What Makes a Good Product-Market Fit Metric & How to Find It for Your Startup? | VC Jobs

Close fundraise quickly with tranches, Understand the Buyer's Pyramid, and the One Slide Investors Want.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: What Makes a Good Product Market Fit Metric? & How To Find it For Your Startup.

Quick Dive:

How To Close Your Fundraise Quickly With Tranches: A Practical Guide.

The Buyer's Pyramid: Understanding Customer Readiness To Buy Your Product.

The Slide Every Investor Wants to See.

Major News: Apple introduces thinnest iPhone yet with in-house modem, OpenAI has begun building out its robotics team., Nvidia unveils AI avatar assistant for desktop & Samsung will let you rent a robot.

20+ VC & Startups Jobs Opportunities.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Sam Altman's guide to startup fundraising: What really works.

Market sizing guide for aspiring venture capitalists.

13 successful VC fund decks that raised over $500M from LPs.

Guide to pitch deck storytelling - proven template from leading VCs & Founders.

Excel template: early stage startup financial model for fundraising.

Antler’s Framework to find the right problem to solve.

The Consumer Subscription Trifecta: what makes consumer AI subscriptions work?

How to use positioning as a differentiator: Building startup in crowded market.

Y Combinator warns founders: avoid these startup ideas.

Excel template: Competitor analysis framework for early stage startups.

Marc Andreessen's guide to finding Product-Market Fit!

Excel Template: early stage startup financial projections.

How consumer unicorns scale: the two growth engines behind billion-dollar startups.

1000+ Euro tech angel investors & VC firms database.

A MESSAGE FROM SUPERHUMAN

🤝 Start the Year Ahead With Superhuman

The inbox is where your next big idea takes shape, where partnerships are born, and where your vision grows. But it can also be where your day gets lost. Superhuman helps founders and executives turn the inbox into a place of progress, not frustration.

Designed for speed and clarity, Superhuman gives you back your focus. You’ll spend less time buried in admin and more time building, strategizing, and leading.

Start the year inspired. Try Superhuman free for one month and see how much further your email can take you.

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

TODAY’S DEEP DIVE

What Makes a Good Product Market Fit Metric? & How To Find it For Your Startup

Product-market fit (PMF) is the mythical goal of early-stage startups — and rightfully so. Once you have PMF you are at that point where you can shift your daily focus from building something people want to getting what you’ve built out into the world and making money.

Despite PMF being the central goal of an early-stage startup, it is not well defined. Almost every definition of PMF I’ve seen from investors and entrepreneurs is different — and often conflicting. There are tons of definitions you will find on the internet -

PMF is your NPS score

PMF is when 40% of your users would be “very disappointed” if they no longer have access to your product

PMF is a feeling

You need a good distribution channel to have a product market fit…..

These are good metrics, but before using them, founders often forget to ask this question: What makes a good product market fit metric?

A strong product-market fit (PMF) metric should signal when your product is ready for broader distribution, without leading you astray. Before reaching PMF, your focus should be on refining your product to serve your current users better. Once you achieve PMF, it’s time to shift your attention toward scaling your acquisition channels.

A good PMF metric should minimize the chances of false positives and false negatives. A false positive could lead you to start scaling too soon, causing you to waste resources on acquiring users who may churn because the product isn’t good enough yet. On the other hand, a false negative could delay your growth efforts, allowing competitors to get ahead or causing you to miss critical milestones, such as securing the next round of funding before your runway runs out.

To summarize, a good product market fit metric:

Tells you when the product is good enough to work acquisition channels

Minimizes false positives - won’t tell you to work on acquisition channels when the product needs more improvement

Minimizes false negatives - will tell you to on acquisition channels as soon as the product is good enough, to maximize growth

You can use these points to evaluate the other definition of product market fit.

If you look at NPS: Net Promoter Score (NPS) is often used to gauge product-market fit, but it has limitations. While some of the world's biggest tech companies have poor NPS, they still grow to millions or even billions of users.

For example, Apple and Microsoft had NPS scores of about 47 and 45 respectively, while Google had only 11. Even more striking, Coca-Cola sat at 0, and Facebook had a negative score of -21.

This highlights a major issue with using NPS as a product-market fit metric: it can lead to false positives and false negatives.

Just because a product has a low NPS doesn’t mean it can’t achieve massive growth, and vice versa.

Survey-Based Metrics

A popular alternative to NPS is the “40% Rule,” which measures product-market fit by determining whether 40% of users would be “very disappointed” if they could no longer use the product. Superhumans famously used this metric for great success. While this is a stronger indicator of product-market fit than NPS, survey-based metrics have their issues:

Response Bias: Not all users respond to surveys, so the results you get might not fully represent your entire user base. Those who don’t respond might feel differently than those who do.

