Why Do You Need a Moat? & Why Are Founders Afraid to Talk About It? | VC Jobs

Framework to Determine Startup Valuation & to Pitch The Startup Idea.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Why Do You NEED a Moat? & Why Are Founders Afraid to Talk About It?

Quick Dive:

A Simple Framework For Founders To Determine The Startup Valuation.

How to Not Ask VCs for Money?

How to Split Equity between Cofounders & When You Should (and Shouldn't) Split Equity Evenly?

A Simple Startup Pitch Framework: The Rules of a Good Pitch.

Major News: Tesla Set To Layoff 30000 employees, Microsoft-backed Rubrik Launches $5.4B Valued IPO, OpenAI Fired Its Employees & Google Invested $4.5 Million In AI Startup.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH AIMPLY

The Last Newsletter You'll Ever Need.

Aimply Briefs is the first newsletter that scours the internet for articles tailored to your interests, summarizes them, and delivers them directly to you in one convenient email.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Why Do You NEED a Moat? & Why Are Founders Afraid to Talk About It?

A moat is your startup’s ability to maintain an advantage over your competitors, and investors love to talk about it. It is one of the most important things a founder should get across when pitching.

Peter Thiel agrees. He says startups without a moat are companies that can create a lot of value yet still be worth very little.

In an essay, Packy McCormick argues that the most successful companies are the ones who desperately need moats.

His reasoning is simple: good ideas get noticed… quickly. And the best ideas need strong moats to maintain their advantage and grow fast enough to become dominant.

As a result…

Depth of moat needed = How obviously good your idea is - How hard it is to build.

But what does it mean by a good idea, especially one that's hard to build?

Remember - “Generational companies are not built on the latest technologies but in bold statements.”

By the end of this write-up, you will grasp the real meaning of these statements. And learn about how startups like Stripe, Airbnb, and Spotify are perfectly aligned with these statements…

“MOAT” - seems like a new word; in recent times, founders are afraid to talk about the MOAT of their startup.

They don’t want to recall, as most startups or so-called AI startups don’t have a MOAT except those 2-3, you know who I am talking about. Let’s not recall those names but let’s rewind the time when founders used to talk about MOAT. Most of the founders were afraid because they didn’t understand the real meaning of MOAT!!

Just remember it’s not any tech, AI-powered, some API or other things….. So

What’s The Moat For A Startup?

Moats are a set of characteristics (competitive advantages) a company has that make it hard for other companies to compete.

In practical terms, I think about this by answering the question, what can’t a company with $1B sitting in the bank just buy?

The answer? Many things: Community, Trust, Network Effects, Users, etc.

In the past, tech was considered a strong moat since it required large amounts of capital to be built. But the truth is, the level of defensibility provided by tech to startups is at an all-time low and decreasing faster than ever before. Defensibility at a product level is incredibly hard to achieve, let alone sustain.

Features aren’t moats because they can be replicated. And now, as AI starts to spill into software development, software’s marginal cost will dramatically decrease in the upcoming years.With AI Tech will become an even weaker moat. Code will start to become a commodity.

What’s Your Moat?

P.S.: The above Image is Just for fun! But Is this true?

One of the most common questions that every founder receives while pitching investors (or founders in general) is ‘What’s your moat?’.

Most of the tech founders try to find a convincing way to explain why the tech they are building is unbeatable, or why the features that they planned to launch are game changers. But none of this matters.

If you want to convince investors on MOAT of your startup. Just ask one question to yourself.

‘Why am I being asked this? What was Airbnb, Spotify, or any other successful company’s moat when they just were getting started? In their origins, what did they have that nobody else had?’

It is just one thing. “A bold statement on how the world should look like.”

“Generational companies are not built on the latest technologies but in bold statements.”

When these are being built, tech only plays a fraction in innovation. The engine that facilitates the creation of new companies is dreaming of better experiences.

Spotify’s moat

For many years the only option for streaming and downloading music was pirating (usually off Piratebay). People got used to scrolling through music pirating websites and were OK with clicking through spam and fake download buttons to get a new music album. It wasn’t a state-of-the-art experience, but it worked.

If you wanted to hear a song, you could. As mentioned in the episode featuring Daniel Ek, founder of Spotify, in Reid Hoffman’s podcast Masters Of Scale, before the foundation of Spotify, ‘music lovers already had the world music at their fingerprints.’

Although seen as a technological breakthrough, Spotify was more of a powerful statement and an unparalleled experience. At the time, it wasn’t built with mind-boggling software. As far as tech goes, Spotify could have been created five years earlier. Spotify was a bold statement and a big bet. People weren’t unhappy with how they were listening to music. They were happy. No one imagined it could get better until someone did. People weren’t pirating music because it was free. It wasn’t an economic hurdle. It was instead a convenience one.

Daniel Ek did something genuinely bold. Although nobody was complaining about the current state of music, he dared to imagine an even better experience. Building a company in an industry where the vast majority is happy with what they currently have, requires an astonishing vision, and blinding determination.

And that was Daniel’s moat. Unlike tech, a vision (the act or power of imagination) or a statement cannot be bought.

Most of the founders don’t find a bold statement for their startup and fail to create a MOAT for their startup!!!

There is also one thing -

Should entrepreneurs always look to solve ‘problems’?

At that time, Spotify was not solving a true, existing problem. It made the experience 100 better, at least. But back then, nobody would have defined listening to music as a ‘problem.’

This is why, in my opinion, one of the most common tips for founders, ‘Talk to users’, should be taken with a grain of salt. Yes, talking to users can help identify customers’ pain points that may otherwise go unnoticed and provide valuable feedback on a product or idea. However, if founders delegate their entire creative process to potential customers, they automatically set a ceiling on what can be built based on users’ wants. And the truth is, people don’t know what they want until they see it.

There are millions of bold statements waiting to be realized. It just takes a brave mind to effectively see around themselves in non-obvious places where things can get 100 times better.

✨ Launching Our Premium Venture Curator Newsletter & Community

With our biweekly free newsletters (Tuesday & Thursday), we are launching our premium newsletter. Every Sunday (full newsletter) and Thursday (half newsletter), we will share actionable premium content with you on startups, venture capital, AI, and more.

A subscription gets you:

⭐ Premium Subscribers Posts (Every Sunday - full premium post & Thursday - half premium post).

⭐ Daily Premium Content, Discussion, Curated Article & Weekly events list Through Substack Community Chat.

⭐ Access To Founders Resources (10000+ verified Investors’ email contact database, fundraising resources, discount marketplace & more…).

QUICK DIVES

1. A Simple Framework To Determine Your Startup Valuation

Many founders ask me, "How do I know what my startup's valuation should be?"

Here's a simple framework that you can use to determine your startup's valuation:

Identify your key milestones

Remember, raising capital from VCs relies on hitting milestones that expand your startup's growth potential. At later stages, this is driven by metrics like ARR, active users, retention, and growth rate. But at pre-seed, seed, and Series A, milestones are more narrative-driven.

The first step in planning a fundraiser is understanding what milestones you'll need to hit before your next round. That will shape the growth strategy you pitch to investors now.

2. What's Your Expected Burn

Next, conservatively map out the cash you'll need to burn to hit your milestones. Always assume you'll need 1.5x more than you think, in case things go wrong.

This forces you to think through a full, honest growth strategy. Work backwards from the milestones:

What needs to happen for them to be true?

How long will that take in optimistic, realistic, and pessimistic scenarios?

How much will you need to spend?

Can you move faster or reduce risk by spending more?

Map this out month-by-month against your expected revenue. VCs don't expect profitability, but this shows your total burn and monthly burn rate before your next raise.

3. Your Round Size?

To determine your fundraising size, use this formula:

Fundraise size = expected total burn + (expected burn rate * 12) - current cash

VCs typically want 12 months of runway, so multiply your expected burn rate by 12 and add that to your total burn between raises.

(Your current cash is what's in the bank now.)

Example: Let's say your startup has a burn $50K per month over the next 10 months before you'll hit your milestones for the next round and you have $100K in the bank right now:

$500K + ($50K * 12) - $100K = $1,000,000 round size

4. Calculate Your Valuation

Consider how much of the company you're willing to sell in this round. Generally, startups sell 10-20% per round.

Do an honest risk assessment - more unknowns mean you'll need to be on the higher end. If you don't urgently need to raise, you can negotiate lower.

In our example, let's assume you want to sell 15% for $1 million. That sets our valuation around $6.7 million, or $7 million to keep it simple.

5. Double Check the Markets Right Now

Now look at recent deals in your industry and consider market factors using Pitchbook. Talk to VCs not pitching to get context on whether valuations are "high" or "low" right now.

If valuations are "high" you can be aggressive with your story. If "low", you'll need to rely more on traction and metrics and may need to accept selling more equity than preferred.

In our example, let's assume the markets are "low", so you might have to choose between a $6M valuation or raising less capital than desired. That’s it.

2. How to Not Ask VCs for Money?

When an investor asks you why you need to raise money, the worst thing you can reply with is that it’s to extend your runway.

Many founders make this mistake...

Remember - Investors care about growth and having a clear set of milestones you think you can hit. They see a lot of opportunities, and the most exciting ones are fires that are already growing that they can throw gasoline on top of.

This is similar to how your customer doesn’t care about your product, they care about the benefit or transformation your product provides for them.

Show them an opportunity that’s growing quickly but could grow faster with some help, rather than one that needs more money to survive a little longer in the hopes of striking gold. The best way to pitch to investors when they ask is to say something like -

"We need $3M to accomplish these 3 critical projects we have planned that will take us from X users/revenue to 5x in 18 months.

We need these 4 new positions to pull it off and we already have great candidates for each role that we're in active discussions with."

It's a small detail, but an important one to get right when you're looking for investment for your startup.

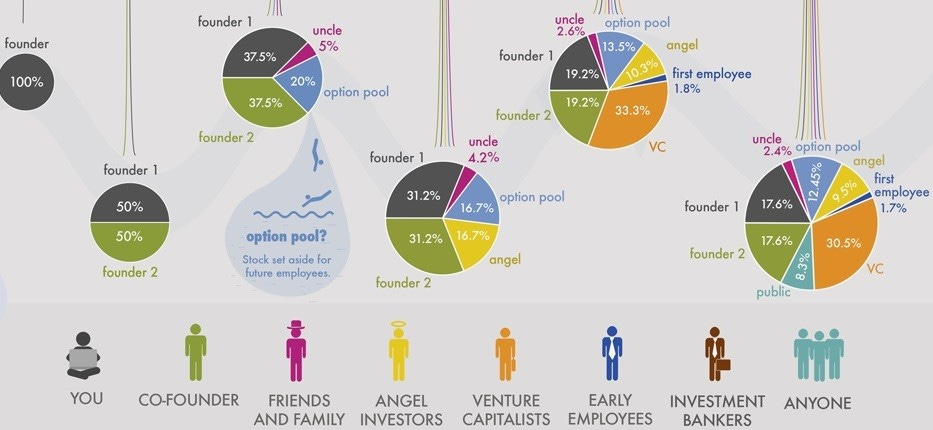

3. How to Split Equity between Cofounders & When You Should (and Shouldn't) Split Equity Evenly?

Founders often ask how they should split equity with their co-founders...

If you search the web on this topic, you will see horrible advice, typically advocating for significant inequality among different founding team members.

A lot of founders follow this trend because of the following reasons:

I came up with the idea for the company

I started working months before my co-founder

This is what we agreed to

My co-founder took a salary for n months and I didn't

I started working full-time & months before my co-founder

I am older/more experienced than my co-founder

I brought on my co-founder after raising n thousands of dollars

I brought on my co-founder after launching my MVP

We need someone to a tie-break in the case of founder arguments

Founders tend to make the mistake of splitting equity based on early work.

All of these lines of reasoning screw up in four fundamental ways:

It takes 7 to 10 years to build a company of great value. Small variations in year one do not justify massively different founder equity splits in years 2-10.

Startups often fail, so the more motivated the founders, the higher the chance of success. Giving founders a larger equity stake can increase their motivation and drive.

Investors view founder equity splits as a signal of how the CEO values their co-founders. Unequal splits can imply that certain founders are not highly valued, which can deter investment.

Dramatic equity disparities can overemphasize the initial idea rather than the team's ability to execute and generate traction. Startup success relies more on execution than the original concept.

Equity should be split equally (or near equally) because all the work is ahead of you. My advice: Split equal (or close to equal) equity splits among co-founders.

These are the people you are going to war with.

You will spend more time with these people than you will with most family members.

These are the people who will help you decide the most important questions in your company.

Finally, these are the people you will celebrate with when you succeed. I believe equal or close to equal equity splits among founding teams should become standard. If you aren't willing to give your partner an equal share, then perhaps you are choosing the wrong partner.

Use this strategy if you are splitting the equity between co-founders.

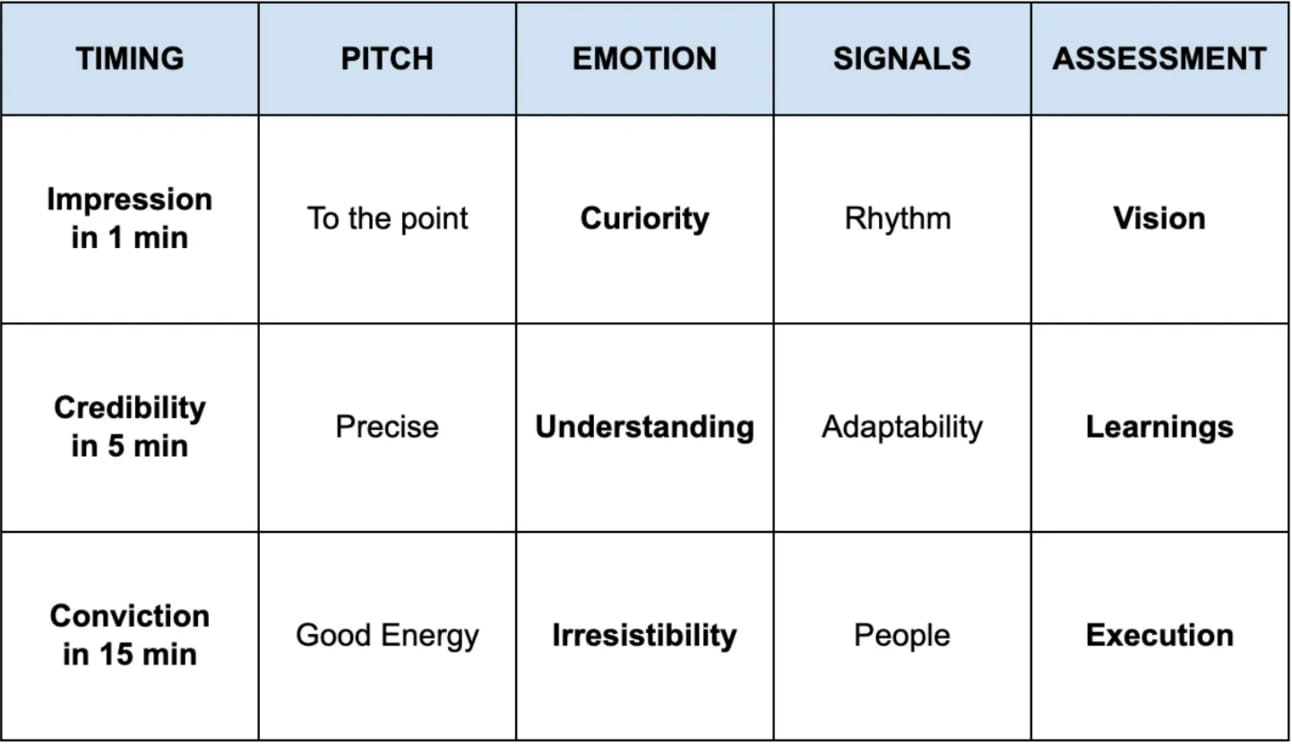

4. A Simple Startup Pitch Framework: The Rules of a Good Pitch.

Have you ever heard an investor say that they can get a feel for how likely they are to invest in a startup within the first few minutes of a pitch, or sometimes even the first minute?

What do they mean by that? And what should you, do as a founder?

It’s unavoidably subjective to a degree, as each investor may look for different things from founders, but this framework from Jean de La Rochebrochard can help you:

Your pitch is about getting the investor from a state of uncertainty to a state of conviction. In the chart above, the “Pitch” column is how you want to speak and deliver information, while the “Emotion” column is what you want the investor to feel (look for body language for signals of this!).

Some important callouts:

The credibility stage is the easiest because it’s largely factual. You either have a relevant and credible background to go after this market or you don’t.

The impression and conviction stages are more subjective — you need to assess on the fly what each particular investor values most from founders.

It’s easier to recover from mistakes in the conviction stage because you’ve already built up some capital from the last two stages of the pitch.

The impression stage is very hard to recover from — so be to the point about yourself, what you’re building, and where you’re at very concisely.

Join 18000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Tesla employees are reportedly concerned about the layoffs of about 30000 workers (20% of the workforce). Read Here

Rubrik, backed by Microsoft, aims to raise $713 million in its IPO, valuing the cybersecurity firm at $5.4 billion. Read Here

AlleyCorp, the New York startup studio and investment firm led by longtime investor-entrepreneur Kevin Ryan, has closed a new, $250 million fund. Read Here

OpenAI has fired two safety researchers (including an ally of cofounder Ilya Sutskever) for allegedly leaking company secrets. Read Here

Ark Investment Management's $54 million VC fund now holds a 4% stake in OpenAI, valued at $86 billion, with Microsoft's $13 billion investment. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

A tweet by Jason Fried, Founder & CEO at 37signals.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Analyst (Healthcare) - Touchdown Venture | USA - Apply Here

Investment Analyst Ventures - Zeiss Venture | Germany - Apply Here

Senior Investment Manager - Zeiss Venture | Germany - Apply Here

Legal Associate - Orios Venture Partner | India - Apply Here

Office Manager - Hasna | Australia - Apply Here

Entrepreneur in Residence - Unicap Partner | India - Apply Here

Fund Analyst - Nama Venture | Saudi Arabia - Apply Here

Investment Analyst Intern - Unicap Partner | India - Apply Here

Investment Analyst - SEA - PeakXV Venture | Singapore - Apply Here

Analyst VC (Web3) - Taacl VC | France - Apply Here

Venture Fellow - Saffinova | USA - Apply Here

Business Development Intern - Food Seed Tech | India - Apply Here

Investment Associate - Red Cell Partner | USA - Apply Here

Attention, Lab Analyst | USA - Apply Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Will Meet You On Thursday. Happy Tuesday!

Advertise || Join The Community

✍️Written By Sahil R | Venture Crew Team