Y Combinator Advises Founders to Avoid These Startup Ideas. | VC Jobs

Financial Model Template Download, Visualize Product Market Fit (PMF) & The Psych Framework.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Y Combinator Advises Founders to Avoid These Startup Ideas.

Venture Curator Hub: Get Access To 10000+ investors' email contact database & more.

Quick Dive:

Visualize Product Market Fit (PMF) - Loom As An Example.

What Investors Look for in Your Startup's Financial Model During Fundraising? - With Excel Sheet Template.

Framework To Measure a User’s Motivation to Continue Caring About Your Product?

Major News: Fei-Fei Li Launches AI Startup Valued at $1 Billion After Four Months, Anthropic Launches $100 Million AI Fund With Menlo Ventures, Google Backs Indian Open Source Uber Rival & Sequoia Offers To Buy $800 Million Worth Stripe Shares…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

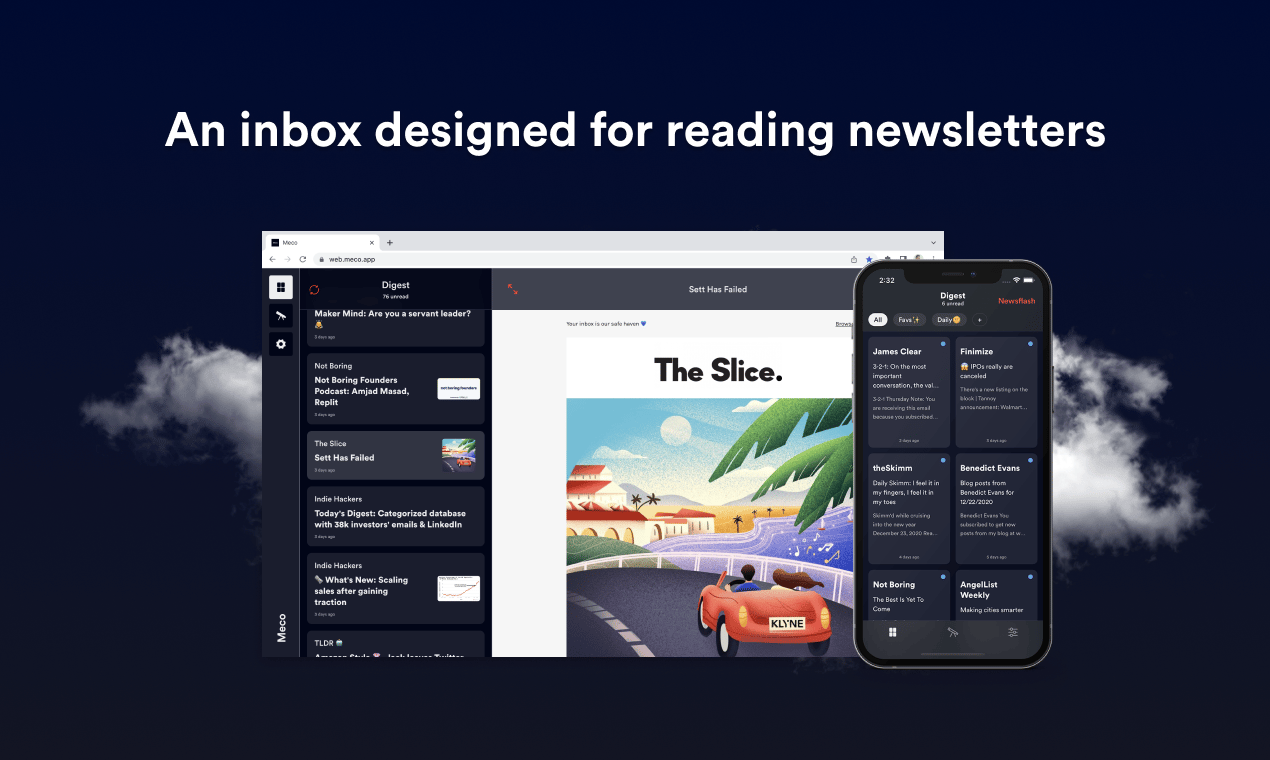

IN PARTNERSHIP WITH MECO

The Best Free New App For Newsletter Reading.