Timing: The point at which you ask users this question can skew results. Asking too early may capture users when they are still excited while asking too late might exclude those who have already churned, thus biasing towards more engaged users.

Mismatch with Actual Behavior: What users say they’ll do doesn’t always align with what they do. They might express enthusiasm for a feature in a survey, but then not use it once it’s launched.

Even though this metric is more reliable than NPS, it’s not foolproof and can sometimes lead to false negatives. You might already have product-market fit even if the survey doesn’t hit the 40% mark.

Distribution and Product-Market Fit

Some definitions of product-market fit include the need for effective distribution channels. However, distribution shouldn’t be a part of the product-market fit criteria. There’s ample evidence that certain distribution channels, like SEO and referrals, generally work for most consumer companies. These channels can provide a competitive edge, though they require effort and time to scale.

Any product demonstrating strong cohort retention can be successfully scaled with the right growth strategy. With the right execution, a product with good retention can always find effective ways to grow.

What is the Cohort Retention Rate?

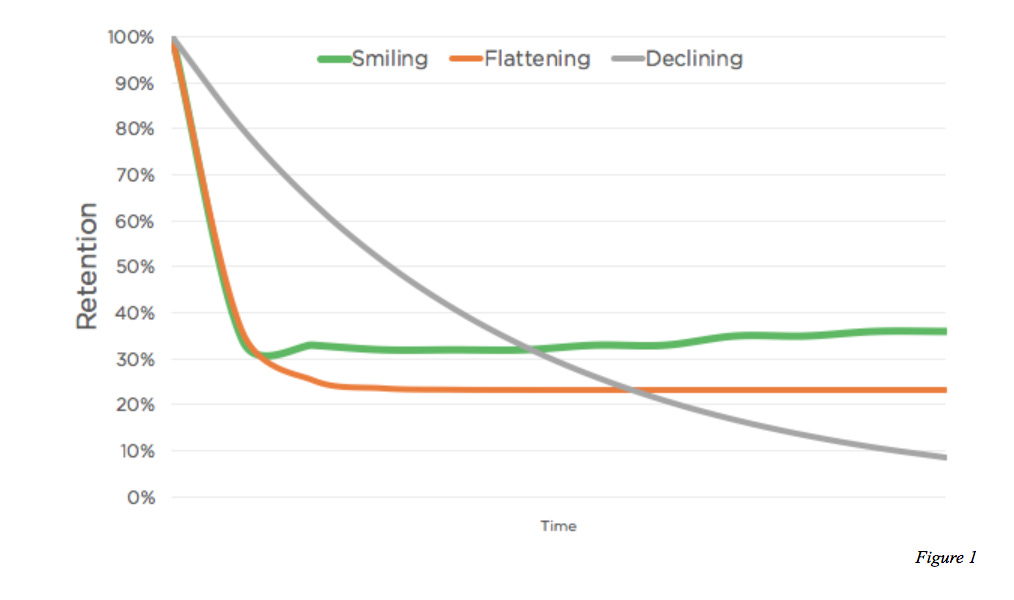

The cohort retention rate is a key metric for understanding how well your product retains users over time. Unlike general retention metrics that mix users with different levels of experience, cohort retention focuses on groups of users who joined simultaneously. Here's how it works:

Cohort retention rate - This measures the percentage of a group of users (a cohort) who stick around long-term after signing up during the same period.

For example, if you look at a cohort retention graph (Green Line) and see that it levels off at 30%, it means that 30% of users from that cohort are still using the product after a certain period. If the graph doesn’t flatten out, it indicates that your retention rate is effectively 0%, meaning users aren’t sticking around long-term.

Why Cohort Retention Rate Matters

You should see newer cohorts with higher retention rates as you improve your product. You can use a cohort retention "triangle" chart to track this progress. This chart helps visualize how retention rates change over time with each new cohort.

For example, if you notice that retention improves significantly after a certain date, it’s likely due to product enhancements made around that time. Once multiple cohorts levelling off at a certain retention rate, you may have reached product-market fit.

Benchmarks for Cohort Retention

Different types of products have different benchmarks for what constitutes product-market fit.

For consumer products, a cohort retention rate of 25% is often considered the minimum,

while for B2B SaaS products, the floor is typically around 70%.

However, top-performing products often exceed these numbers, with great consumer products achieving over 40% and B2B SaaS products reaching over 80%.

Why Cohort Retention Rate is a Strong Product-Market Fit Metric

Cohort retention rate has several advantages over survey-based metrics:

No Response Bias: It captures data from all users, not just those who take the time to fill out a survey.

Full User Lifecycle: You get a complete view of how users engage with your product over time, rather than just at a single point.

