VCs' 5-Question Framework to Create an Elevator Pitch for Startups | VC Jobs

Cap table building; download the template & AI’s $200B question is now AI’s $600B question...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: VCs' 5-Question Framework to Create an Elevator Pitch for Startups

Quick Dive:

Building Cap Table As A Founder: Template to Download.

AI’s $200B question is now AI’s $600B question.

Market Command Matrix

Venture Curator Hub: Get 10000+ investors' contact databases & more.

Major News: Sequoia Offers To Buy $800 Million Worth Stripe shares, OpenAI Unveils Five-level Roadmap to AGI, Alphabet To Acquire Wiz at $23 Billion, Google Won't Buy Hubspot After All & SoftBank Acquired UK-Based Chip Company…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH MECO

The Best Free New App For Newsletter Reading.

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco, you can enjoy your newsletters in an app built for reading while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox).

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

You can try the experience for free and available on iOS and the web (desktop).

Over 30k readers are enjoying their newsletters (and decluttering their inboxes) with Meco - try the app today!

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

5 Questions Framework To Create An Elevator Pitch

Every founder dreams of that perfect elevator pitch - a 30-second ride that ends with millions in funding. While this movie scenario is unlikely, crafting a compelling elevator pitch is crucial. It's often your startup's first impression on potential investors, setting the stage for future conversations. A well-honed pitch can open doors, even if it doesn't immediately open wallets. So polish that pitch - you never know when you'll need it.

There are lots of articles surfing on the internet but still, many founders struggle to create elevator pitches for their startups. So in today’s writeup, I am going to share a “5 Question framework” that can help you to create an elevator pitch.

Also, many founders believe that they just need to have one elevator pitch and they can impress anyone. But this is not true, I believe you need to have multiple versions of an elevator pitch like - The emotional benefit version, the Success story version, the pressing call to action version and the version where you reference competitors. I will share more ideas on how to create each version of an elevator pitch. So let’s deep dive into this:

Image Credit: igothired

What is an elevator pitch?

An elevator pitch won’t get someone to invest in your company, but it’s going to whet their appetite and get you in the door. It’s thirty seconds long. That’s the usual “rule” given for elevator pitches. You’ve got 30 seconds to share an enormous amount of information about the company.

Your elevator pitch isn't about speed-talking; it's about impact. Every word should count. This brief but powerful message isn't just for investors - it's the essence of your company's identity. It'll shape your website's "About Us" section and become the go-to description for everyone in your organization, from the CEO to the newest intern. Think of it as your startup's movie poster: a quick glimpse that tells your whole story and leaves people wanting more.

One of the most common questions that every founder has is - “How long should an elevator pitch be? Do I really only have 30 seconds?”

Look, nobody's gonna time your pitch with a stopwatch. If it takes 31 seconds, no biggie. But here's the thing: you can pack a lot into 30 seconds if you're smart about it. If you're rambling on, it might be time to tighten things up.

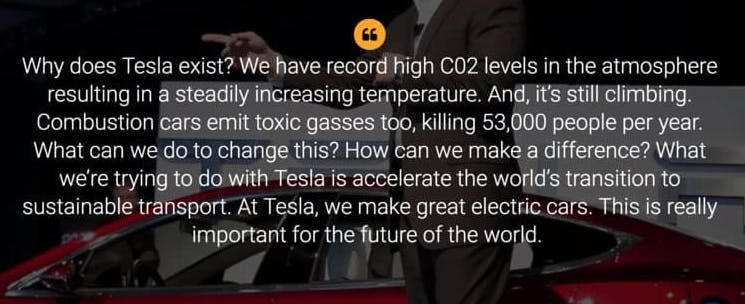

Now, rules are made to be broken, right? Take Tesla. Their pitch is longer, but damn if it isn't effective. Elon Musk might be in hot water lately, but the guy knows how to sell an idea. Some folks can keep you hooked for a full minute and leave you sold.

But let's be real - not everyone's Elon Musk. The 30-second thing is just a guideline, not a hard rule. What matters is nailing your audience, the situation, and your startup's value. That's the secret sauce.

