The Myth of Hyper-Growth: Successful Startups Follow Quadratic Hypergrowth, Not Exponential. | VC Remote Jobs

The Myth of Startup's Hyper-Growth Exponential....

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: The Myth of Startup's Exponential Hyper-Growth.

Quick Announcement: Join Verified Founders & Investors Community…

Featured Article: How To Run A Great User Interview? by Emmett Shear.

Major News: QIA Launched $1 Billion VC Fund, Vinod Khosla's $37 Million AI Investment, Paypal's Mafia Launched AI Startup & NVIDIA Hit $2 Trillion Market Cap.

Best Tweet Of This Week On Startups & Technology.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

This Harvard-founded AI Startup Grew 5x in 2023 (And You Can Invest)

Here’s a fantastic startup inviting Venture Curator readers to an early opportunity to invest….

Out of free articles? Zette.ai lets you legally bypass articles behind the paywall with a single subscription, all while using AI-powered recommendations to send the coolest content your way.

They’ve already raked in $1.7 million from Afore, Halogen, & more. And talk about moats:

50,000+ registered readers and 5x year-over-year growth rate

110 top publisher deals secured, including Forbes and the Miami Herald

Featured in Forbes, TechCrunch, and Fast Company’s “World Changing Ideas” Honoree

The Zette.ai team (former journalists and engineers out of Harvard and MIT) wants to revolutionize the $60B media industry now: with 3rd party cookies disappearing and a presidential election coming up in the fall, all eyes will be on the news cycle in 2024.

Invest as little as $250 in Zette on Wefunder before early bird terms sell out.

Partnership With US: Promote your startup to our community of 23,000+ entrepreneurs and investors. Please fill out the form, our team will reach out to you….

TODAY’S DEEP DIVE

The Myth of Exponential Hyper-Growth.

Fast-growing startups are frequently described as “exponential,” especially when the product is “viral.” But “exponential” is an incorrect characterization, even for hyper-growth, “viral” companies like Facebook and Slack.

If your model is incorrect, you don’t understand growth, which means you can’t control it, nor predict it.

— Jason Cohen

In his [long and mathematical] essay, Jason suggests an alternate model for how fast-growing companies actually grow. I like his thesis, so I’m going to do my best to synthesize it for you today.

Because, in his own words: …understanding the model is useful not only for predicting growth but also because understanding the foundational drivers of growth allows us to take smarter actions to create growth in our own companies.

First, he dispels the notion of “exponential” by looking at some popular companies that grew rapidly, and who often get dubbed as examples of this growth model.

Let’s take a look.

Not exponential

It’s been a minute since high school math…

Exponential growth = growing by a multiple. For example: In year 1 you grow by 10, in year 2 by 100, in year 3 by 1000.

Quadratic growth = growing by adding a constant. For example: Growing in year 1 by 10, then in year 2 by 20, in year 3 by 30.

In both, growth is clearly still accelerating, just at wildly different rates. To drive the point home:

Facebook is the definition of hyper-growth—getting to $50B in revenue faster than any company in history. The product is “viral”—friends bring other friends—which theoretically leads to “exponential growth.” But Facebook didn’t grow exponentially in the number of monthly active users:

Essentially linear for nearly twenty years, only exponential in the first four years.

Slack was the fastest-growing enterprise software company ever, going from $0 to $10M ARR in their first 10 months, and 0 to 10,000,000 active users in just five years. It’s also a “viral” product—organizations invite their members, who then create their own Slack-groups and invite others. So surely Slack has exponential growth?

Slack’s own data shows initial quadratic growth, followed by years of linear growth.

— Jason Cohen

So, given there’s no proof of an exponential growth model in startups — even looking at real-world data from the fastest growing companies (he also investigated HubSpot and Dropbox) — Jason points out that in fact… hyper-growth is quadratic.

But Why Do Products Grow Quadratically?

It’s not enough to just say that growth in real life is quadratic. We have to be able to know why this model makes sense, as this will give us a better understanding of the growth drivers in our own companies.

Luckily, Jason gives us a first-principles explanation so we have that insight, using the life-cycle of a marketing campaign as an example.

In my experience, marketing campaigns follow this pattern:

At the foot of the curve, we’ve launched a new campaign, but it’s ineffective; we haven’t figured out the best design and messaging and calls-to-action for this new medium and audience. Sometimes we never figure it out, and abandon the effort.

But in the case that we unlock the secret of efficacy, the campaign rapidly reaches a natural level of contribution; in this example, a number of “sales per week.” The specific level depends on many things: ad inventory, our budget, audience-receptivity, and the consonance between the audience and our target market.Next we enter the optimization phase.

We A/B Test our way to incrementally better results. Also we enjoy the result of multiple exposures—most people need to see the ad more than once before they act.

Finally we enter a phase of decline. There are various causes, all instructive:

The audience saturates. Everyone in the channel has seen the ad more times than is required to act; it’s now falling on deaf ears. Even if the audience is growing, the number of new people is small compared to the number of people that were new-to-us when we began the campaign

The channel declines. A media site that was popular loses readers through over-monetization. An event that was well-attended loses favor. A newsletter that was frequent and insightful becomes less frequent or other writers take over. A podcast moves to a closed platform and loses many listeners.

The auction becomes uneconomical. For auction-based systems like Google and Facebook advertisements, or other zero-sum programs like affiliates or limited-inventory spots on newsletters or podcasts, the winner is the one who will pay the most. What is cost-effective for one bidder will be laughably overpriced for another, due to better conversion rates, higher revenue per customer, higher profitability per customer, or due to categorization as a “loss leader” or other way of ascribing value beyond immediate pay-back.

He calls this…

Whether it’s a marketing campaign or a new product release, growth initially accelerates as early issues are solved, then grows roughly linearly as things are optimized, and then starts dipping over time. That slowdown/decay is natural as things scale.