Actual User Behavior: It reflects what users are doing, not just what they say they will do.

While it’s beneficial to use both cohort retention and survey-based metrics, the cohort retention rate is crucial for understanding true product-market fit.

Overall

Actively measure your cohort retention rate using a “triangle” cohort retention chart

Find the retention rate of comparable successful products and set a product market fit goal

Improve your product and watch retention improve with new cohorts!

AFFINITY HAS SOMETHING FOR YOU

🤝 Affinity’s Guide: Early Deal Sourcing Secrets from VC Leaders

At a time when 42% of VCs cite increased competition as a key challenge, how do you ensure your firm stays ahead?

Sourcing the highest quality deals as early as possible is key. Affinity's new deal sourcing guide offers practical insights from industry leaders at Kleiner Perkins, Intel Capital, and more.

QUICK DIVES

1. How To Close Your Fundraise Quickly With Tranches: A Practical Guide

As a founder, you're probably eager to wrap up your round and get back to building your company. Makes sense - fundraising can be a huge time sink.

One powerful strategy I've seen work well is using tranches. Let me break down what this means and how you can use it effectively.

What exactly are tranches? Simply put, tranches are different pricing tiers in your fundraising round. Instead of raising everything at one valuation, you segment your raise into parts. The early investors usually get in at a lower valuation, creating an incentive for quick decisions.

Why consider using tranches? Early-stage startups are inherently risky, and getting that first check is often the biggest hurdle. VCs tend to move faster when they see other investors already committed. By offering early investors a better deal, you're not just rewarding them - you're creating momentum for your entire raise.

How do investors typically react? Most sophisticated investors understand the game. They know that whether they got in at $5M or $10M won't matter much if the company becomes really valuable. That said, there are some unwritten rules:

Never offer worse terms to later investors than what early ones got

Be honest about your strategy and intentions

Don't string investors along just to create FOMO

What's the best way to communicate new tranches? Keep it natural. Something like: "We opened a small initial allocation to move quickly, and now we're raising the rest at a fair cap." Or if you're extending the round: "We're seeing strong interest beyond our initial target, so we're considering taking on additional capital while managing dilution."

How many tranches should you use? Keep it simple - two or three maximum. Any more gets messy and complicated to manage.

How should you size each tranche? You've got three main approaches:

Small first tranche, bigger second (great for speed)

Large first tranche, small follow-on (better for controlling dilution)

Flexible sizing based on market response (good when you're testing the waters)

Remember, tranches are just a tool to help you close your round efficiently. Used thoughtfully, they can create positive momentum and get you back to focusing on what really matters - building your company.

Before jumping into fundraising, you need the right pitch deck that can help you to scheduled a call with investor. We are team of investors, designers who can help you to build pitch deck within 4-5 days at $500, scheduled a call with us.

2. The Buyer's Pyramid: Understanding Customer Readiness To Buy Your Product.

“Figuring out” your startup’s TAM is somewhat useless. Most of the time it’s made up (TAM - Totally Made-Up Number) or at least very generous, and everyone knows it. But the real sin about TAM is that it’s just one giant number.

Sure, you have SAM and SOM as well but those aren’t much better. They don’t tell you anything actionable like, for example, how ready to buy your market is.

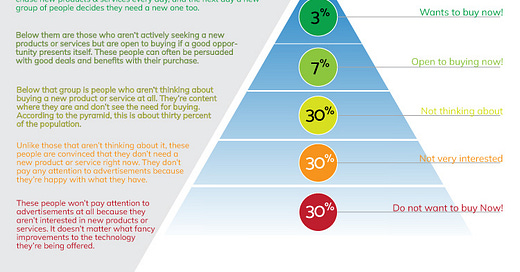

The Buyer’s Pyramid is a framework that divides your potential market into five categories based on how likely they are to buy your product or service. Spoiler alert: only 3% of your audience is actively shopping for what you offer. Here’s the breakdown:

Buying Now (3%)

These are your hot leads—the tiny sliver of people ready to purchase. They’re already doing research, comparing options, and looking for the best deal. This group is your low-hanging fruit but also your most competitive audience.Open to Buying (6–7%)

This group isn’t actively looking but could be convinced with the right offer. Think: discounts, special promotions, or solutions to a problem they didn’t know they had.Not Thinking About It (30%)

These people are comfortable—they don’t feel the need to buy right now. However, they’ll eventually move up the pyramid when their current solution becomes outdated or inconvenient.Think They’re Not Interested (30%)

This group believes they don’t need what you’re offering, but with the right messaging, you can nudge them toward seeing the value of your product.Know They’re Not Interested (30%)

The toughest audience—people who’ve recently purchased or are firmly against buying. It’s not worth wasting your ad budget here.

