PMF Score Vs NPS & Sequoia Capital's Runway Reality Check for Founders | VC Jobs

Runway Reality Check for founders & Sam Altman's Startup Pivots Framework

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: PMF Score vs. NPS

Quick Dive:

Sequoia Capital Framework: Reality of Startup Runway.

Sam Altman: Successful Pivots Typically Fall Into Two Categories.

8 Signs Your Startup Is a Zombie and 3 Things to Do About It.

When You Should (and Shouldn’t) Split Equity Evenly?

Major News: Ilya Sutskever Leaving OpenAI, Instagram Co-founder Joined Anthropic, Real Estate Tycoon, McCourt Bids For TikTok US & Sony Music's Legal Notice To 700 Companies For Using Artist Music.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH PORTLESS

The only thing that should be floating on the water this summer is you, not your inventory 🏖️

With Portless, you can ship orders directly from China in just 6 days, 3x your cash flow, and improve lead time by 10x.

Say goodbye to the lengthy 45-90-day wait for restocks. Now, you can replenish your best-selling items in just 3-5 days.

Ready to skip the ship and go Portless? Contact us today and receive 20% off your pick-and-pack fees during your first three months.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

PMF Score vs. NPS (Product Market Fit Score Vs Net Promoter Score)

One of the common mistakes seen with NPS (Net Promoter Score) is that it is used at the wrong time by most of the founders. Combine this with the fact that it is also a lagging indicator and you get not only misrepresented information but you get it, way, way too late. But there is a simple way to help you make it more effective.

Enter Product Market Fit Score

PMF score simply measures how well your product is meeting your users’ needs.

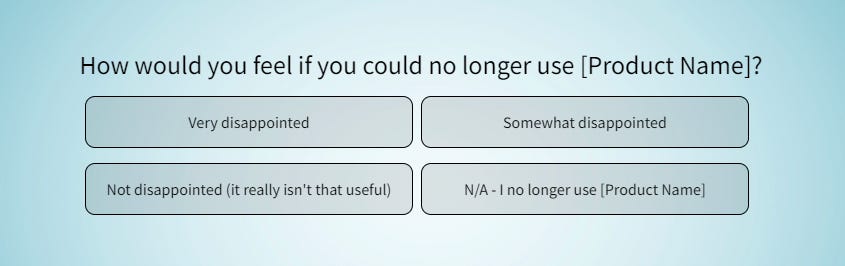

To use it, ask your users how disappointed they’d be if they couldn’t use your product anymore and give them the options of “Very”, “Somewhat”, and “Not at all”

You want over 40% of qualified responses to pick “Very” — that’s an indicator that you’re meeting the core needs of enough users to start hitting actual PMF, which is notoriously tough to measure.

For example -

In 2007, Marc Andreessen, the co-founder of Netscape and a prominent venture capitalist, made a statement that has become a central criticism of the PMF (Product/Market Fit) score.

“You can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can.”

Basically, you’ll KNOW when you hit PMF without needing a survey to tell you. But the PMF score is still useful as an indicator, before you hit PMF, of whether you’re trending towards it or not. If 28% of responses last month were “Very” but this month it’s 31%, keep doing what you’re doing.

Also — the PMF score was originally created by Sean Ellis, the former Head of Growth at Dropbox who’s also founded multiple startups that were eventually acquired.

When to Use PMF Score

This may seem obvious, but the PMF score is most useful when you’re actively trying to find PMF (either in the early stages of a new idea, or when you’re navigating a pivot).

But this doesn’t only mean in the early days of your startup. When I worked at Uber in 2017 we used PMF score for new product launches, even though it was years after Uber’s core ridesharing service had found PMF.

