The Venture Capitalist's Death Trap: Follow-on Investments | VC Jobs

Pitch deck has one purpose... & Sequoia Capital's Method To Find PMF!

👋 Hey Sahil here! Welcome to this bi-weekly✨ free edition✨ venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: The Venture Capitalist's Death Trap: Follow-on Investments.

Quick Dive:

The pitch deck has one purpose - to drive enough interest to schedule a meeting. That’s it.

When Should You Raise Funding For Your Startup? & How Much To Raise?

Sequoia Capital: Two simple methods that can help founders find whether they have achieved Product-Market Fit (PMF)!

Y-Combinator Guide: How to Pitch Your Startup.

Major News: a16z backed Post News Startup Shutdown, Founder Sentenced to 18 Months in Prison, Adam Neumann Ups His Bid For WeWork & EU Eyes Antitrust Probe into Microsoft-OpenAI Deal.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH MVST

Founder Driven - Software Development & Design Support

Founder-driven, MVST understands the need for efficient support in building digital products as you focus on running your business. With our team seamlessly collaborating, you’d have a scalable MVP in record time.

Your contact for Full Product Delivery, UX/UI Design, Software Development, Product Management, ML Ops, Dev Ops, and AI.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

The Venture Capitalist's Death Trap: Follow-on Investments.

“Contrary to what one might think, the biggest problem for VCs isn’t making an investment in a company that fails. All VCs invest in lots of companies that don’t work out. It’s a known risk and the main one everyone thinks about. But this is not typically where VCs really get into trouble. The much bigger trap is around follow-on investment decisions.

Here’s why:

Typically, a VC fund will invest in something like 20 – 40 companies in a fund. Some investors do a lot more, few do much less. Also, most funds reserve some capital for follow-one. Most VCs invest at least 2X as much money for follow-ons as they do for initial investment dollars. Some investors reserve much more. So, this means that a typical investor might be putting 1-2% of the fund at risk in any one investment after the first check. Here’s the math:

Let’s say we have a $300M fund

Let’s that fund invests 1/3 of the capital into the initial rounds. That’s $100M

Let’s say that $100M is spread across 25 companies. That’s $4M per company.

So, the % at risk is $4M / $300M = 1.3%

So, the downside of a bad initial investment is pretty minimal to the fund overall. What is problematic is putting a lot more capital into follow-on rounds for a company that ends up not working. And so, the VC death trap happens when one of their companies seems really hot, raises a lot of money really quickly, and ends up failing. Here’s a typical path for an investment like this, for a fund similar to the example above.

The $300M fund invests in a big seed for a company. Let’s say they invest $2M

Things are looking great! They want to pre-empt the series A. There is a lot of competition, so the fund ends up investing $5M into the A round at a pretty high price.

6 months later, the company is really taking off. A fancy firm puts down a term sheet to invest $40M in the new company. This looks like a winner, so our VC fund does as much of its pro-rata as it can. Let’s say they do another $10M. At this point, the firm has invested $17M (2 + 5 + 10).

10 months later, there are a few warning signs starting to show, but growth is still great. Also, tons of investors want to invest after the fancy firm that led the B. The company gets a term sheet for another $50M. The firm decides this is the time to go big or go home! They invest another $15M.

Things are starting to go sideways, or the market has turned. No worries – insiders do a $20M round to get the company another year. The fund does a $5M chunk of this round

Things are now falling apart. No one wants to invest in this company. The last round’s investors are willing to lead another round but is putting some structure in place to penalize anyone who doesn’t participate. The fund has $37M into this company already, they have to keep going. So, they do another $3M.

At this point, the firm has now invested $40M into this one company. They invested $2M initially, but now have invested 20X that amount, and it’s not looking great. This company may end up salvaging some value in a sale, but it could also be a near-total loss, which is tough to swallow. Assuming this fund targets 20% ownership, they would need a $200M exit from a different company just to dig out of that hole.

