Y-Combinator guide: How to build your seed round pitch deck with better design? | VC & Startup Jobs.

Founders get wrong about market leadership & Close your fundraising quickly with tranches.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Y-Combinator guide: How to build your seed round pitch deck with better design?

Quick Dive:

What founders get wrong about market leadership.

How to close your fundraising quickly with tranches: A practical guide.

Major News: OpenAI and Perplexity take on Google, Microsoft saves $500M after cutting 9,000 jobs, X CEO Yaccarino steps down & Jack Dorsey is working on a Bluetooth messaging app, Meta recruits Apple’s head of AI models.

20+ VC & Startups job opportunities.

INVESTMENT OPPORTUNITY WORTH EXPLORING

🧸 The $100B Toy Industry Has a 3 Million Pound Problem.

Every year, over 3 million pounds of plastic toys are sent to U.S. landfills. Parents want better options, and they’re willing to pay for them.

Playper’s solution: Plastic-free, battery-free toys that kids love building and playing with.

Why investors are excited:

Already in 600+ Barnes & Noble stores nationwide

$63K+ raised on Wefunder from 50+ investors

Backed by execs from LEGO, Mattel & Fisher Price

Winner of Fast Company’s World Changing Ideas Award

Toys that teach more, waste less and get played with.

🤝 PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week

Marketing for founders - the only guide you need.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Global VC First Look - Q2 2025.

What is the vibe code for success? By CBInsights.

6000+ European VC Firms Contact Database (LinkedIn Links).

UK Innovation Update – Q2 2025

An explosive new distribution channel by Tomasz Tunguz.

Startup legal document pack – essential legal docs for founders.

A CEO of AI applications marks a new era of AI competition.

Working with LLMs: A Few Lessons.

Jack Dorsey’s advice to founders raising venture capital.

How to craft your moat.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

US Venture Capital Outlook: Midyear Update.

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them)

📜 TODAY’S DEEP DIVE

Y-Combinator guide: How to build your seed round pitch deck with better design?

Building a pitch deck for your seed round is a crucial step in your startup journey. It’s not just about putting slides together—it’s about crafting a story that resonates with investors and gets them genuinely excited about your vision.

While there are plenty of guides online about building pitch decks, most of them fall short of offering clear, actionable advice. That’s why I’ve taken the time to dive deep into Y Combinator’s resources, watch hours of their videos, and analyse detailed articles to create this comprehensive and practical guide for you.

Why a Great Pitch Deck Matters

Your pitch deck should achieve two things:

Convey the most critical points about your startup and

Make it easy for investors to understand and remember your story.

For seed-stage startups, this often means focusing on simplicity and narrative clarity. Remember, at this stage, most startups don’t have extensive data or years of history to share, and that’s perfectly fine. Your goal is to make your story as compelling and concise as possible.

Structuring Your Seed Round Pitch Deck

Creating a pitch deck doesn’t have to be overly complicated. It’s all about telling a clear, concise, and compelling story that investors can follow easily. Here’s how you can structure your deck:

Title Slide

Start strong with a title slide that sets the tone for your pitch. It should include:

The name of your company.

A one-line description of what you do.

Keep it simple and professional. This is your first impression, so make it count.

The Problem

This is where you lay out the real-world issue your startup is solving. A well-defined problem statement is crucial for connecting with your audience.

Focus on the impact of the problem on real people or businesses.

Use a statistic, example, or story to make it relatable.

Avoid overloading this slide with too much text or technical jargon. The problem should be clear and easy to understand.

The Solution

Next, explain how your product or service solves the problem you’ve just described. This is your chance to show why your approach is unique and valuable.

Keep your explanation brief and to the point.

Highlight the concrete benefits of your solution.

If needed, use visuals or diagrams, but avoid cluttering the slide.

