Successful Startups Grow Quadratically Not Exponentially. | VC & Startup Jobs.

Timeline to product-market fit & Strategy to avoid excessive equity dilution.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Successful Startups Grow Quadratically Not Exponentially

Quick Dive: Today's deep dive is a bit different—I’m answering FAQs straight from your DMs and emails.

How Do I Avoid Giving Away Too Much Equity?

How Long Does It Take to Achieve Product Market Fit?

How to Get a Meeting With An Investor ?

Major News: OpenAI spends $14M on this new ad, Trump moves to end VCs carried interest benefits, Ilya Sutskever’s startup seeks $20 billion valuation & more.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

OpenAI accidentally discovered LLMs.

How Duolingo works: 14 years of big learnings in one little handbook.

How to negotiate your first term sheet – A step-by-step guide.

Y-Combinator guide: How to design a better pitch deck.

2700+ US angel investors & VC firms contact database (Email + LinkedIn Link).

Jen Abel on when to hire Head of Sales.

Peter Yang on what software's next chapter is really about.

Bedrock’s Investment strategy: The best time to invest in a company is when it’s most in violation of a popular narrative.

Write your monthly investor update (Email Template Download).

Sam Altman’s three observations for Upcoming AGI.

Early stage startup financial model template for fundraising, simply put your numbers and get right financial model.

Questions VCs may ask you - The only guide you need.

For AI enthusiasts: Must-have resources to stay updated on AI tools, trusted by MIT students and tech professionals from OpenAI and NVIDIA.

INVESTMENT OPPORTUNITY FOR YOU

📢 This Tech Shrinks Shipping Costs by 31x—Why Investors Are Backing Smart Cups

This got me thinking: Why are companies still shipping heavy, wasteful liquid products when Smart Cups' technology eliminates the need entirely? Their patented microencapsulation tech enables major brands to create just-add-water products—from beverages to medicine and even pet care—cutting shipping costs, waste, and carbon emissions. Smart Cups licenses its breakthrough technology to established companies, helping them create sustainable, high-margin products.

Why it matters:

Shipping liquid is inefficient—Smart Cups’ tech fits 31x more products in the same space.

Huge environmental impact—cutting carbon emissions and packaging waste.

Applies beyond beverages—think medicine, pet care, and military rations.

Why I’m watching:

$11M+ in funding & patented tech.

CEO Chris Kanik won Gordon Ramsay’s Food Stars, securing a $250K investment.

2021 Time Magazine Best Inventions of the Year

Strategic partnerships with the U.S. Army & major retailers signal massive growth potential.

Now, they’re raising $2.61M to scale production and expand partnerships.

Want to invest in the future of sustainable products? Learn more →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Successful Startups Grow Quadratically Not Exponentially.

Fast-growing startups are frequently described as “exponential,” especially when the product is “viral.” But “exponential” is an incorrect characterization, even for hyper-growth, “viral” companies like Facebook and Slack.

If your model is incorrect, you don’t understand growth, which means you can’t control it, nor predict it.

— Jason Cohen

In his [long and mathematical] essay, Jason suggests an alternate model for how fast-growing companies grow. I like his thesis, so I’m going to do my best to synthesize it for you today.

Because, in his own words: …understanding the model is useful not only for predicting growth but also because understanding the foundational drivers of growth allows us to take smarter actions to create growth in our own companies.

First, he dispels the notion of “exponential” by looking at some popular companies that grew rapidly, and who often get dubbed as examples of this growth model.

Let’s take a look.

Not exponential

It’s been a minute since high school math…

Exponential growth = growing by a multiple. For example: In year 1 you grow by 10, in year 2 by 100, in year 3 by 1000.

Quadratic growth = growing by adding a constant. For example: Growing in year 1 by 10, then in year 2 by 20, in year 3 by 30.

In both, growth is clearly still accelerating, just at wildly different rates. To drive the point home:

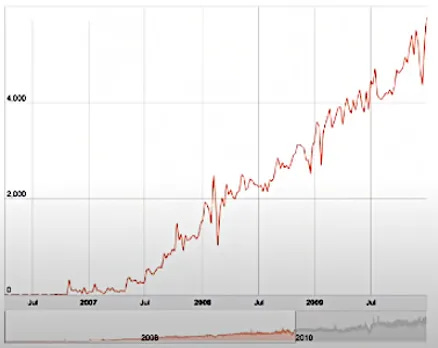

Facebook is the definition of hyper-growth—getting to $50B in revenue faster than any company in history. The product is “viral”—friends bring other friends—which theoretically leads to “exponential growth.” But Facebook didn’t grow exponentially in the number of monthly active users:

Essentially linear for nearly twenty years, only exponential in the first four years.