So why bother with elevator pitches? Simple. They force you to boil down your big idea into something snappy and memorable. It's like a first impression for your business - make it count!

Why elevator pitches are such a big deal?

First off, it's all about grabbing attention. You've got this killer idea, right? The elevator pitch is how you make someone else go "Whoa, tell me more!" in just a few seconds.

It's not just for impressing investors, though that's a big part. Think bigger. Remember how Steve Jobs lured John Sculley away from Pepsi with that line about changing the world? That's the power of a great pitch.

Your elevator pitch is like your secret weapon. It's how you stand out at crowded conferences, how you snag those first crucial customers, and how you get top talent interested in joining your team. Hell, it's even what makes your LinkedIn profile pop.

The key thing? It's gotta work on people who've never heard of you before. That's where it differs from your pitch deck. It's your first impression, your hook, your "here's why you should care" moment.

5 Question Framework To Create An Elevator Pitch -

To re-iterate, the five basic pieces of information that will be contained in an elevator pitch are:

Who you are

What you do

How you do it

Who you do it for (i.e. the customer) and

Why now (the urgency of your idea)

And then, sitting on top of this is the need to make it accessible to the listener. This means you need to assume that they’re not aware of your business, or anything about the sector that you’re in.

Here's a great example of this. Here’s a pitch that was proving unsuccessful for a startup:

“I work on nanotechnology to deliver medical therapies to targeted cells.”

It has all five of the elements of an elevator pitch in there. It covers:

Who you are (a medical science company)

What you do (medicine)

How you do it (nanotechnology innovation)

Who you do it for (people who need medicine)

Why now (it improves the delivery of medicine)

Now, technically, it hits all the marks. But let's be real, unless you're deep into nanotech, your eyes are probably glazing over already.

So they went back to the drawing board and came up with this: "We are using the manufacturing techniques of the computer industry to make better vaccines."

Boom! Way more accessible, right? It's less jargon but packs a bigger punch. It's the kind of thing that makes people go, "Huh, tell me more."

And get this - that new pitch? It landed them an investment from the Bill Gates Foundation. No joke.

The takeaway? Keep it simple, make it interesting, and for the love of all that's holy, don't assume everyone knows what the hell you're talking about. Your grandma should be able to get the gist of it, you know?

While building an elevator pitch, start by asking yourself these four questions:

Who's your audience?

What's bugging them?

How are you fixing it?

How'll they know you've helped?

Now, here's a neat trick. There's this formula you can use to get started:

"You know how [your people] struggle with [their problem]? I've got [your solution]. It helps them [the benefit] so they can [their goal]."

Let's say you've got this cool gadget that helps people find their lost stuff. Your pitch might go something like:

"Ever been late 'cause you can't find your keys? Happens to tons of folks. I've made this nifty Bluetooth thingy that helps you find lost stuff in seconds. Makes mornings way less stressful, ya know?"

But here's the deal - don't just copy-paste this. Make it your own. Tweak it. Play with it. The last thing you want is to sound like every other startup out there.

Oh, and a pro tip? Don't BS your numbers. Investors can smell that a mile away. Stick to the facts you know are solid. It'll make you sound way more legit.

Remember, this is just your starting point. You'll want different versions for different situations. Keep it fresh, keep it real, and most importantly, keep it you.

Why You Need Different Elevator Pitches

Your elevator pitch shouldn't be one-size-fits-all. Having multiple versions lets you tailor your message to different situations and audiences. Here are a few types to consider:

The Emotional Appeal: Focus on how your product makes people feel. This can be powerful for early customers and marketing.

The Success Story: Once you have clients, share real-world examples of how you've helped them. This proves your value.

The Urgent Call-to-Action: Sometimes you need to push for immediate interest. Craft a version that creates a sense of urgency.

The Competitor Comparison: If you're entering a market with big players, explain how you're similar but different. "We're like X, but for Y."

The One-Liner: Have a super-short version ready for quick encounters or social media.

Remember, context is key. The pitch you use with an investor in an actual elevator will differ from the one you give after a conference presentation. By preparing various approaches, you'll be ready to adapt on the fly and make the most of every opportunity.