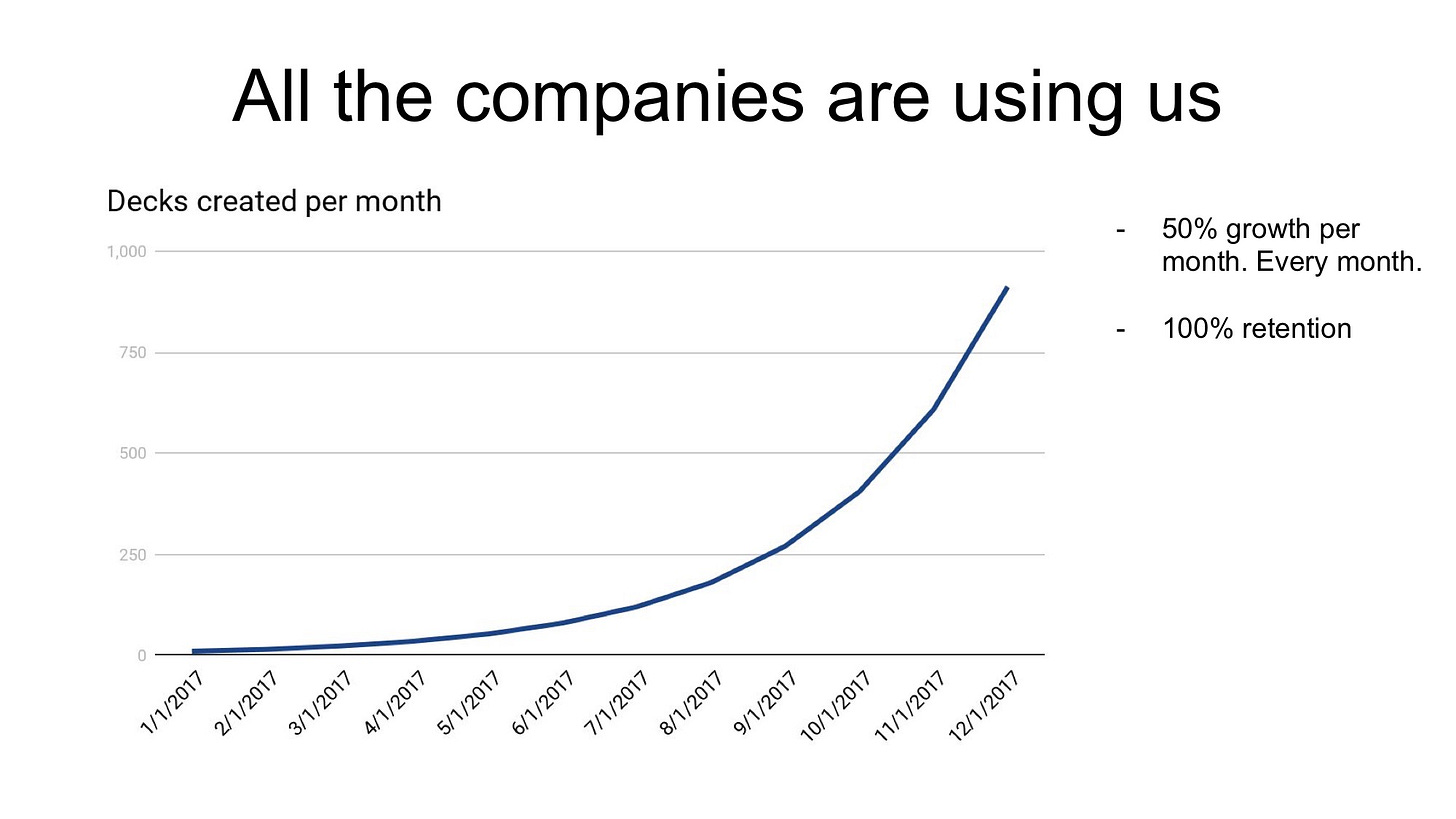

Traction

Investors love to see traction—it’s proof that your startup is making progress. Even if your numbers are early, show them off in a way that’s easy to understand.