Poor decisions during follow-on rounds, especially when these decisions are steered by fundraising momentum is really the biggest risk of value destruction for VCs. Being great at follow-on investments might not turn a 1X fund into a 5X fund, but it does have a significant impact on overall performance and is really tricky, nuanced stuff. A couple of other observations:

1. As unicorns come down to earth, this scenario (or worse) will play out multiple times over the next several years.

Over the course of the late-stage frenzy over the last few years, a lot of funds have made aggressive follow-on investments into companies that will end up not working out. We’ve been in a period of unnatural financings, both in terms of valuation and the amount of capital that has gone into companies relatively early in their life. As an existing investor, it’s very hard not to try to pour more money into companies that seem to be getting lots of external investor validation, even if you suspect that the company doesn’t warrant it. This is compounded by the fact that many LPs have shown an interest in investing directly into individual companies in recent years, and have looked to their underlying managers to try to get them access to these high-flying unicorns through opportunity funds or SPVs. This can lead to a fund not only investing a big % of its fund into a failing company but also getting some of its own underlying investors to put even more capital into these companies, without the benefit of broader diversification. This double whammy will be tough for funds and their investors to swallow.

2. Time and dollars are strangely misaligned in VC decision-making

There is not a linear relationship between the amount of capital a VC invests and the amount of time spent making these decisions. What it mean is that most VCs spend most of their time and effort deciding on an initial investment. The level of effort and diligence that goes into a follow-on investment is typically much lower. Although this makes some sense given the work involved with getting to know a new company, the level of disparity is still puzzling given that 65% – 75% of fund capital (or more) goes into follow-on rounds.

You would think that it would make sense to allocate time in a way that is roughly equivalent to dollars being invested at each step of the way. But this is not anything close to what actually happens. In high-momentum follow-on rounds, it’s hard to check yourself and not aggressively do your pro-rata, especially since there are probably other buyers trying to do as much as they can as well. In less aggressive rounds, a series A or series B lead will need to do their pro rata as well, because it otherwise sends a very weak signal to other investors and can put the round in jeopardy. In either case, the time and effort that goes into these decisions is minimal relative to the dollars in.

Most funds do start having hard conversations around follow-ons is when they need to lead inside rounds or protect themselves in down rounds. But often, these are for relatively smaller checks AFTER a bunch of capital has already gone into a company.

This might not be true of all VC funds, and a number of funds have a mantra that they treat follow-on rounds like “a new deal”. But practically, think that doesn’t happen as often as we lead ourselves to believe, and a lot of funds would agree that they could do a better and more thorough job with follow-on investment decisions, especially since that’s where the vast majority of their capital is actually going.

3. Hit rates and outside leads can be very misleading

One metric mentioned from time to time is the idea of a follow-on hit rate. For example, what % of the time do a seed fund’s companies get to series A Or what % of companies that raise a series A from a particular fund end up raising an outside-led series B? The assumption here is that the higher the better.

I used to think that this was an important metric, but I’m not really sure any more. A high hit rate isn’t necessarily a great thing. Typically, investors that put significant capital into follow-on rounds try to concentrate as much capital as possible on the small number of best-performing companies. This is particularly true in the VC business where typically, the best 1-3 companies in a fund far outperform the rest of the portfolio. A high hit rate makes it tougher to concentrate this capital and makes it easy to stumble into the VC death trap.

The opposite of this is also true. Many of the very best companies in portfolios I know are ones where there was little or no outside investment interest. These are cases where there was going to be no impressive markup, or impressive Techcrunch headline announcing a unicorn valuation.

However, the investors with inside knowledge of the company had conviction, continued to invest in these companies, and were ultimately rewarded with outsized ownership in exceptional businesses. One very experienced and successful investor remarked to me once that he had “begged” someone on his “hands and knees” to invest in a company, which ended up being a massive winner for both funds’ portfolios.

