Timing Is The Single Biggest Reason Why Startups Succeed! | On the Life & Death of Y Combinator Startups | VC Remote Jobs and More

Timing is everything! | On the Life & Death of Y Combinator Startups | VC Remote Jobs

📢 Today At A Glance

Focus On: Timing Is The Single Biggest Reason Why Startups Succeed

Featured Article: On the life and death of Y Combinator startups

Major News In Startups: Seed deals getting more expensive & FTV Capital Sues Company To Get Back $61M & More

This Week’s Must Reading on Startups, Venture Capital & Technology

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝 In Partnership : bbv.media

Make Outsized Returns On Your Content💡

Content is fundamental in today's world of VC.

Not “How 4 am alarms/cold showers made my fund 10x” Instead, a wise content strategy can transform your brand to:

Drive deal flow

Forge a thought leader reputation with investors and LPs

Build brand power and a network of digital IOUs

VC funds with €2B+ in exits, pro athletes, angels, and more trust bbv.media to create their content.

Timing Is The Single Biggest Reason Why Startups Succeed!

What makes the startup successful - is it idea, team, funding, business model, talent or luck? What do you think?

But wait one thing is missing here & that’s “Timing”! You might be thinking if I have a great idea with talented team and strong unit economics business model no one can stop me! But that’s where most of the startup founder failed which is determining the timing phase of their startup.

If you know 90% of startups failed and one reason is just bad timing. Founder just failed to determine the timing phase of their startup. So How can you determine?

If you want to start the next $100M revenue, $1B+ valuation company, you have to find a market that is small enough but growing quickly.

These are four types of markets you can find yourself in as a startup:

Your startup’s fate depends on if and when there is growth in the market you’re addressing.

Let’s look at each one and break them down.

1. Small Market, Not Growing

If you find yourself building a small market with no path to growth, your efforts will be futile. There are few startups in this bucket, as they tend to be about selling or servicing old technologies: Don’t start a company selling or servicing fax machines, copiers, landline phones, or photo film.

There’s no story to get to growth, and it will be impossible to find venture dollars.

2. Large Market, Growth In The Past

Imagine starting a new smartphone manufacturer today. You’d be battling incumbents all day, and just to get your product on shelves, you’d have to invest tremendous amounts of money into building table stakes features. The larger incumbents can use their existing revenue streams to fund development, while you’ll have to give away your company piecemeal to VCs.

These are markets best left to large companies with more resources, as they can quickly deploy large teams and lots of capital to address whatever opportunity they see.

But even they might be too late if the market has already made up its mind: Just think about how Microsoft failed with Windows Mobile.

There is one special case here: Elad Gil call them “crowded uncrowded markets”. There are markets that are seemingly “over” but still have opportunities for new and differentiated entrants. For example, this was the case for social networks in 2010:

When Pinterest, Instagram, and Snapchat came around in 2010 and 2011, respectively, it seemed like the social space had been won by Facebook and Twitter.

But all three enabled new use cases: Pinning articles from the web, sharing filtered photos, and disappearing messages, features that made sense on their own and weren’t catered to by the incumbents.

In my opinion, all three of these players are just barely squeezed by, but it validates that investing in a market like this sometimes does work.

3. Small Market, Too Early

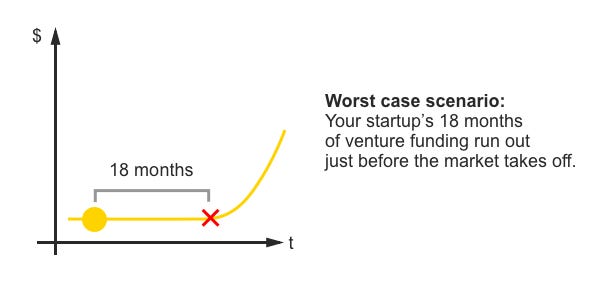

You found a brilliant startup idea, but you found it just a bit too early for your venture funding to last long enough for the market to take off. Your startup didn’t take hold in time and your startup crashed and burned.

The annals of startup history are littered with stories like this:

WebVan burned through almost $400M in venture funding in the late 1990s only to crash and burn, yet ordering groceries online is commonplace today.

WebTV pioneered Internet-connected TVs in the 1990s but was a failure as a product — meanwhile today it’s more common for a TV to be Internet-connected than not.

Dodgeball pioneered social location sharing via text messages as early as 2003. The company was acquired and the product was later shut down. Checking into locations is now common behaviour on Facebook and similar platforms.

Being early is the same as being wrong:

Venture rounds are raised with an 18-month time horizon, and if the market you’re addressing doesn’t grow during that time, you have to fold.

If you’re an established entrepreneur with a strong track record, you can win these markets, as you’ll be able to raise more money and give yourself a longer time horizon. For example, Elon Musk, coming off of PayPal’s success relied on boatloads of venture funding for Tesla and SpaceX — companies that went years before finding product-market fit.

To avoid the fate of the companies above, recommend applying what call the “Sam Altman test” of distinguishing fake trends from real trends -

"Ask yourself whether enthusiasts of your technology actually use it all day. For example, VR is cool, but even enthusiasts of the technology don’t use it on a daily basis.”

4. Small Market, Growing Quickly

This is where you want your startup to be. The ideal scenario is that you arrive just in time. Large incumbents are still paralyzed: A forward-looking executive may have spotted an opportunity, but it’s too small to make a serious investment, which at large companies often occurs in increments of 50 headcount, and requires getting lots of internal buy-in.

The common thread in opportunities that are of this shape is that they are powered by either a shift in user behaviour, a shift in technology, or both. Here are a few examples:

Each of these shifts enabled multiple $1B startups. But you had to be there right when they happened.

To find opportunities like this, you have to be an early adopter, try all the new products, and not be tied up with other projects just when the opportunity hits.

Overall -

Timing your startup determines much of your outcome.

If you’re an entrepreneur thinking about startups, consider the size and phase of the market you’re entering:

Don’t waste your time with small markets that are not growing.

Large markets with all the growth in the past are extremely difficult — incumbents have distribution, product, and funding advantages. Sometimes opportunities for differentiated products are overlooked — these are “crowded uncrowded markets” — but they’re extremely rare.

You can be in a small market where you think a lot of growth may happen in the longer term future. Being too early is the same as being wrong, and you risk becoming the next Webvan. In these markets, try to raise a large VC round and conserve your spending as long as possible.

Try to find a small market that’s growing quickly, enabled by a technology or behaviour shift. Landing in a market like this feels like having the wind at your back — fundraising, sales, and hiring will feel like a breeze.

Most of the founder get wrong here, to determine in which phase they lie in…..So if you are building something, try to determine your startup timing phase first.

🤝 Advertise in The Venture Crew’s Newsletters

Want to promote your startup to my community of 14,000+ entrepreneurs and investors? Reply “advertise” and I’ll share my media kit.

Featured Article:

On the Life And Death of Y Combinator Startups

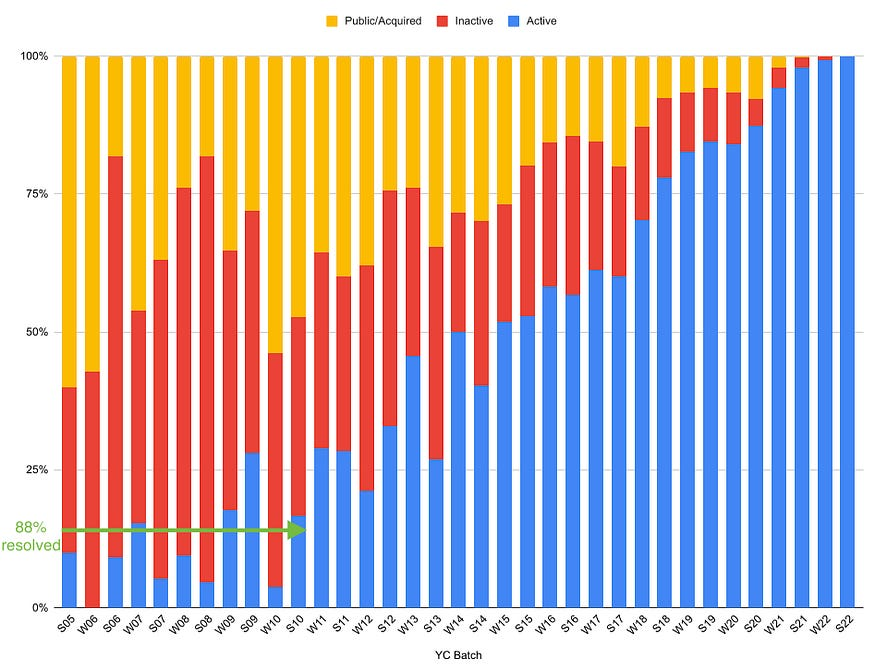

“~88% of Y-Combinator-backed startups have either shut down or exited.”

You read it correctly. You might be thinking that this number could be lower for one of the renowned accelerators, Y-combinator but this is not true. 88% of Y-combinator-backed startups have shut down or exited. Let’s deep dive into this truth.

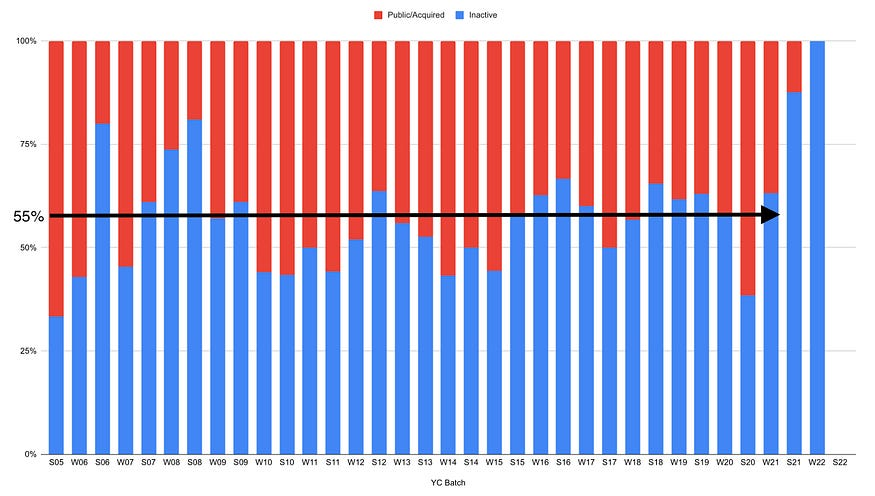

If you look at the chart below illustrates - the percentage of YC startups that are active (i.e., still operating), inactive (i.e., failed), or public/acquired (i.e., exited) by batch since the incubator’s founding in 2005.

Source: Rebel Fund

The blue bars (active) decline sharply going back in time as more startups reach their ultimate resolution. They don’t really stabilize until the ~12-year mark, by which point ~88% of startups have either shut down or exited. This means that only ~7% of startups from a given vintage reach resolution each year.

After the ~12-year mark, here’s the breakdown of YC startups by status:

By this point half of the startups have failed, over one-third of them have exited, and the remainder are still operating.

There is an expression in venture investing “The lemons ripen early” which is to say your failed investments tend to show themselves before the successful ones do.

This does seem to ring true for YC startups, but only in the first couple of years of their life cycle.

Below we’ve removed active companies from the first chart to only show the resolved ones. Here we can see that indeed some companies start failing soon after inception, but once a couple of years have passed, the inactive vs public/acquired ratio seems to stabilize around 55:45.

This means that after a couple of years of survival, a YC company is nearly as likely to end up exited as failed in any given year, which is better than I expected!³

This post also gives an idea about - the time it takes for an investor to exit from a Y-combinator-backed startup.

If - you are an Early-stage venture investor, you can safely ignore it though, because how many 100x investments are in your portfolio matters way more than how many 0x investments you have.

YC founders or Going to be YC Founders :) can ignore it too because it shouldn’t matter how many of your peers succeed or fail — just whether you do ;)

The most fun thing about startup investing is the upside is virtually unbounded but the downside is limited to 1x invested capital.

If you want to read the full post - here is the link.

Join 7000+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

📰 Today’s Major News: VC & Massive Funding Updates

Seed deals getting more expensive for investors Read Here

FTV Capital filed a lawsuit against the company Solid to get its $61 million investment back Read Here

Microsoft has closed its $69 billion acquisition of video game publisher Activision Blizzard Read Here

More funding for defence tech Read Here

VCs explained how startups can capture and defend market share in the AI era Read Here

Subscribed To, VC Daily Digest Newsletter and join 3000+ Avid Readers For Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox. 🚀

🗞️ Weekday’s Read On: Startup, Technology & VC

Make a Product a Few Love, Not Many Like, At The Start. Why? Read More (Startups & Venture Capital)

How to Think About Generative AI? Read More (AI)

The End of SaaS Is Closer Than You Think! Read More (Venture Capital & Startups)

Life is Short By Paul Graham! Read More (Startups)

Centaurs & Cyborgs: The Jagged Frontier of AI! Read More (AI)

VC Don't Care About LTV/CAC Ratio? Read More (Startups)

How To Launch A New Product! Read More (Venture Capital & Startups)

💼 Venture Capital Remote Jobs & Internships

Investment Analyst - Flashpoint | Remote - Apply Here

Marketing Associate - Ten Eleven Venture | Remote - Apply Here

Investment Manager - Circulate Capital | Remote - Apply Here

Vising Analyst - Planet A Venture | Remote - Apply Here

VC Fellow - Fundamental | Remote - Apply Here

Investment Analyst - Creadev | USA - Apply Here

VC Intern - First Momentum Venture | Germany - Apply Here

Investment Analyst - WIT Angel Club | France - Email Here

Join our VC Enthusiast Community - VC Crafters - A Community For VC Enthusiasts To Learn, Collaborate, Network and Craft Path To VC.

You’ll get access to:

📦 Share VC’s Newsletter

Refer a friend to gain access to our venture resources. 🎊

Get Venture Capital and Investors Database. for 4 referrals

Get Access To private Slack for 10 referrals

Get On a 30-minute call for 15 referrals ( To Discuss fundraising, breaking into VC funds, making a pitch deck, building a newsletter and others)

✍️Written By Sahil | The Venture Crew Team