Slack was the fastest-growing enterprise software company ever, going from $0 to $10M ARR in their first 10 months, and 0 to 10,000,000 active users in just five years. It’s also a “viral” product—organizations invite their members, who then create their own Slack-groups and invite others. So surely Slack has exponential growth?

Slack’s own data shows initial quadratic growth, followed by years of linear growth.

— Jason Cohen

So, given there’s no proof of an exponential growth model in startups — even looking at real-world data from the fastest growing companies (he also investigated HubSpot and Dropbox) — Jason points out that in fact… hyper-growth is quadratic.

But Why Do Products Grow Quadratically?

It’s not enough to just say that growth in real life is quadratic. We have to be able to know why this model makes sense, as this will give us a better understanding of the growth drivers in our own companies.

Luckily, Jason gives us a first-principles explanation so we have that insight, using the life-cycle of a marketing campaign as an example.

In my experience, marketing campaigns follow this pattern:

At the foot of the curve, we’ve launched a new campaign, but it’s ineffective; we haven’t figured out the best design and messaging and calls-to-action for this new medium and audience. Sometimes we never figure it out, and abandon the effort.

But in the case that we unlock the secret of efficacy, the campaign rapidly reaches a natural level of contribution; in this example, a number of “sales per week.” The specific level depends on many things: ad inventory, our budget, audience receptivity, and the consonance between the audience and our target market. Next, we enter the optimization phase.

We A/B Test our way to incrementally better results. Also, we enjoy the result of multiple exposures—most people need to see the ad more than once before they act.

Finally, we enter a phase of decline. There are various causes, all instructive:

The audience is saturated. Everyone in the channel has seen the ad more times than is required to act; it’s now falling on deaf ears. Even if the audience is growing, the number of new people is small compared to the number of people who were new to us when we began the campaign

The channel declines. A popular media site loses readers through over-monetization. An event that was well-attended loses favour. A newsletter that is frequent and insightful becomes less frequent or other writers take over. A podcast moves to a closed platform and loses many listeners.

The auction becomes uneconomical. For auction-based systems like Google and Facebook advertisements, or other zero-sum programs like affiliates or limited-inventory spots on newsletters or podcasts, the winner is the one who will pay the most. What is cost-effective for one bidder will be laughably overpriced for another, due to better conversion rates, higher revenue per customer, higher profitability per customer, or due to categorization as a “loss leader” or other way of ascribing value beyond immediate pay-back.

In my experience, marketing campaigns follow this pattern:

He calls this…

Whether it’s a marketing campaign or a new product release, growth initially accelerates as early issues are solved, then grows roughly linearly as things are optimized, and then starts dipping over time. That slowdown/decay is natural as things scale.

But, we don’t do single campaigns or releases, do we…we add new ones. Some end up being bigger than others, some can be better optimized, or decline sooner, and some decay more steeply than others.

So, companies that want to continue growing quickly after their first product reaches scale, must launch new products into new markets.

This leads to a variety of Elephant Curves across time —which, if plotted together — look very quadratic.

Okay, so what? What’s the advice for founders?

The consequence of knowing that the growth we encounter at work is quadratic is important, as we’re all trying to understand (and likely change) growth drivers. So, “getting the right language, and the right model, will lead to correct analysis, and right action.”

And to leave you with something more actionable here:

It’s great to add a feature to an existing product, but significant additional growth comes from increasing carrying capacity or creating a new avenue of growth. Early on you should focus on winning market share in one space, creating the first Elephant Curve, but after the product matures, something more drastic is required: Wholly new products, or updates significant enough to address new markets.

It’s well-known that companies need to add additional products to continue fast growth after achieving scale. However, the second product is highly unlikely to achieve the same market share and monetary scale as the first, so there needs to be multiple, not just one. This requires serious investment, parallel efforts, and the chutzpah to kill off the ideas that aren’t working.

Because word-of-mouth-driven growth is so much more effective than marketing-driven growth (both in cost-per-customer and in that unlike direct advertising it grows automatically as the company grows), it is worth a great deal of time trying to figure out how to build that into the product, rather than relying only on the marketing team.

STARTUP INVESTMENT WORTH EXPLORING

🤝 Solving a $200B Industrial Energy Problem: Why Investors Are Backing PowerBox

What got my attention: PowerBox Technology is tackling a massive, costly problem for industrial manufacturers—grid instability, high energy costs, and inefficient renewable integration. Instead of relying on expensive and unreliable backup systems, their modular hardware and AI-driven software work together to prevent disruptions, lower energy bills, and make renewable energy seamless for factories.