Most businesses spend too much time chasing the top 3%, fighting over the same small pool of customers. The Buyer’s Pyramid shows that 67% of your potential market is in the middle layers, waiting to be educated, nurtured, and persuaded.

What I like about the framework is that you can use different strategies for each distinct user group, track performance with simple tagging when potential customers are in your funnel, and audit whether you’re spending your time and money most effectively with sales and marketing.

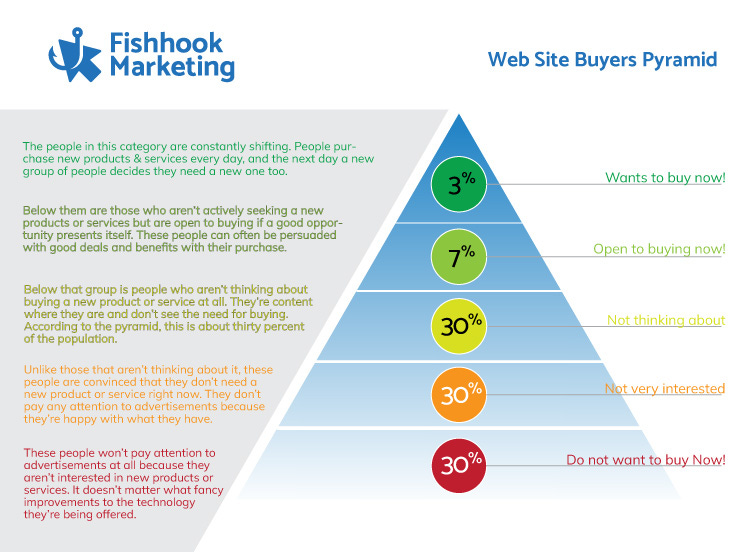

3. The Slide Every Investor Wants to See.

Investors pass on great opportunities every day simply because founders fail to tell their story clearly. I've seen this happen too many times.

Here's a slide that founders can include in their pitch deck to improve clarity for investors:

Why This Problem?

Don't bore investors with TAM/SAM/SOM charts. Instead, show them the market opportunity & real pain point and what it costs your customers. Make it tangible.

Why This Solution?

Break down your solution and why you chose this specific approach. Be concrete about how you're solving the problem differently.

Why Now?

Markets, tech, and human behavior are constantly shifting. Show investors why your startup's moment is today, not yesterday or tomorrow.

Why You?

What makes you and your team uniquely positioned to win? This isn't about your resume - it's about why you're the right person to bet on.

Remember: How you communicate your startup's story reflects how you'll communicate with customers, team members, and partners. Keep it sharp, keep it clear, and own your narrative.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Apple plans to introduce the iPhone 17 Air as part of its next major iPhone upgrade, offering a thinner, more appealing option than the iPhone Plus or mini. (Link)

NovaSky, a UC Berkeley team, released Sky-T1-32B-Preview, an open-source reasoning AI model trained for under $450, competing with earlier OpenAI models. (Link)

OpenAI revived its robotics department, with plans to develop adaptive, versatile robots powered by its in-house AI models and custom sensors. (Link)

Apple is reportedly developing a new app called Invites, spotted in iOS 18.3 beta code, to share visually rich event details and invitee lists. (Link)

Nvidia's R2X avatar, unveiled at CES 2025, is a desktop AI assistant that combines video game-like visuals with LLMs like GPT-4o or xAI's Grok for enhanced functionality. (Link)

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Most aspiring VCs don’t know how to prepare for VC interviews. I’ve interviewed candidates for analyst and associate roles, and many struggle to answer even the basic question: Why do you want to become a VC?

That’s why, together with a few VC partners, I’ve created an all-in-one VC Interview Preparation Guide. For a limited time, we’re offering a 30% discount. Don’t miss out!

VC Analyst - ManchesterStory | USA - Apply Here

Founding AI Engineer - Nimora | Remote (Stockholm) - Apply Here

Senior AI Engineer - - Nimora | Remote (Stockholm)- Apply Here

Portfolio Success Manager - Amazon Catalytic fund | USA - Apply Here

Investment Associate - Playground global | USA - Apply Here

Senior Associate - Yamaha Motor Venture | USA - Apply Here

Investment Associate - Elevation Capital | USA - Apply Here

Marketing Intern - Connecticut Innovation | USA - Apply Here

VC Associate - Breega | UK - Apply Here

MBA Internship Summer 2025 - 25madison | USA - Apply Here

Associate - Engine Venture | USA - Apply Here

Investment Associate - EIT Urban Mobility | Spain - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Investor Relations Manager - Griffin Gaming Partner | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator