Why Your Startup Idea Isn’t Big Enough for Some VCs? | Understanding Churn and Building Action Plan | Product Market Fit Misconceptions | VC Remote Jobs & Internship

Not Big Enough Idea For VC | Strategy to Lower Churn Rate By BVP | VC Remote Jobs

📢 Today At A Glance

Focus On: Why Your Startup Idea Isn’t Big Enough for Some VCs?

Article: Understanding churn and building an action plan to fix the proverbial “leaky bucket” By Bessemer Venture Partner

Intersting Tweet On: 98% Of Founders Get The Definition of Product Market Fit Wrong.

Weekend’s Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partners

📢 Sponsored By: Poised

🗣Don't settle for mediocre meetings. Get immediate AI feedback so you can communicate in a way that inspires and motivates the team – and adjust when you haven’t.

📊 At-a-glance insights on how clearly you spoke

✅ Personalized feedback on how well you accomplished your meeting goals

📢 Reflect and decide how you can get your message across better next time

Let Poised work its magic in your next call. Our readers can try it for free.

🤝 Interested In Sponsoring This Newsletter?: Apply to Partner With Us! Click To get In Touch 📢Why Your Startup Idea Isn’t Big Enough for Some VCs?

VC functions with a power law, the majority of a fund’s returns come from a small percentage of investments.

Because of this, Venture Capital need to know if a single investment can return the entire fund. What does it mean? Let’s understand this 👇

Fig: Power Law In Venture Capital

As Bill Gurley said “Venture capital is not even a home-run business. It’s a grand slam business.” This is where the Return The Fund (RTF) analysis comes into play.

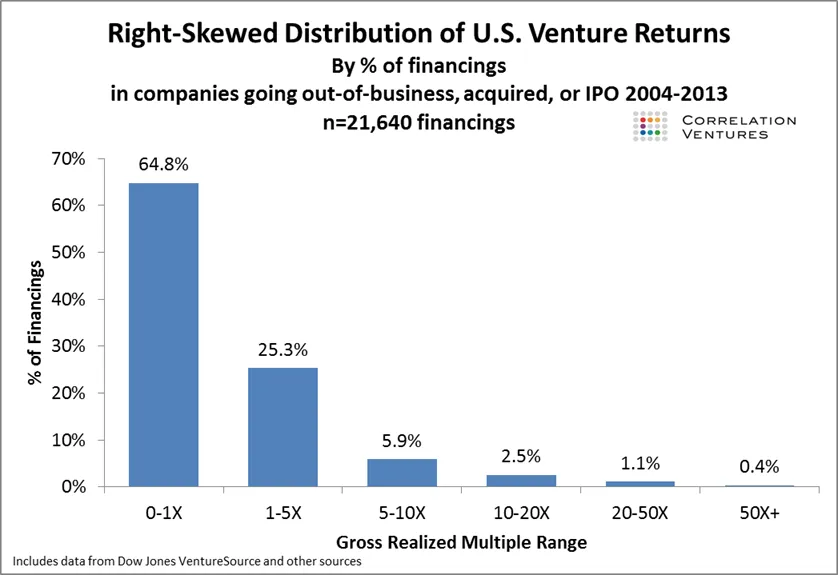

Look at the below Data from 2004-2013.

https://www.sethlevine.com/archives/2014/08/venture-outcomes-are-even-more-skewed-than-you-think.html

If we assume an exit distribution, over 60% of a fund’s investments are 0–2x their money, With the remainder falling between 2–5x, a “unicorn” type 10x+ outcome can put a venture fund into the desired 3x fund returns that put them among the top performers in VC.

Your 1–3 investments that “return the fund” and probably even more (the grand slam), are what will make or break you, While the other 2x-5x investments create additional alpha.

Let's understand the math behind the Return The Fund (RTF) to get a better idea.

The math for an RTF analysis is pretty simple:

Fund Size / % owned at exit = Minimum Viable Exit

To get a clear idea - let's take an example of an autonomous vehicle startup built on the blockchain, X raising a $2M seed at a $10M Post money valuation (Selling a 20% stake).

VC Fund A is a $50M seed fund investing $1M.

$1M/$10M valuation = 10% ownership

In order to return the fund, X must exit for (50/.1) = $500M

But over the period, Fund A wasn't able to invest in the next rounds (not maintain pro-rate thing ) so their stake got diluted. Assume dilution by 20%.

With this dilution by 20% - the real return of the fund number is $625M ($50M/.08). So in order to pass RTF (Return To Fund) analysis, VC Fund A must believe that X will exit for at least $500M and more realistically $625M. This is for some small funds like seed.

Now let’s look at a larger fund model.

VC Fund B is a $250M fund investing $1M in X.

$1M/$10M valuation = 10% ownership

Return to Fund calculation: VC Fund B has to believe that X will exit for $2.5B ($250M fund / 10% stake).

Assume this fund is able to invest in further rounds and able to get 5% extra which makes the stake 15% at exit.

VC Fund B has to believe that X will exit for $1.66B ($250M/15%) in that increased ownership scenario.

But does the company really exit at $1.66B or more? What’s the past data say? -

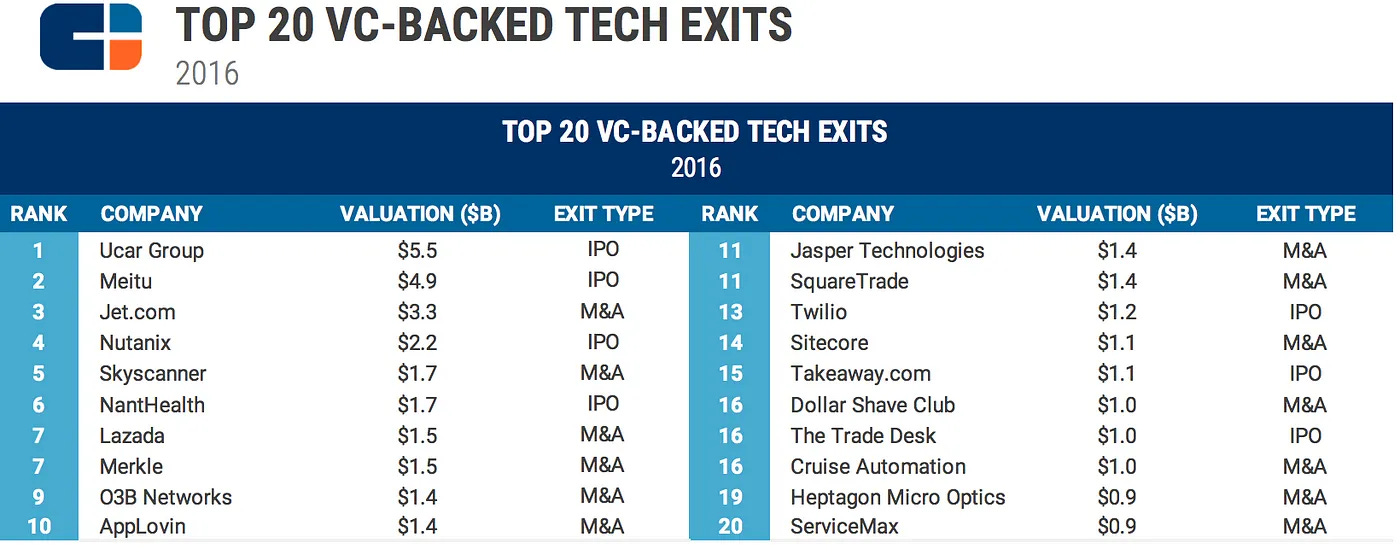

Let's look into this. If you look at data on equity ownership at exits, the image below:

Data till 2016 - on VC Backed Startups Exit

As an investor, the difference between a company exiting for $500M vs. $2.5B is not trivial. Less than 10% of all VC-backed exits in 2016 were $500M+, per CB Insights.

As a founder, this trickles down to thinking about their potential investor’s philosophy. While some startups are built to exit in the 100 of millions of dollars, Larger funds could push through their natural exit points in order to go for broke and hit a grand slam which is unlikely to occur. Return to the fund (RTF) is a good barometer, but just one data point in the Due Diligence Process.

It is a quick way to gut-check ownership and investment size and also allows investors to think about how they will need to build their positions over time. But while this thought process is generally useful, like all things in startups, there are outliers.

Join 4200+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and implement Startups, Technology and venture Capital.

📢Article: Understanding Churn And Building An Action Plan To Fix The Proverbial “Leaky Bucket” By BVP

One of the most interesting articles to read for all founders & investors. Here is the summary:

The age-old statistic that it costs 5-25 times more to acquire a new customer than to retain an existing one is more than just a mantra. It's a guiding principle for SaaS executives like Gabe Miller-Smith, former SVP of Global Customer Success at Procore.

In the early stages of a startup, it's easy to focus on acquiring new customers. However, neglecting churn can lead to significant problems down the line. It's crucial to remember, "If you can’t hold on to customers, you’ll never be able to grow." Reducing churn and increasing net retention is paramount, especially for startups. It's a "team sport," requiring the support of the entire organization.

But what's a realistic target for net retention? According to Gabe, a 10% churn rate is too high. "At Procore, I never had a churn target that was greater than 9%," he says. Addressing churn involves understanding who’s churning, why they’re churning, and when in their journey they’re churning. It's about categorizing customer churn to identify patterns and developing strategies to tackle the problem.

Gabe's team at Procore focused on automating processes, building certificate programs, and setting up drip email campaigns. These initiatives helped customers get value out of Procore faster and freed up customer success to provide added counsel and support.

Looking ahead, predictive analytics could be a game-changer for customer success teams. It's about knowing when customers are going to churn and planning the next move. Remember, not all churn is obvious. Dig deep into your data to uncover hidden issues. And keep in mind, net retention should be your North Star metric.

And if you need a reminder, put the stat right above your desk: It costs 5-25x more to acquire a new customer than to retain an existing one.

Read More about this here: Understanding Churn and Building an Action Plan to Fix the Proverbial “Leaky Bucket”

🗞️ Read VC Daily Digest’s Newsletter

VC Daily Digest: Join 2500+ Avid Readers For Daily Venture Insights, Funding Updates And Startup Stories In Your Inbox. 🚀

📢Intersting Tweet: 98% Of Founders Get The Definition of Product Market Fit Wrong.

Recently we shared a tweet on PMF:

Most Founders think that initial signs of repeatable revenue growth, low churn, happy customers, and customer referrals/word of mouth mean that they find the PMF.

To be clear this is not the Product Market Fit (PMF), these are just signs of early market validation. So what is exactly PMF for Startups?

📢Weekend’s Reading on Startups, Venture Capital & Technology

📮 Venture Capital Fund Modelling III: Masterclass Read More

📰 Why it's Better To Raise Less Capital In The First Round? Read More

📪Why Do VC Firms Want an Option Pool Before the VC Round? Read More

🗃️ YC Startup Index Gives 176% Return Read Here

📜 How do VCs Evaluate and make High-Quality Investment Decisions? Read More

📑 Decoding Sequoia Capital: How Do They Dominate the VC Landscape? Read Here

📑 How To Convince Investors That Your Startup Can Give Maximum Return To Them? Read Here

📢Venture Capital Remote Jobs & Internships: From Scout to Partners

💼 VC Associate - Pender Venture 📍Remote - Apply Here

💼 VC Associate - Boost Venture 📍Remote - Email at: adam@boost.vc

💼 Investment Manager - Circulate Venture 📍Remote - Apply Here

💼 VC Internship - Precursor Venture 📍Remote - Apply Here

💼VC Fellow - Mighty Venture 📍Remote - Email at: sharran@mighty.capital

💼 VC Scout - First Momentum Venture 📍Remote - Apply Here

💼 Visiting Analyst - WI Venture 📍Remote - Apply Here

Join our VC Enthusiast Community - VC Crafters - A Community For VC Enthusiasts To Learn, Collaborate, Network and Craft Path To VC. Join Now