Use a chart or graph to showcase key metrics like revenue or user growth.

Add context to explain why these metrics are important.

Keep it honest and straightforward. Smooth growth curves are rare, and that’s okay.

Your Unique Advantage

What makes your startup special? Use this slide to highlight what sets you apart from competitors.

Focus on your unique insights, technology, or approach.

Keep it concise and avoid unnecessary technical details.

Business Model

Your business model is all about showing how you make money. While it doesn’t have to be perfect, it should be clear enough for investors to understand.

Explain your revenue streams and pricing strategy.

If you have any early results, include them here.

Break complex models into simpler components if needed.

Market Opportunity

Investors need to see the potential for scale. Use this slide to showcase the size of your market and the opportunity you’re addressing.

Provide a high-level overview of your Total Addressable Market (TAM).

Use a clean, visual representation to convey scale.

A compelling market opportunity slide gives investors confidence in your startup’s long-term potential.

Team

Your team is one of the most critical factors for early-stage investors. Use this slide to show why your team is uniquely qualified to solve the problem.

Highlight the key strengths and relevant experiences of the founders.

Keep the focus on the people leading the company rather than advisors or extended team members.

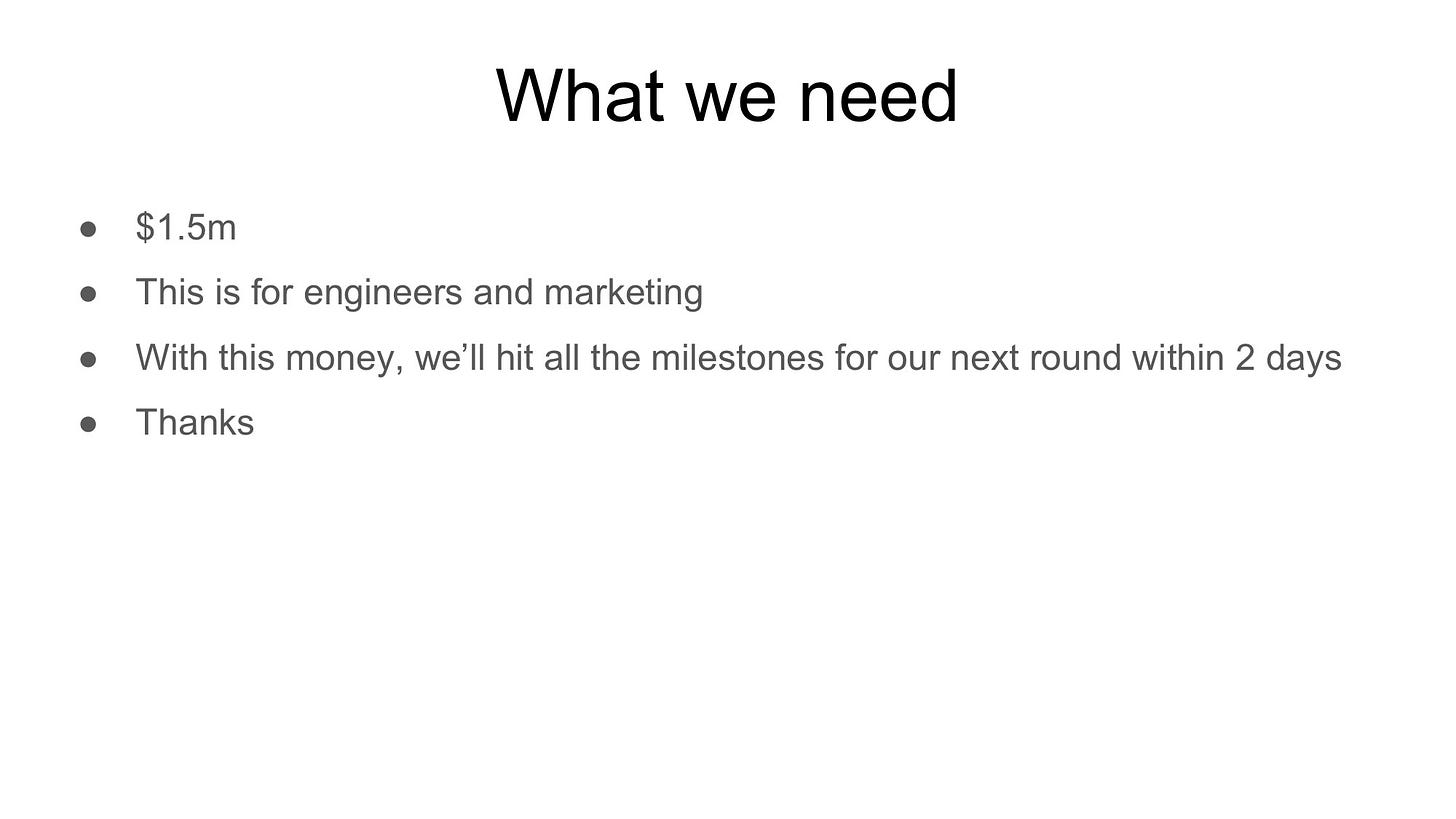

The Ask

Wrap up your pitch with a clear “ask.” Be specific about what you need and what investors can expect in return.

State the amount you’re raising.

Explain how the funds will be used (e.g., product development, hiring, marketing).

Outline where you expect to be within a year and how this funding helps you get there.

Remember - even the best content can fall flat if your slides aren’t designed effectively. According to YC, a great pitch deck follows three fundamental principles: Legibility, Simplicity, and Obviousness.

Legibility

Use large, bold fonts with high contrast.

Avoid clutter; each slide should be easy to read, even from the back of a room.

Place key text at the top for better visibility.

Simplicity

Stick to one idea per slide.

Avoid excessive text, diagrams, or branding.

