VC: "I Don't Care About Your LTV/CAC Ratio!" Why? | VC Remote Jobs

"I Don't Care About LTV/CAC Ratio, What He Cares About Is The Velocity With Which Invested CAC Comes Back In The Form Of LTV."

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: I Don't Care About Your LTV/CAC Ratio.

Quick Dive

The GP Stakes Market Is Ready For A Comeback.

Which Startup Industries Are Still Growing Headcount?

Featured Article:

Two Simple Methods To Evaluate, Whether You've Achieved The PMF.Major News:

Former Twitter CEO Sued Musk For $128 Million, EU Fined Apple $2 Billion, Anthropic latest GenAI tech Superior to GPT-4 & Stripe Valuation.Best Tweet Of This Week On Startups & Technology.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

This Harvard-founded AI Startup Grew 5x in 2023 (And You Can Invest)

Out of free articles? Zette.ai is pioneering a future where you’ll never be blocked again.

With over 50,000 registered readers and a 5x year-over-year growth rate, the team at Zette.ai (including former journalists and engineers out of Harvard and MIT) has already secured deals with 110 publishers, including Forbes and the Miami Herald, to bypass paywalls with just a click.

Known as the “Spotify for news,” Zette.ai offers one subscription to read it all, starting at $9.99 per month for 30 articles. Not only do they save readers money, but they also share revenue directly with newsrooms to support journalism—all while building a proprietary AI-powered recommendation system to surface the most interesting articles across the internet today.

As a first mover in addressing the $60B paywall opportunity, Zette.ai represents a unique investment opportunity on Wefunder, targeting significant growth and an eventual IPO.

Invest as little as $250 in Zette on Wefunder before early bird terms sell out.

Partnership With US:

Promote your startup to our community of 23,000+ entrepreneurs and investors. Fill out the form, and our team will reach out to you….

TODAY’S DEEP DIVE

Focus On CACD & LTV Than CAC & LTV

“I don't care about LTV/CAC ratio, what I care about is the velocity with which invested CAC comes back in the form of LTV which I called CACD.” Says Venture Capitalist.

So, over the weekend, I had a chat with VC. We got into talking about the LTV/CAC ratio, and he dropped that quote I mentioned earlier. Now, you might be curious about what this CACD thing is all about. What's up with the 'D'? Let's break it down and find out.

LTV: Life Time Value ; CAC : Customer Acquision Cost ; CACD: ?

A business is an engine that attracts customers, delivers something of value to them, and then extracts that value in the form of profits. That’s what a business is. Thus it logically follows that the cost of attracting a new customer needs to be less than the value we can extract from that customer. If it costs us $15 in advertising to get a customer, and we can only make $7 from them then Houston, we have a problem. But if it costs $15 to get them, and then once they are a customer they make a bunch of repeat purchases that yield $75 in profit, then we are happy. Ultimately every venture of every kind has to have a Customer Acquisition Cost (CAC) that is less than the Lifetime Value (LTV) of a customer. It’s a simple, self-evident concept.

Yet it’s a leading cause of startup death.

A high percentage of startups die because their cost of getting customers turns out to be higher than they can make from them. Partly this is just because we’re all optimists — we all think our startup is so awesome that people will flock to become customers and they will remain customers forever. But eventually, that optimism fades as we realize that marketing is expensive and no customer stays forever. The immutable laws of economics set in, and at some point, many startup founders find that their LTV/CAC ratio is slowly draining their bank account.

To paraphrase Ernest Hemingway, Startups go broke two ways: gradually, and then suddenly.

Investors tend to obsess over the LTV/CAC ratio.

Investors care about your LTV/CAC ratio because it’s the essence of a successful business. But it’s also a proxy for the potential ROI of their investment. If you have proof that you can spend $1 on customer acquisition activities and get $5 in value back (an LTV/CAC ratio of 5.0), investors will want to shovel as much money as possible into that engine. Most of the VCs look for ‘just-add-money opportunities.’ Having a business with an LTV/CAC ratio of over 5.0 looks like a “just-add-money opportunity” to investors.

But it’s a blunt tool that is better if sharpened.