QUICK DIVES

1. Building Cap Table As A Founder: Template to Download.

A cap table, or capitalization table, is a chart typically used by startups to show ownership stakes in the business. It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company.

You can obtain a stockholder ledger from your lawyer, which lists all stockholders and shows how many shares or options they hold. However, I don't consider this document a comprehensive cap table. In this, I am sharing a cap table template that is used by various leading VC firm’s partners.

The basic outlines of this cap table are:

It shows all the major stockholders of the company listed on the left side. It also shows the major option holders and buckets of option holders

It shows all of the classes of stock and how much was paid for them across the top of the columns

For each investor, you show how much of each class was bought and how many shares of that class they own as a result

You total up the cost and shares and then calculate ownerships on a fully diluted basis (which means you include the options, whether issued or non-issued or vested or non-vested).

I like this presentation for its simplicity and because it shows the progression of financing activity. It also has the benefit of showing how much each investor has put in on a cost basis, which many cap tables leave out.

If you want to make a cap table for your company, feel free to replicate this format. If you have angel investors, put them in the angel section. I would include the largest ones and bucket all the rest into “other angels.”

If you’ve got any questions about this cap table, or cap tables in general, feel free to email me.

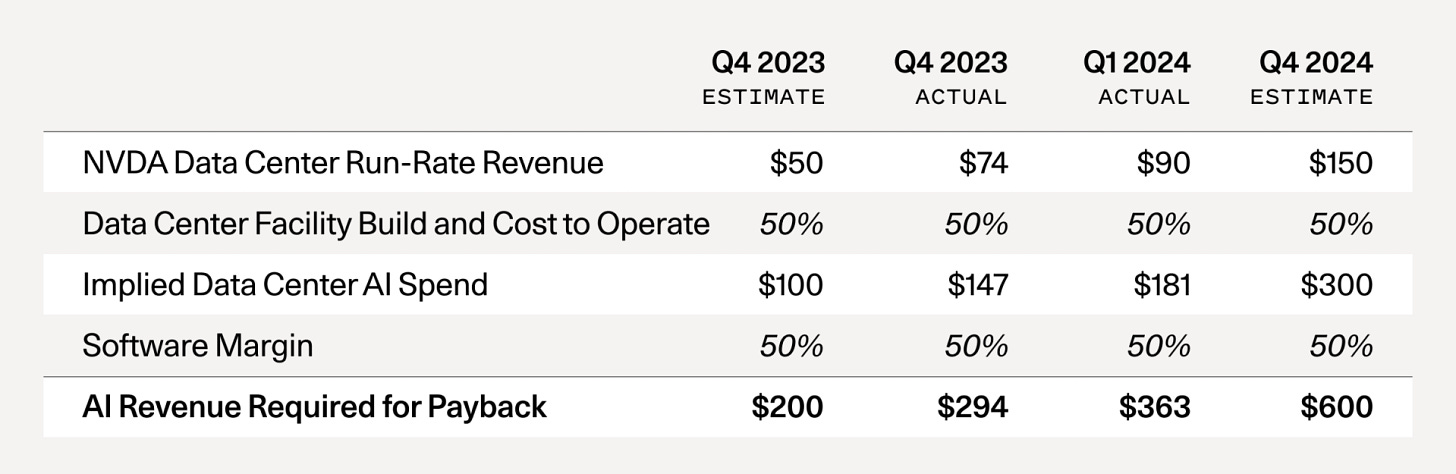

2. AI’s $200B question is now AI’s $600B question.

If you're a long-time reader of our newsletter, you'll recall our featured article on Sequoia Capital's AI's $200B Question, highlighting a significant gap between AI infrastructure investments and actual revenue generation in the AI ecosystem. This question has now evolved into a "$600B question", indicating an even larger discrepancy.

The analysis is based on Nvidia's revenue forecasts, multiplied to reflect total AI data centre costs and end-user gross margins. Since the original publication, several key changes have occurred:

Source: Sequoia Capital Articles

GPU supply shortages have largely subsided, making it easier for companies to acquire necessary hardware.

Major tech companies are stockpiling GPUs, with hyperscale CapEx reaching historic levels.