One might say that from a founder’s perspective, a high hit rate can be a good thing. It means that taking money from a particular firm can reduce financing risk down the road. But as I think we are starting to see, too much money too soon or with the wrong expectations can really hurt a company and ultimately not help anyone involved.

The point of this long post is that follow-on investments are really hard. It’s probably the easiest way for investors to get themselves into trouble. It has the fewest internal checks and balances. It also has the most external pressure from the founder, market, and one’s own sense to greed or pride to just follow inertia and invest. This is not just a matter of failing to spend enough time making decisions. Time alone doesn’t lead to better decisions. But I think the issue is primarily about making intentional and independent decisions. We all try to be independent thinkers with our initial investments, but given that the majority of most VC’s capital goes into follow-on rounds, it’s equally critical to make follow-on decisions independently too, and not get sucked in by momentum, fancy co-investors, or other similar forces.”

This Writeup Shared By Rob Go, Cofounder of NextView…..

✨ Launching Our Premium Venture Curator Newsletter & Community

With our biweekly free newsletters (Tuesday & Thursday), we are launching our premium newsletter. Every Sunday (full newsletter), we will share actionable premium content with you on startups, venture capital, AI, and more.

A subscription gets you:

⭐ Premium Subscribers Posts (Every Sunday )

⭐ Daily Premium Content, Discussion, Curated Article & Weekly events list Through Substack Community Chat.

⭐ Access To Founders Resources (10000+ verified Investors’ email contact database, fundraising resources, discount marketplace & more…).

QUICK DIVES

1. The pitch deck has one purpose - to drive enough interest to schedule a meeting. That’s it.

It should not (and will not) convince someone to invest in the company.

You should be able to accomplish this goal in 6-12 slides, max. If your pitch deck is 14+ pages, you are likely providing too much information. Too much information can be risky because it gives investors more opportunities to find red flags. And most founders make these mistakes.

So omit unnecessary details so that investors can focus on the following details that matter most:

The problem you're solving - the existing customer pain. It's a challenge to get people to invest in problems that aren't clear to the customer. Make the pain your customer has really obvious. If you can, make it emotional to have them feel the pain themselves. 1-2 slides.

The product/service you'll build to seize the opportunity — it’s highly unlikely that you'll have a unique solution if there's a large market opportunity. 3-4 slides.

Why your approach to the problem is different from existing solutions and the status quo — you have to assume that doing nothing is a reasonable option for your customer. 1-2 slides.

Proof of product-market fit. You may not have it yet. If not, speak to the status of your efforts to establish it. It’s much better if you have proven it already. 1-2 slides.

How you'll reach the people who have the problem you've outlined. This is your marketing plan. 1-2 slides.

How your customer will purchase your solution, Your sales plan. 1 slide.

The team you've put together that makes your company better than any other in the market. 1 slide.

How much money you need to raise and what milestones you'll achieve with it. Show the viewer that you've done your homework on your real capital needs. Ask for the money, don't be soft about it.

“We're looking for $n and we’d appreciate if you'd consider investing in us.” 1 slide.

That's it. If you’re having trouble ruthlessly editing your own work, try presenting your deck to someone who knows nothing about your industry. Like a parent, grandparent, or sibling.

As you explain your business to someone who doesn’t understand your industry, you’ll quickly realize what is (and what is NOT) a powerful addition to the deck. Read More Here

2. When Should You Raise Funding For Your Startup? & How Much To Raise?

One of the most common mistakes that founders make is 'jumping into fundraising when the business is not ready. What does it mean?

Remember - Investors write checks when the idea they hear is compelling when they are persuaded that the team of founders can realize its vision and that the opportunity described is real and sufficiently large. When founders are ready to tell this story, they can raise money. And usually, when you can raise money, you should.

But for some founders, it is enough to have a story and a reputation

However, for most, it will require an idea, a product, and some amount of customer adoption - traction.