Use visuals sparingly and only when they add value.

Example slide:

Obviousness

Test your slides on someone unfamiliar with your startup. If they can’t understand a slide in seconds, simplify it.

Use captions and labels to make data and visuals explicit.

Avoid distractions like animations or memes.

Avoiding Common Mistakes

To make your deck truly stand out, steer clear of these common pitfalls:

Overloading slides with information: Keep your slides clean and focused.

Using illegible screenshots: Replace them with simplified visuals or bullet points.

Skipping key slides: Ensure you address the problem, solution, and team clearly.

Forgetting the big picture: Focus on the opportunity and how your startup fits into it.

By following these guidelines, you’ll create a pitch deck that’s not only visually appealing but also tells a compelling story. Remember: clarity, simplicity, and obviousness are your best friends. Focus on making your key points memorable, and you’ll stand out to investors.

Also, remember, getting pitch decks is not enough; you have to prepare for some tough, weird questions from investors. Many founders failed at it. So we have built an all-in-one Q&A preparation guide for founders.

Also, sharing more resources might be helpful in your fundraising journey:

40 real startup pitch decks that raised $350M+ (Including leading startups decks)

Investor data-room guide & templates for founders.

The startup valuation guide for founders.

All-In-One term sheet guide for founders.

📃 QUICK DIVES

1. What founders get wrong about market leadership.

Most founders believe the best product wins. Or that getting to market first guarantees success. But that’s not how markets work.

In reality, the companies that win big are usually not the first to launch. They’re the first to achieve product–market fit. That’s a critical difference.

Being early means nothing if customers don’t want what you built. The real advantage comes from being the first to nail the solution, to deeply understand the problem and deliver exactly what the customer is hungry for.

Think about it like this: the market doesn’t reward effort. It rewards clarity and precision. If you're the first to give people what they want, you get the head start that compounds over time, and that’s where the power lies.