But, we don’t do single campaigns or releases, do we…we add new ones. Some end up being bigger than others, some can be better optimized, or decline sooner, and some decay more steeply than others.

So, companies that want to continue growing quickly after their first product reaches scale, must launch new products into new markets.

This leads to a variety of Elephant Curves across time —which, if plotted together — look very quadratic.

Okay, so what? What’s the advice for founders?

The consequence of knowing that the growth we encounter at work is quadratic is important, as we’re all trying to understand (and likely change) growth drivers. So, “getting the right language, and the right model, will lead to correct analysis, and right action.”

And to leave you with something more actionable here:

It’s great to add a feature to an existing product, but significant additional growth comes from increasing carrying capacity or creating a new avenue of growth. Early on you should focus on winning market share in one space, creating the first Elephant Curve, but after the product matures, something more drastic is required: Wholly new products, or updates significant enough to address new markets.

It’s well-known that companies need to add additional products to continue fast growth after achieving scale. However, the second product is highly unlikely to achieve the same market share and monetary scale as the first, so there needs to be multiple, not just one. This requires serious investment, parallel efforts, and the chutzpah to kill off the ideas that aren’t working.

Because word-of-mouth-driven growth is so much more effective than marketing-driven growth (both in cost-per-customer and in that unlike direct advertising it grows automatically as the company grows), it is worth a great deal of time trying to figure out how to build that into the product, rather than relying only on the marketing team.

If you want me to answer your questions on fundraising and product building in the upcoming newsletter, feel free to post your questions in this form.

QUICK ANNOUNCEMENT

Community Announcement

With your Responses to the last newsletter’s poll - we are launching our verified founders & investors slack community. As a community member, you will get access to - weekly events, daily discussions, curated resources, investors database, monthly fundraising demo day, startup deals (for investors), networking sessions & more….Stay tuned for more updates!

Need Help in MVP Development & Pitch Deck?

Pitch Deck Design: We write, design and model your pitch deck into a storyteller book within 4-5 days. Get Your Storyteller Book

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Want to build a SaaS platform, mobile or web app - we are here to help you. Build Your MVP

FEATURED POST

How To Run A Great User Interview?

Emmett Shear, the former CEO of Justin TV shared " The primary objective during the initial set of interviews is not to inquire about optimizing user flow or delve into specific features details. Such questions can be distracting because users often think they know what they want.

This situation can lead to the "horseless carriage effect," where users request a faster horse instead of seeking a solution to the underlying problem.

Thus, it is crucial to avoid discussing features as much as possible.. Read More Here

Join 14500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

The Qatar Investment Authority (QIA), the sovereign wealth fund is launching a $1 billion venture capital fund of funds. Read More

Vinod Khosla’s $37 Million Investment In Storytelling AI Startup. Read More

Paypal's Co-founder and Former CFO launched an AI-powered email assistant startup backed by Peter Theil and Sequoia Capital. Read More

Sam Altman holds an 8.7% stake in Reddit, valued at $435 million if Reddit goes public at a $5 billion valuation. Read More

Reddit plans to reserve an as-yet-undetermined number of shares for 75,000 of its most prolific Redditors. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9500+ Avid Readers!

TWEET OF THIS WEEK

Best Tweet I Saw This Week

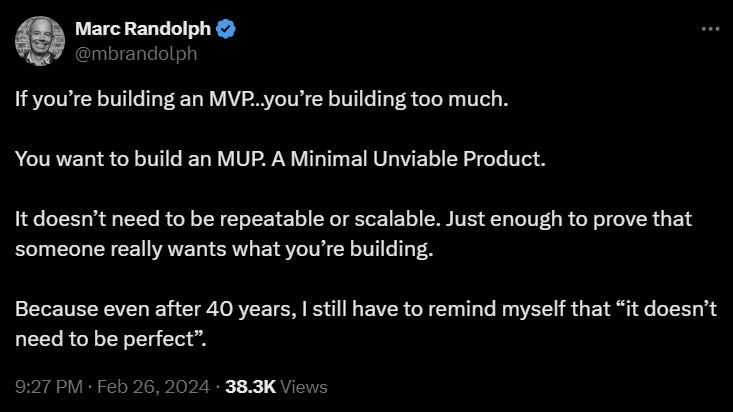

Let’s take an example to understand this. Shared by Marc -

“If I had the idea for an app which let me order groceries and have them delivered, I wouldn't need to test whether people trust me to provide their credit card (I already know that) or whether the app can accurately determine where I am (I already know that) or whether I can have a directory of every possible grocery store and their inventory (I know that is possible too).

No, I'm curious whether customers care. How frequently they use it. What prices they would pay? So I could hack that together using a no-code front end and see what happens."

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

VC Analyst - Concentrics | UK - Apply Here

Investment Professional - Cherry Venture | Sweden - Apply Here

Finance and Investor Relations Associate - Visionary Club - Apply Here

Analyst / Associate - The Legal Tech Fund | USA - Apply Here

Associate -Next 47 | USA - Apply Here

Portfolios Manager - Prime Venture | India - Apply Here

Associate - Episode 1 Venture | USA - Apply Here

Associate - Westly Group | USA - Apply Here

Analyst - Plug and play tech | Spain - Apply Here

Head of Research - EARTH VENTURE CAPITAL | Vietnam - Apply Here

Vice President - Tusk Venture Partner | USA - Apply Here

Associate- Neo | USA - Apply Here

Investment Analyst - Artha Venture | India - Apply Here

Investment Analyst - DeepTech & AI - PeakXV | India - Apply Here

→ Looking to break into VC / Want Daily Updates on VC Job Opportunities? Join VC Crafter 👇

Join our 250+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team