Why it matters:

Grid instability causes millions in lost productivity for manufacturers.

Smart energy management lowers costs while improving efficiency.

Seamless renewable integration moves industries toward sustainability.

Why I’m watching:

Three active pilots, including a packaging factory losing 1-2% of sales due to grid instability.

Backed by the University of Illinois, NASA, NSF, and top industry advisors.

Equity crowdfunding campaign nearing $55K, with additional investment commitments.

They’re raising $500K to scale their solution and bring PowerBlock to market in 2025.

💡 Want to invest in the future of industrial energy? Learn more →

📃 QUICK DIVES

Today's deep dive is a bit different—I’m answering FAQs straight from your DMs and emails! Got a question? Reply here or shoot me an email.

1. How Do I Avoid Giving Away Too Much Equity?

This is one of the most common question I received in my DMs. So here’s the answer - don't raise so much money from investors.

I know, I know. How do a bunch of VCs get away with suggesting to founders that they should be raising LESS VC money? Who do we think we are, anyway?

Most people in the tech startup ecosystem have been conditioned to believe that VC funding is the golden ticket to startup success.

But here's the kicker: many wildly successful companies either didn't raise VC money, waited to raise, or barely touched what they raised. Yes, really. For example, way back in the day...

The Microsoft Model

When Microsoft launched in 1975, founders Bill Gates and Paul Allen opted not to raise VC funding. When they finally took their first (and only) VC investment 5 years later, it wasn't because they needed the money.

They took the investment because the lead investor was a friend and advisor. As of 2014, that investment was still in Microsoft's bank.

They never spent it.

"Ok, ok," I can hear you think. "That was like 100 years ago. No way you could build a massive company without tons of VC funding today."

Well...

What about Babylist?

Babylist started as baby registry in 2012. And now, 14 years later, the brand includes a growing media business, a thriving content marketing machine, a showroom that’s become a destination for expecting celebrities and influencers, and a health and wellness platform.

And founder Natalie Gordon basically bootstrapped the biz until 2021, when she raised a $40m Series C round.

For the first 11 years of the business, Babylist's strategy was straightforward:

build something her users truly needed

ship quickly

earn revenue

re-invest the revenue back into the business

Since she didn't have a bunch of investors hounding her to hit outrageous growth milestones, Natalie was able to prioritize profitability and user-experience.

Because Babylist's growth depended on their revenue – not outside funding – hiring was slower than at VC-backed competitors. And that allowed Natalie to ensure that every employee on the team was aligned to the same mission: build for the customer.

And ultimately, this was her moat.

Plus, Natalie could take her time determining how to take the business from a baby registry into the empire it is today.

And when Natalie was finally ready to raise the big Series C round, she didn't suddenly get diluted out of her own company.

Pretty cool, right?

Then there's same case for Tuft + Needle

VC Money Comes with Strings

Let's get real about VC money.

When you take VC money, you're not just getting cash; you're selling a piece of your company.

It can also lead to:

Pressure to achieve rapid growth at all costs.

Misaligned incentives between founders and investors.

A focus on vanity metrics rather than sustainable business practices.

It's like trying to turn your startup into a race car... when maybe what you really need is a good 'ole minivan.

So, what's the move?

Many of you reading this might think that your only course of action is to raise from VCs. But that may not be the case.

Here are some tips to keep your startup lean:

Focus on unit economics from day one. Understand your costs and revenue at a granular level.

Wait to hit certain revenue milestones before hiring additional teammates.

Explore alternative funding sources like revenue-based financing, crowdfunding, or bank loans.

If you do need to raise VC money, approach it strategically. Raise what you need, not what you can get.

It's highly plausible that having a lean mindset mentality will force you to grow without outside capital. And when you don't need capital, that's when the investors come running.

That is a powerful place to be, indeed.

2. How Long Does It Take to Achieve Product Market Fit?

In my experience, it roughly takes 1-5+ years. And "it's much easier to do this with a small team, low burn, and extreme focus"

- Michael Siebel, Partner-YC.

Harsh Truth: 3 out of 5 startups would never find their PMF, and would fail.

How to determine if you have the Product/Market Fit?

People often say funnily, "Product-market Fit is like porn...when you see it, you just know." In qualitative terms ...

"When the customers aren’t quite getting much value out of the product/service, word of mouth isn’t spreading, usage isn’t growing that fast (spikes in the months where you advertise), press reviews are kind of “blah”, the sales cycle takes too long, and most of the deals never close" - Marc Andreessen.