OpenAI continues to dominate AI revenue, with recent reports showing an increase from $1.6B to $ 3.4 B.

The revenue gap, or "hole", has grown from $125B to $500B annually.

Nvidia's upcoming B100 chip promises significant performance improvements, likely leading to another surge in demand.

Comparisons to historical infrastructure build-outs like railroads are addressed, noting key differences:

GPU computing lacks the pricing power of physical infrastructure monopolies.

Speculative investment frenzies often lead to high rates of capital incineration.

Rapid improvements in chip technology lead to faster depreciation of existing hardware.

While acknowledging that AI will create significant economic value, there's a caution against the "delusion" of get-rich-quick schemes based on AGI expectations and GPU stockpiling. Instead, the emphasis is on a long road ahead for AI development, with ups and downs, but ultimately worthwhile.

A level-headed approach is encouraged for company builders focused on delivering value to end users, suggesting they stand to benefit from lower costs and accumulated learnings during this period of experimentation and investment.

3. Market Command Matrix

Patrick Campbell sold his startup, Profitwell, for $200 million last year — and it was entirely bootstrapped.

Since then he’s started sharing a lot of primary research he’s commissioned into topics that there isn’t a lot of ground truth data on. Most recently, he shared his competitive research playbook and shared this framework — the market command matrix:

The y-axis represents how much of a competitor’s resources they’re piling into your market, and the x-axis represents how aware customers in your market are of the competitor.

The big text in each quadrant is what you should do in response. While the placements on the matrix aren’t exact (for example a “big VC bet” could have dramatically more or less mindshare depending on what stage they’re in), Patrick’s recommendations are good.

Note that he only recommends you take action against the two quadrants on the right — the competitors who your target and/or existing customers are likely to be aware of.

Another note: “all-out attack” may mean exploring partnerships when you both have leverage in different parts of the market — it doesn’t mean burning all your money on paid ads.

He also includes free playbooks on how to handle competitors in each quadrant — the full article is worth a read.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

Join 29000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Sequoia Capital is offering to buy up to $861 million worth of Stripe shares from its limited partners in funds raised between 2009 and 2011, at a $70 billion valuation. More Here

The Rabbit r1 AI assistant has been secretly storing user chats, making them potentially accessible if the device was lost, stolen, or sold, and users were initially unaware of this logging. More Here

OpenAI has developed a five-level scale to measure progress toward AGI. The levels range from chatbots, reasoners, and agents to innovators and systems that can do the work of entire organizations. More Here

Alphabet, Google's parent company, is reportedly in advanced talks to acquire cloud security company Wiz for around $23 billion. More Here

HubSpot shares fell 12% on Wednesday after a report indicated that Alphabet is no longer interested in acquiring the software company. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

“Ideas are common. What sets people apart is the initiative to turn those ideas into reality.”

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Associate - Live Nation Entertainment | USA - Apply Here

Venture Capital Senior Analyst - Flux Capital | USA - Apply Here

Investment Analyst - Crypto Capital - Apply Here

Investment Associate - ICONIUM Venture | USA - Apply Here

Venture Partner - Taisu Venture - Apply Here

Managing Director London - Techstars - Apply Here

Partner 22, Content Marketing, Investor Relations - a16z | USA - Apply Here

Investment Associate - Koch Disruptive Tech | USA - Apply Here

Program Associate - Techstars | USA - Apply Here

Investment Analyst - Koch Tech | USA - Apply Here

Venture Capital Fellow - Ankurit Capital | India - Apply Here

Investment Analyst Intern -QI Venture | India - Apply Here

🧐 VC Interview Preparation Guide

Knowing what to expect when going into a VC interview increases your odds of success.

Here are the usual question categories:-

1️⃣ “Fit” questions

2️⃣ Background & experience

3️⃣ Market & investment trends

4️⃣ Firm-specific & process

5️⃣ Technical & modelling (later stage)

6️⃣ Formal case study

Those looking for a high-level guide, check out this list of commonly asked questions 👇 (Attached PDF)

Download the full guide here.

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Tuesday. Will meet You on Thursday!

✍️Written By Sahil R | Venture Crew Team