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco, you can enjoy your newsletters in an app built for reading while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox).

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

You can try the experience for free and available on iOS and the web (desktop).

Over 30k readers are enjoying their newsletters (and decluttering their inboxes) with Meco - try the app today!

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Y Combinator Advises Founders to Avoid These Startup Ideas.

These ideas are deceptive in appearance and present themselves with a disconcerting ease as obvious, until one wonders why no one has solved them before.

In the search for startup ideas, it often happens that founders come across some seemingly obvious and simple ideas. These are ideas that seem great at first, but end up being a major drain on your time and resources. Most founders fall into the trap of pursuing these ideas, assuming them to be promising. Y Combinator terms these concepts 'Tarpit Ideas'.

You might be thinking what’s the difference between a bad idea and a Tarpit idea?

The only difference between a bad idea and a Tarpish idea is that you would know when to stop pursuing a bad idea. A Tarpit Idea is identified a little bit too late — when money is already spent on developing it. Looks scary, right?

In this writeup, we’ll be discussing the common “tarpit” ideas that founders often pivot into and away from, and provide some tips on how to avoid them.

What’s The ‘Tarpit Idea’?

A Tarpit, in nature, is where petroleum seeps through the Earth. It’s a hotbed for finding fossilized remains like dinosaurs. Because animals mistake the tar pits for freshwater ponds. They step in, get stuck due to the sticky tar, and unfortunately perish. The interesting thing is — “Scent attracts more animals, creating a domino effect.”

Image Source: Tarpit Club

Interestingly, this mirrors a phenomenon in the startup world

where some ideas lure entrepreneurs in, but the challenges and failures cascade, trapping them in a cycle much like the unsuspecting animals in a tar pit.

How Is This Related To The Startup World?

Tarpits in the startup world lure founders with seemingly brilliant and unexplored ideas.

The absence of famous companies tackling these issues makes them more attractive. It’s like discovering a pristine freshwater pool that appears wide open for success. However, beneath the surface lies a hidden danger.

Many startup founders unknowingly fall into the tarpit trap, where the graveyard of failed attempts is not immediately apparent. Recognizing this trap is crucial because awareness significantly increases the probability of your startup’s success. In essence, avoiding the allure of deceptive ideas can be the key to steering your entrepreneurial journey toward triumph rather than failure.

Interesting Fact — Most Tarpit Ideas Are Consumer Ideas!

Why Consumer Ideas Are Tarpit Ideas?

People often lean towards consumer ideas because we’re all consumers! From the products marketed to us throughout our lives, our problems and interests naturally revolve around things we use or think our friends would.

Most startup stories we hear are about consumer successes like Steve Jobs or Mark Zuckerberg, creating a default association between startups and consumer-focused ventures.

Unlike the consumer realm, it’s rare to find someone head over heels for enterprise solutions like Cisco or Oracle. Essentially, our familiarity and exposure make consumer ideas the default go-to when diving into the startup world.

The most interesting thing is that — most consumer-based idea seems to be so simple but it’s really difficult to build a good startup. There is a reason why there is no solution for a simple idea…..

Why It’s Difficult To Build A Consumer Startup?

Illustration by Lars Leetaru

It’s tough for two reasons -

First, many underestimate the high bar set by successful consumer products. They often don’t realize how good those products are and how many others have tried and failed.

Second, timing is crucial in the consumer space. Sometimes, founders do understand when the timing is in their favour or working against them. Additionally, existing big players have an edge, creating an almost unfair advantage.

For instance, imagine someone with an idea for an un-launched consumer social network. They might believe it’s groundbreaking without knowing the real standards.

Let’s take Google as an example to understand the high bar — it wasn’t just about launching; it was about creating something so exceptional that users couldn’t resist.

Google:

In its early days, there was no advertising or growth hacking — just a website. They relied on incredible word of mouth. Users had to manually discover it, often through internet forums like Slashdot.

Without spending on user acquisition, branding, or marketing, Google attracted millions of users daily. The product’s quality was so high that people not only wanted it but evangelized it.

The founders initially weren’t keen on running a startup; they even tried to sell the technology. However, the demand was so intense that they got pulled into the startup world.

This highlights a key aspect of successful consumer ideas — creating something people are obsessed with and of exceptional quality, so much so that users pull the founders into the journey.

The same case with the facebook…

2. Facebook

Facebook’s journey mirrors Google’s success. Within 48 hours of its Harvard release, 75% of the campus was using it.

Investors like Peter Thiel and Reed Hoffman witnessed users spending an average of two hours daily on the site.

The striking part? No money was spent on marketing or growth hacking.

The truth about these iconic consumer companies is often overlooked. They started with excited users who pulled the product themselves. Users were passionate, even demanding the product at their universities.

The lesson here is clear: successful consumer companies have in common genuinely enthusiastic users. They didn’t rely on aggressive marketing tactics but rather created products that people became obsessed with early on. This sets a high bar for what defines a compelling consumer idea.

Why Timing is So Important?

If you look closely into the data…

Making a consumer or mobile company in the mid-2000s and early 2010s was easier due to specific circumstances. During the 2000s, many people had broadband and computers, and the lack of competition for attention made launching something cool quite successful.

For instance, Facebook gained traction without battling numerous social networks. In the smartphone era, having an app store and the novelty of mobile apps meant even basic creations could attract users.

Back in college, everyone had a computer screen, and with limited TVs, people were more engaged with computers. The absence of major web incumbents and the dominance of TV in entertainment created a sweet spot for web-based startups. Similarly, the early smartphone era allowed for simpler apps to thrive, unlike today’s highly competitive app landscape.

“The key takeaway is — Success often depends on being in the right place at the right time.”

So — How To Identify Tarpit Ideas?

Ideas that have survivor bias:

user problems that may look solvable from a posterior, results-oriented perspective. For example, discovery problems help people find new restaurants to try and new places to go.Ideas that are second-order on widely adopted innovations.

Innovations that have step function improvements bring many low-hanging second-order opportunities. For example, in today’s environment, a “social network for X” might be a Tarpit Idea.Ideas that are more difficult for startups to scale.

For example, hardware start-ups require a lot of funding before seeing the first results, and although they can scale eventually, they require the right approach.

Some tarpit ideas might not be so with the right founders and business model. At the same time, good ideas that were launched years ago might be a tarpit idea now.

Based on the above factors, if you find that you are targeting Tarpits (unproductive or overcomplicated ideas), then as a founder, how can you make a great pivot?

Before understanding — how can someone make a great pivot? Let’s understand a concept called — Supply-Demand in Founders & Ideas.

Some ideas attract a large pool of founders (more supply) due to their appeal — think partying with celebrities. On the flip side, ideas like building open-source developer orchestration tools have a lower supply because of the specific skills required.

The demand side is crucial too. Unlaunched, undifferentiated social apps face minimal demand in a saturated market. On the other hand, there’s a high demand for high-quality software that solves significant business problems, making companies more efficient.

In essence, tarpit ideas refer to those with an oversupply of founders relative to market demand.

It’s akin to the job market — having unique, differentiating skills sets you apart. The plea here is for experienced individuals who might not see themselves as startup material; if you’ve solved a niche problem or have industry insights, you could be a startup person. The startup world isn’t limited to consumer apps or social networks; it embraces diverse perspectives to solve real-world problems.

So if you find that you are solving the Tarpit Problem and You want to pivot your business then follow this “Supply & Demand Rule”. How?

The best pivots occur when a founding team recognizes the supply and demand dynamics. It involves moving from an idea with an oversupply of founders and low customer demand to an idea with a lower founder supply and higher customer demand.

Examples include Brex and Retool. Instead of heading to the easy freshwater pond, which is a trap, successful pivots lead toward less explored areas like the mountains or desert. It’s about moving away from the common tar pit ideas and embracing challenges.

For aspiring founders, it’s crucial to do thorough research, understand the bar for success, and consider the supply and demand aspect. Creating luck involves recognizing these dynamics and making strategic moves to increase the odds of success.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

QUICK DIVES

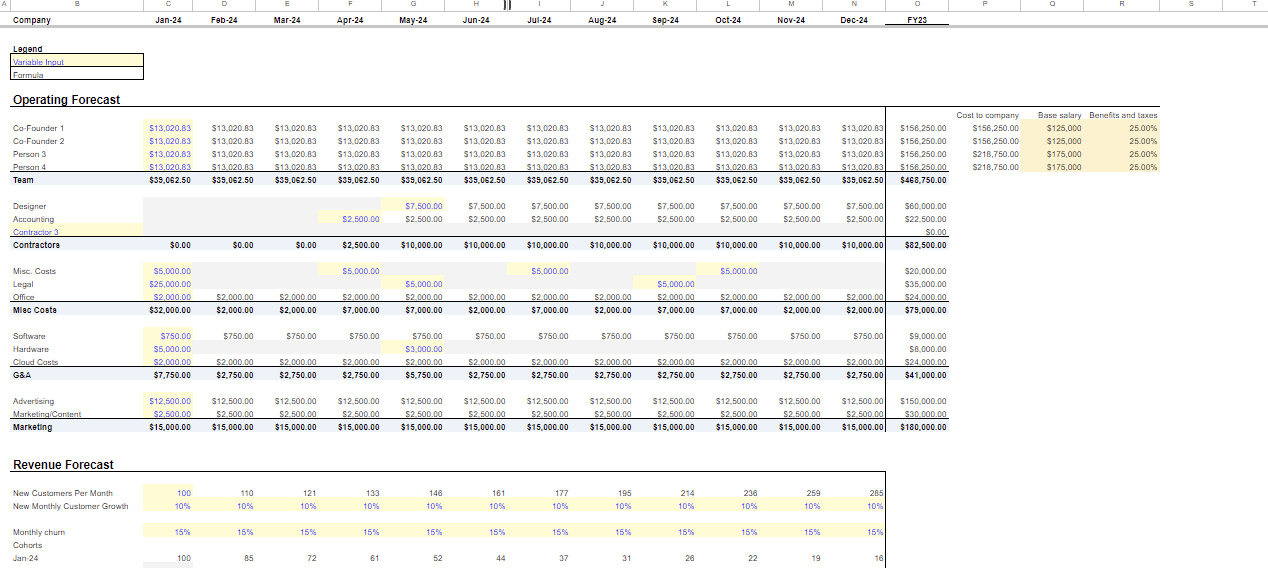

1. What Investors Look for in Your Startup's Financial Model During Fundraising?

When you learn about entrepreneurship in school you’re taught to have a clear, strong business plan and financial model when you start, and to use that as a way to communicate the path your business will take.

The real world is much messier. Any plan you had when you started gets changed quickly. Every day or even hour of your time that you devote to your startup needs to be spent getting it off the ground. The same is true for a financial model. Your projections will be wildly wrong.

Not only that, but the levers you have at your disposal in the model may not end up being what you think they’ll be — the entire business may change, and you likely don’t know enough yet at the pre-seed stage to be sure.

Investors all know this. They see tons of startups and have many first-hand data points showing that everything can change and often does.

What they don’t know is if YOU know that.

Investors are looking to de-risk the idea of investing in you. Startups are inherently so risky that they look for ways to think of your startup as less risky than others. One of those ways is to assess your founder mindset — how much do you “get” what being a founder will really be like?

The thinking there is that the more you “get” it the more you’ll be able to anticipate challenges and be emotionally steady when things get rocky.

This is a very common place where first-time founders and founders who don’t have a strong network fail to build trust with an investor. That might not be fair, but it’s true. Two of those signals for how well someone is ready to be a venture-backed founder are:

How well do they know how to prioritize their time? - Whether they realize everything will change from their “plan” or not. Presenting investors with detailed financial projections at the pre-seed stage fails both of those tests.

Get access to the financial model template.

Ok… So Why is a Financial Model Useful?

VCs who want to see a model use it as a proxy for understanding whether a founder can correctly break down the incentives and value levers in a problem space.

VCs want to trust that if the business needs to change, the founder will be able to quickly figure out how to evaluate new opportunities and position their product for success in a new market. It's just a different way of de-risking an investment opportunity.

The simple takeaway is that each investor is different in what traits they value and how they reach conviction. So Know your investor - talk to their backed founders, and read their content. Think about the type of investor you want as a partner based on their evaluation approach.

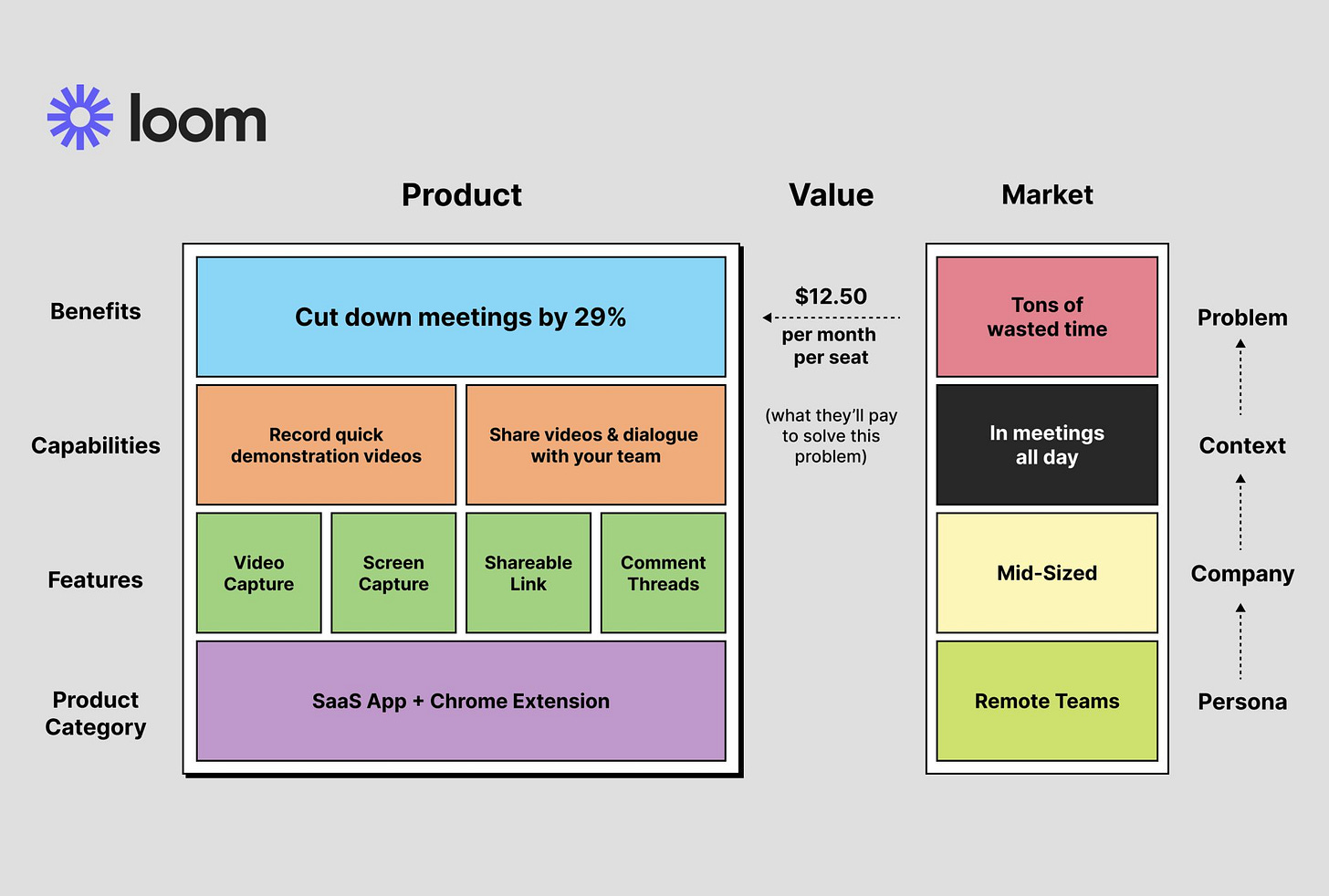

2. Visualize Product Market Fit (PMF) - Loom As An Example.

I came across this image (By Loom) with what seems to be a completely original way of thinking about product-market fit.

Think about finding PMF like an equation — does your position in the market (based on how painfully your ICP - Ideal customer profile feels the problem) and how effectively your product solves that problem, justify the price you’re charging?

Here’s the breakdown:

Let's start with the PRODUCT. Think of a product as a "stack" of elements:

Category: Essentially, where does your product live on the supermarket "shelf"? Who do people compare you to? (You want to choose something that highlights your strengths and downplays your weaknesses)

Features: These are the nuts and bolts of your product, the "what". Features can be technical in nature but also can include things like user experience, customer service, credibility, etc.

Capabilities: The new things you can now do that you couldn't before, the "how". These have to be tied to a specific feature. What do I DO with the features of the product?

Benefits: How the product is increasing the good or decreasing/removing the bad, the "why". This is the OUTCOME of using the capability — what does that unlock change for me OUTSIDE of the product?

Now let's move on to the MARKET SEGMENT:

Persona & Company Type: The ideal user in the ideal company for your product. You may only have one or another one of these and not both depending on the type of product you've built.

Context: Their world today without your solution, and how they're trying to make progress.

Problem: The issues caused by doing it the way they currently do. These go hand in hand — the context without your product leads to issues that are solved by your product.

Finally VALUE: What they would pay to get access to the product and solve their problem & make progress.

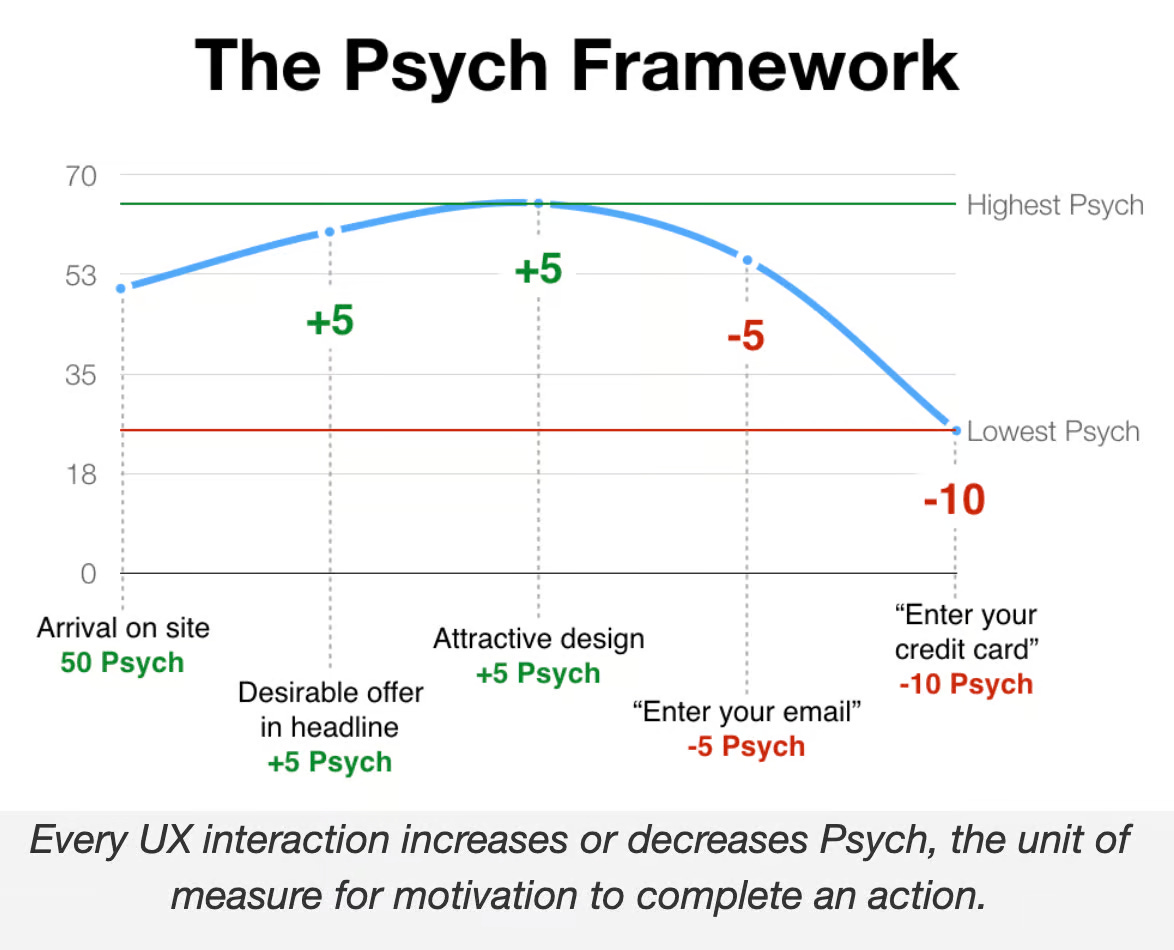

3. Framework To Measure a User’s Motivation to Continue Caring About Your Product?

The Psych Framework tries to help you map it throughout a user journey by framing moments in the journey as either increasing or decreasing motivation and assigning points to each moment. The main principles are:

Every element on a page adds or subtracts emotional energy ("Psych").

Inspiring users is as important as reducing friction.

For example, asking a user to enter information manually will decrease future motivation — you’re “spending” your site’s mental capital with the user to get them to perform that action.

Image Source: Andrew Chen

While the actual point values that an action increases or decreases motivation by are likely to vary from user to user, using the framework is a good reminder that you can’t ask for too much from users — you have to give as well, to keep them excited.

Join 30000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Fei-Fei Li, called the "godmother of AI," has founded World Labs, a startup valued at over $1 billion after just four months. More Here

Figma Inc., a San Francisco-based design startup, has been valued at $12.5 billion in a recent investment deal led by Coatue Management, Alkeon Capital Management, and General Catalyst Partners. More Here

Menlo Ventures and Anthropic have partnered to launch the $100 million Anthology Fund, aimed at investing in early-stage AI companies. More Here

Microsoft laid off an internal team focused on diversity, equity, and inclusion, (DEI). More Here

Former OpenAI, Tesla engineer Andrej Karpathy starts the AI education platform. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

An insightful breakdown from Gagan Biyani (Maven CEO, Udemy Co-founder) on the multifaceted role of startup founders:

Vision setting: Regular meetings with investors, competitors, and other CEOs. Constant evaluation of strategy and direction.

People management: 30-50% of the time. Recruiting, 1:1s, skip-levels, product reviews, and leading meetings.

Strategic priorities: Focus on 1-2 key tasks monthly, like hiring, product launches, or customer interviews.

Operations: P&L reviews, investor updates, calendaring, and correspondence. Some networking events and social media engagement.

Most CEO time (70%+) is spent on unseen tasks: hiring, coaching, aligning the company, and attending meetings. This is typical for most CEOs, with few exceptions.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Director, Investments - Pivotal Venture | USA - Apply Here

Senior Fund Controller - Earlybird | Germany - Apply Here

Fund Administrator - Vertex holding - Apply Here

Head of Legal - Adara Venture | Spain - Apply Here

Executive Assistant Office Manager - SE Ventures | USA - Apply Here

Associate, - Aegis venture | USA - Apply Here

Operations and Investment Associate - Four Cities Capital | UK - Apply Here

Investment Listener: Fall/Winter 2024/25 - Listen | USA - Apply Here

Investor - Founder collective | USA - Apply Here

Chief of Staff - Enaic | USA - Apply Here

Investment Partner - Joyance Partner | USA - Apply Here

Venture Partner - Joyance Partner | USA - Apply Here

Investment Associate 2024 - Truebridge Capital | USA - Apply Here

Portfolio Talent Lead - Galaxy Ventue | USA - Apply Here

VP/Directors - Dexter capital advisor | India - Apply Here

🧐 The Math Behind Venture Capital - Guide For Aspiring Venture Capitalists

Even if you're potentially looking for a junior position, knowing how VCs at any level think, make decisions, and deal with the complexity of Fund Management (= building a company as opposed to merely 'investing') will make you stand out -

The attached document will give lots of insights on:

1️⃣ VC firm structure

2️⃣ The 2-20 rule and the math behind it

3️⃣ How investors make investment decisions and think through various exit scenarios

4️⃣ The reality check on getting a return on startup investments

5️⃣ How VCs think about reducing risk for startup investments

6️⃣ The 5 Ts that every VC considers while making an investment decision

Download the full guide here.

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team