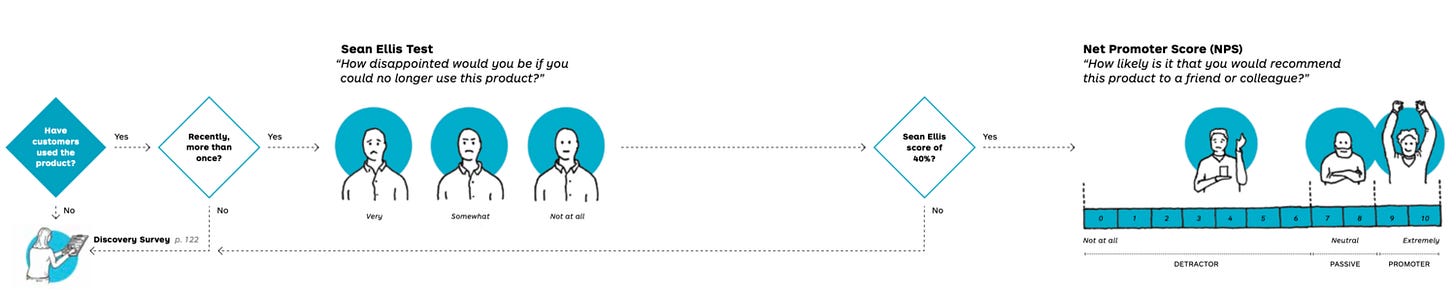

Another, often overlooked point about PMF score is that you should only care about responses given by people who have used your product recently and more than once.

Source: Testing Business Ideas by David Bland

A PMF score from a new user who’s only gone through your signup flow is useless (and not filtering those out can skew the results).

If they haven't experienced the core value proposition recently and more than once, use a discovery survey instead. Include a call-to-action for customer interviews to understand why they signed up. A signup shows the "what" (quantitative), but not the "why" (qualitative).

If they answer "somewhat" or "not at all" disappointed, don't give up. Segment them into groups and dig into why by interviewing them, looking at referral sources, to understand why the value proposition isn't resonating.

Source: Testing Business Ideas by David Bland

On the other hand, Net Promoter Score (NPS) measures how likely customers are to recommend you and classifying users as Promoters (9-10), Passives (7-8), or Detractors (0-6) based on their response. A higher percentage of Promoters indicates stronger customer loyalty. If they do recommend, it drives growth and saves on paid marketing costs.

For Example -

There is much debate on what a good NPS score is depending on the industry, but basically, you are looking at the following calculation:

% PROMOTERS - % DETRACTORS = NPS

Source: Testing Business Ideas by David Bland

If 50% are Promoters, 30% are Passives, and 20% are Detractors, the NPS would be 30 (50% - 20%).

Even with NPS tests, teams often face the situation of customers being extremely likely to recommend the product, yet not being disappointed if the product goes away, resulting in an awkward silence.

This situation happens all too frequently because we aren’t using the appropriate forms of customer research in the correct sequence. You also need to go way beyond surveys but I digress. You can solve this issue only by asking NPS after you’ve found product market fit, which you can help diagnose using the Sean Ellis Test.

If customers recently experienced your core value, use the Sean Ellis Test for fit. If they're not disappointed if your product went away, find out why. If disappointed, use a Net Promoter Score survey later to see if they'd recommend it.

If likely to refer, make it easy with referral programs and make them product ambassadors.

With tweaks to sequencing experiments and discovery, you'll understand customers better.

Nobody wants customers who don't care if your product goes away, but will still recommend it to friends.

So Overall:

PMF (Product Market Fit) Score

Definition: The PMF score measures how well a product is meeting users' needs.

Key Question: "How disappointed would you be if you could no longer use this product?"

NPS (Net Promoter Score)

Definition: NPS measures customer loyalty by asking how likely they are to recommend the product.

Key Question: "How likely are you to recommend this product to a friend or colleague?"

When to Use Each Metric

PMF: Most useful when seeking product-market fit, especially in the early stages or during pivots.

NPS: Suitable for measuring customer satisfaction and loyalty at any stage of product development.