The first to achieve product–market fit becomes the default

Once you become the default choice in a category, everything shifts in your favour:

You get more word-of-mouth because people trust what works

You earn higher margins, which lets you reinvest more into growth

You attract better talent because people want to work at the winner

You set the tone in the market; others have to define themselves relative to you

And most importantly, you start pulling away. Even if someone else builds something a little better or a little cheaper, it often doesn’t matter.

Momentum beats marginal improvements.

That’s why chasing the leader rarely works

If you’re not leading, your biggest temptation is to copy what’s working. Build a similar product. Match their pricing. Try to undercut them.

But that almost never works, because when you follow, you become invisible.

Here’s what usually happens:

Your product sounds like a knockoff

Your pitch includes the competitor’s name

Your messaging is reactive

Your pricing feels like a race to the bottom

You’re not creating a new story. You’re living in someone else’s shadow.

And in a crowded market, clarity wins. If customers don’t know what makes you different, they stick with the leader. Safe choice. Known results. Less risk.

So if you’re behind, you need to tack, not compete head-on

In sailing, you can’t pass the boat ahead by sailing in the same direction.

You have to tack, adjust your angle and find a different wind.

Same in business. You win from behind by changing the frame. Redefining the problem. Shifting your product. Finding a different entry point.

Some of the biggest companies today didn’t win by doing it better.

They won by doing it differently:

Solving a niche pain others overlooked

Targeting a different type of user

Packaging the solution in a simpler, more lovable way

Tacking is how you reset the game. You go where the leader can’t follow.

Focus on the customer, not the competition

Most laggards obsess over competitors ‘ features, roadmaps, and pricing.

But great companies obsess over the customer.

If you’re spending more time analysing your rivals than talking to your users, you’re already off track.

Customers don’t care if you’re 10% better than the leader. They care if you understand them better. If your product feels like it was built for them. If you solve a pain they feel.

So instead of watching what others are doing, go deeper:

What do your customers hate about the current solutions?

What do they wish existed but haven’t seen yet?

What trade-offs are they tired of making?

That’s where your edge is not in imitation, but in insight.

The market rewards leaders, brutally

Over time, most markets settle into a clear pattern:

The #1 player takes 40%

The #2 takes 20%

The #3 takes 10%

Everyone else fights over the scraps

And in network-effect markets (like platforms, marketplaces, social products), the #1 can take 90%+.

That’s why your goal shouldn’t be to stay in the race; it should be to break away.

If you hit product–market fit first, pour fuel on it. Build distribution. Reinforce your brand. Pull talent in. Scale.

Because once you lead, everything gets easier. And once you fall behind, every inch becomes harder.

Remember - Markets don’t reward the second-best product. They reward the clearest solution to a painful problem—delivered first, at scale, with conviction.

So stop thinking like a follower. Don’t copy. Don’t chase. Tack. Own something different. Solve something deeper.

And if you do get the chance to lead, protect it. Because in most markets, the gorilla wins it all.

2. How to close your fundraising quickly with tranches: A practical guide.

As a founder, you're probably eager to wrap up your round and get back to building your company. Makes sense - fundraising can be a huge time sink.

One powerful strategy I've seen work well is using tranches. Let me break down what this means and how you can use it effectively.

What exactly are tranches? Simply put, tranches are different pricing tiers in your fundraising round. Instead of raising everything at one valuation, you segment your raise into parts. The early investors usually get in at a lower valuation, creating an incentive for quick decisions.

Why consider using tranches? Early-stage startups are inherently risky, and getting that first check is often the biggest hurdle. VCs tend to move faster when they see other investors already committed. By offering early investors a better deal, you're not just rewarding them - you're creating momentum for your entire raise.

How do investors typically react? Most sophisticated investors understand the game. They know that whether they got in at $5M or $10M won't matter much if the company becomes really valuable. That said, there are some unwritten rules:

Never offer worse terms to later investors than what early ones got

Be honest about your strategy and intentions

Don't string investors along just to create FOMO

What's the best way to communicate new tranches? Keep it natural. Something like: "We opened a small initial allocation to move quickly, and now we're raising the rest at a fair cap." Or if you're extending the round, "We're seeing strong interest beyond our initial target, so we're considering taking on additional capital while managing dilution."