Let’s say that during the quarter we spent $10,000 on sales and marketing and got 1,000 new customers — a CAC of $10. But probably some of those customers came through word-of-mouth, some came as referrals, some came from our PR efforts, and some came from paid advertising. So we had a blended CAC of $10, but that doesn’t tell us anything about the relative effectiveness of each of our different customer acquisition efforts. Which leads me to the next point:

Not all customers are created equal.

With every business I’ve ever run, I’ve realized at some point that 80% of our profits were coming from 20% of our customers. It’s amazing how this tends to be true with almost all businesses. So if we look at the LTV (Lifetime Value) of our entire universe of customers, we’ll probably see that 20% of them have a much higher individual LTV than the rest. Wouldn’t we want to focus our CAC efforts on getting more of the high-LTV customers? Yes, we would.

Therefore, cohorts matter.

The two points above would indicate we want to track the LTV/CAC ratio by customer cohort. For example, what’s the ratio of customers acquired through Facebook advertising vs those acquired through Google advertising? Knowing that would tell us a lot about how we should allocate advertising dollars. What’s the LTV/CAC ratio for customers acquired through our referral program? Knowing that would tell us how much we can afford to offer in a referral fee. Knowing your company’s blended LTV/CAC tells you the health of the overall engine, but it doesn’t tell you how to optimize the engine’s performance for the next quarter. Tracking customer cohorts tells you that.

Also, velocity matters.

But do you know? - most of the VC don’t care about the LTV/CAC ratio, what they cares about is the velocity with which invested CAC comes back in the form of LTV.

They generally used CACD rather than CAC — the D is for “doubled”. CACD answers the question, “If we spend $12 in customer acquisition activities, how long does it take for us to get $24 back?” As an investor, he wants to see a business with a CACD of less than eight months. This formula gets to the heart of an inherent flaw in the LTV/CAC ratio: it doesn’t include a time factor. A business with an LTV/CAC ratio over 5.0 might seem good at first, but if you have to service a customer for 10 years before you make back the money you spent getting him, then it doesn’t seem so good, right?

Velocity matters. So think about how you can measure CACD for your business. Putting $12 somewhere where it returns with a high velocity will accelerate your engine of growth.

That’s it! So, from now it’s not LTV or CAC it’s LTV & CACD.

HOW CAN I HELP YOU?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors…. Want to build a SaaS platform, mobile or web app - we are here to help you. Build Your MVP

Pitch Deck Design: We write, design and model your pitch deck into a storyteller book within 4-5 days. Get Your Storyteller Book

TODAY’S QUICK DIVE

The GP Stakes Market Is Ready For A Comeback.

In 2023, major asset managers spent less on GP stakes due to market uncertainty and fundraising concerns.

GP stake deals involving minority ownership dropped to 17.2% of total deal value, down from 84% in 2019.

Petershill Partners is now preparing to deploy capital from its $5 billion fund after a cautious approach in 2023.

Bonaccord Capital Partners and Hunter Point Capital were the most active, completing three GP stake deals each in 2023.

Blue Owl Capital closed its fifth GP stakes fund at $12.9 billion in January 2023 and started raising for its sixth fund.

Blackstone reduced its fundraising target for its Blackstone Capital Partners IX fund from $26 billion to $20 billion.

Q4 of 2023 saw a rebound in overall GP stake deals, with 26 announced, but a shift towards majority control transactions.

In 2024, industry players anticipate more add-on acquisitions and minority stake sales, with a decrease in massive strategic deals

Which Startup Industries Are Still Growing Headcount?

A study by Carta shows that as of Q3 2023, the "deep tech" sectors such as Energy, Hardware, Medical Devices, and Biotech are experiencing notable growth, with consistent positive headcount trends since 2019.

The chart reveals a decline in overall startup headcount growth, especially in industries like SaaS, where hiring failed to match departures in recent quarters. Early 2021 saw peak growth across various sectors, with Biotech leading at 5.5 hires for every departure. In contrast, Edtech and Gaming currently face the lowest headcount growth, with only 0.7 new hires for each departure. The data also emphasizes the ongoing deep tech revival in venture capital. More Here

FEATURED POST

Two Simple Methods To Evaluate, Whether You've Achieved The PMF.