QUICK DIVES

1. Sequoia Capital Framework: Understanding Startup Runway

Many founders make mistakes when calculating their runway period. Sequoia Capital has shared a simple framework that can help founders think beyond the basic runway calculation equation. It covers -

Calculating your current runway?

Determining how much runway you actually need? and

How to extend your runway if you need more time?

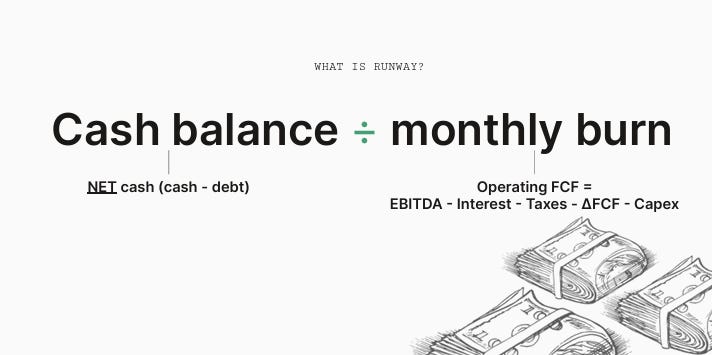

Calculating Runway:

Runway is calculated as your cash balance divided by your monthly burn rate. However, it's important to use your net cash balance, which is your cash on hand minus any debt you've drawn. Debt is borrowed money that you owe creditors, so it should not be counted as part of your runway calculation.

The monthly burn rate is different from net income - it accounts for cash inflows and outflows, including inventory purchases, capital expenditures, and upfront revenue collection.

Determining Needed Runway:

Runway needs to be evaluated in the context of meeting valuation milestones for your next fundraising round. Your runway should allow enough time to hit the fundamental metrics (ARR, gross profit, etc.) required to raise at your desired valuation, whether an up round, flat round, or reaching cash flow positive.

Many founders are 3-4 years away from their last valuation milestone but have less cash runway than that.

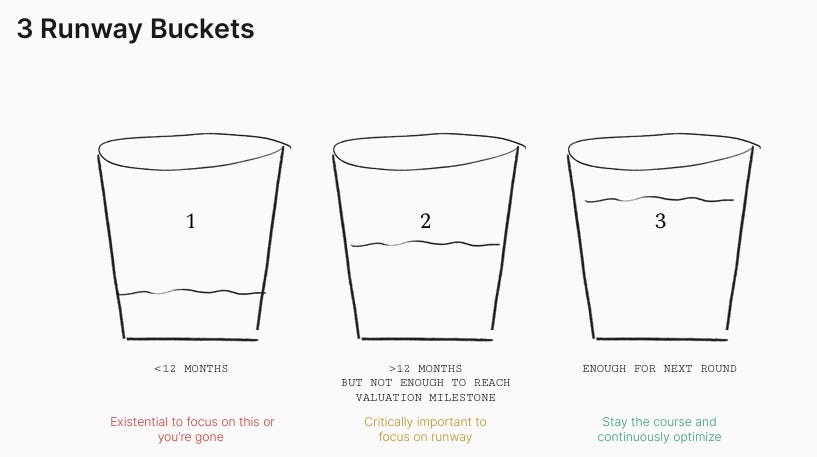

Generally, companies are into three buckets:

<12 months runway (existential focus on extending)

12+ months runway but not enough for a flat round

Enough for a flat round, up round, or cash flow positive

Most founders think they are in Bucket 3 but are likely in Bucket 2, needing to manage their runway carefully.

Extending Runway:

To extend the runway, deeply analyze your P&L to identify the biggest areas of cash burn. Prioritize high-impact changes even if they are difficult to execute. Set a realistic goal for how long it will take to hit the milestones for your next round, then target having 12 months more than that timeframe.

Making the difficult decisions to significantly reduce burn (e.g. layoffs, exiting markets, raising prices) will be painful but put the company in a stronger long-term position.

Key Takeaways:

You likely need more runway than you think

Your next round valuation will be based on real metrics and financials, not just the story

Most companies in Bucket 2 need to proactively extend the runway

Executing on reducing burn will position you for long-term success

2. Sam Altman: Successful Pivots Typically Fall Into Two Category.

“Pivoting in the business world has become a bit of a buzzword, hasn't it?

It's almost like a shiny badge of honour that some wear proudly. The whole concept revolves around changing course when things aren't going as planned, and there are people out there who actually brag about how many times they've pulled off a pivot. But let's just pause for a moment and really think about what this means.

Pivoting, in essence, is a sign that things didn't go according to plan, in simple words - it’s a failure!

It's a recognition that the initial strategy or idea didn't pan out as expected. And you're right, failure is undeniably part and parcel of the entrepreneurial game. It's important to be tolerant of failure, not holding it against anyone, and certainly not turning it into a celebration.

However, there's a fine line between acknowledging failure and glorifying it as a success. Some entrepreneurs proudly wear the badge of multiple pivots, almost boasting about how many times they've changed direction.

But here's the thing – pivoting a startup is sucks, plain and simple.

The focus should be on learning from it and avoiding the repetition of the same mistakes, rather than treating it as a badge of honour.

Great startups, the ones that truly succeed, don't necessarily see pivoting as a badge of honour. They view it as a learning experience that contributes to building a potentially successful business.

Not all pivots are created equal, and the distinction lies in the reasons behind them.

If you look at some great startups that pivot you will find that - there are two types of pivots that tend to be more successful and make total sense.

First, there's the pivot where the founder ends up building something they were passionate about from the start.

Take Instagram's Kevin Systrom, for example. His initial venture, Bourbon, wasn't working out. During a vacation, he built something he was genuinely passionate about—photography with filters. This pivot worked because it aligned with his true interests.

The second type of pivot that makes sense is born out of necessity.

Consider Airbnb's founders during the financial crisis. They were broke, maxed out credit cards, using plastic sheets to keep track of them—real desperation. In this dire situation, they rented out a spare room to make ends meet. This pivot was out of sheer survival, and it worked. Today, Airbnb is known for more than just spare rooms; it's a significant player in affordable housing.

However, the common type of pivot, where founders sit down, realize their startup isn't working, and brainstorm a new idea on a whiteboard, rarely succeeds.

Why? Well, if you're rushing to come up with an idea, chances are it won't be a good one. Moreover, if you already have investors, you need a plausible-sounding idea to present to them.

It's fine to have a good idea that initially sounds bad, but pivoting into such an idea is tougher.” Sam Altman Here

3. 8 Signs Your Startup Is a Zombie and 3 Things to Do About It.

Knowing when to quit and when to stick with it is a key skill for all startup founders.

Even the best investors in the world aren’t right all the time. So most investors apply a portfolio approach (Simple word — Broad Portfolio) to spread their risk and increase the chances of backing a billion-dollar opportunity — Power Law Guys….

In any investor’s portfolio, you have three types of startups: the dogs, the stars, and the zombies.

Dogs run out of cash before finding a scalable business model. These companies return nothing to the investors.

Stars are the home runs — the investments that generate 10x returns and make up for all the dogs.

Zombies are companies that are neither dogs nor stars. They make revenue, perhaps enough to break even, but not enough to generate a huge return for investors. Their growth seems stagnant and they can’t consistently generate more revenue than costs. They are constantly raising money, are focused more on investors than on customers, and rarely have a unique value proposition that generates exponentially more value for customers than existing solutions. Investors see zombie startups as no longer attractive, and not worth a follow-up investment — which can be the kiss of death for those companies.

What Creates a Zombie

If you have read a book by Seth Godin titled The Dip: A Little Book That Teaches You When to Quit (and When to Stick).

Godin’s main idea is that in order to be the best in the world, you must quit the wrong stuff and stick with the right stuff. In the case of startups, it says that after some initial traction, there comes a dip.

From there, one of two things happens:

The dip bounces back and starts to trend upward to scale, or the dip turns into a cliff and never bounces back. Godin proposes that at the bottom of the curve — in the dip — founders have to choose to double down or cut their losses.

The ability to know when to hold them and when to fold them is the difference between dogs and stars.

Zombies happen because some founders get caught up in the dip, and neither flame out nor take off to greatness.

How to Tell If Your Startup Is Doomed

There are many signs that can alert a founder (or investor) that a startup is stalling and zombie-bound. But the following signals can show that you may be in a zombie phase:

You don’t want to get out of bed in the morning.

You don’t want to go out in public for fear you’ll have to explain what you do.

You haven’t hit 10 per cent week-over-week growth on any meaningful metric (revenue, active users, etc).

You’ve been working on the same idea for more than a year and still haven’t launched.

You’ve launched a consumer service and have less than 2 per cent week-over-week growth in signups.

You’ve launched an enterprise service and have less than 2 per cent week-over-week growth in the revenue pipeline.

You are the CEO and hole yourself up in the offices so you don’t have to talk to employees and can read TechCrunch.

You’ve hired consultants to figure out revenue, culture, or product in a company of less than 10 people.

What You Can Do About It

Accept it. Call it a day, or as some founders choose to, flame out big. Double down on your efforts and fail large instead of quietly fading away.

Pivot one of the parts of your business model. To become a startup unicorn, you likely need an exponential advantage in one of these areas to shift from zombie to star (think: Netflix offers 10x the entertainment of a movie theatre for less than half the cost). There are lots of examples of how a pivot evolved from a zombie into a star: Yelp, YouTube, PayPal, Flickr, Groupon, and Shopify.

Organize an acquihire and make lemonade from your lemons. Sometimes, others can leverage what you have built to drive growth in their business. This is often done through an acquihire (buying a company as a means of hiring that startup’s people). While this may not be an optimal outcome, it is often the best choice for zombies.

Unlike on the TV show The Walking Dead, zombie status isn’t forever. There are examples of startups pivoting and becoming stars (and many more examples of startups pivoting and becoming dogs).

But what’s more important is that the decision you make is making a decision. Do not delude yourself.

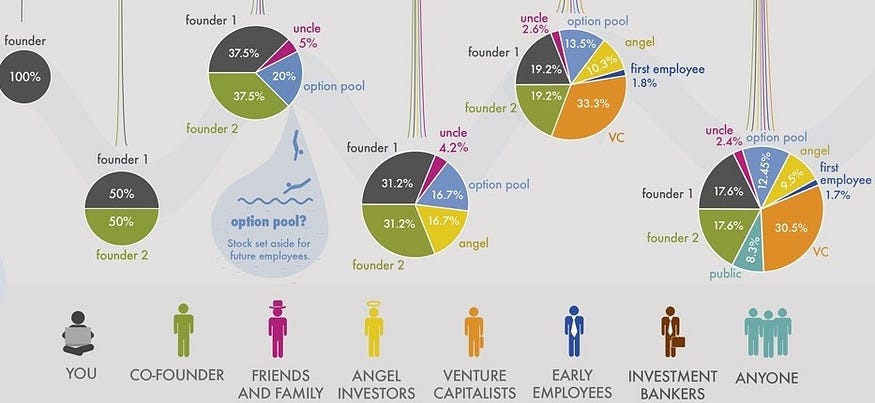

4. When You Should (and Shouldn’t) Split Equity Evenly?

Founders often ask how they should split equity with their co-founders….

If you search the web on this topic, you will see horrible advice, typically advocating for significant inequality among different founding team members.

A lot of founders follow this trend because of the following reasons:

I came up with the idea for the company

I started working months before my co-founder

This is what we agreed to

My co-founder took a salary for n months and I didn’t

I started working full-time & months before my co-founder

I am older/more experienced than my co-founder

I brought on my co-founder after raising n thousands of dollars

I brought on my co-founder after launching my MVP

We need someone to tie-break in the case of founder arguments

Founders tend to make the mistake of splitting equity based on early work.

All of these lines of reasoning screw up in four fundamental ways:

It takes 7 to 10 years to build a company of great value. Small variations in year one do not justify massively different founder equity splits in years 2–10.

Startups often fail, so the more motivated the founders, the higher the chance of success. Giving founders a larger equity stake can increase their motivation and drive.

Investors view founder equity splits as a signal of how the CEO values their co-founders. Unequal splits can imply that certain founders are not highly valued, which can deter investment.

Dramatic equity disparities can overemphasize the initial idea rather than the team’s ability to execute and generate traction. Startup success relies more on execution than the original concept.

Equity should be split equally (or near equally) because all the work is ahead of you.

My advice :

Split equal (or close to equal) equity splits among co-founders.

These are the people you are going to war with.

You will spend more time with these people than you will with most family members.

These are the people who will help you decide the most important questions in your company.

Finally, these are the people you will celebrate with when you succeed.

I believe equal or close to equal equity splits among founding teams should become standard. If you aren’t willing to give your partner an equal share, then perhaps you are choosing the wrong partner.

Join 20000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Ilya Sutskever, OpenAI's co-founder and longtime chief scientist, has left the company. More Here

Tesla plans to lay off an additional 601 employees in California as part of global job cuts initiated by CEO Elon Musk to slash 20% of the workforce. More Here

Mike Krieger, co-founder of Instagram and Artifact, has joined Anthropic as the company's first Chief Product Officer. More Here

Billionaire businessman and real estate mogul Frank McCourt putting together a consortium to purchase TikTok's U.S. business. More Here

Kyle Vogt, the ex-Cruise CEO, launched the Bot Company, a robotics startup for household chores with $150M in funding. More Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

It’s amazing something like this went from idea to reality.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Associate - Perdue Venture | USA - Apply Here

Business Development - YL Venture | USA - Apply Here

Portfolio Development Associate - IBM Venture | USA - Apply Here

Venture Capital Analyst - Next commerce accelerator | Germany - Apply Here

Marketing Communications Specialist - Nauta Capital | USA - Apply Here

Associate Vice President / Manager (Accounts) - GVFL | India - Apply Here

Senior Crypto Analyst - Expert dojo | USA - Apply Here

Investment Analyst - Matrix partner | India - Apply Here

Marketing manager - Matrix Capital Partner | India - Apply Here

Program Operations Manager - Forum Ventures | Canada - Apply Here

🧐 Some Tips To Break Into VC:

The Six Most Popular Venture Capital Interview Questions (And How to Answer Them)

Why this role, at this firm?

What sectors/startups are of interest to you right now and why?

Walk us through how you would screen potential opportunities.

What do you think of our portfolio? Which investments do you like? Which would you have passed on?

What VC resources do you read/subscribe to?

What are the trade-offs between traditional equity financing and convertible notes?

Read how to answer them here

Develop Your Opinion / Thesis About The World.

To find a job in VC you will need to find ways to let the firms you're 'applying to' answer the following question positively: “Is this person going to help us to invest in companies that we otherwise would not have invested in without her/him?”

How to do this in a way that is unique to you?

Watch this video from 2010.

The two folks being interviewed are Fred Wilson & John Doerr, two of the most legendary Venture Capitalists from the US. You'll notice two things about them:

they have incredibly clear opinions, about everything

they are sometimes wrong

And that's exactly what makes them amazing VCs. In the same way their well-thought-out opinions sometimes end up being wrong, they sometimes end up being very right. And in VC being right once will make up for being wrong 100 times.

Fundamentally, the role of a VC is to decide where to put money. To do that, you'll need to have or develop clear and strong opinions about the world, and at the same time adopt the mind of a learner, accepting that you're wrong most of the time.

Starting to develop your well-thought-out, clear and interesting views of the world today will help you stand out amongst the other 1,000 individuals looking for the same thing as you (a job in VC). Read More Here

→ Looking To Break Into Venture Capital?: Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?: We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.