What Matters Most For Startup Growth? From VP of Growth at Facebook | 37% Of First-time VCs Might Not Able To Raise A Second Fund | VC Remote Jobs

37% Of First-time VCs Might Not Able To Raise A Second Fund....

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: What Matters Most For Startup Growth?

Quick Dive

37% Of First-time VCs Might Not Able To Raise A Second Fund.

Private markets, Venture Capital Funds Lag Historical Returns.

Equity Dilution Trends in Venture Rounds (2020-2023)

Featured Article:

Paul Graham's 10 Strategies to Get Successful Startup Ideas.Major News:

OpenAI Filing ‘GPT’ As Trademark, EU to fine Apple $539 Million, Lyft CEO's $2 Billion Typo Mistake & OpenAI's CVC Under Governance RiskVC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

Negotiating A Term Sheet? OR Want To Learn About VC Term Sheets?

Download Thunder.vc's free guide on the Tip 10 Terms to Negotiate in a Term Sheet for raising venture capital.

Thunder.VC is a tech-enabled investment bank that has helped companies secure over $100M in capital.

Try our free tools for founders, like our VC Finder Tool and Debt Finder Tool, which have helped 100’s of companies secure over $1B in financing.

Partnership With US: Promote your startup to our community of 22,500+ entrepreneurs and investors. Fill out the form, our team will reach out to you….

TODAY’S DEEP DIVE

What Matters Most For Startup Growth?

With Alex Schultz, VP of Growth at Facebook.

While reading about Facebook's early growth tactics, I came across various articles by Alex Schultz, who is VP of Growth at Facebook. He shared some of the growth tactics that most founders missed at an early stage. So, I thought to share it with you along with my opinions…

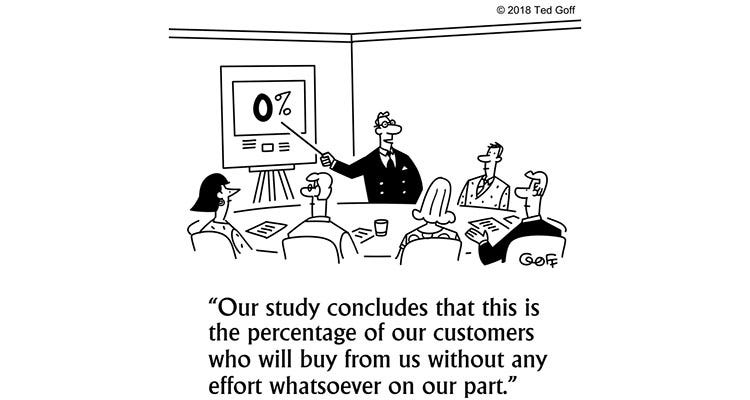

What do you think matters most for growth? Great products, customers, or word of mouth? It’s actually the culmination of all three: Retention.

For first-time founders, growth typically revolves around creating great products, attracting customers, and leveraging word-of-mouth marketing. Also, they invest heavily in acquiring new customers while neglecting the crucial aspect of retention, which often leads to business failure. Additionally, most founders struggle with determining when to prioritize retention over customer acquisition. So in today’s writeup, we will try to answer these questions…

