Which Is The Better Option For Growth Funding: Venture Debt or Venture Capital?

Venture Capital vs Venture Debt | Friday Weekend VC Reading | VC Remote Jobs | Investor Insights Events & More

Today At A Glance

Which is the better option for growth funding: venture debt or venture capital?

Friday Weekend VC Reading

VC Remote / Hybrid Jobs & Internships

Venture Crew’s Investor Insight Event Info

I have been speaking with multiple founders from the early stage to the growth stage. While raising the fund at their growth stage or wanting a fund to achieve growth milestones, they always got confused about whether to go for venture debt or venture capital. And they always wonder which one is a good option considering the risk & benefits.

If you are one of them getting confused about which option is better to go for your growth stage startup, then this is the write-up for you. We will understand this with a simple example.

Join 3400+ investors, operators, innovators and students inducing content every week in our VC Newsletter.

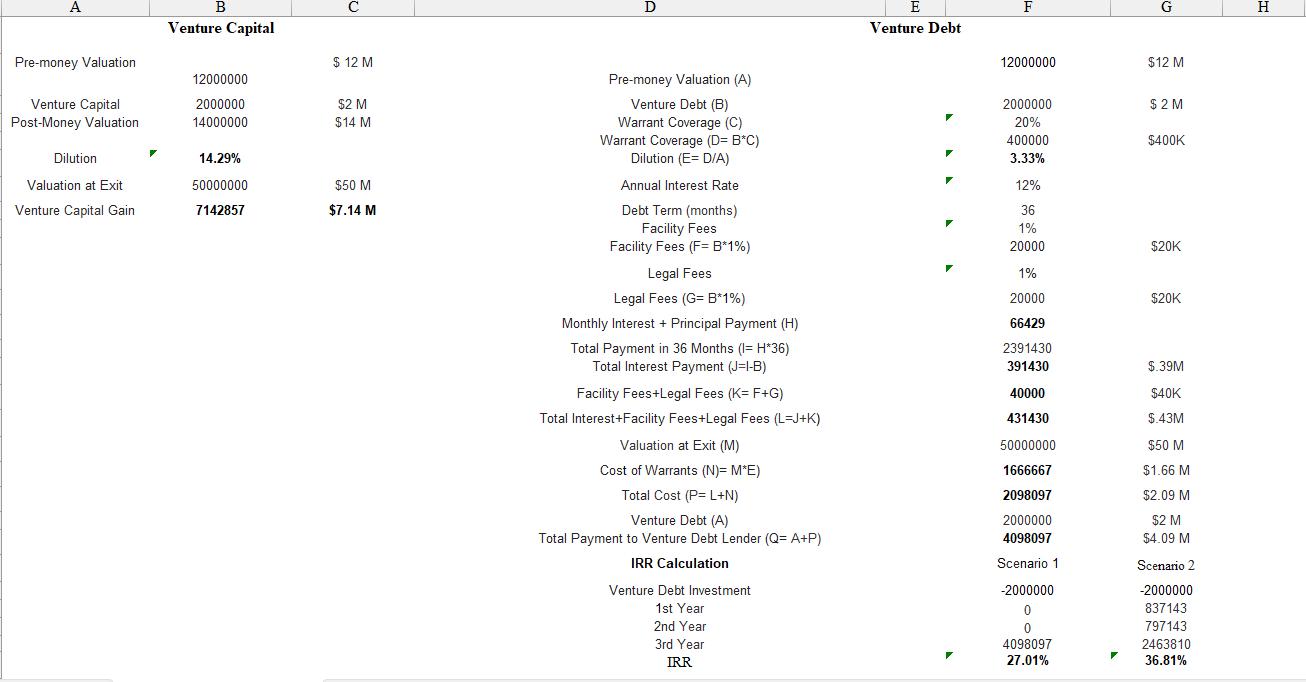

Consider a founder who is looking to raise $2M to achieve his next growth milestones and he is wondering whether to go for $2M Venture Capital or $2M Venture Debt. Let’s decode this and see which one is the best option for fundraising.

Option One: Venture Capital

Let considers some terms about the company.

- Pre-money Valuation of the Company= $12M

- Venture Capital Raised= $2M

- Post-money Valuation= $14M (Pre Money + Investment Amount)

- Equity Dilution = $2M/$14M = 14.28%

- Company Valuation at Exit= $50M (You can get this through financial modelling)

- Venture Capital Gain= $50M*14.28%= $7.14M (till exit the vc firm able to maintain the equity)

Second Option: Venture Debt

Venture Debt is typically structured as a Term Loan with Interest Payments and WARRANTS.

If you are not aware of the Warrant term - let me explain to you in simple terms - “Warrants are a security that gives the holder the right (but not the obligation) to purchase company stock at a specified price within a specific period of time.”

- Pre-money Valuation of the Company= $12M

- Venture Debt Raised= $2M

- Pre-Money Valuation= Post-Money Valuation ( for ease of calculation subscription of shares from Venture Debt has been considered as a Capital Increase at a Marginal Value)

- Venture Debt Annual Interest Rate= 12% (monthly 1%)

- Tenure= 36 months

- Facility Fees= 1%

- Legal Fees= 1%

- Warrant Coverage= 20%

- Warrant Coverage= $2M (Venture Debt)*20%= $400K

- Dilution= $400K/ $12M (Post-money Valuation)= 3.33% (remember for Venture Capital Financing it was 14.28%)

- Facility Fees= $2M*1%= $20K

- Legal Fees= $2M*1%= $20K

Next will calculate the Monthly Interest and Principal Payment:

- Used PMT function on an Excel sheet

- It will look like this = -PMT(monthly interest rate, total number of payments for the loan, present value of the debt, future value, type)

- Monthly Interest+ Principal Payment=-PMT(1%, 36, $2M, 0, 0)= $66,429

- Total Payments in 36 Months= $66,429*36= $2.39M

- Total Interest Payment= $2.39M- $2M= $.39M

- Total Interest Payment+ Facility Fees+ Legal Fees= $.39M+ $20K+ $20K= $.43M

- Now Company Valuation at Exit= $50M

- Cost of Warrants= $50M*3.33%= $1.66M

- Total Interest Payments+ Facility Fees+ Legal Fees+ Cost of Warrants= $.43M+ $1.66M= $2.09M

- Venture Debt= $2M

- Total Payment to Venture Debt Lender= $2M+ $2.09M= $4.09M

- IRR Calculation: $2M (1+R)^3= $4.09M, R= 27.01%

Finally,

- Venture Capital Gain= $7.14M

- Venture Debt Gain= $4.09M

- Overall gain to the Founder if he considers Venture Debt option= $7.14M- $4.09= $3.05M

I hope this will give an idea of how Venture Debt is cheaper than Venture Capital.

If you want to download the Excel sheet with an example that is used here - Download it Here.

Friday Weekends VC Reading 📚

How to Spot a Great Early-Stage Founder - Read here…..

Why seed valuations haven’t fallen (yet) - Excellent case study - Read here…

4 VCs illustrate why there’s good reason to be optimistic about the machine learning startup market - Read Here…..

Software That You Can't Shut Down By AVC - Read here….

Today’s Remote Jobs 👨💼

📢 Join Us: Investor Insights Wednesday - An Interactive Session With Jake Casas

Excited to share about an online event - "Investors Insights Wednesday - an interactive session with investors". We are inviting all crew to join the session and ask your burning questions to our guest speaker.

An Interactive Session with Investors - Don't miss this opportunity to interact directly with Jake Casas and ask your burning questions.

Date: 5th July 2023

Time: 10:00 AM - 11:00 AM PST

Online Event (Zoom Call)

Secure Your Spot ( Registered now) - https://lu.ma/crewinvestorinsightsI

Get your message in front of 3000+ Founders and Investors. Easy.

Want to promote your startup, please visit - https://www.theventurecrew.xyz/newsletter/#sponsor

By - The Venture Crew!