Silicon Valley's Cargo Culting Problem - Wearing A Black Turtleneck Doesn’t Make You Steve Jobs | VC Remote Jobs & More

Silicon Valley's Cargo Culting Problem In AI...

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Today At Glance

Deep Dive: “Wearing A Black Turtleneck Doesn’t Make You Steve Jobs” - Cargo Culting Problem

Featured Tweet: Investors Are Looking For Market Opportunity, Not Just Size!

Major News In Ecosystem: Apple's Vision Pro Struggling, Musk Denies Report Of Raising Money For AI Startup & Reddit IPO in March 2024.

Must Read on Startups, Venture Capital & Technology

VC Jobs & Internships: From Scout to Partner

FROM OUR PARTNER

The Portfolio Intelligence Platform, Vestberry For Data-Driven VCs

Vestberry consolidates vital portfolio information and turns it into powerful analytics, enabling venture capital professionals to concentrate on extracting valuable insights from their data rather than managing it.

Expand your VC Network for the next fundraising!

Grab this free list of 6000+ LPs investing in Venture Capital for 2024. Grow your connections and unlock new opportunities.

🤝 PARTNERSHIP WITH US!

Want to promote your startup to our community of 21,500+ entrepreneurs and investors? Fill out the form, our team will reach out to you.

🎉Get A Discount of 20% For Multiple Ads

TODAY’S DEEP DIVE

Silicon Valley's Cargo Culting Problem

“Wearing A Black Turtleneck Doesn’t Make You Steve Jobs!”

When it comes to building a startup you’re never doing it entirely from scratch. Inspiration and ideas can come from a variety of places, including other successful startups.

But there’s a thin line between borrowing smart ideas and copying them blindly - otherwise known as Cargo Culting.

In simple words, Cargo Culting is copying something without understanding why you're copying it. That’s where most founders fall into the trap. Even in recent times, startups are following blindly other AI startups that are not even successful because they raise millions of dollars.

If you are wondering about the Cargo Culting word - This term originated from the practice of creating fake landing strips to attract aeroplanes without understanding the reasons for the attraction.

In the classic variety of cargo cutting, the founder’s mentality is “It's just I'm going to copy something, don't know why but I'm going to copy it and then I will be as successful as the thing I'm copying.” Almost all founders think this.

However, in the modern new age of Cargo Culting, there is a question of whether the thing being copied is worth copying at all. This one misses some obvious aspects because they don't deeply understand the product they are copying.

If you look at some of the companies that had classically covered Culting:

In 2000, Every Startup Was Obsessed With Google.

“Everyone seemed fixated on Google's practices – whether you were the next Google or striving to emulate their success. Ideas, good or not, were trained to lean towards mimicking what Google did.

The most apparent trend was replicating their office culture: open spaces, bright colours, and free snacks. This "Googly" vibe became a benchmark for startups, as if mirroring Google's office culture was the key to real success.

The absence of traditional offices, the flat organizational structure, and the mantra of hiring as many smart engineers as possible were also part of this emulation.

Even down to the details like cute startup names with dropped vowels and logos reminiscent of Google's style, complete with lens flares, were considered crucial. In the pursuit of building the world's best search engine, it became evident that replicating Google's office culture and aesthetics played a vital role.”

The second one is Facebook.

“They're the pioneers of going viral. So for every startup founder/investor “going viral” became the question and everyone tried to follow Facebook’s playbook without thinking this copy was good or bad.

Also, Facebook introduced the concept of the share button – a must-have on everything. Another classic from Facebook was avoiding direct user revenue and focusing on building a massive user base, then transitioning into an ads business.

This was the mantra, universally accepted – follow the Facebook Playbook, regardless of the business type. Charging users was frowned upon; the goal was to accumulate vast user data. The prevailing belief was that privacy didn't matter, a notion blindly followed by many without thinking it was right or wrong.”

The last one is “Spend Like Uber.”

“It all started with the notion of spending as much money as possible – a strategy that, amusingly, became a key takeaway.

The concept of cargo cutting emerged, where people imitated Uber's actions without understanding the reasons behind them. Uber did well in what it did, but the folly lay in blindly copying its superficial actions – scaling without comprehension, burning through funds, ignoring laws, and neglecting unit economics.