How many tranches should you use? Keep it simple - two or three maximum. Any more gets messy and complicated to manage.

How should you size each tranche? You've got three main approaches:

Small first tranche, bigger second (great for speed)

Large first tranche, small follow-on (better for controlling dilution)

Flexible sizing based on market response (good when you're testing the waters)

Remember, tranches are just a tool to help you close your round efficiently. Used thoughtfully, they can create positive momentum and get you back to focusing on what really matters - building your company.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Ego Death Capital, a bitcoin ecosystem venture firm investing in bitcoin layer 3 projects, closed its second fund at $100m. (Read)

Boldstart Ventures, a NYC-based inception fund for technical founders building the autonomous enterprise, closed Fund VII at $250m. (Read)

OnePrime Capital, a Palo Alto, CA-based technology secondary firm, closed OnePrime Secondary Fund III, L.P., at $305m. (Read)

Zenyth Partners, a NYC-based private equity firm building healthcare services platforms, closed its second flagship fund, Zenyth Partners II, at $375M in aggregate capital commitments. (Read)

Major Tech Updates

Microsoft revealed it saved over $500M in call centre costs thanks to AI tools improving productivity across sales and engineering. (Read)

Linda Yaccarino resigned as CEO of X, Elon Musk’s social platform, just months after it was acquired by his AI startup xAI, citing her own decision, though details remain unclear. (Read)

Apple’s Ruoming Pang, who led the development of its in-house AI foundation models, is leaving to join Meta’s new AI superintelligence unit. (Read)

Jack Dorsey has developed a Bluetooth mesh messaging app called Bitchat, enabling offline communication with a range of up to 300 meters via peer-to-peer relays. (Read)

Google DeepMind's drug discovery company, Isomorphic Labs, is "getting very close" to starting the first human trials for its AI-designed medicines. (Read)

New Startup Deals

Hived, a London, UK-based AI-powered parcel delivery network built for ecommerce, raised $42m in Series B funding. (Read)

Castelion, a U.S. hypersonic weapons startup founded by ex-SpaceX execs, is raising a $350M Series B led by Lightspeed and Altimeter Capital. (Read)

Terra CO2, a Golden, CO-based own-carbon building materials company, raised US$124.5M in new equity capital. (Read)

Wonderful, an Israeli developer of an AI agents’ platform, raised $34m in seed funding. (Read)

Tailor, a San Francisco, CA-based headless ERP platform for modern retail businesses, raised an additional $8m in close of its Series A. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Associate - OMERSE Venture | USA - Apply Here

Principal - Al Fund | USA - Apply Here

Chief of Staff to Founding Partner - One Way Venture | USA - Apply Here

Investor (AI) - Samsung Next | USA - Apply Here

Operations Associate - Techstars | USA - Apply Here

Investment Trainee (US) - Hashkey Capital | USA - Apply Here

Associate - Episode 1 Venture | UK - Apply Here

Fund Operations Manager - Teja Venture | Singapore - Apply Here

Chief of Staff - 11x Capital | India - Apply Here

Associate - Entrepreneur First | USA - Apply Here

Investment Analyst - Camber Partners | USA - Apply Here

Associate (Software Infrastructure) - Omerse Venture | USA - Apply Here

Partner 36 - a16z | USA - Apply Here

Senior Associate - Serica VC | USA - Apply Here

Investment Intern - DTCP | UK - Apply Here

Investment Analyst - Blue Capital | India - Apply Here

Partner 36 - a16z | USA - Apply Here

VC Growth Partner - Exit fund | India - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Portfolio Analyst - GCO Venture | Spain - Apply Here

Associate - OMERSE Venture | USA - Apply Here

Principal - Al Fund | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator