Why it's Better To Raise Less Capital In The First Round? | Don’t Waste Time Chasing Investors | How To Convince Investors | VC Jobs & More

Better to raised less captial in first round, Convincing Investors, VC Jobs & More

📢 Today At A Glance

Why it's Better For Founder To Raise Less Capital In The First Round?

Article: Don’t Waste Time Chasing Investors. Do This Instead

Intersting Tweet On: How To Convince Investors That Your Startup Can Give Maximum Return To Them?

Weekday’s Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships

📢 Sponsored By: Poised

Don't settle for mediocre meetings. Get real-time feedback during meetings with Poised so you can communicate in a way that inspires and motivates the team.

🫤 Come across more confident

✅ Drastically improve your clarity

🕒 Reduce unproductive meeting time

Let Poised work its magic in your next call. Our readers can try it for free.

📢 Why it's Better For Founder To Raise Less Capital In The First Round?

When you're just beginning your startup journey, should you go all-in and raise a massive amount of capital, or is there wisdom in starting small?

Let's explore why it often pays off to raise less during your initial funding rounds.

It is common now for founders to raise SeriesA financing even to hire talent or work further on their MVP. Typically, in this stage, the startup will have acquired one customer, ready to pay for its MVP with a guarantee that it will become a bigger customer if it works on the MVP.

At this stage, the founder has an ESOP (Employee Stock Option Pool). Assuming that it has issued 1.5 Mn shares, out of which 0.5 Mn are ESOP, it raises capital for $300k from an investor to hire a couple of employees to work on MVP.

It finds an investor to fund $300k at a pre-money valuation of 1.3 Mn.

Pre-money price/share = 1.3 / 1.5 = 0.87

At 300k, the investor gets 0.346 Mn shares (0.3/0.87)

Post-money valuation at the end of Series A = 1.6 Mn (1.3+0.3)

The startup will grow at 95% next year and then go for 6 Mn funding. The reason is that its PMF (Product Market Fit) is validated and has a big customer contract. Now it wants to SCALE.

It drafts a pitch deck, gives projections of 90%, 85%, 75% and 70% in the next 4 years, and assumes a probability of a sale by a strategic buyer in the 5th year.

At the end of 5 years, it projects 20.4 Mn in revenues, and at a 2x multiple (looking at its peers), it arrives at an exit valuation of 40.8 Mn.

At a 50% hurdle rate, it arrives at a post-money equity value of 12.1 Mn (40.8/(1+50%)^3).

Pre-money value = 12.1-6 = 6 Mn.

Pre-money price / share = 6 / 1.846 = 3.3

Thus, a new investor will get 1.214 Mn shares for his 4 Mn investment, and if the earlier investor wants to invest 2 Mn, he has to buy shares at 3.3/share to get 0.606 Mn shares. In addition to 0.346 Mn shares of Series A, he has 0.953 Mn shares.

The benefit for the founder is that he can raise more capital (6 Mn against 0.3 Mn), but he has diluted his ownership from 81.3% to 40.9% (50% dilution).

However, had he raised 1 Mn in Series A against 0.3 Mn, his ownership would dilute from 56.5% in Series A to 28.5% in Series B.

So, what's the takeaway here?

1. Start Small, Stay Nimble: In the early stages, your startup is still evolving. You might need to pivot or adapt to changing market dynamics. Raising less capital early on gives you the flexibility to make strategic adjustments while retaining control.

2. Small Beginnings, Bigger Rewards: As your startup proves its worth, you'll attract more customers and orders, which will naturally drive up your valuation. When you eventually seek funding for scaling, you'll dilute fewer shares because your pre-money valuation will have risen.

In simple terms, raising less initially allows you to grow smarter and stronger. It's not about the quantity of capital you raise but how strategically you use it.

Remember, it's like planting a seed - nurture it wisely, and watch your startup grow into a mighty oak.

📢 Article: Don’t Waste Time Chasing Investors. Do This Instead

I read an article discussing how founders often waste their time chasing investors. The article proposed some valuable strategies that I believe are worth sharing with all founders.

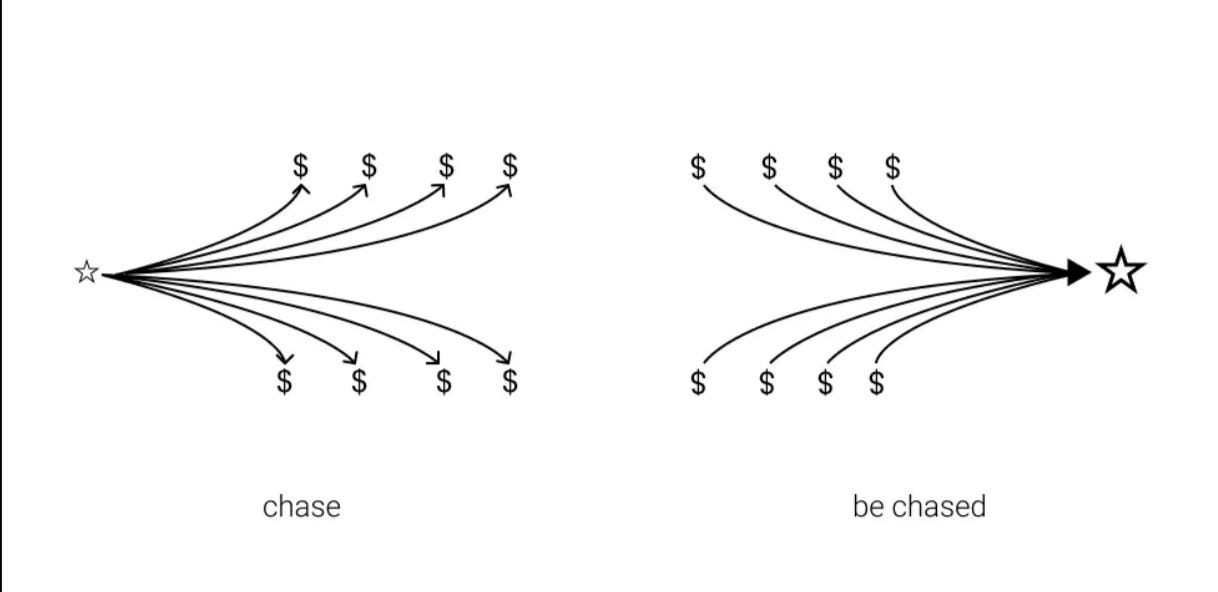

“ If you’re chasing investors…you’ve already lost."... be chased" Make them feel like they’re “catching a deal.” But How?

Here are three key practical ways:

Produce and share valuable content:

Create a broader area for you and your company to be discovered.

Share content to showcase expertise and become a thought leader in the industry. It expands your reach and attracts investors, creating opportunities for introductionConnect with founders in the VC’s portfolio:

You’ll find that VCs are much more receptive to intros from founders in their portfolio than cold emails/messages. Chances are that your experience could help their portfolio startup's founder. Think about adding value to them. Offer your help and genuine interest in their company or story. Ask for their fundraising story. Work on building a mutually beneficial relationship first, demonstrate why your company are a great bet, and they will automatically send your startup to their investors.Ask for advice, not money:

VCs like catching deals early. Signal strength to VCs: Don't seem desperate for funds. Seek advice, not just money. Show you're refining strategy and building valuable relationships.

These are more practical approaches and if you are using them in the right way - I am damn sure you are on the path of raising your capital. So use it and see the result.

Join 4100+ investors, operators, innovators and students inducing content every week in our VC Newsletter.

📢 Interesting Tweet On How To Convince Investors That Your Startup Can Give Maximum Return To Them?

The single biggest challenge when pitching to VCs is convincing them your startup can return its funds. It is THE key factor that drives their decision.

These 6 simple steps can help you address the “fund returner” during the pitch:

📢 Weekday’s Reading on Startups, Venture Capital & Technology

📜 Do Things That Don’t Scale Read More

🚀 Making a financial model for your early-stage startup?

Read Here🗈 Why Brand Building Is So Important For Startups? Read Here

🪧Hidden Trap Of Convertible Note and Liquidation Preference Multiples Read Here

🚀 How to Start A Startup By Paul Graham? Read Here

📪The Secrets Behind Market Sizing! Read Here

📢 Venture Capital Remote Jobs & Internships

💼 MBA Fall Semester Fellow - Collide Venture Remote - Apply Here

💼Venture Associate - Capital One Venture 📍Remote - Apply Here

💼 VC Associate- CITI Venture 📍 Hybrid - Apply here

💼 VC Internship - Papa Oscar Venture 📍 Frankfurt - Apply Here

💼 Portfolio Venture - WEX Venture 📍 Remote - Apply Here

💼 VC Associate - Boost Venture 📍 Remote - Email at adam@boost.vc

For More Jobs, check this out - theventurecrew

📢 Subscribed To: VC Daily Digest

VC Daily Digest: A Daily Dose of Venture Insights, Funding Updates, And Startup Stories, Delivered Straight To Your Inbox.

Join the 2400+ Top executives from leading firms to receive daily updates on startup investing, startups, technology, AI and Venture Capital.

🤝 Interested In Sponsoring This Newsletter?: Apply to Partner With Us! Click To get In Touch ✍️Written By The Venture Crew Team

🤗Join Community 🗈 Want to Feature 📢 Sponsor Us 👉 Follow Us