Pay Attention to Your Retention Curve

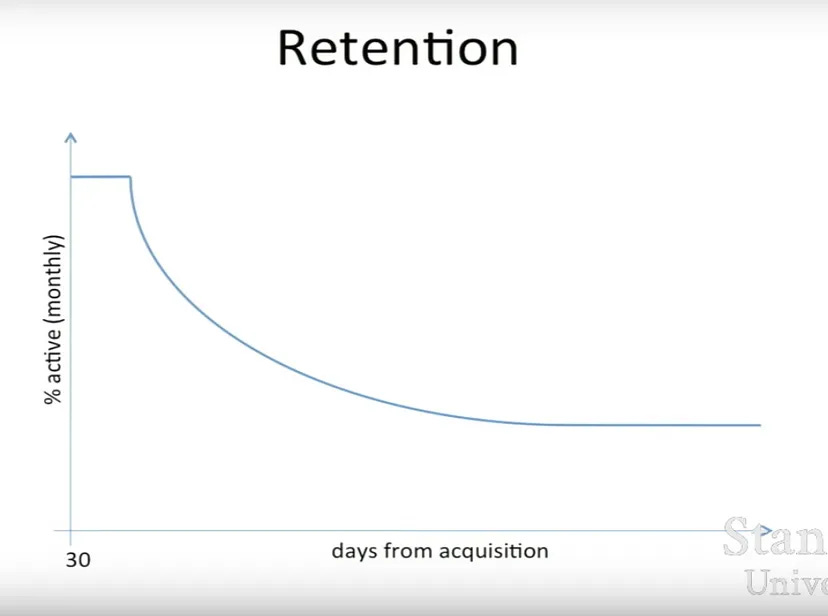

If you want to grow your startup, focus on your Retention Curve (see below).

If you plot the percentage of monthly active users versus the number of days from acquisition, you should end up with a retention curve that is asymptotic to a line (Blue line) parallel to the X-axis. That’s when you have a viable business.

Also look at all of your users, who have been on your product one day. What percentage of them are monthly active?!

It’s 100% for the first 30 days, as monthly active they all signed up on one day.

But then you look at Every single user, on their 31st day after registration, what percentage of them were monthly active, 32nd day,33rd day, 34th day? And that allows you to get a clear idea of what this curve is gonna look like for your product.

And you’re gonna be able to tell does it is asymptote. It’ll get noisy out towards the right-hand side, but you’ll be able to get a handle on it, does this curve flatten out or not?

If it doesn’t flatten out, don’t go and do growth tactics, don’t go and do virality, don’t hire a growth hacker. Focus on getting product market fit. Because in the end, idea, product, team, execution.

If you don’t have a great product, there’s no point executing well on growing it. Because it won’t grow.

Most startups fail to achieve product-market fit and try various growth tactics and virality.

So What Does Good Retention Look Like?

Most founders often get confused in this but it’s easy to figure out for your startup using dimensional reasoning. What does it mean?

If you are aware of Geoffrey Taylor, a British physicist who won the Nobel Prize. Just by looking at pictures of the atomic bomb, he figured out the power of the U.S. bomb. (Read this article if you want to learn exactly how Taylor did it.)

Dimensional reasoning involves looking at the dimensions that are involved in a problem to come to a solution.

Taylor used dimensional reasoning to figure out what the power of the U.S. atomic bomb was, as well as the ratio of power between the Russian and American bombs. And he ended up revealing one of the top secrets that existed in the world at that time.

Figuring out the ratio of power between the Russian and U.S. atomic bombs is hard.

However, figuring out the retention rate will be not that hard. Let’s take an example of how Facebook came up with its good retention rate from VP of Facebook, Alex :

There are approximately 2 billion people on the Internet (excluding China where Facebook is banned), and Facebook has around 1.3 billion active users. Divide the second number by the first to find out Facebook’s retention rate. It won’t give you the most accurate answer, but it’ll be close enough.

Your Retention Rate Depends on Your Vertical

Different verticals need different terminal retention rates for them to have successful businesses. If you’re in e-commerce and you’re retaining on a monthly active basis like 20, or 30% of your users, you’re probably gonna do pretty well.

If you’re in social media, and your first batch of people signing up for your product are not like 80% retained, you’re not gonna have a massive social media site. And so, it really depends on the vertical you’re in, and what the retention rates are.

What you need to do is have the tools to think about who out there is comparable. And how you can look at it and say, am I anywhere close to what real success looks like in this vertical?

Operating for Growth

Schultz says that startups shouldn’t have growth teams because the entire company should be focused on growth. The head of growth should be the CEO, acting as the north star for where the company wants to go.

For example, Mark Zuckerberg is Facebook’s north star because he’s always been focused on growth. In the early years of Facebook, many companies focused on their registered users. But Zuckerberg focused on monthly active users instead.

Schultz recounts that, when Zuckerberg talked about growth, he meant “everyone active on Facebook, not everyone signed up on Facebook” and that was the internal goal. “It was the number he made the whole world hold Facebook to, as a number that we cared about.”

Airbnb followed a similar model when it came to measuring growth. They’ve always benchmarked themselves against the number of nights booked compared to the largest hotel chains in the world.

The takeaway is that the metric for growth varies from company to company. What matters is that the CEO is focused on that metric, acting as the company’s north star.