Luckily, the software development ecosystem today is such that a sophisticated web or mobile product can be built and delivered in a remarkably short period at a very low cost. Even hardware can be rapidly prototyped and tested.

Investors also need persuading. Usually, a product they can see, use, or touch will not be enough. They will want to know that there is product market fit and that the product is experiencing actual growth.

So, founders should raise money when -

"they have figured out what the market opportunity is who the customer is, and when they have delivered a product that matches their needs and is being adopted at an interestingly rapid rate."

How rapid is interesting? This depends, but a rate of 8-10% per week for several weeks is impressive. To raise money founders need to impress.

For founders who can convince investors without these things, congratulations. For everyone else, work on your product and talk to your users.

How Much To Raise?

In my view, the answer is based on a startup’s life, which can be divided into two parts—Before Product/Market Fit, and After Product/Market Fit.

Before Product/Market Fit, a startup should ideally raise at least enough money to get to Product/Market Fit.

After Product/Market Fit, a startup should ideally raise at least enough money to fully exploit the opportunity in front of it, and then to get to profitability while still fully exploiting that opportunity.

Also, the definition of “at least enough money” in each case should include a substantial amount of extra money beyond your default plan so that you can withstand bad surprises. In other words, insurance. This is particularly true for startups that have not yet achieved Product/Market Fit since you have no real idea how long that will take.

These answers all sound obvious, but in my experience, a surprising number of startups go out to raise funding and do not have an underlying theory of how much money they are raising and for precisely what purpose they are raising it.

3. Two simple methods to find whether startups have achieved Product-Market Fit (PMF).

Rajan Anandan, Managing Director at Sequoia Capital, shared two simple methods that can help founders find whether they have achieved Product-Market Fit (PMF)

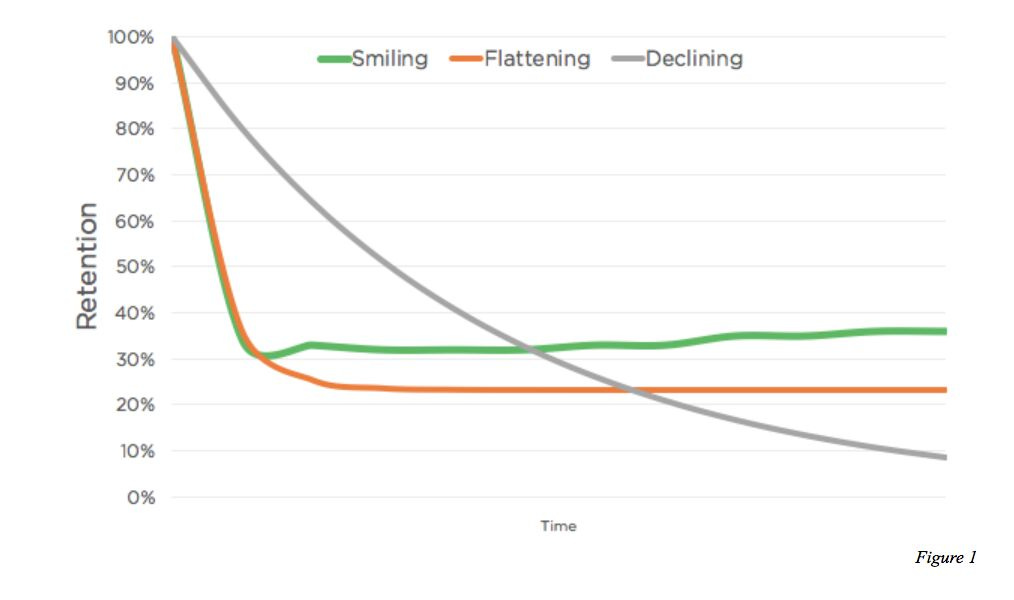

The First is the "Retention Curve" -

"The retention curve is what percentage of your users keep coming back over some time while using your product/service."

