Venture Capital Fund Modelling III: Masterclass

Part III: How the Venture Capital Fund Cycle Works? (VC Trademill) | VC Remote Job Opportunity

If you're on the lookout for an irresistible opportunity to level up your venture capital game, we've got something special for you. Our newsletter has been abuzz with the first & second articles in our groundbreaking series: VC Fund Modelling: Masterclass I & Masterclass II. Trust us, it's a must-read! And here's the best part – we're back with the highly anticipated third part that's bound to blow your mind.

Get ready to dive deep into the intricate world of VC fund modelling and uncover the secrets behind the Venture Capital fundraising cycle and terms like commitment capital/years, follow-on investment amount/years and fund I or II etc. Whether you're a driven founder or a die-hard VC enthusiast, this masterclass will grant you invaluable insights into the investor's mindset.

Join 3000+ forward-thinking individuals who are unlocking high-signal, curiosity-inducing content every single day in our VC Newsletter.

Bonus: For Aspiring Venture Capitalist: From VC basics to interviews

"Unleash Your Venture Capital Success with 'Mastering the VC Path: A Curated Guide by Leading VC Experts'!

Elevate your career today!"

Till now got amazing responses from 55+ Aspiring Venture capitalists.

It’s a limited edition, visits and get it yours (30% off for the first 20 Aspiring VCs): https://sahilfuise.gumroad.com/l/vc/aspiring_VC

Let’s deep dive into the VC Fund treadmill and understand the VC fund cycle:

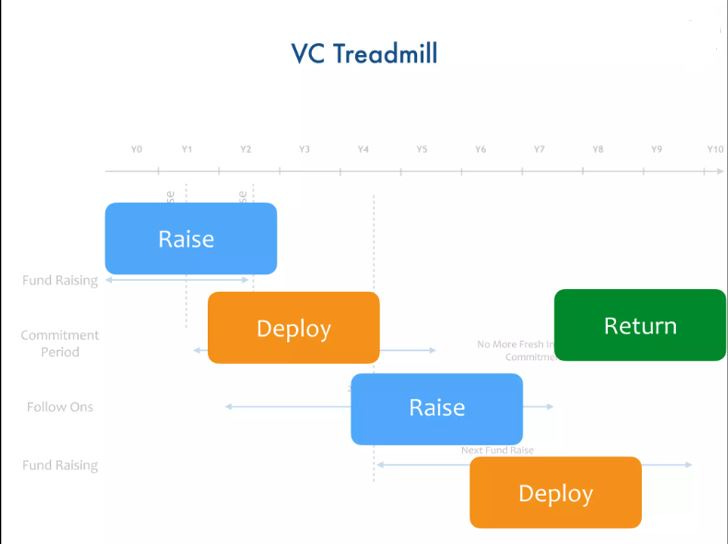

Take a close look at the below image of the timeline of the VC fund:

Source: Google Images

Don’t get confused with the terms or complexity described in the image. I will explain to you all the terms described in the image.

From the image, it’s clear that - the fund life of this VC fund is about 10 years. ( Horizontal line from Y0 to Y10)

Raising funds for a new venture capital (VC) fund is a challenging task for General Partners (GPs) who hold higher positions. GPs typically start by seeking investments from Limited Partners (LPs), including High Net Worth Individuals (HNIs), Family Offices, and School endorsement funds.

Typically, it takes approximately 2-2.5 years for new funds to secure the total capital from LPs. For instance, if a group of GPs aims to raise around $50 million from LPs, the fundraising process would generally span 2-2.5 years. It's worth noting that even for lower amounts, such as $25 million, the duration for raising the funds remains similar.

The process of raising funds for a new venture capital (VC) fund is typically divided into two stages: the first close and the final close, as depicted in the image. During the first close, which typically takes around 1-1.5 years, the General Partners (GPs) aim to secure approximately 40-50% of the total targeted fund to be raised from LPs ($50 million in this case). The remaining portion of the funds is then raised during the subsequent 1-1.5 years, leading up to the final close.

But what after the first raised (40%-50% of decided raised capital) - Does VC start to invest in startups / start to charge Management fees OR wait to raise the rest of the money and then start the investment?

Generally, after First Raised, VCs start to invest in the startups over the commitment period which is about 3-5 years. In the Commitment period - VCs will do the fresh investment in around 10-15 startups (depending on investment strategy). Simultaneously, VCs begin charging management fees over the fund's lifespan. These management fees usually amount to around 1.5%-2% annually.

“But till the first raised - the VC business worked kind of a bootstrapped startup.”

The commitment fund is designated for investing in newly established startups. However, once the commitment period concludes, VCs are no longer able to make investments in additional startups. Instead, they shift their focus to follow-on investments, which typically occur around two years after the commitment period.

The follow-on investment phase extends from the initial fundraising to approximately 7-8 years into the fund's lifespan, as depicted in the image. During this period, follow-on investments are made in the startups that were previously invested during the commitment period.

Typically, VC funds are organized into Fund I or Fund II, as you mentioned. Fund I is formed by combining the capital raised during the first and final raises. However, once the commitment period concludes, VCs are unable to invest in new startups. To avoid being unable to invest in fresh startups, VCs initiate the process of raising funds from Limited Partners (LPs) for Fund II. Fund II fundraising usually begins before the end of the 1-1.5 year commitment period.

This cycle of raising funds and deploying them into startups forms what is known as the VC Treadmill, where VCs continuously seek new funds to sustain their ability to invest and support startups.

VC Treadmill:

Source: Google Images

Raised Fund → Deployed in startups → Raised Fund → Deployed in startups

The primary responsibility of raising funds from LPs in the VC business primarily falls on GPs or MDs. It is the GPs and MDs who handle investment decision-making, fund operational activities, fundraising efforts for new funds, providing support to portfolio startups, and presenting the fund's performance to LPs. Individuals working in the VC industry can envision the extensive workload involved in these tasks, which encompass a wide range of responsibilities to ensure the success and growth of the fund.

That’s it. I hope you are able to understand the lifecycle of a VC fund and the most common terms used in this space.

Today’s VC Job:

Night Ventures - MBA Internship - Remote - Apply

Gateway Venture - VC Intern - Remote - Apply

In-Q-Tel - Investment Associate - Hybrid - Apply

FOR SPONSORSHIP

Get your message in front of Innovators, a startup working professionals and Investors. It’s Easy!

(We are Open to Promote)

For more Visit: Promotion / Advertisement

Also, don't forget to join our Slack community, The Venture Crew, to connect with like-minded startup enthusiasts and founders.

Subscribed to “The Venture Crew” newsletter to receive daily updates on startups, venture capital, startup investing and vc jobs.

By - The Venture Crew!