The desire to be like Uber led to some rather silly endeavours by those who didn't truly grasp the essence of Uber's success.”

The most interesting thing is that all these startups - Google, Facebook or Uber worked very well and are pioneers today but the startup that followed Cargo cutting just died in a few years. So what makes these three startup to be pioneers?

Because - they knew what they were doing without copying/following the Cargo Culting strategy.

For Google, hiring really smart people was crucial because they were tackling a challenging problem. Before Google, there was a misconception that search was a commodity, but Google proved otherwise with its technical breakthroughs. They hired talented engineers after the dot-com bubble crash, making perfect sense in a historical context.

Facebook's decision not to charge users but to focus on building an ad business made sense for their scale. However, blindly copying their playbook didn't lead to the same success. Going viral, a great strategy for Facebook, might not work for everyone. It's easier when users spend hours daily on your platform, unlike products with shorter usage times.

Uber's common beliefs were often inaccurate. Investors funded markets with good unit economics, not ones burning money. Copying Uber's expansion strategy without understanding market dynamics didn't work. Uber succeeded because it provided immediate value, not by superficial imitation. Replicating success is challenging; it requires genuine understanding and smart execution.

So “Wearing A Black Turtleneck Doesn’t Make You Steve Jobs or Successful like Apple.” If you are copying someone, the most important thing to understand is whether it’s good or bad.

Also even if you look at current AI hype, What worries me more with the surge in valuations is - founders copying companies that haven't succeeded yet. It's alarming when founders adopt strategies simply because a company raised a significant round or gained attention.

When I asked about some companies in pitching, the common response is often "I have no idea." As a CEO, betting your company's strategy on limited information from fundraising announcements or podcast interviews seems risky.

Copying something that's working might bring luck, but copying something that's not working is questionable. The inflated valuations seem to have skewed perceptions. Assuming a company is successful just because investors value it at a billion dollars is misguided.

I've seen many influenced by the likes of WeWork or Zoom Pizza, blindly copying strategies based on fundraising rather than business success.

Unfortunately, this often leads to flameouts for the founders who followed such trends.

Interestingly, there's a growing trend among startups where they engage in modern cargo quilting. The focus shifts towards the superficial – how the startup appears to others. It's all about the logos, as we discussed earlier.

Founders feel the need to mimic other startups to create a certain perception. The superficial checklist includes raising money, having notable advisors, and even getting a patent. A killer pitch deck becomes crucial, along with the ability to pitch the company anywhere. Attending conferences and securing press coverage are deemed essential. These are actions taken by founders not necessarily for the users but to impress themselves and other founders.

It's all about creating a startup image that aligns with what's perceived as successful.

The key takeaway here is that while innovation is important, it's also crucial to recognize the value of learning from existing successful companies.

Founders should begin by understanding what users want and identify the companies that users are currently paying for similar services. By studying these successful companies, founders can gain valuable insights.

It's essential to view the business through the eyes of the user. For example, do users prioritize the Google logo, or do they value getting accurate search results quickly? Similarly, for Facebook, is the focus on the platform itself or on staying connected with friends and receiving timely updates? When founders prioritize understanding user needs, they are more likely to make essential decisions.

Starting with a user-centric approach avoids getting caught up in superficial details and allows for a more meaningful assessment of what truly matters to the users.

This user-focused mindset is a more effective way to navigate the complexities of building a successful business compared to starting with fundraising announcements, which can be challenging and may lead to overlooking the core aspects that drive user satisfaction.

So overall - Don’t follow Cargo Culting….

FEATURED TWEET

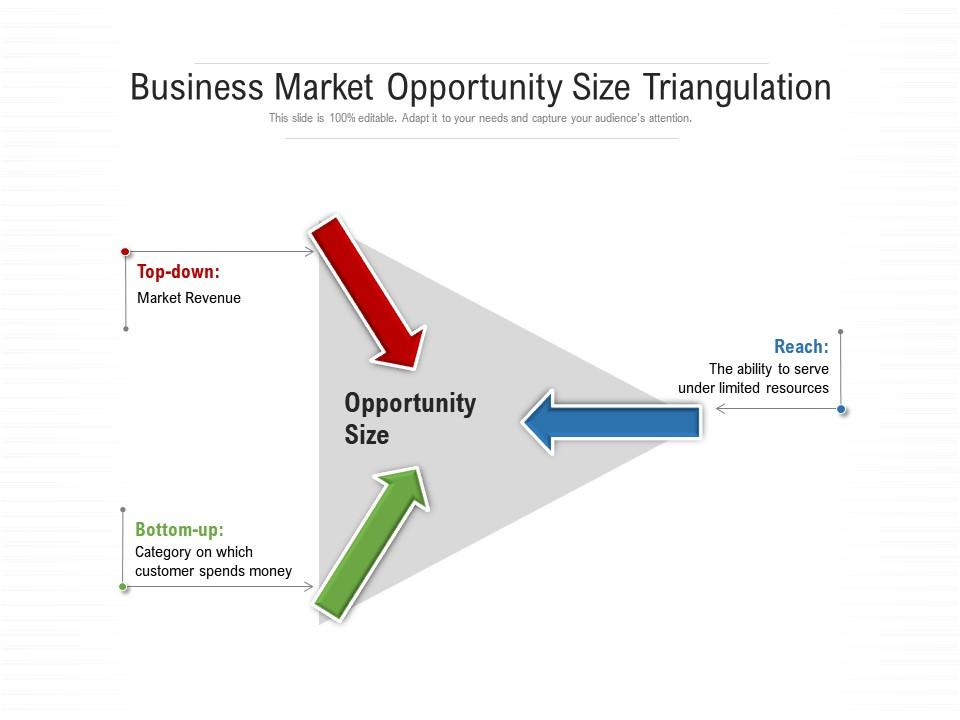

Investors Are Looking For Market Opportunity, Not Just Size!

"The typical market-size slide is obsolete." VC Partner. Why?

Market slide often misses the mark due to a standardized approach by pitch coaching. This template mandates the inclusion of TAM, SAM, and SOM in three bubbles.

It’s clear why entrepreneurs try to pump up their market size. They’ve been told that VC is only interested in unicorns, and so they assume that the best way to become a unicorn is to go for the largest market… Read More Here

Join 13,500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Apple’s Vision Pro is Struggling as YouTube, Netflix, and Spotify, along with Meta, have chosen not to build for the platform. Read More

Reddit is reportedly planning to go public in March, joining a wave of IPOs in 2024 that includes Circle and Shein. Read More

With thousands of Disney’s mass layoffs, CEO Bob Iger walked away from 2023 with a salary of $31 million. Read More

VC Firm closing million dollar funds to focus on sustainability. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 8500+ Avid Readers!

WHAT I READ THIS WEEK

Must Read on Startups & Venture Capital

One Type of Founder Investors Hate Funding Read More (Startups)

TAM - that's Totally A Made Up Number. Read More (Startups)

Don't track LTV/CAC; Instead track LTV/CACD, Why? Read More (Startups)

Why Entrepreneurs Try To Pump Up Their Market Size? Read More (Startups)

NASA’s X-59 Fly Faster Than Speed Of Sound Without Any Noise. Watch Here (Technology)

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

MBA Summer Associate - Emerson Collective | USA - Apply Here

Associate - Leran | USA - Apply Here

Associate - NextGen Venture Partner | USA - Apply Here

Senior Investment Associate, India - B Capital | India - Apply Here

Senior Associate, Blue Ivy & Nassau Street - Alumni Venture | Apply Here

GP - Outside VC | USA - Apply Here

Associate / Senior Associate - Millennium Technology | USA - Apply Here

Investor Relations Manager - Frontline | UK - Apply Here

Investment Associate -Neo | USA - Apply Here

Associate - Frontline | UK - Apply Here

Intern - France | France - Apply Here

Investor Relations Manager - Cusp Capital - Apply Here

VC Intern - Muse Captial | US - Apply Here

Marketing Manager - Struck Capital - USA - Apply Here

Senior Associate -B Capital | India - Apply Here

→ Want Daily Updates on VC Job Opportunities? Check out VC Crafter 👇

Join our 200+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team