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

1. Declining Curve (dark grey line), let's say you’ve launched a consumer internet app on day 0, and every week your retention rate declines by 10%, which essentially means that by the end of 3rd month, all your initial users would have churned, then that's a declining curve, which indicates that you don’t have a product-market fit.

2. The Flattening Curve (orange line) is good, although it kind of varies depending upon the category (Health-Tech, EdTech, etc.,) but generically speaking if the retention curve flattens between 20%-40% that could be quite good.

3. Finally the best one is the Smiling Retention Curve (green line), which means that retention drops but then as time goes on you keep reactivating users, which indicates that you're getting close to your product-market fit.

Another question that the founder should think about is -

Do Customers Love Product? Net Promoter Score (NPS) is a metric that organizations use to measure customer loyalty toward their brand, product or service.

NPS works by asking your customers a single question: "How likely are you to recommend our products/services to others?"

NPS = % Promoters (score 9-10) - % Detractors (score 0-6)

If the magic score is = 70% or more, then you have an amazing product-market fit. But if the number declines to 40% or below, then you don’t have it. It's that simple!

4. Y-Combinator Guide: How to Pitch Your Startup

Most founders don't really understand what investors are looking for when they pitch their startup ideas. Because of this, they end up talking about stuff that doesn't really matter.

So, Y-Combinator partners have made it simpler by breaking down the pitch process into seven key questions. If you can give clear and straightforward answers to all seven questions, you'll be way ahead of most other pitches.

The Seven Questions are:

What do you do? - Explain your product/service in the simplest terms possible.

How big is the market? - Estimate the market size using a bottom-up or top-down approach.

What's your progress? - Highlight your achievements and speed of execution.

What's your unique insight? - Explain your deep understanding of the problem you're solving.

What's your business model? - Describe how you plan to make money.

Who's on your team? - Introduce the founders, their backgrounds, and the equity split.

What do you want? - Clearly state your ask (e.g., investment, advice).

Join 18000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Post News, a Twitter alternative startup backed by Andreessen Horowitz, is shutting down. Read More

Manish Lachwani, founder of app testing startup Headspin, sentenced to 18 months for inflating revenue by 400%. Read More

Tesla is recalling all of the 3,878 Cybertrucks that it has shipped due to a sticky accelerator pedal. Read More

Meta released two new AI models, Llama 3 8B and Llama 3 70B, claiming they outperform other open models on various benchmarks. Read More

Adam Neumann's Firm Flow Increases Bid to Over $500M to Repurchase WeWork. Read More

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

The customer doesn't care about features – they care about solving their problems.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Manager - Nventuer | USA - Apply Here

Senior Managing Director - BioSTL | USA - Apply Here

Program Manager - mHUB | USA - Apply Here

Investment Manager - Energy Venture | UK - Apply Here

Principal - Artha Venture Fund | India - Apply Here

Community Manager - DTCP | Germany - Apply Here

Event Management Specialist - Artha Venture Fund | India - Apply Here

Associate - Venture Capital - Artha Venture Fund | India - Apply Here

Investment Analyst - Peak XV Venture | India - Apply Here

Scouting Associate - Antler | Australia - Apply Here

Investment Analyst - Velocity Venture | Singapore - Apply Here

Summer Undergraduate Intern - Overtune | USA - Apply Here

Summer MBA Intern - Overtune | USA - Apply Here

Investor Analyst - MXV Venture | USA- Apply Here

Some Tips To Break Into VC:

“Target applying to a new VC firm To Get a Job or Internship, How?”

I think most of the VC Enthusiast not aware of this thing - I see a lot of you applied for VC jobs on job portals (Open for all) but Let me share a trick that I observed people use and it worked very well to grab the VC job/internship easily.. (It takes some work & consistency) “Target applying to a new VC firm! - It's Simple. Read More Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Happy Tuesday!

Advertise || Join The Community

✍️Written By Sahil R | Venture Crew Team