“Let’s say you have an awesome product market fit. You’ve built an ecommerce site, and you have 60% of people coming back every single month, and making a purchase from you, which would be absolutely fantastic. How do you then take that and say, ‘Now it’s time to scale.’ That’s where growth teams come in,” Schultz explains.

Importance of the Magic Moment

When you hear the term “magic moment,” you might think of a touching moment between a couple or some song. But there is another magic moment: when users first see value in your business.

The magic moment for Facebook? Schultz says it’s when people can see their friends. It’s that simple. The magic moment takes place when you first see that first picture of one of your friends on Facebook and you realize, “Oh my God, this is what this site is about!”

For Zuckerberg, that magic moment depended on getting people to 10 friends in 14 days. The most important thing in a social media site is connecting to your friends. Without that, you have a completely empty newsfeed and you’re not going to come back because you’ll never get any friends telling you about things you’re missing on the site.

Facebook, Twitter, WhatsApp, and LinkedIn – all pay attention to showing you the people you want to follow, connect to, and send messages to, as quickly as possible because that’s what matters. In a different vertical, eBay‘s magic moment is when you list an item on their platform and get paid.

You need to think about what the magic moment is for your product and get users connected to it as fast as possible. Then you can move up where that blue line (on the retention curve graph) becomes asymptotic. If you can connect people with what draws them to your site, then you can go from 60% retention to 70% retention easily, explains Schultz.

Schultz says that you get to that magic moment by “focusing on the marginal user – the one person who doesn’t get a notification in a given day, month, or year.” Building an awesome product is all about the power user. But when it comes to driving growth, you don’t need to worry about people who are already using your product.

Tactics for Virality

Sean Parker approaches virality in terms of three things: payload (how many people can you hit with any given viral blast), conversion rate, and frequency. These three factors give you a fundamental idea of how viral a product is.

Hotmail (now called Outlook) is “the canonical example of brilliant viral marketing,” according to Schultz.

When Hotmail first entered the email scene, people couldn’t get free email clients because they had to be tied to their ISP. Hotmail and a few other companies launched, and their users were able to access their mail from wherever they were.

Most of these email companies tried to get clients by spending tons of money on TV, billboard, and newspaper campaigns, but Hotmail couldn’t do that because they didn’t have a lot of funding. So they added a little link at the bottom of every email that said, “Sent from Hotmail. Get your free email here.”

Because Hotmail users were usually emailing just one person at a time, the payload was low. However, the frequency was high because users were emailing the same people over and over. So those people were going to be hit one to three times per day, increasing impressions. And the conversion rate was also really high because people didn’t like being tied to their ISP email.

In the end, Hotmail became extremely viral because of its high frequency and high conversion rates.

That’s it. So overall

Retention is crucial for startup growth, with the retention curve being the most important graph for founders.

Startups should focus on achieving product-market fit before pursuing growth tactics, as indicated by a flattening retention curve.

The "magic moment" is when users find value in a product and tactics for virality, like high frequency and conversion rates, are emphasized for sustained growth.

FROM OUR PARTNER

Overwhelmed With Customer Support?

Don't worry – Hey Foster has got your back with their amazing team. How?

Hey, Foster’s team -

Handles your customer support daily,

Respond within 24 hours on weekdays,

Document processes, track trends, and ensure full coverage so your business succeeds without the hefty cost of an in-house team.

Talk to the support team for free to learn more…

TODAY’S QUICK DIVE

37% Of First-time VCs Might Not Able To Raise A Second Fund

2021 was the heyday for new entrants in venture capital: First-time fundraising reached a peak of $14.7 billion, including more inexperienced managers without bulletproof track records or networks. Now that LPs have retreated, those same fund managers are in trouble.

A report by Pitchbook says - 37% Of First-time VCs might not be able to raise 2nd funds. Between 2006 and the end of 2018, 63.0% of US VC first-time managers raised a second fund 5.

In 2023, the time between first-time and sophomore funds increased to a near-record 2.6 years.

Historically, 76.7% of first-time Managers who secured $50 million in commitments for their initial fund successfully raised a second fund. and just 42.3% for managers with undisclosed fund sizes.

Just 56.7% of first-time managers outside of California, New York, and Massachusetts have historically gone on to raise a second VC fund.

The time between the first and second funds historically hovers around two years, but in 2023, it increased to 2.6 years.

This study estimated that 247 of the 667 first-time managers who closed funds between 2019 and 2021 may be unable to raise a sophomore fund.… More Here

In private markets, Venture Capital Funds Lag Historical Returns.

A report by Pitchbook - Venture capital funds have experienced negative returns for the fourth consecutive quarter.

Funds under $250 million showed a notable improvement in one-year return through Q2 2023 compared to previous quarters.

The performance of VC funds has been challenging, with struggles in recent periods due to backtracking on 2021 valuation markups.

Public markets saw strong performance in 2023, with double-digit returns in Q4, raising questions about whether VC and PE will track similar results.

Preliminary returns for Q3 2023 in the private market strategies show a slightly positive overall figure of 0.2%.

Overall, the venture capital sector faces ongoing challenges in performance, with the need to address valuation markups and align with the positive trends seen in public markets.

Equity Dilution Trends in Venture Rounds (2020-2023)

A recent analysis by Carta - from 17,000 primary venture rounds since 2020 reveals key trends in founder dilution. Here is how much founders are selling to investors:

𝗣𝗿𝗶𝗰𝗲𝗱 𝗦𝗲𝗲𝗱 • 20.6% median in 2023 • Nudging down from 2020, but flat from 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔 • 20.1% median in 2023 • Consistently notched downward over the past 4 years

𝗦𝗲𝗿𝗶𝗲𝘀 𝗕 • 17.6% median in 2023 • Bumped up from 17.1% in 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗖 • 13.4% median in 2023 • Essentially flat from 2022

𝗦𝗲𝗿𝗶𝗲𝘀 𝗗 • 11.5% median in 2023 • Sizable rise from the 10.4% median in 202

In fundraising through SAFEs and Convertible Notes, founders typically sell around 18% in major SAFE rounds (>$2M) and 8-10% in minor SAFE rounds. Employee option pools start at 10% and can grow to 20% by Series D.

Each fundraising round varies, with founders selling different percentages. The dead equity from early exits can impact future funding enthusiasm. No fixed rules, but these benchmarks highlight potential dilution challenges.

FEATURED POST

Paul Graham's 10 Strategies to Get Successful Startup Ideas.

"Live in the future and build what seems interesting." Paul Graham.

In November 2012, Paul Graham shared an essay on 'How to get a startup idea?' which is still relevant today like -

Utility vs. Novelty Ideation, Build for the few, who want a lot, Live in the future, build what’s missing, But what’s missing? Build what’s interesting, Scratch your own itch, and Explore new domains and competitors, .… Read More Here

Join 14500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Ex-Disney star Bridgit Mendler's startup Orbital Insights secures $20+ million in funding from top VC firms. Read More

Accolade Partners, fund of fund raises $1B for venture and growth equity funds. Read More

OpenAI’s $175 Million Fund Under Potential Governance Risk due to its unusual ownership structure. Read More

75% of the Super Bowl traffic received by Elon Musk's X was fake. Read More

EU to fine Apple $539 million over Spotify's antitrust complaint. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9500+ Avid Readers!

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Web 3.0 Analyst - King River Capital | Sidney (Remote) - Apply Here

Venture Partner - Cancer Fund | US (Remote) - Apply Here

Investment Intern - Photon Venture | Netherland - Apply Here

Investment Associate - Cocon Capital | Indonesia - Apply Here

Fund Operations Analyst - Cocon Capital | Singapore - Apply Here

Finance Manager - B Capital | USA - Apply Here

Startup Success & Program Manager - Intern - Inovexus | France - Apply Here

Summer Fellowship - F Prime capital | USA - Apply Here

Venture Capital Intern - Lnai Capital | Spain - Apply Here

Portfolio Engagement Director - Toyota Venture | USA - Apply Here

Life Sciences Senior Associate - General Catalyst | USA - Apply Here

Event Associate - Artha | India - Apply Here

Technical VC Analyst - Superseed venture | UK - Apply Here

→ Looking to break into VC / Want Daily Updates on VC Job Opportunities? Join VC Crafter 👇

Join our 250+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team