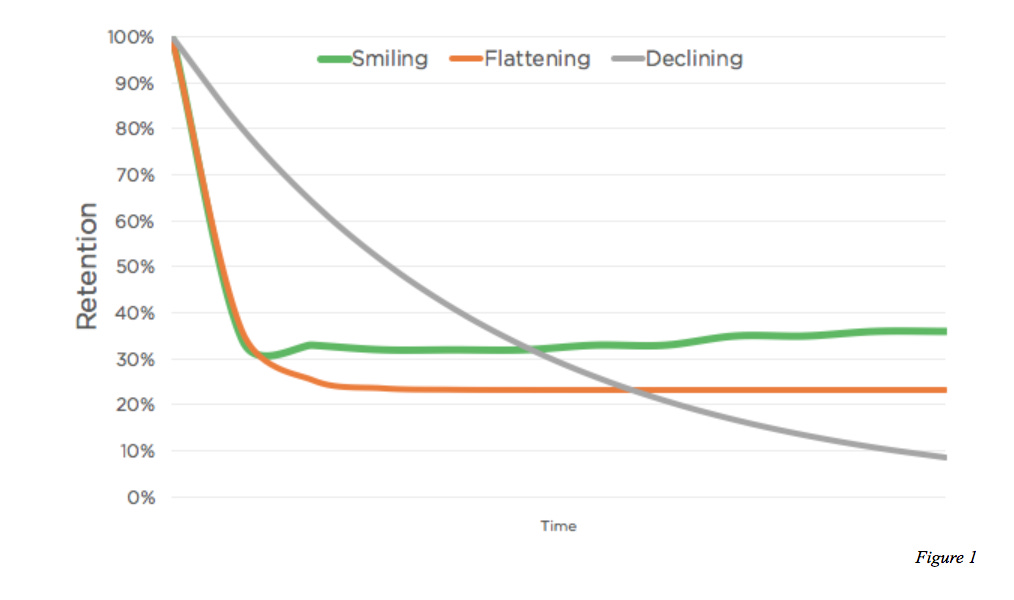

The First is the Retention Curve, "The retention curve is what percentage of your users keep coming back over some time while using your product/service."

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

Another question that the founder should ask is - Do Customers Love Product….. Read More Here

Join 15500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

The European Union has fined Apple €1.84 billion for violating antitrust rules related to its music streaming services. Read More

Four former top Twitter executives, including former CEO Parag Agrawal, have sued Elon Musk for over $128 million. Read More

Stripe's valuation rebounds to $65 billion as payments giant buys back employee shares. Read More

Mistral AI, OpenAI’s Rival Partnered With Microsoft and Raised $16M. Read More

Apple has decided to shut down its electric vehicle project after Spending $162 Billion. Read More

→ Get the most important startup funding, venture capital & tech news. Join 10,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Agree 100%.

Resourceful: Being able to find solutions and navigate challenges independently.

Reliable: Demonstrating trustworthiness and consistency in delivering on commitments.

Results-Oriented: Focusing on achieving goals and producing tangible outcomes.

What do you think? Anything missing here…

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Associate - City Light | USA - Apply Here

Principal - Venture Scientist - Marble | France - Apply Here

Analyst - Raise Venture | France - Apply Here

Principal - Futur Roof Venture | USA - Apply Here

VC Legal Intern - Plug and Play Tech Center | USA - Apply Here

Spring Marketing Capital - Analysy | India - Apply Here

Analyst - Giffin Venture | USA - Apply Here

Principal - Rethink Venture | Germany - Apply Here

Associate Rackhourse Venture Partner | USA - Apply Here

Investment Analyst - Panacea Innovation | UK - Apply Here

Spring Marketing Capital - Analysy | India - Apply Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to daily job updates, resources for learning about venture capital, weekly VC and startup events, daily discussion sessions, and tips/tricks to break into VC.

Join Our VC Enthusiast Community, VC Crafter To learn, network & craft a path to venture capital.

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team

CACD insight is awesome. People forget about velocity and magnitude