep kit for founders. (Link)

📜 DEEP DIVE

Y Combinator Pitch Deck Framework: Access 50+ Decks That Raised Over $450M.

Building a pitch deck for your seed round is a crucial step in your startup journey. It’s not just about putting slides together—it’s about crafting a story that resonates with investors and gets them genuinely excited about your vision.

While there are plenty of guides online about building pitch decks, most of them fall short of offering clear, actionable advice. That’s why I’ve taken the time to dive deep into Y Combinator’s resources, watch hours of their videos, and analyze detailed articles to create this comprehensive and practical guide for you.

Why a Great Pitch Deck Matters

Your pitch deck should achieve two things:

clearly convey the most critical points about your startup and

make it easy for investors to understand and remember your story.

For seed-stage startups, this often means focusing on simplicity and narrative clarity. Remember, at this stage, most startups don’t have extensive data or years of history to share—and that’s perfectly fine. Your goal is to make your story as compelling and concise as possible.

Structuring Your Seed Round Pitch Deck

Creating a pitch deck doesn’t have to be overly complicated. It’s all about telling a clear, concise, and compelling story that investors can follow easily. Here’s how you can structure your deck:

Title Slide

Start strong with a title slide that sets the tone for your pitch. It should include:

The name of your company.

A one-line description of what you do.

Keep it simple and professional. This is your first impression, so make it count.

The Problem

This is where you lay out the real-world issue your startup is solving. A well-defined problem statement is crucial for connecting with your audience.

Focus on the impact of the problem on real people or businesses.

Use a statistic, example, or story to make it relatable.

Avoid overloading this slide with too much text or technical jargon. The problem should be clear and easy to understand.

The Solution

Next, explain how your product or service solves the problem you’ve just described. This is your chance to show why your approach is unique and valuable.

Keep your explanation brief and to the point.

Highlight the concrete benefits of your solution.

If needed, use visuals or diagrams, but avoid cluttering the slide.

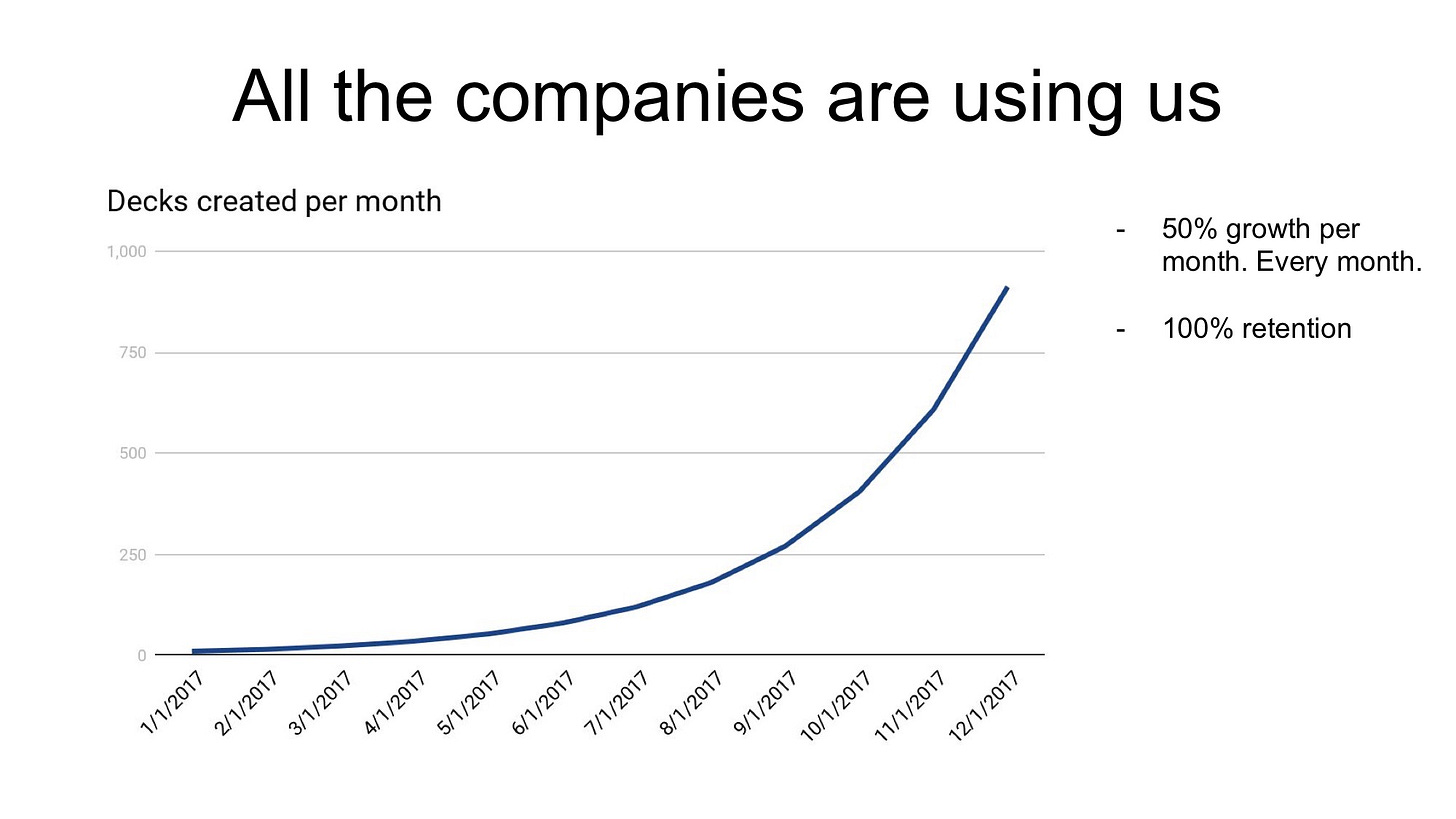

Traction

Investors love to see traction—it’s proof that your startup is making progress. Even if your numbers are early, show them off in a way that’s easy to understand.

Use a chart or graph to showcase key metrics like revenue or user growth.

Add context to explain why these metrics are important.

Keep it honest and straightforward. Smooth growth curves are rare, and that’s okay.

Your Unique Advantage

What makes your startup special? Use this slide to highlight what sets you apart from competitors.

Focus on your unique insights, technology, or approach.

Keep it concise and avoid unnecessary technical details.

Business Model

Your business model is all about showing how you make money. While it doesn’t have to be perfect, it should be clear enough for investors to understand.

Explain your revenue streams and pricing strategy.

If you have any early results, include them here.

Break complex models into simpler components if needed.

Market Opportunity

Investors need to see the potential for scale. Use this slide to showcase the size of your market and the opportunity you’re addressing.

Provide a high-level overview of your Total Addressable Market (TAM).

Use a clean, visual representation to convey scale.

A compelling market opportunity slide gives investors confidence in your startup’s long-term potential.

Team

Your team is one of the most critical factors for early-stage investors. Use this slide to show why your team is uniquely qualified to solve the problem.

Highlight the key strengths and relevant experiences of the founders.

Keep the focus on the people leading the company rather than advisors or extended team members.

The Ask

Wrap up your pitch with a clear “ask.” Be specific about what you need and what investors can expect in return.

State the amount you’re raising.

Explain how the funds will be used (e.g., product development, hiring, marketing).

Outline where you expect to be within a year and how this funding helps you get there.

Remember — even the best content can fall flat if your slides aren’t designed effectively. You might be wondering how startups that raised millions of dollars build and design their pitch decks.

That’s why we’ve curated 40+ real slides from startups that secured funding from Y Combinator and leading VCs. Here are a few examples:

Maikbou – Raised $3.3M (Seed round)

Pathrise – Raised $3M (Seed round)

Lago – Raised $22M (Seed round)

Apriora – Raised $2.8M (Seed round)

Careerist – Raised $8M (Series A)

Vori – Raised $45M (Series A)

Rippling – Raised $145M (Series B)

Thunkable – Raised $30M (Series B)

Pelago – Raised $58M (Series C)

And many more. Link below -

You can find pitch decks here.

We’ve also built multiple guides and frameworks that can be helpful to early-stage founders:

Startup Legal Document Pack – Essential Legal Docs for Founders.

Excel Template: Early Stage Startup Financial Model For Fundraising.

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

Startup Legal Document Pack

Investor CRM Template – The Ultimate Fundraising Tracker

5000+ Verified Investor contact database from USA, India, Africa, and Australia.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

VP of Fundraising - Scale Asia Venture | Japan - Apply Here

Senior Principal - Newsbreak Venture | USA - Apply Here

Investment Analyst - Cornell University | USA - Apply Here

Associate - Venture Capital - Artha Venture Fund | India - Apply Here

Investment Team - WEH Venture | India - Apply Here

Venture Scout - First momentum Venture | Remote - Apply Here

Analyst / Associate - Core Innovation Capital | USA - Apply Here

Program Associate - Plug and Play tech Center | USA - Apply Here

Executive Assistant - AN Venture Partner | USA - Apply Here

Visiting Investment Analyst - Join Capital | USA - Apply Here

AI Tech Lead - Core Innovation Capital | USA - Apply Here

Investment Analyst - Caanan | USA - Apply Here

Venture capital Fellowship for PhDs - Contrarian Venture | USA - Apply Here

VC Associate UK - Breega | UK - Apply Here

Analyst - Investments - Blackhill Fund | India - Apply Here

Partner 16, Deal Operations - a16z | USA - Apply Here

🤝 Partnership With Us

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator