When to Raise Funding? How much funding is too little? Too much? | VC Remote Jobs & More

One of the most common mistakes that founders make -"Jumping into fundraising when the business is not ready..."

Hi, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Today At Glance

Deep Dive: When to Raise Funding? How much funding is too little? Too much?

Featured Post: Y-Combinator Strategy To Build A Successful Minimal Viable Product (MVP).

Major News In Ecosystem: Snapchat Layoff 500 Employees, Musk Under Investigation For illegal Drugs & Sam Altman's Brother Launched VC Fund.

Must Read on Startups, Venture Capital & Technology

VC Jobs & Internships: From Scout to Partner

FROM OUR PARTNER

Close Your Round Faster With Flowlie’s Fundraising Hub.

Fundraising made simple…

Flowlie combines expert advice with software to help early-stage founders plan, prepare, and execute their fundraising strategies.

✨ No connections in VC? No problem -

Whether you’re a first-time founder or have successfully fundraised in the past, we’ve got you covered.

📆 Book Your Free Fundraising Consultation Now & Get advice on your round and learn how Flowlie can help you design the right capital stack for your business.

🤝 PARTNERSHIP WITH US!

Want to promote your startup to our community of 22,000+ entrepreneurs and investors? Fill out the form, our team will reach out to you.

🎉Get A Discount of 20% For Multiple Ads

TODAY’S DEEP DIVE

When to Raise Funding? How Much Funding Is Too Little? Too Much?

One of the most common mistakes that founders make in fundraising is 'jumping into fundraising when the business is not ready.' What does this mean?

Additionally, many founders have questions about how much funding they should raise and whether it's too much or too little.

When to Raise Funding?

How Much Money Should You Raise? Too little & Too Much?

So, grab your coffee and let’s deep dive into it

When to Raise Funding?

Investors write checks when the idea they hear is compelling when they are persuaded that the team of founders can realize its vision and that the opportunity described is real and sufficiently large. When founders are ready to tell this story, they can raise money. And usually, when you can raise money, you should.

For some founders, it is enough to have a story and a reputation

However, for most, it will require an idea, a product, and some amount of customer adoption, a.k.a. traction.

Luckily, the software development ecosystem today is such that a sophisticated web or mobile product can be built and delivered in a remarkably short period at a very low cost. Even hardware can be rapidly prototyped and tested.

But investors also need persuading. Usually, a product they can see, use, or touch will not be enough. They will want to know that there is product market fit and that the product is experiencing actual growth.

Therefore, founders should raise money when -

they have figured out what the market opportunity is who the customer is, and when they have delivered a product that matches their needs and is being adopted at an interestingly rapid rate.

How rapid is interesting? This depends, but a rate of 10% per week for several weeks is impressive. To raise money founders need to impress. For founders who can convince investors without these things, congratulations. For everyone else, work on your product and talk to your users.

The next question to ask is, What Is The Appropriate, Amount Of Funding For A Startup?

The answer to that question, in my view, is based on a startup’s life, which can be divided into two parts—Before Product/Market Fit, and After Product/Market Fit.

Before Product/Market Fit, a startup should ideally raise at least enough money to get to Product/Market Fit.

After Product/Market Fit, a startup should ideally raise at least enough money to fully exploit the opportunity in front of it, and then to get to profitability while still fully exploiting that opportunity.

Also, the definition of “at least enough money” in each case should include a substantial amount of extra money beyond your default plan so that you can withstand bad surprises. In other words, insurance. This is particularly true for startups that have not yet achieved Product/Market Fit since you have no real idea how long that will take.

These answers all sound obvious, but in my experience, a surprising number of startups go out to raise funding and do not have an underlying theory of how much money they are raising and for precisely what purpose they are raising it.

So How Much Money Should I Raise?

In general, as much as you can.

Without giving away control of your company, and without being insane.

Entrepreneurs who try to play it too aggressively and hold back on raising money when they can because they think they can raise it later occasionally do very well, but are gambling their whole company on that strategy in addition to all the normal startup risks.

Suppose you raise a lot of money and you do well. You’ll be really happy and make a lot of money, even if you don’t make quite as much money as if you had rolled the dice and raised less money upfront.

Suppose you don’t raise a lot of money when you can and it backfires. You lose your company, and you’ll be sad.

Is it worth that risk?

There is one additional consequence to raising a lot of money that you should bear in mind, although it is more important for some companies than others.

That is liquidation preference. In the scenario where your company ultimately gets acquired: the more money you raise from outside investors, the higher the acquisition price has to be for the founders and employees to make money on top of the initial payout to the investors.

In other words, raising a lot of money can make it much harder to effectively sell your company for less than a very high price, which you may not be able to get when the time comes.

If you are convinced that your company is going to get bought, and you don’t think the purchase price will be that high, then raising less money is a good idea purely in terms of optimizing for your financial outcome. However, that strategy has lots of other risks and will be addressed in another entertaining post, entitled “Why building to flip is a bad idea”.

Taking these factors into account, though, in a normal scenario, raising more money rather than less usually makes sense, since you are buying yourself insurance against both internal and external potential bad events—and that is more important than worrying too much about dilution or liquidation preference.

How Much Money Is Too Much?

There are downside consequences to raising too much money.

I already discussed two of them—possibly incremental dilution (which I dismissed as a real concern in most situations), and possibly excessively high liquidation preference (which should be monitored but not obsessed over).

The big downside consequence of too much money, though, is cultural corrosion.

You don’t have to be in this industry very long before you run into a startup that has raised a ton of money and has become infected with a culture of complacency, laziness, and arrogance.

Raising a ton of money feels good—you feel like you’ve done something, that you’ve accomplished something, that you’re successful when a lot of other people weren’t.

And of course, none of those things are true.

Raising money is never an accomplishment in and of itself—it just raises the stakes for all the hard work you would have had to do anyway: building your business.

Some signs of cultural corrosion caused by raising too much money:

Hiring too many people—slows everything down and makes it much harder for you to react and change. You are almost certainly setting yourself up for layoffs in the future, even if you are successful because you probably won’t accurately allocate the hiring among functions for what you will need as your business grows.

Lazy management culture—it is easy for a management culture to get set where the manager’s job is simply to hire people, and then every other aspect of management suffers, with potentially disastrous long-term consequences to morale and effectiveness.

Engineering team bloat—another side effect of hiring too many people; it’s very easy for engineering teams to get too large, and it happens very fast. And then the “Mythical Man Month” effect kicks in and everything slows to a crawl, your best people get frustrated and quit, and you’re in huge trouble.

Lack of focus on product and customers—it’s a lot easier to not be completely obsessed with your product and your customers when you have a lot of money in the bank and don’t have to worry about your doors closing imminently.

Too many salespeople too soon—out selling a product that isn’t quite ready yet, hasn’t yet achieved Product/Market Fit—alienating early adopters and making it much harder to go back when the product does get right.

Product schedule slippage—what’s the urgency? We have all this cash! Creating a golden opportunity for a smaller, scrappier startup to come along and kick your rear.

So, depending on your startup stage before PMF or after PMF make the right decision to raise the appropriate amount. That’s it.

FEATURED POST

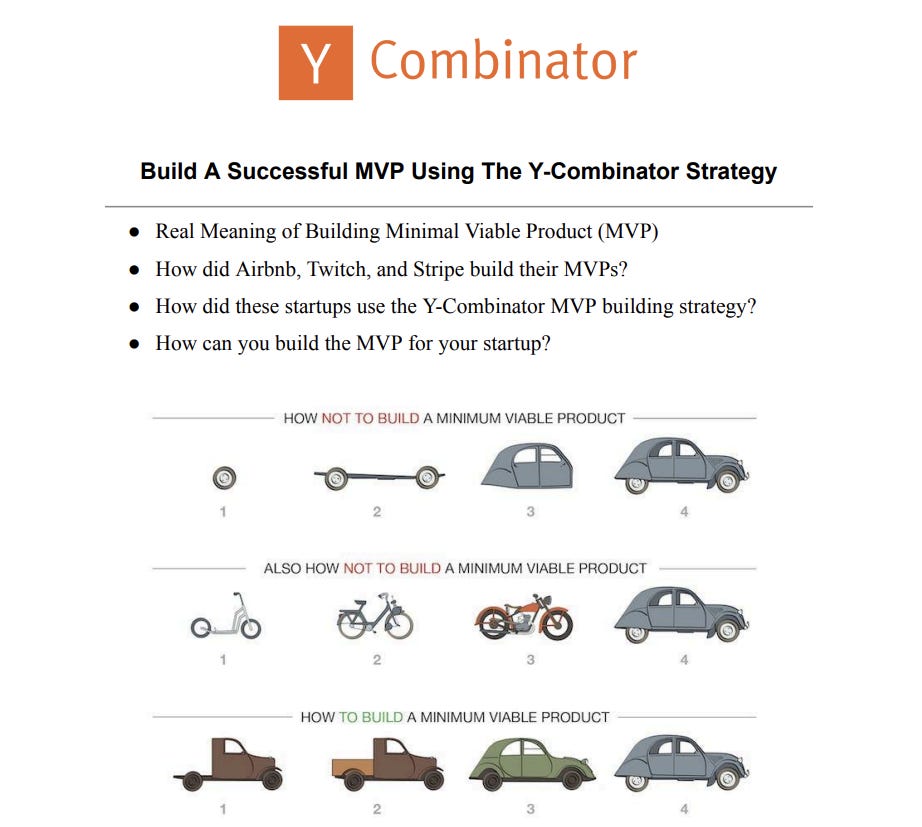

Y-Combinator Strategy To Build A Successful Minimal Viable Product (MVP)

"The types of founders who think they know exactly what the customer needs even before building a product. We call them fake Steve." Y-Combinator Partner.

In their minds, Steve Jobs built the iPhone and iPod, such amazing products in one go. You don’t know what the customer needs. The customer alone knows what they need.

If you ask them, they will tell you. How you ask them is by showing them your MVP. So follow this Y-Combinator strategy…. Read More Here

Join 14000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Snap Inc., the maker of Snapchat, plans to cut 10% of its workforce, affecting over 500 employees. Read More

Developers criticizing Meta's decision over shut down of Facebook Groups API Access. Read More

CEO Jeff Bezos, Amazon’s founder today filed to sell about $8.5 billion worth of Amazon shares. Read More

The Wall Street Journal reported Elon Musk's illegal drug use and consumption with board members. Read More

The Messenger, a Media startup backed by $50 million, suddenly shuts down after just nine months. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9000+ Avid Readers!

WHAT I READ THIS WEEK

Must Read on Startups & Venture Capital

How to train large language model by Chamath Palihapitiya. Read Here

The Future of AI Compute by Chamath Palihapitiya. Read Here

AI Design Patterns by Tomasz Tunguz. Read Here

Never express your ‘Use of Funds’ slide as percentages, why? Read Here

Standard Issue AI by Tomasz Tunguz. Read Here

Meta’s Powerful AI-Language Model Has Leaked Online - What Happens Now? Read Here

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Investment Analyst - 137 Ventures | USA - Apply Here

Senior Associate - Cross Boundary Group | UK - Apply Here

Associate Principal - Cross Boundary Group | UK - Apply Here

Venture Operations - Array Ventures | India - Apply Here

Event manager - B Capital | US - Apply Here

Partner Track Associate - Future Venture | US - Apply Here

Analyst - ARRAY Venture | USA - Apply Here

Investment Manager - Alpha Future Fund | Germany - Apply Here

Emerson Collective - MBA Summer Associate | US - Apply Here

Investment Associate - Connecticut Innovations | USA - Apply Here

Director, Investments (Singapore) - 500 Southeast Asia | Singapore - Apply Here

→ Want Daily Updates on VC Job Opportunities? Check out VC Crafter 👇

Join our 200+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

Are you a founder? Currently looking to raise funding, check out Flowlie to build your fundraising strategy for free…..

That’s It For Today! Will Meet You on Thursday

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team