Most startups that have raised ($5-$10 Mn) Series A funding, assume they’ve got a product-market fit, just because they’ve raised funding. They're wrong, why do you think 70% of startups that raised Series A still fail, because the no.1 reason was lack of PMF!

You have it ...

On a high level, you've found product market fit when you can repeatably acquire customers for a lower cost (CAC) than what they are worth (LTV) to you.

- Elizabeth Yin

“You can always feel when Product/Market Fit is happening. The customers are buying the product just as fast as you can make it - or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company's account.

You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.” - Marc Andreessen

When product-market fit occurs something magical happens, all of a sudden your customers become your salespeople i.e. they sell for you. - Josh Porter.

3. How to Get a Meeting With An Investor ?

Few days back, one of founder send me DM asking what can fundraising founders do to increase their chances of getting a meeting? Here are 4 things you can follow to increase your odds of landing a meeting with a VC:

1. Keep it short

Most investors are constantly on the go, checking email on their phone between meetings.

They likely won’t have time to read a 5-paragraph essay that outlines your company’s mission, business model, value prop, fundraising goals, and traction.

My recommendations:

Include one sentence about the problem you're solving + your solution

Use a few bullet points to indicate the value prop, pilots, and/or traction

End with a clear call to action, like “Do you have time for a 15-minute call to talk about fundraising?”

2. Get a warm intro

Investors are 93% more likely to take a meeting with someone who has been

recommended to them.

But not everyone has a second-degree connection to an investor. So, how do you make a warm intro out of thin air?

One tactic is to reach out to one of the investor’s portfolio company CEOs.

Start by introducing yourself to the CEO and asking for their advice on something startup-related (see #1 for tips on getting a response).

Then, once you’ve developed a relationship with her, ask the CEO for an intro to their investors.

When an investor gets an introduction to an emerging startup from one of their star CEOs, they’re more likely to take you seriously.

3. Do your research

VCs often tailor their investments around a certain type of business. Their focus could be an industry (VR vs. marketplaces), founder profile (female founders vs. founders in a specific region), or size (pre-seed vs. Series A).

Many VCs won’t take the time to respond to emails from startups that aren’t in their sweet spot, let alone take a meeting with them.

As one investor told me, “I’m far more likely to book a meeting from a cold email that seems like it could be a good fit for my firm’s mandate than I am to book a meeting from a warm intro to a company that isn’t a fit.”

4. Reduce Your Red Flags

VCs assess startups quickly to decide if a meeting is worth their time. Certain red flags can make them pass instantly:

The founder isn’t working on the business full-time.

The revenue model relies entirely on ads.

The team appears distracted by multiple projects instead of focusing on the core business.

A similar company is already in their portfolio.

The startup requires massive funding just to launch an MVP.

The valuation is unrealistically high.

These red flags vary from fund to fund. Do your research (see tip #3) to understand what different VCs consider deal breakers.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

President Trump urged Republican lawmakers to eliminate the carried interest tax break, which allows private equity and venture fund managers to pay lower capital gains tax rates on investment earnings.

Safe Superintelligence, founded by former OpenAI chief scientist Ilya Sutskever, is in discussions to raise funding at a valuation of at least $20 billion, a fourfold jump from its $5 billion valuation last September.

DeepSeek’s R1 model can be manipulated to generate harmful content, including bioweapon attack plans and self-harm campaigns, according to The Wall Street Journal.

OpenAI debuted a $14 million Super Bowl ad showcasing AI as a natural evolution of human innovation, highlighting practical ChatGPT applications like business planning and language tutoring.

Elon Musk stated he is “not chomping at the bit to acquire TikTok,” denying reports that he had bid for the app despite speculation following Trump’s push for a forced sale.

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

VC Associate - Octant Venture | USA - Apply Here

Visiting Analyst Venture Capital - neotech venture | Germany - Apply Here

Senior Director of Marketing and Communications - Aegis Venture | USA - Apply Here

Analyst, Office of the CEO - Energy Impact Partner | USA - Apply Here

Ventures Associate - Crypto - Plug and Play tech Centre | USA - Apply Here

Community and Office Manager - Rackhouse | USA - Apply Here

Venture Capital Associate - Connecticut Innovation | USA - Apply Here

Investment Operations Analyst - ACE Venture | USA - Apply Here

Venture Analyst - Hearst Venture | USA - Apply Here

MBA Venture Capital Associate Intern - DRW | USA - Apply Here

Venture Capital Fund Controller - Spring Tide Venture | USA - Apply Here

Director of Investor Relations - Navitas Capital | USA - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Nice insights!